Credit Union Ach Risk Assessment Template

A more complete approach greater diligent bank of prudence.

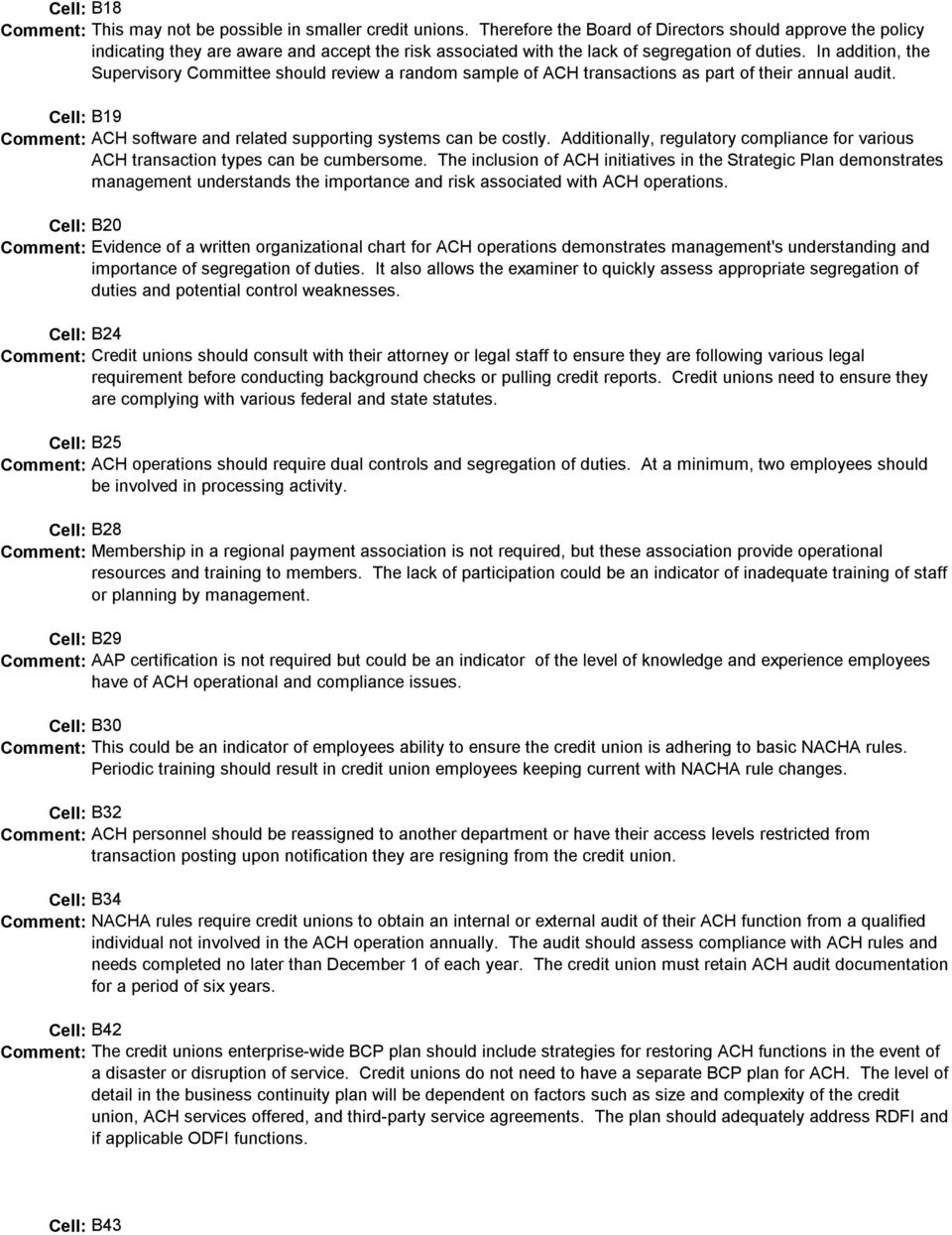

Credit union ach risk assessment template. Template would serve as the credit unions transactional risk assessment and report to the board of directors. Determine if personnel changes at the credit union have an impact on the ach. Or perhaps they learn that the exposure limit established and approved on paper for an originating business client is not what is being monitored electronically by the ach software. Maybe the ach credit union learns from the audit or risk assessment that staff needs additional training or more staff is needed.

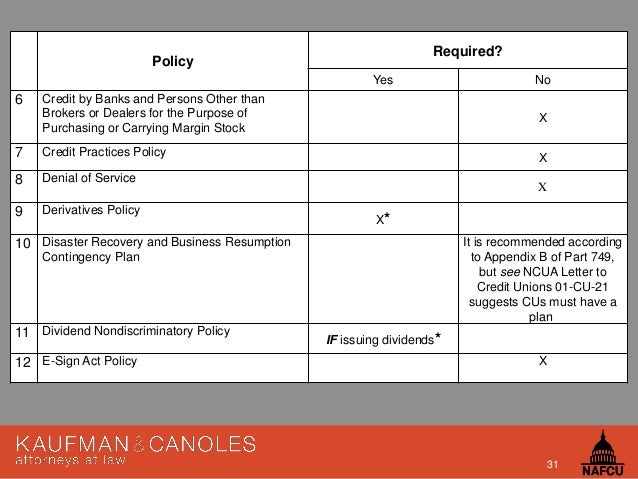

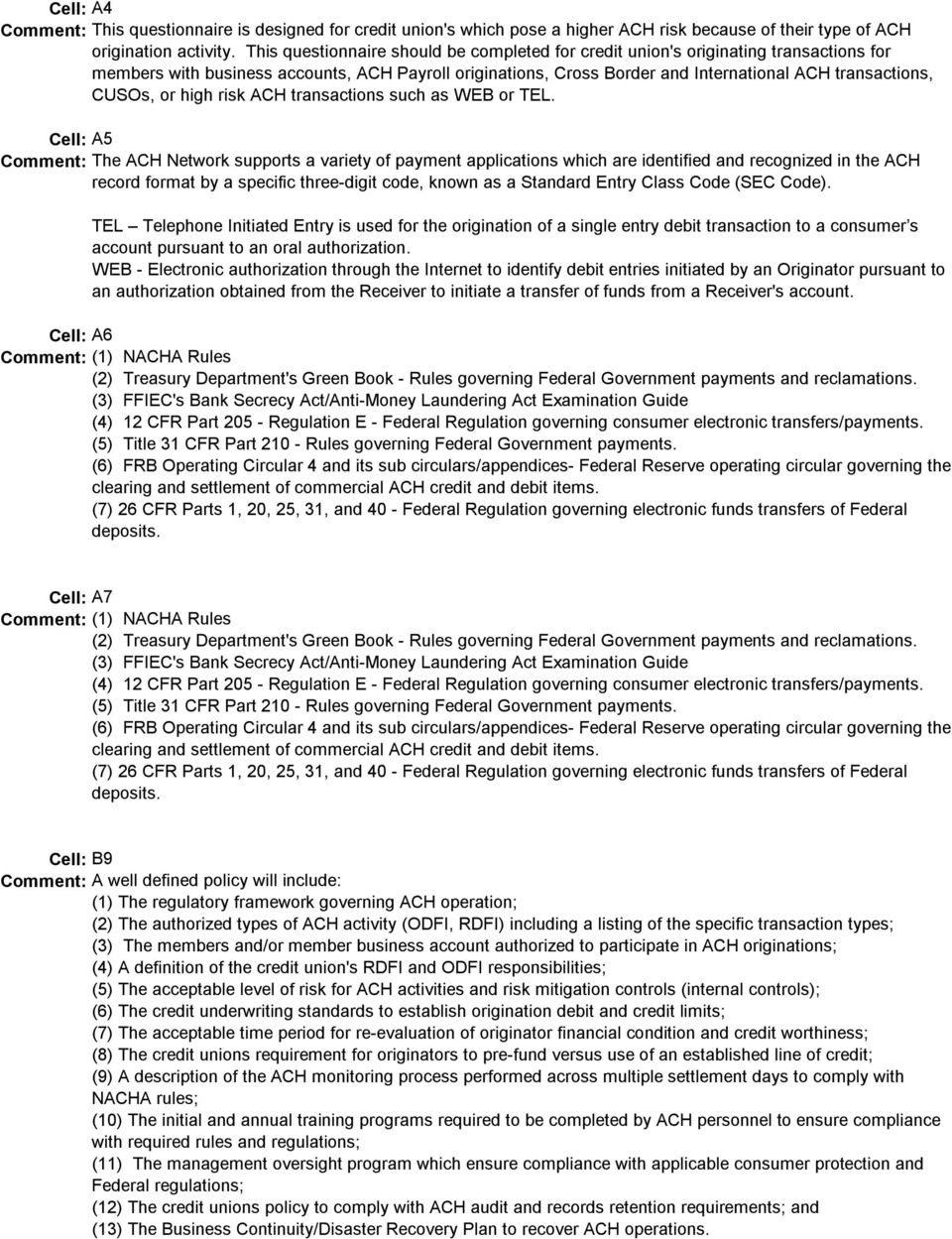

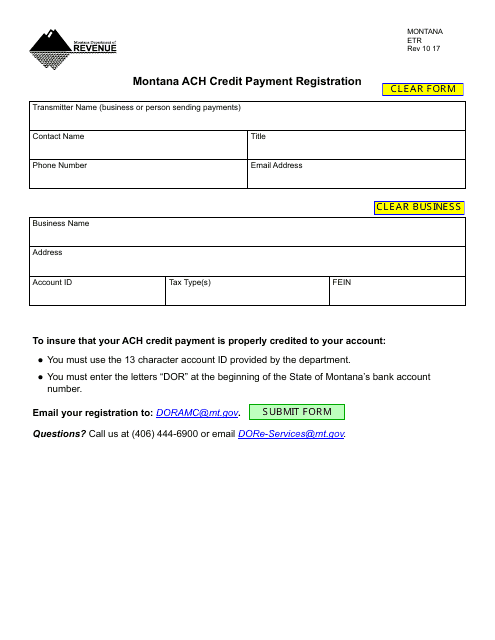

Please fill out all required fields before submitting your information. The risk impact of these items varies depending on a credit unions complexity. An email has been sent to verify your new profile. The general ach tab is designed to assist examiners to determine the level of review necessary given the types of ach activities in which the credit union is involved.

The second section of the document see appendix a includes a synopsis of recent court cases to give credit unions additional background related to these types of lawsuits. Questions on this tab will provide an assessment of whether the rdfi odfi moderate or odfi high tab should be completed. The rdfi incurs credit risk when it grants funds availability to its customer prior to the final settlement of the credit entry. The ach risk assessment workbook guides you in completing the step by step risk assessment.

Individual chapters address system and controls credit risk high risk activities compliance risk third party service providers and direct access to the ach operator operational and transaction risk and information technology risk. Files exceeding limits could be fraud and expose the ficustomer to loss. Detailed risk assessment tools. Mop has information for auditlink for credit unions concerned with the patriot act cuanswers is interested in any feedback your teams may have.

A less complex credit union may have less comprehensive documentation. Ways for the credit union to engage with our teams eg.