Check Resale Certificate

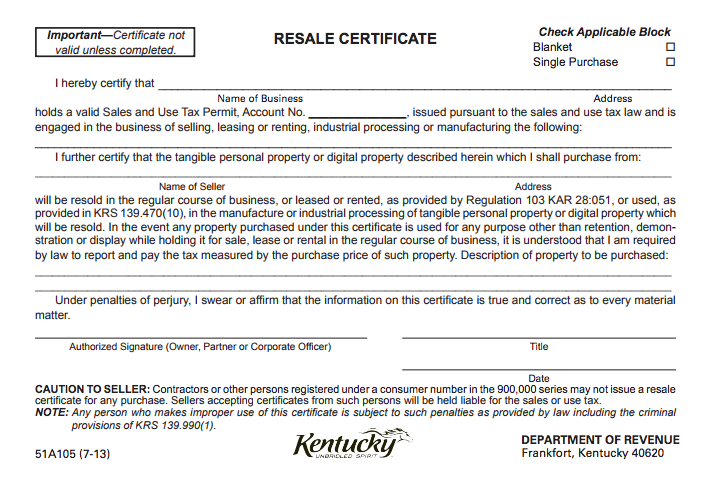

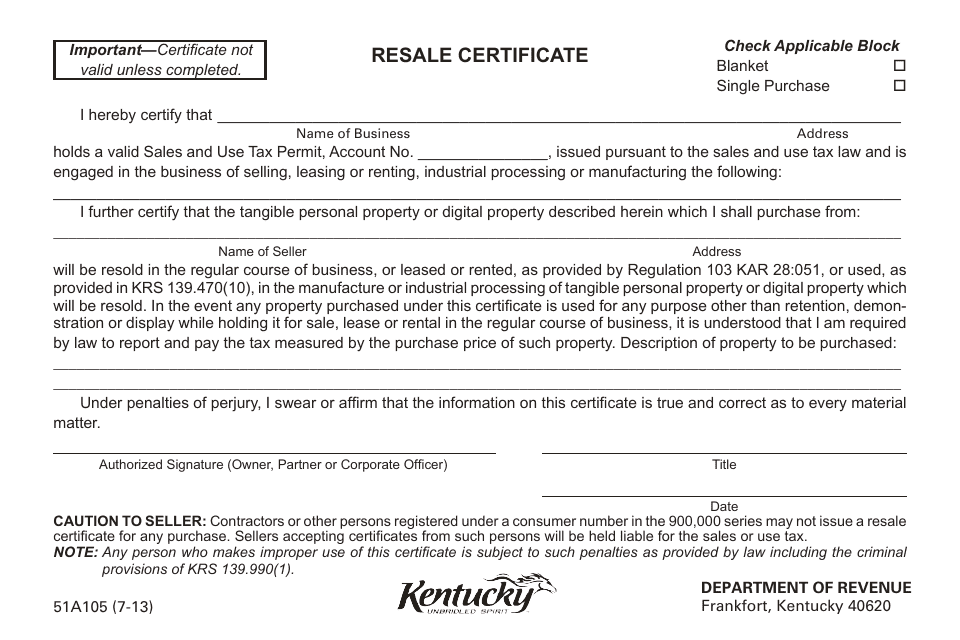

Resale certificate check applicable block blanket single purchase name of business address caution to seller.

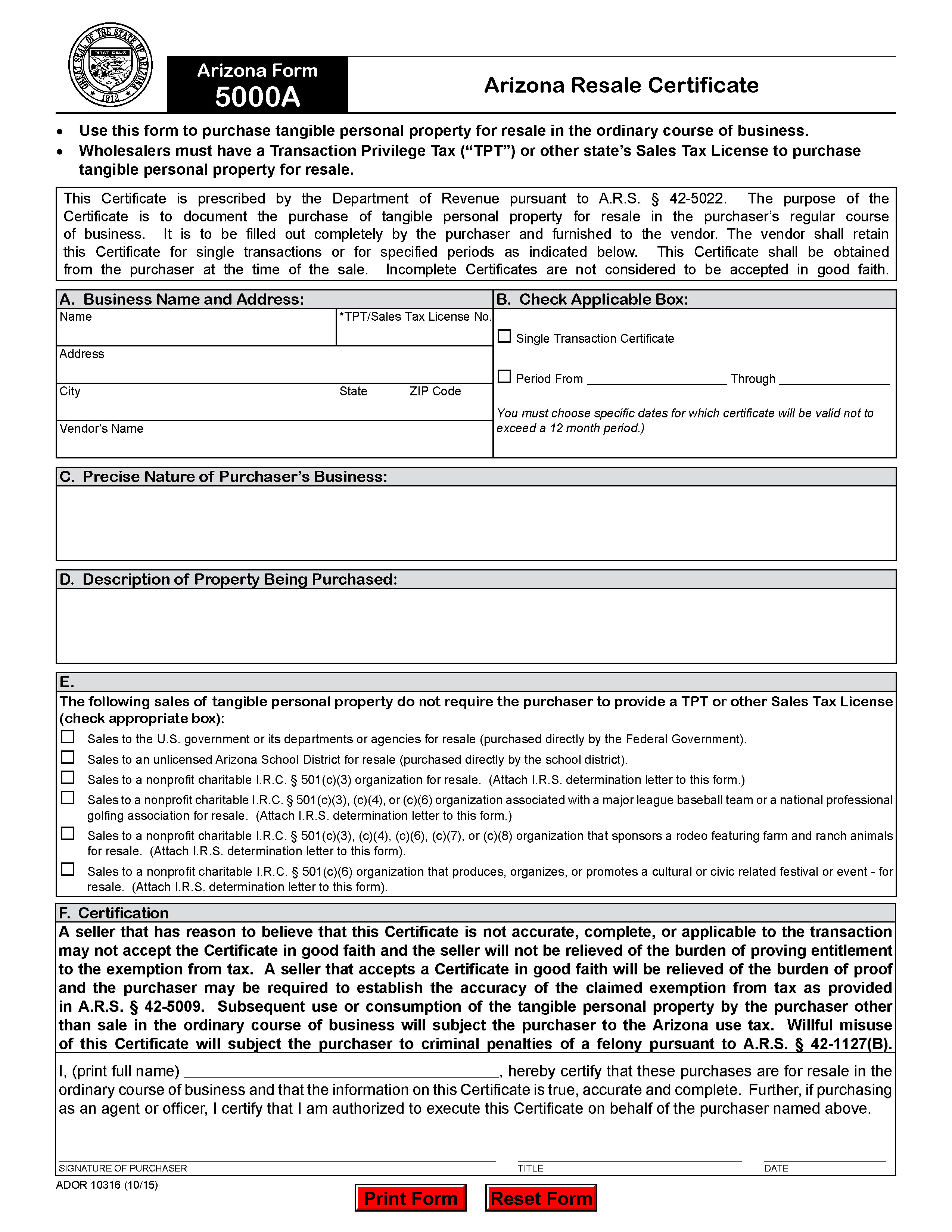

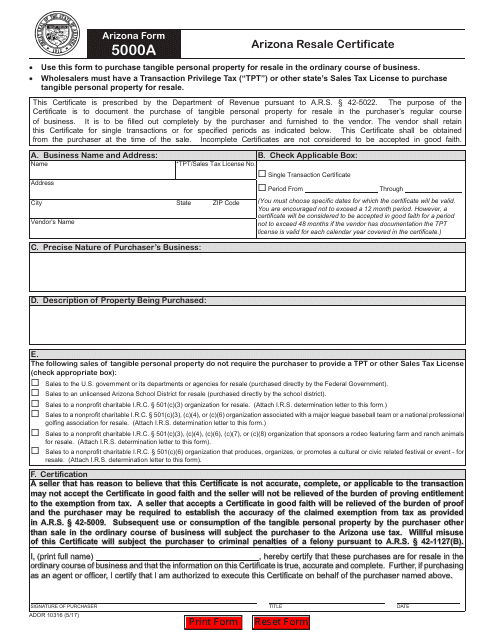

Check resale certificate. Businesses that register with the florida department of revenue to collect sales tax are issued a florida annual resale certificate for sales tax annual resale certificate. Arizona enter the number here. Exempt organization exempt purchase certificate is available by calling 518 485 2889. The certificate allows business owners or their representatives to buy or rent property or services tax free when the property or service is resold or re rented.

The state board of equalization is currently updating its website. May i use my certificate of registration to purchase items tax free. Number should have 8 digits. If you are using a screen reading program.

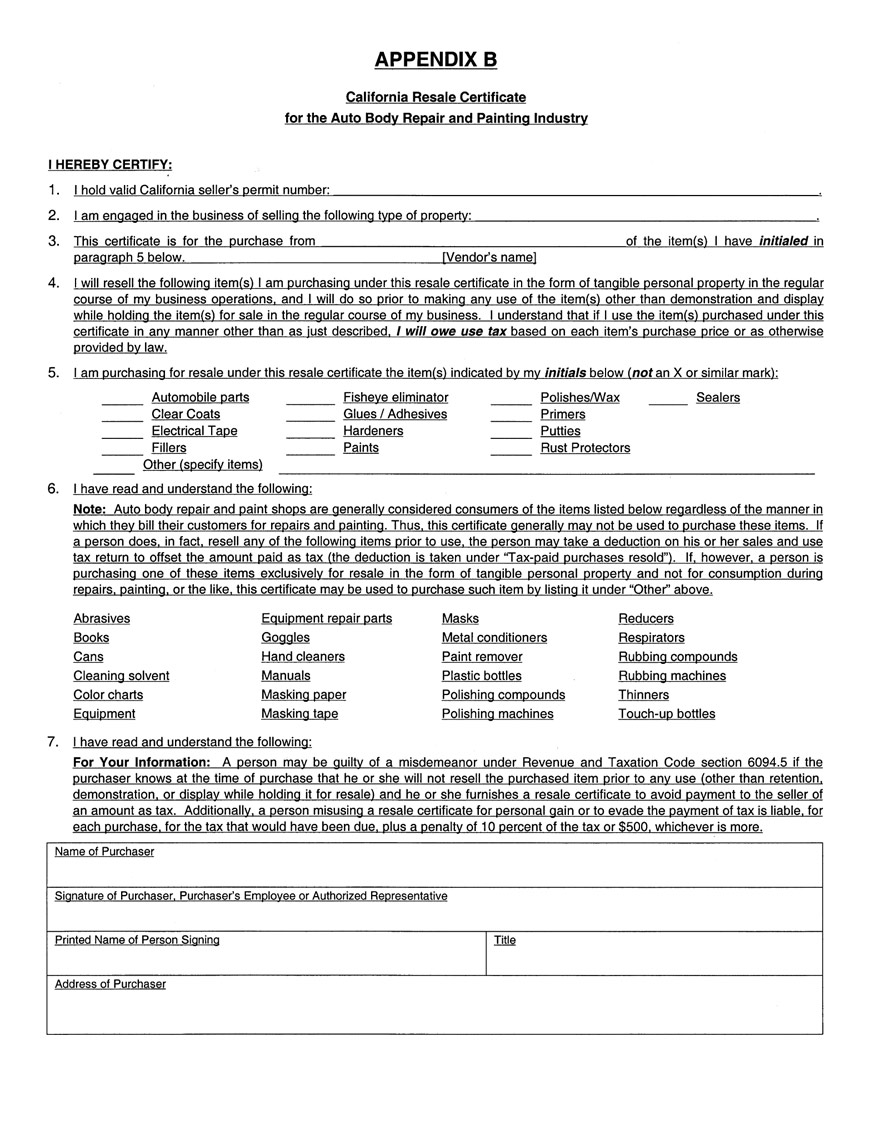

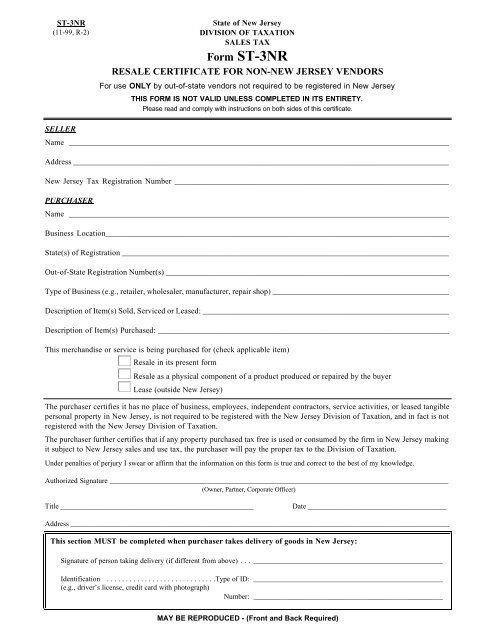

Retailers and wholesalers to purchase items for resale without paying sales tax. What is the difference between a certificate of registration resale certificate tax exempt number and license number. We appreciate your patience during this process. Under what circumstances will i be registered as a reseller.

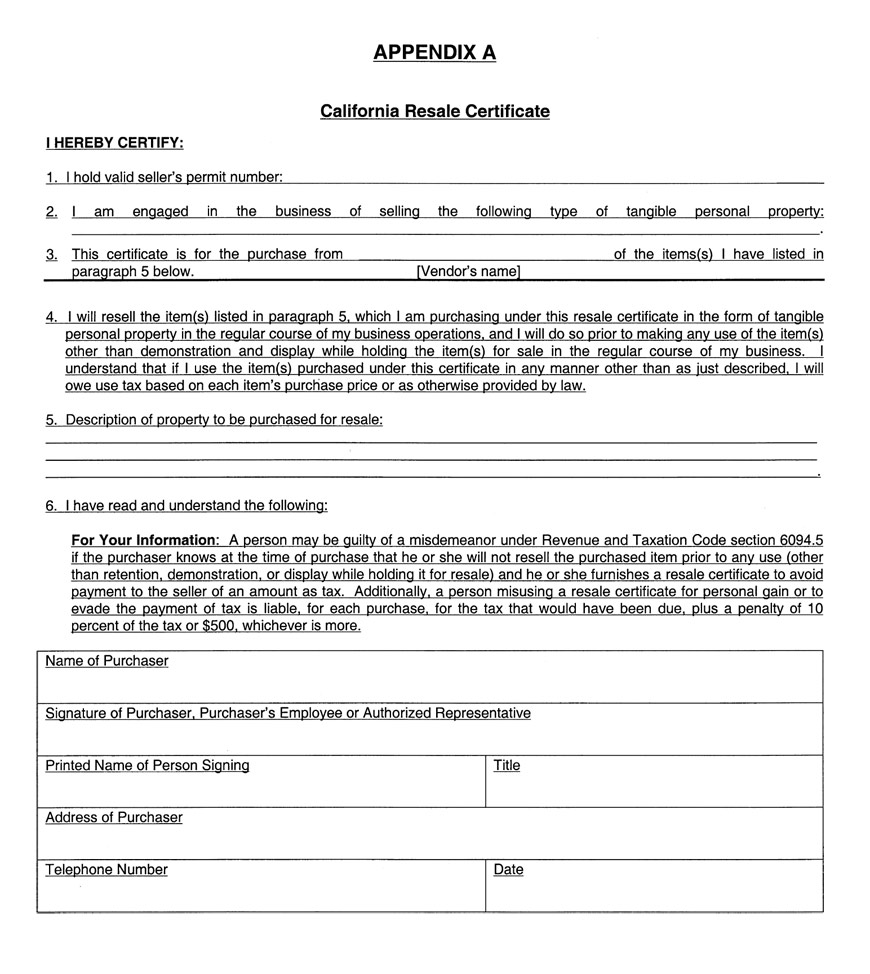

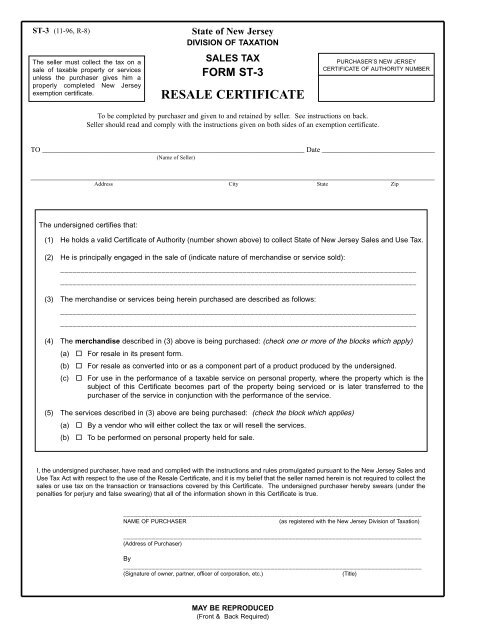

What is a reseller permit. How to verify a resale certificate in every state. Enter the security code displayed below and then select continue. A is registered as a new york state sales tax vendor and has a valid certificate of authority issued by the tax department and is making purchases of tangible personal property other than motor fuel or.

Alabama login required. During this process some items may be moved or unavailable. The taxpayer transparency and fairness act of 2017 which took effect july 1 2017 restructured the state board of equalization and separated its functions among three separate entities to guarantee impartiality equity and efficiency in tax appeals protect civil service employees ensure fair tax collection statewide and uphold the california taxpayers bill of rights. Contractors or other persons registered under a consumer number in the 900000 series may not issue a resale certificate for any purchase.

Ft 123 fill in instructions on form. Reseller permits are generally valid for four years. Form st 120 resale certificate is a sales tax exemption certificate. Manufacturers to purchase ingredients or components that are used to create a new article for sale without paying sales tax.

Registered sales tax vendor lookup. Importantcertificate not valid unless completed. Reseller permits are distributed by the state and allow. Please contact us for assistance locating property tax alcoholic beverage tax or tax on insurers material.

Arkansas use either the resellers permit id number or streamlined sales tax number. The following security code is necessary to prevent unauthorized use of this web site. From there click the start over button business verify an exemption certificate. Ida agent or project operator exempt purchase certificate for fuel.

Certificate of sales tax exemption for diplomatic missions and personnel single purchase certificate.