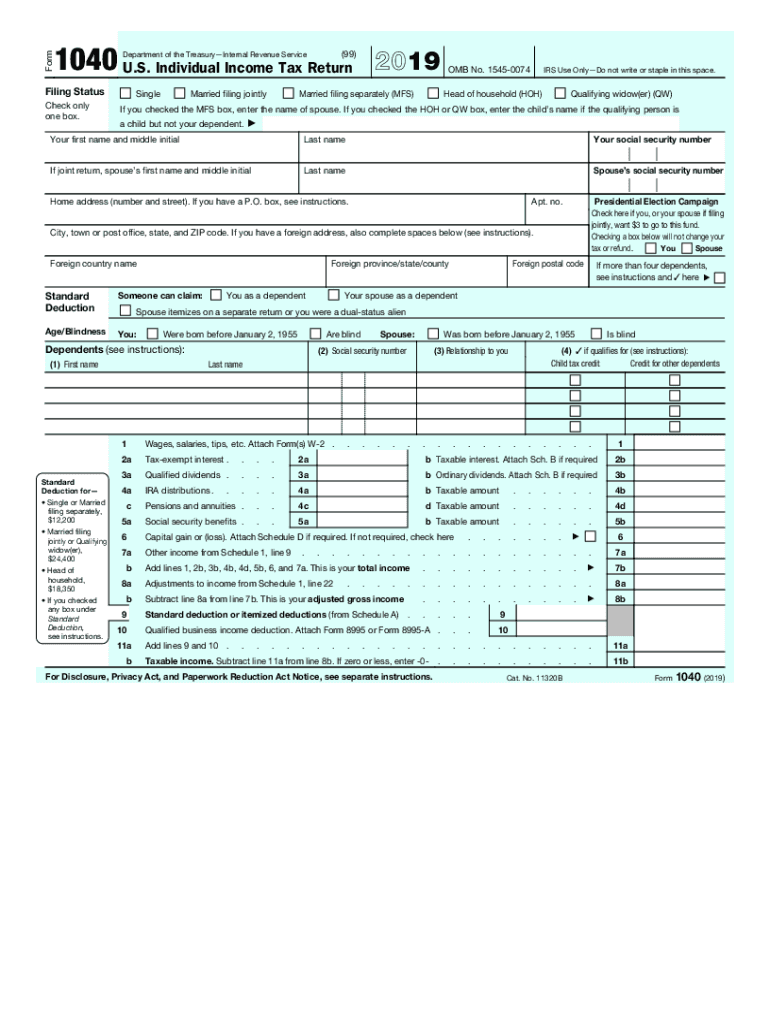

1040 Form 2019 Printable

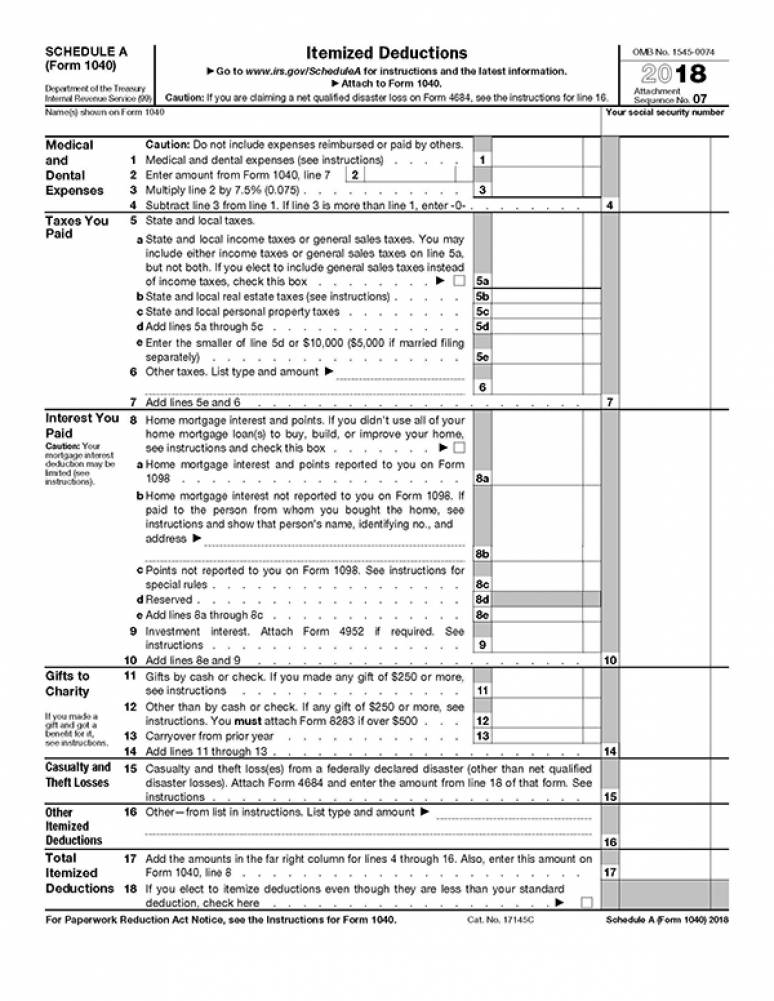

Printable 2019 federal tax forms are listed below along with their most commonly filed supporting irs schedules worksheets 2019 tax tables and instructions for easy one page access.

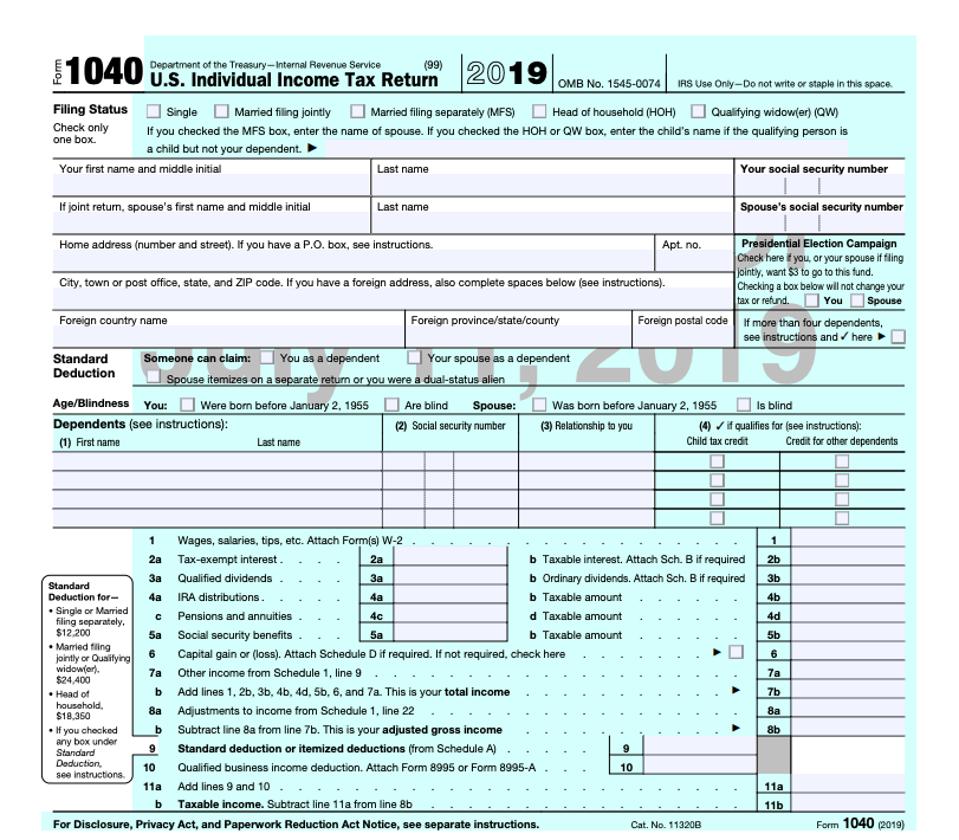

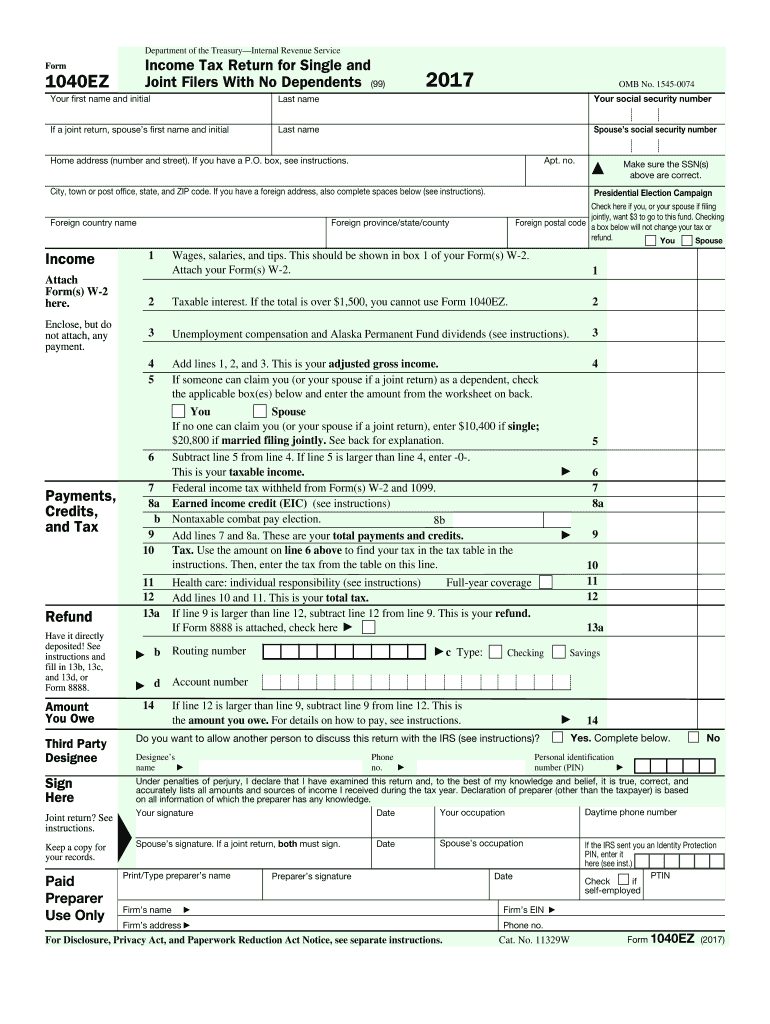

1040 form 2019 printable. Form 1040 ez is a short version tax form for annual income tax returns filed by single filers with no dependents. You may only need to le form 1040 or 1040 sr and none of the numbered schedules schedules 1 through 3. Individual income tax return including recent updates related forms and instructions on how to file. Irs use onlydo not write or staple in this space.

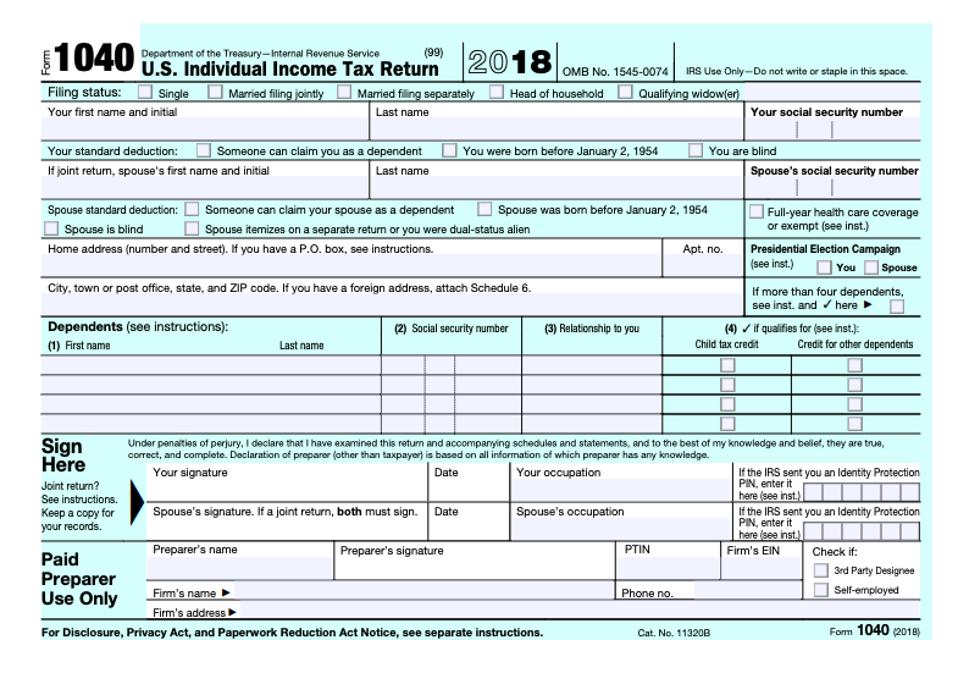

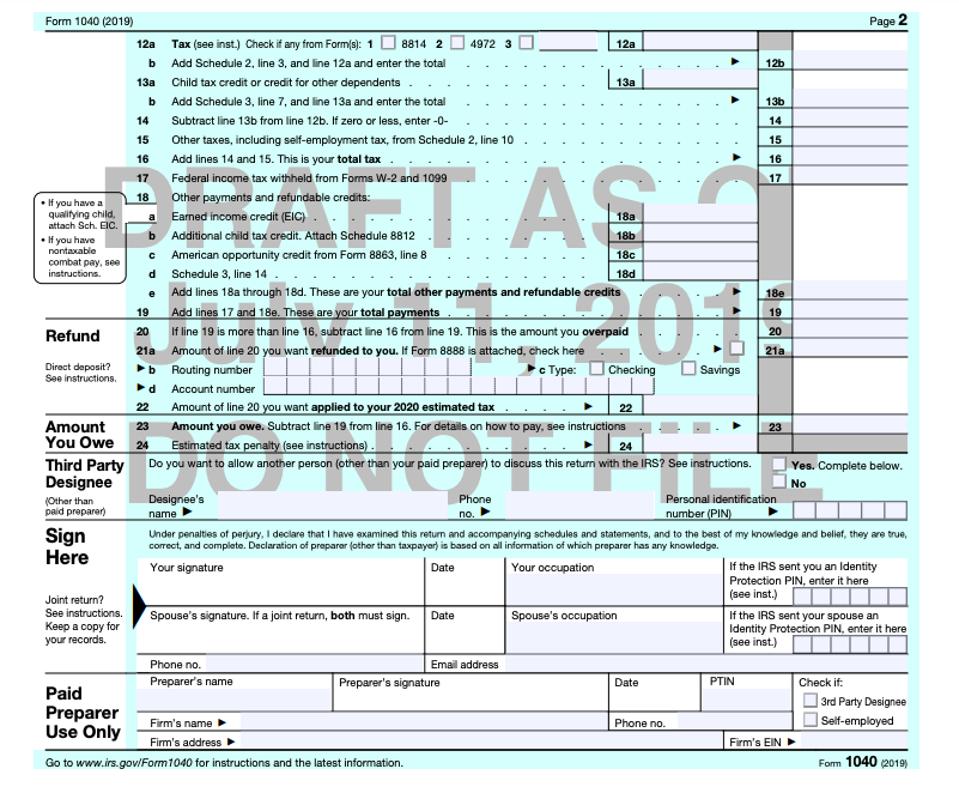

If line 24 equals line 25 enter 0. Attach to 2019 form 1040 1040 sr or 1040 nr. For 2019 you will use form 1040 or if you were born before january 2 1955 you have the option to use new form 1040 sr. Washington as part of a larger effort to help taxpayers the internal revenue service plans to streamline the form 1040 into a shorter simpler form for the 2019 tax season.

The new 1040 pdf about half the size of the current version would replace the current form 1040 as well as the form 1040a and the form 1040 ez. If line 25 is greater than line 24 leave this line blank and continue to line 27. Information about form 1040 us. Complete the following information for up to four.

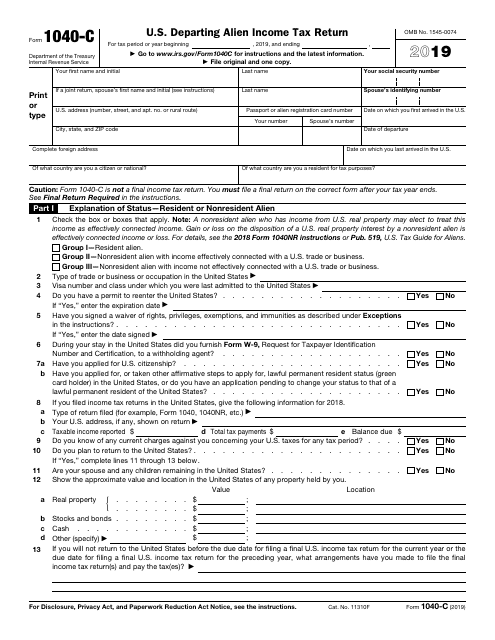

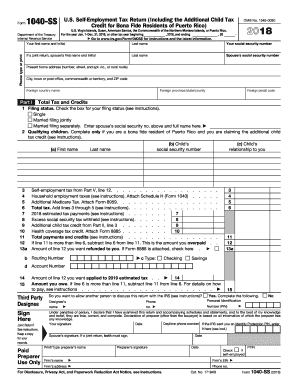

1040 form 2019 printable the irs 1040 form is one of the main documents in the united states to file the taxpayers annual income tax return. It is divided into sections where can be filled with any data about income and deductions to refund all expecting taxes. Printable 2019 federal income tax forms 1040 1040sr 1040ss 1040pr 1040nr 1040x instructions schedules and more. Estimated tax for individuals.

Form 1040 es is used by persons with income not subject to tax withholding to figure and pay estimated tax. Form 8962 2019 page. On schedule 3 form 1040 or 1040 sr line 9 or form 1040 nr line 65. Form 1040 is used by citizens or residents of the united states to file an annual income tax return.

Form 1040 department of the treasuryinternal revenue service 99 us. If married file a separate form for each spouse required to file 2019 form 8606.

:max_bytes(150000):strip_icc()/Form1040_screen_shot_2019-10-14_at_4.05.40_pm-e3d41e44e75c4ea29d04e6e71d2b94ef.png)

:max_bytes(150000):strip_icc()/Screenshot2018-12-0623.28.52-5c09f72d46e0fb000195b16b.png)

/Screenshot2018-12-0623.28.52-5c09f72d46e0fb000195b16b.png)