1099 Contract Template

:max_bytes(150000):strip_icc()/filling-out-form-w9-3193471-v2-5b733961c9e77c00572ddf88.png)

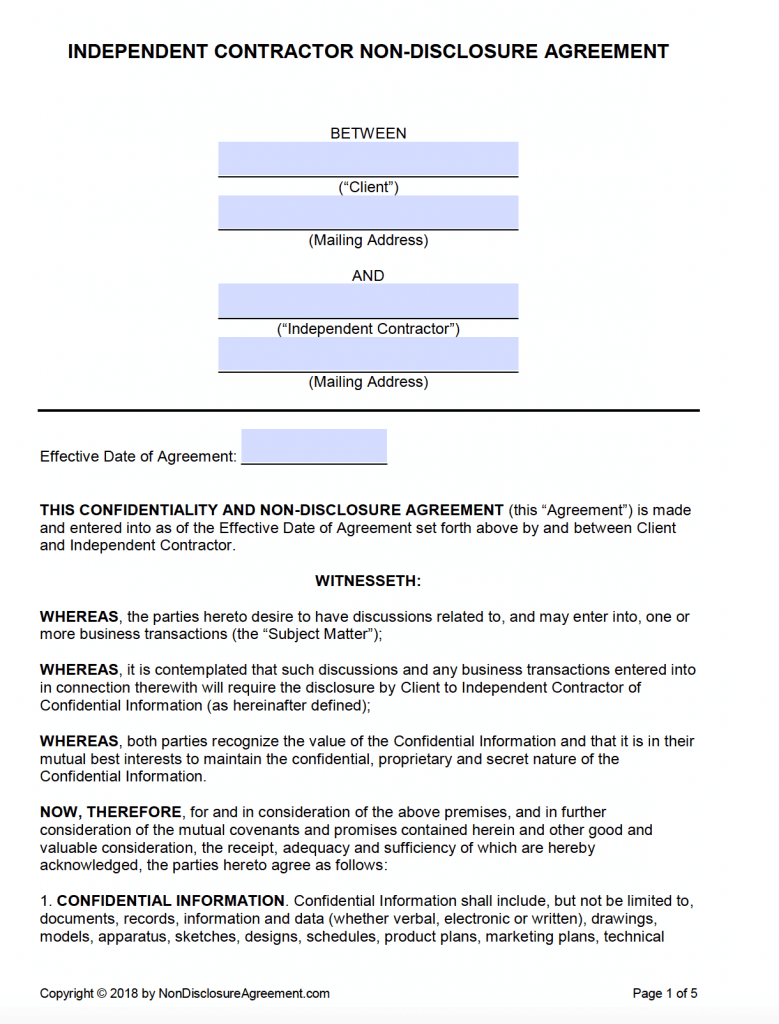

Here is an independent contractor agreement template that contains contract language beneficial to both your company and to the independent contractor you hire.

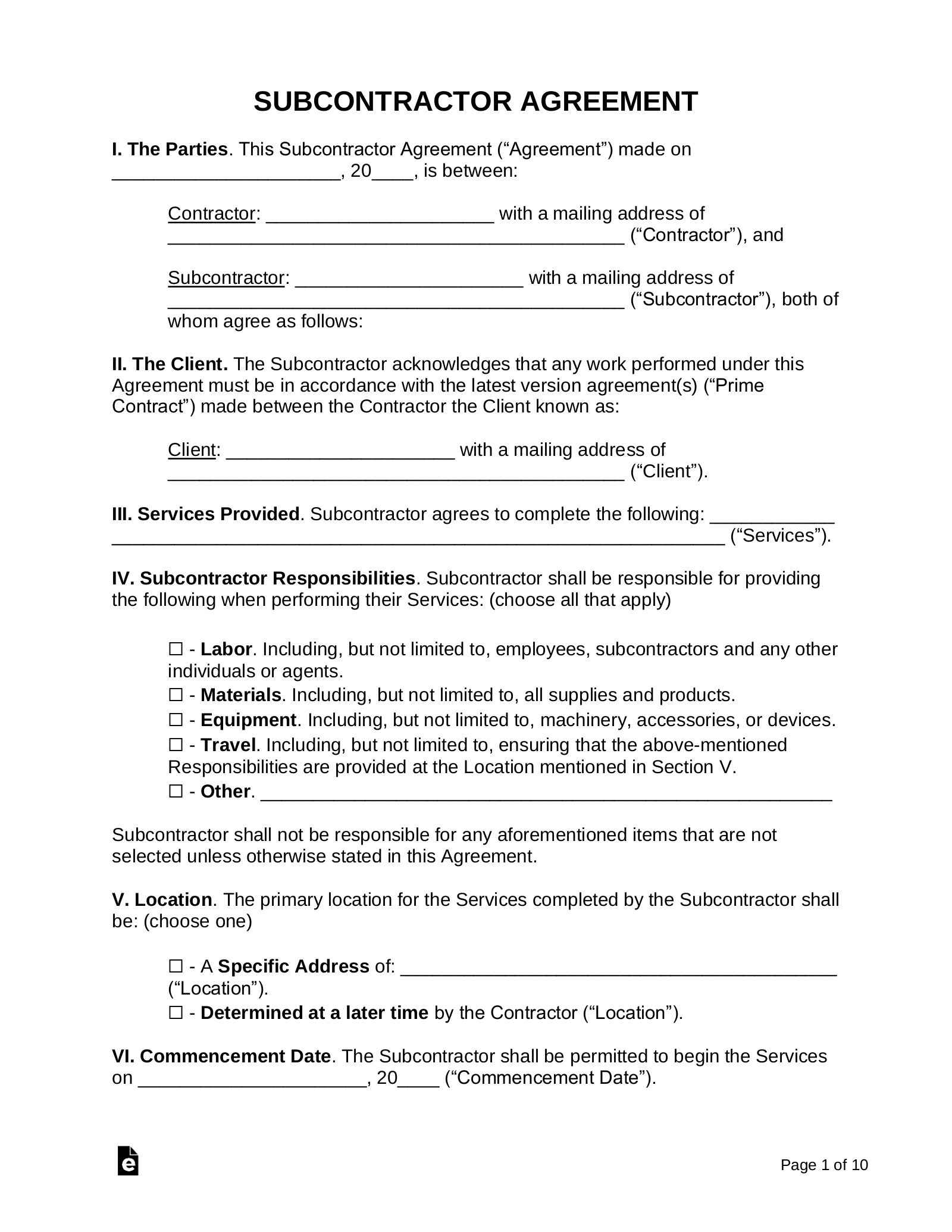

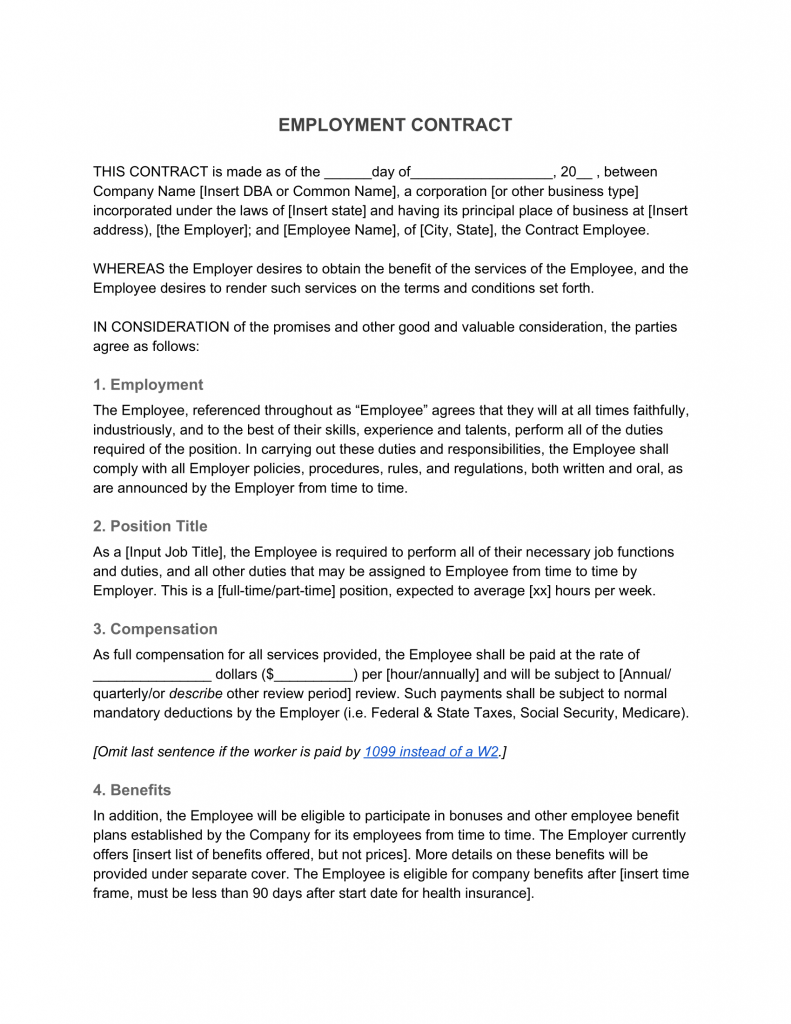

1099 contract template. Contractor agrees to pay eastmark a finders fee of 20 of the gross fees received by contractor for such services. It can be the difference between staying open and forced to shut down. An independent contractor agreement also known as a 1099 agreement is a contract between a client willing to pay for the performance of services by a contractor. This agreement in conjuction with the attached non disclosure agreement exhibit a and commission schedule exhibit b constitutes the entire understanding of the parties and revokes and supersedes all prior agreements between the parties and is intended as a final expression of their agreement.

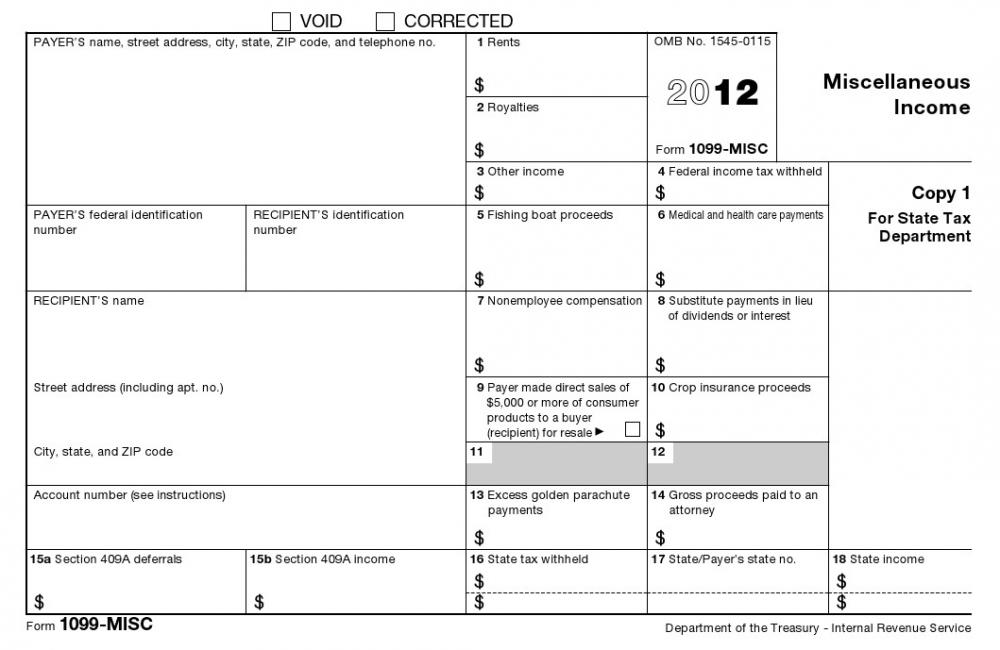

Client will regularly report amounts paid to contractor by filing a form 1099 misc with the internal revenue service as required by law. Generally if youre an independent contractor youre considered self employed. The contractor will not be entitled to workers compensation retirement insurance or other benefits afforded to employees of the company. If you would like the irs to determine whether services are performed as an employee or independent contractor you may submit form ss 8 determination of worker status for purposes of federal employment taxes and income tax withholding.

The contractor may not act as agent for or on behalf of the company or to represent the company or bind the company in any manner. Agreement for independent contracting services irs form 1099. Contractor may perform the services required by this agreement at any place or location and at such times as contractor shall determine. 3 min read a 1099 sales rep agreement is important to have for companies that employ sales representatives.

1099 sales rep agreement is important to companies that employ sales representatives. Contractor may only be released from such prohibitions against performing services upon payment to eastmark of a fee to be negotiated by the parties under a separate agreement. You must have a w 9 on file for each independent contractor so that you dont have to withhold income taxes from that individual. In accordance with the internal revenue service irs an independent contractor is not an employee and therefore.