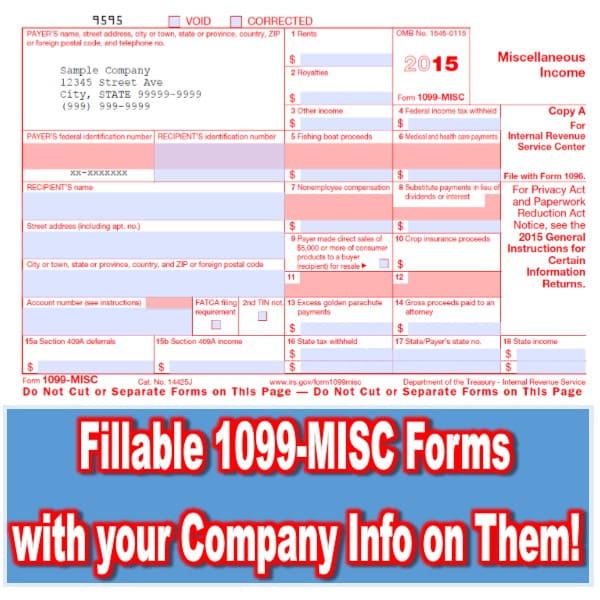

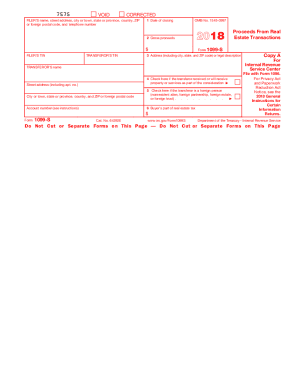

1099 Misc Template Pdf

At least 600 in.

1099 misc template pdf. Medical and health care payments. Looking for a printable form 1099 misc and independent contractors. To begin the form utilize the fill sign online button or tick the preview image of the form. What is a 1099 misc form.

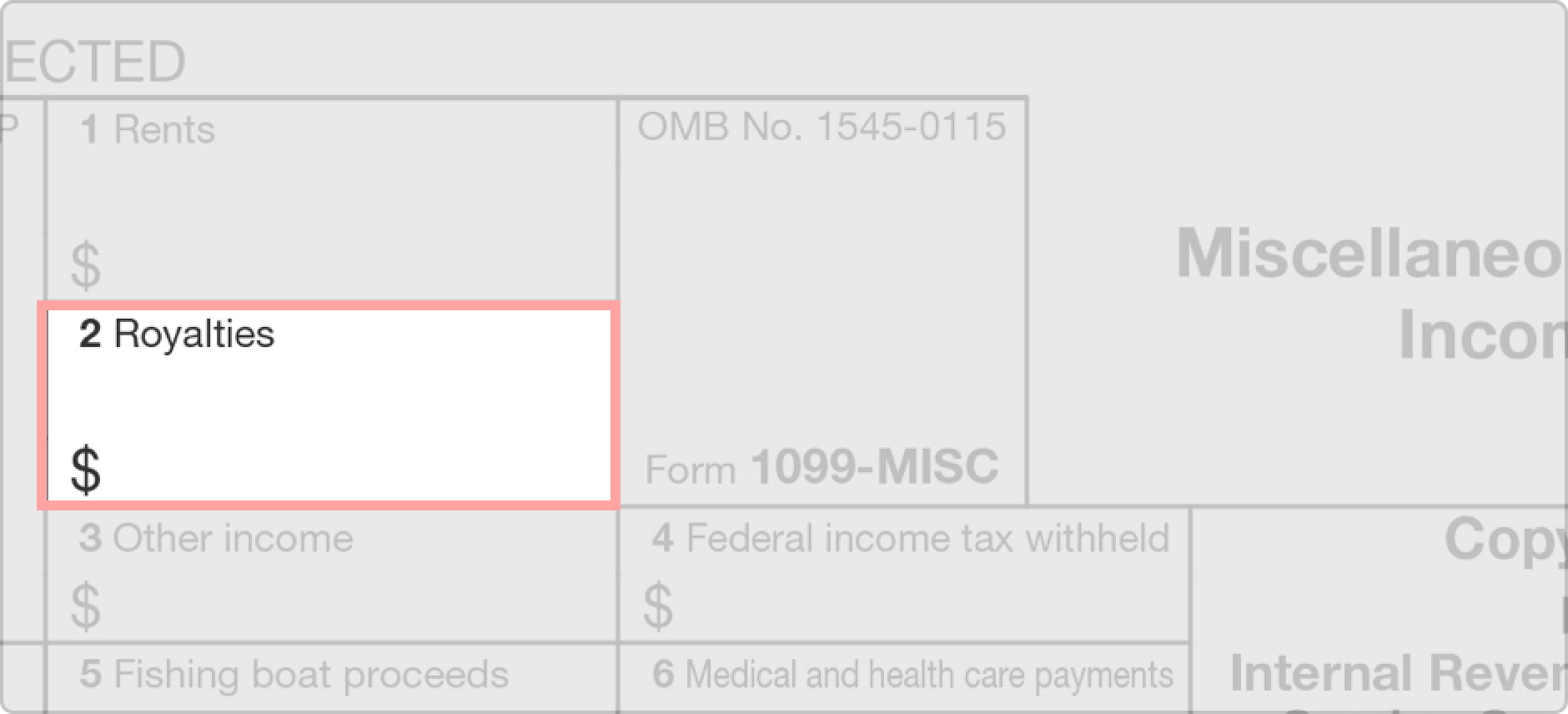

1099 misc 1099 misc form is used for self employed or independent conductors. A penalty may be imposed for filing with the irs information return forms that cant be scanned. Online service compatible with any pc or mobile os. At least 10 in royalties or broker payments in lieu of dividends or tax exempt interest.

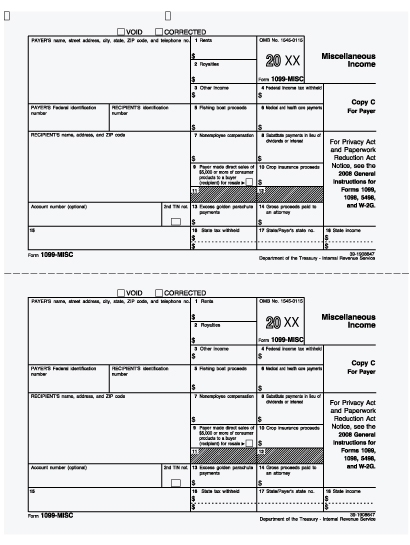

Irs form 1099 misc miscellaneous income is an internal revenue service irs form used to report non employee compensation. Print and file copy a downloaded from this website. Use this step by step guide to fill out the 1099 misc 2017 form quickly and with excellent accuracy. Create your sample print save or send in a few clicks.

It is a required tax document if a non employee such as a contractor or freelancer makes more than 600 from the company or individual issuing the document. File form 1099 misc for each person to whom you have paid during the year. Services performed by someone who is not your employee. Print and file copy a downloaded from this website.

The 1099 misc is used to report income. Here you will find the fillable and editable blank in pdf. Instantly send or print your documents. The advanced tools of the editor will lead you through the editable pdf template.

Reported payments file form 1099 misc by february 28 2020 if you file on paper or march 31 2020 if you file electronically. Create complete and share securely. If any of your forms 1099 misc reporting nec will be filed after january 31 2019 file them in a separate transmission from your forms 1099 misc without nec due april 1 2019. Independent contractors freelance workers sole proprietors and self employed individuals receive one from each business client who paid them 600 or more in a calendar year.

It must be filled for every income of 600 or more during the tax year. The official printed version of copy a of this irs form is scannable but the online version of it printed from this website is not. It must be filled for every income of 600 or more during the tax year. It details the income and also notes that you have not deducted any federal state or other taxes from the income.

Choose the fillable and printable pdf template. The official printed version of copy a of this irs form is scannable but the online version of it printed from this website is not. The way to complete the online 2017 1099 misc on the internet.