Cpa Preparation Certificate

You must register or renew your registration with the new york state tax department for every calendar year in which you.

Cpa preparation certificate. To be eligible to take the uniform cpa examination you must meet one of the following requirements. Option 1 120 licensure requirement. The graduate certificate in cpa exam preparation is designed as a standalone credential. Cpas may offer a range of services.

The cpa preparation certificate is designed to support students with bachelors degrees in any non accounting area in obtaining the accounting and business courses approved and required by the maryland state board of public accountancy so that they can sit for the cpa examination in the state of maryland. Records and supporting documents must be maintained by the cpa for at least five years following completion of the cpe course and must be made available to the department of education and the state board for public accountancy upon request. Or will facilitate a refund anticipation loan ral or refund anticipation check rac. Now that youre a cpa in new york.

In addition cpas must comply with ethical requirements and complete specified levels of continuing education in order to maintain an active cpa license. Complete the program on campus or online giving you additional flexibility. To support your personal and professional goals you can focus your studies on either advanced accounting or. Some cpas specialize in tax preparation and planning.

If you applied for licensure and completed your education prior to august 1 2009 you must meet one of the following. Will be paid to prepare one or more new york state tax returns or reports. Prepare to qualify for the certified public accountant cpa exam by completing this 30 credit hour certificate program designed exclusively for individuals who already have a bachelors degree and wish to transition to a career in the field of accounting. Take classes in financial and managerial accounting.

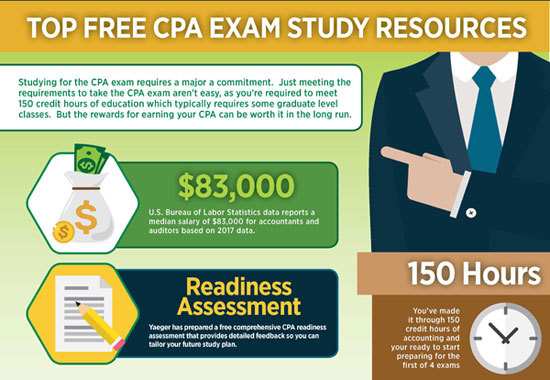

Harpers cpa prep certificate courses are approved to meet cpa exam requirements. If youd like to take your education further some credits are transferable to the masters degree in accounting and financial management program. When you decide to pursue the cpa license its a significant decision that can lead to a rewarding career with expanded opportunities and great earning potential. But before you focus on your first step of passing the uniform cpa examination you should prepare by developing your own personal exam strategy.

The online cpa accounting certificate program consists of a maximum of 12 units equivalent to 30 semester hours and is designed for post baccalaureate students who need to complete the accounting course requirements included in the educational requirements for the illinois cpa exam.