Business Expenses Without Receipt

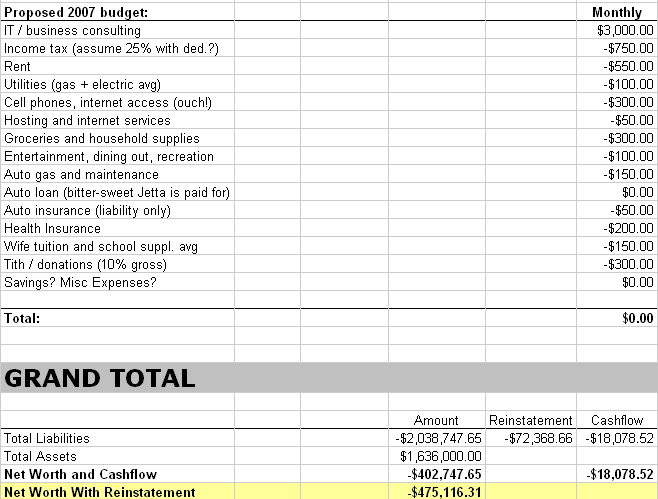

Business expenses you can usually claim an income tax deduction for it.

Business expenses without receipt. Many of the expenses are for 10 50. However there are some expenses that are specifically blocked eg. I worked as a freelance contractor for 7 months in 2013. While we know things can happen sometimes and its not always possible to get a receipt the ideal scenario is to have a record.

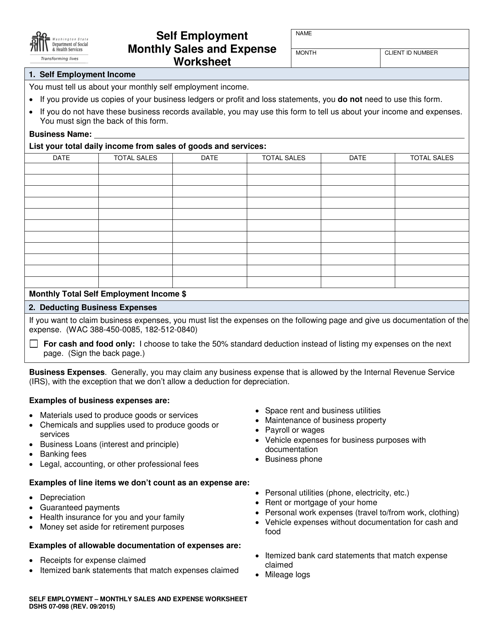

Generally you cant make tax claims without receipts. You do need receipts for these expenses even if they are less than 75. It isnt just business expenses that can be. Tax deductions without receipts.

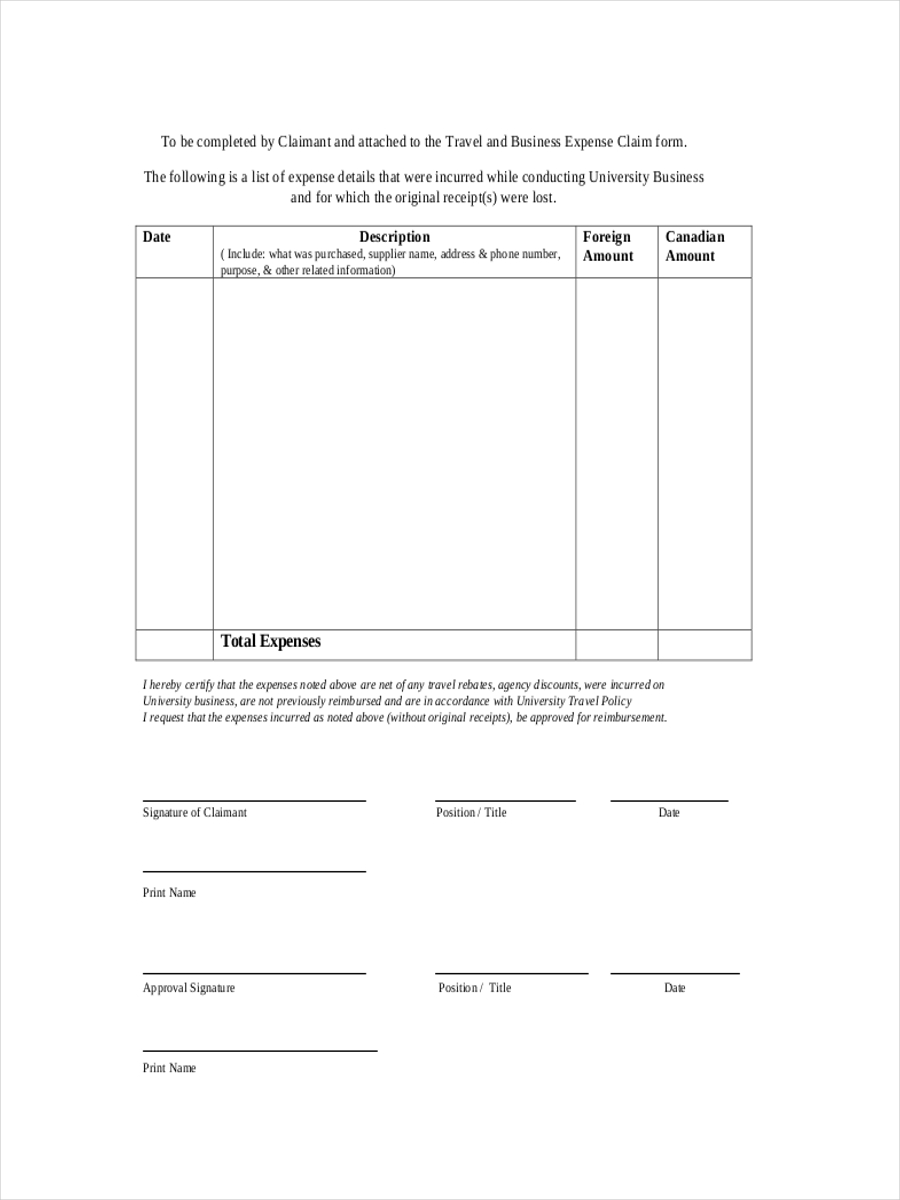

Although you may be able to miss a few expenses without receipts its best to have documentation on as many of your itemized items as possible. This exception does not apply to lodging that is hotel or similar costs when you travel for business. Ive read on the irs website that if you have adequate evidence you don. Invoices expenses are the costs you incur other than purchases to carry on your business.

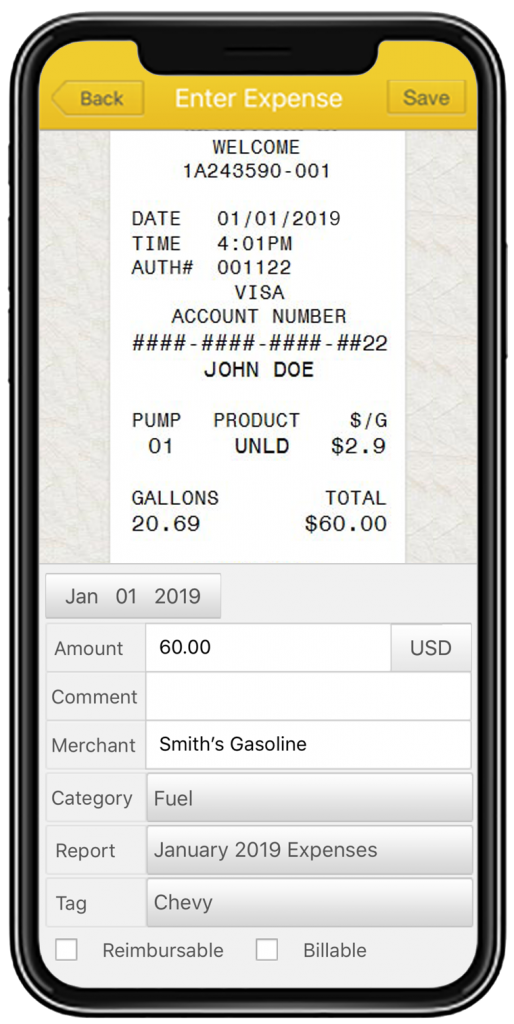

I am comparing the receipts that i saved and my creditdebit card statements and i realize that i didnt save receipts for many business expenses. Of course these business expenses without receipts or invoices are just some examples. It was my first time freelancing and i didnt exactly know the rules of the game. Credit card receipts and statements.

Entertaining contacts and others that may be at least restricted. In summary if you pay for something necessary for running your business ie. He was a flashy guy and tended to pay in cash. The rule of thumb is to make sure you collect and store tax records diligently.

Without the evidence from receipts for your claimed business expenses the canada revenue agency cra may decide to reduce the number of expenses you have deducted. The irs disallowed cohans large travel and entertainment expenses because he didnt have receipts. Documents for expenses include the following.

:brightness(10):contrast(5):no_upscale()/keeping-an-eye-on-the-figures-187147709-5a7df1983de4230037c5a100.jpg)

:brightness(10):contrast(5):no_upscale()/budgeting-stack-of-receipts-GettyImages-108933688-5822435c3df78c6f6a351c3c.jpg)