Credit Dispute Template

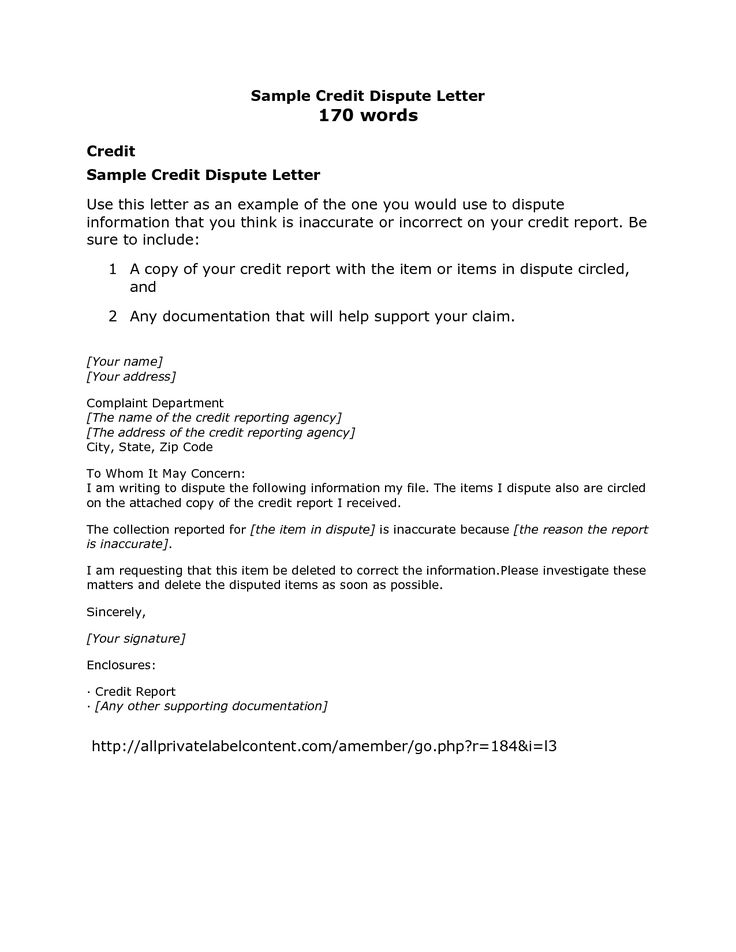

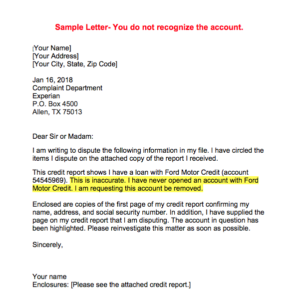

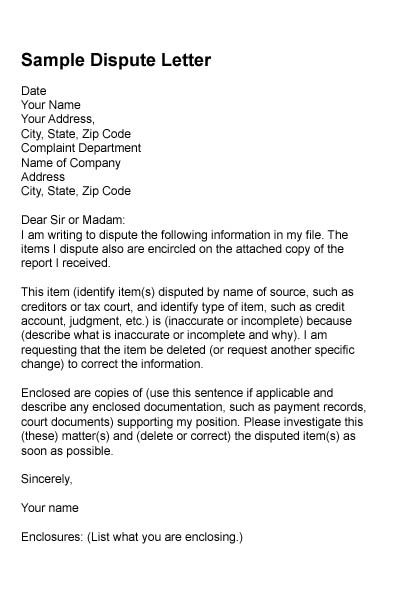

Your letter should clearly identify each item in your report you dispute state the facts and explain why you dispute the information and request that it be removed or corrected.

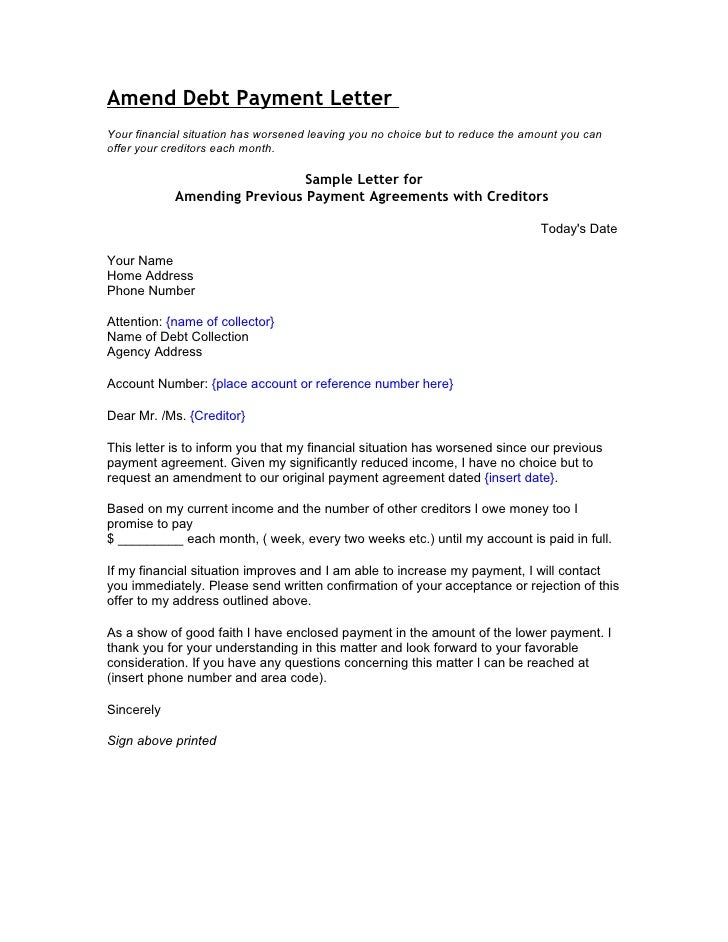

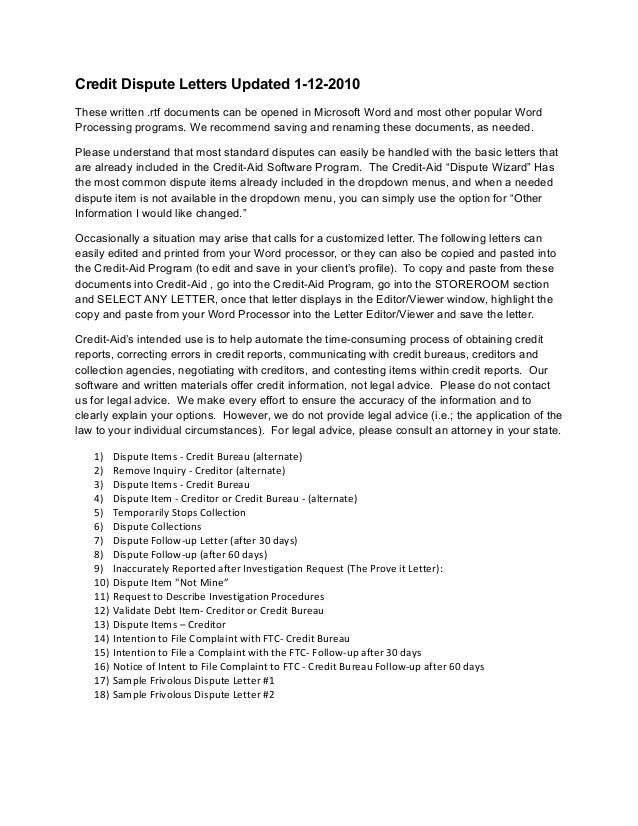

Credit dispute template. Its intended to give you an idea of what a credit report dispute letter should look like and what it should contain. However certified mail is the always the better option. In the letter you can explain why you believe the items are inaccurate and provide any supporting documents. When writing a formal or company letter presentation style and also style is vital making a good first perception.

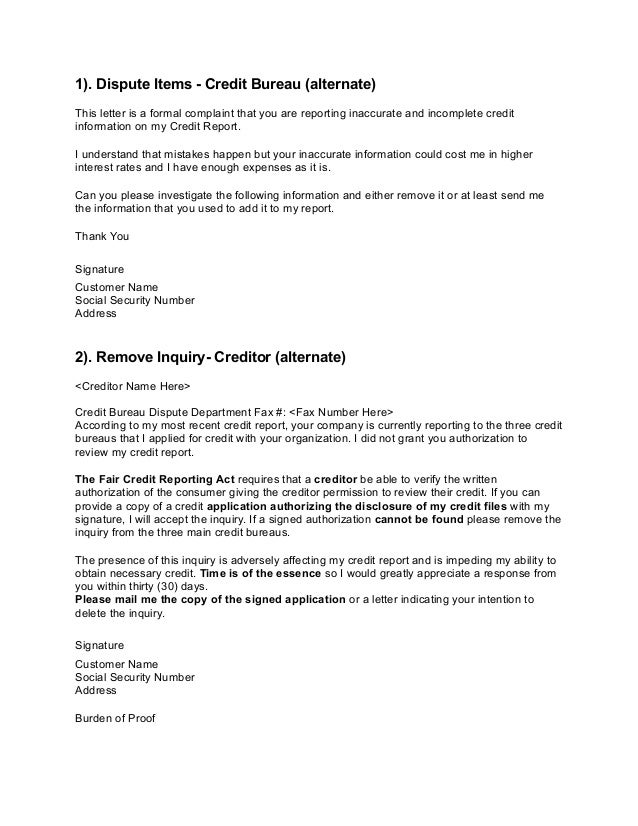

The 609 letter is similar to a debt verification letter you would send to a third party collector when trying to validate the legitimacy of a balance due which is your right under the fair debt collection practices actthe 609 letter however is based on section 609 of the fair credit reporting act fcra a federal law that regulates the credit reporting agencies. Increasing your fico is easy with this template to dispute credit report letter to get bad marks wiped clean. Sample letter credit report dispute this guide provides information and tools you can use if you believe that your credit report contains information that is inaccurate or incomplete and you would like to submit a dispute of that information to the credit reporting company. Please remember that its just an example.

The common thread amongst all credit dispute letters no matter what information youre trying to dispute is including the right kind of information. It can be used for an equifax experian or transunion dispute. The ftc found that one in five people have a mistake on their credit report a mistake that means youre paying higher rates than you should. It is important to dispute inaccurate information.

Use this sample to draft a letter disputing errors on your credit report. Credit dispute letters can be a sent either by mail or online. Remember that the burden of proof is on the credit bureau or creditor so dont provide any more information on your account or payment history than is necessary. All three credit reporting bureaus equifax experian and transunion accept dispute requests online standard mail and by phone.

Below is a sample dispute letter disputing a credit card account. A credit dispute letter is a document you can send to the credit bureaus to point out inaccuracies on your credit reports and to request the removal of the errors. Online submissions offer speed and convenience. The credit report dispute letter is used to remove an invalid collection from a persons credit history that was either paid falsely listed or if the debt is more than 7 years old.