Eitc Due Diligence Questionnaire Template

Key questions to determine whether exception may apply are preparers trained in eitc due diligence.

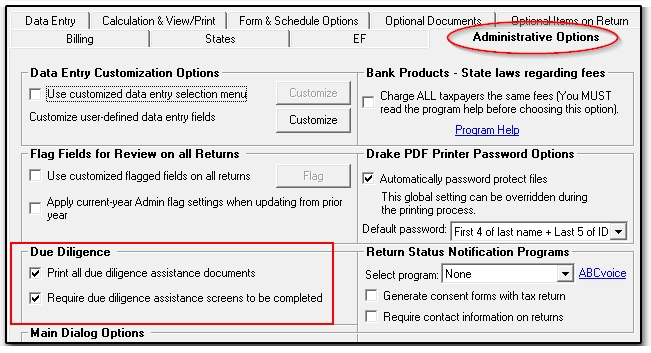

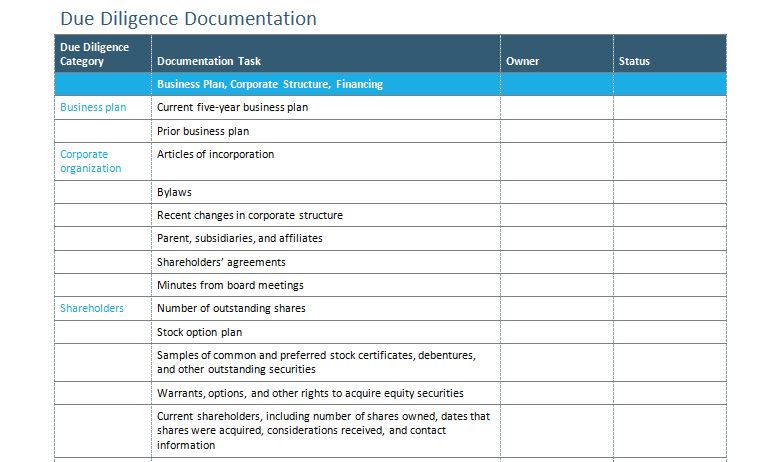

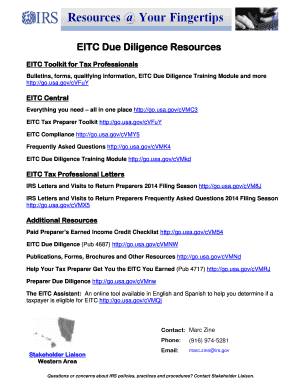

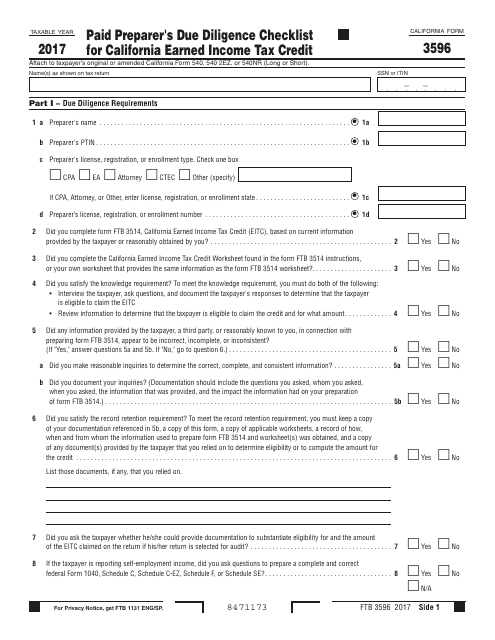

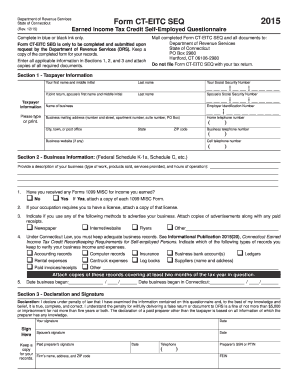

Eitc due diligence questionnaire template. Irs assesses more than 90 percent of all due diligence penalties for failure to comply with the knowledge requirement of irc 6695 g. Consider what due diligence requires in the following situation. More in tax preparer toolkit. Remember to document any additional questions you ask your client and the answers your client gives at the time of the interview either in the client file or within your software.

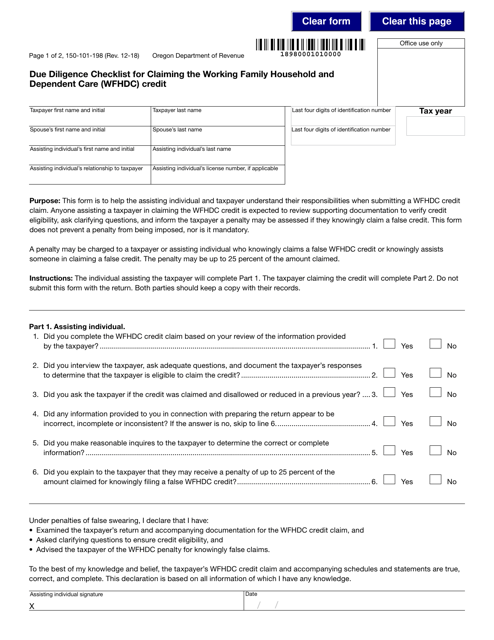

So dont miss any tax savings or refundable credits for your clients. Due diligence requirements for the eitc the ctc and the aotc is. Family dynamics change and just because they qualified last year doesnt mean they will qualify this year. Committed when claiming the credit discusses the eic due diligence requirements imposed on professional tax return preparers and identifies the sanctions to which preparers and their employers may be subject for a failure to meet expected due diligence requirements.

Find a list of states and local governments that have eitc programs here. Eitc 1 3 is your income 43352 or less. Ask each client all the questions every year. Know the questions to ask to help your clients get the most out of education and child related tax benefits.

Or things could have changed and this year they qualify. Yes or no are you legally married. These examples show how asking the right questions can help you get all the facts. Eic questionnaire page 1 of 1 eitc taxpayers due diligence questionnaire todays date taxpayer name ssn circle all answers that apply to you.

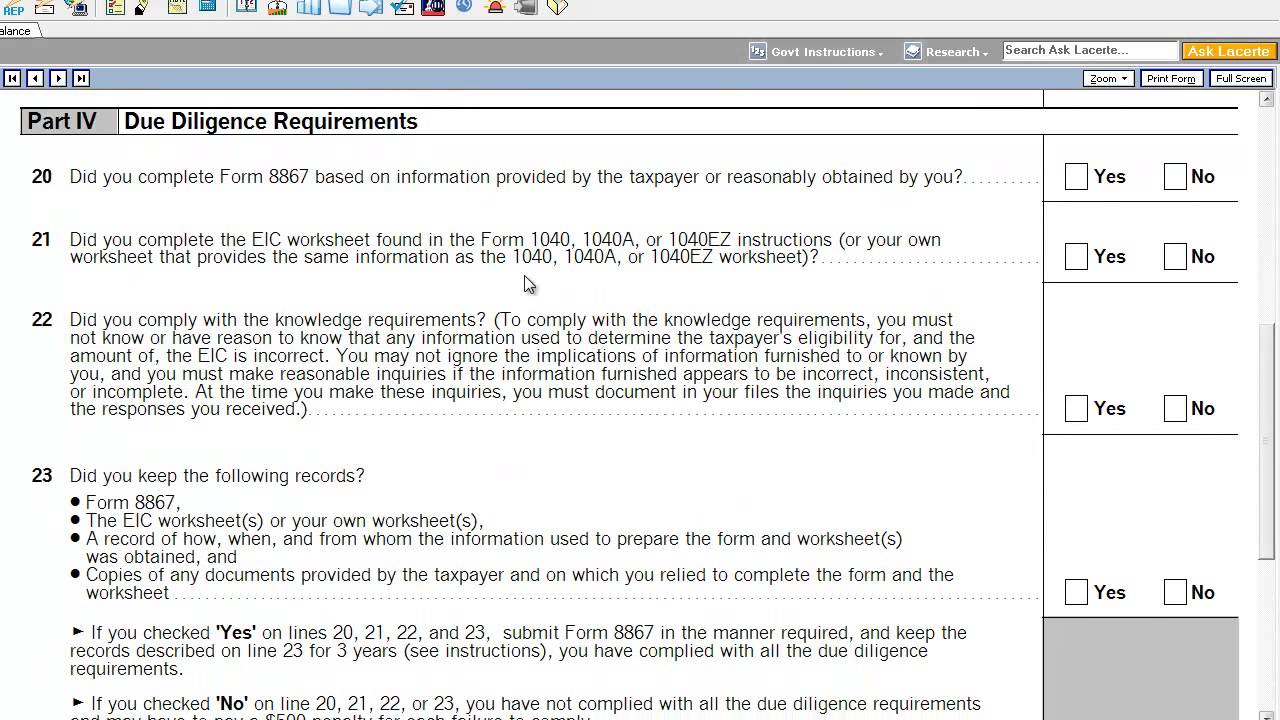

Section of the frequently asked questions. The earned income tax credit eitc to also cover the child tax credit ctc and the american. Practice your due diligence and help your clients get the credits they are due. Section 6695g of the internal revenue code and related regulations set out the preparer due diligence requirements and the penalties for determining eligibility for the earned income tax credit eitc child tax credit ctc additional child tax credit actc credit for other dependents odc american opportunity tax credit aotc and head of household hoh filing status.

Questions about eligibility or how to claim eitc on a state or local return should be directed to your state or. For an eitc due diligence visit examiner determines if preparer has complied with irc 6695g if penalties are. Does the income that the taxpayer is reporting seem sufficient to support the taxpayer and the qualifying children that are being claimed. Earned income credit additional due diligence questions income.

Learning objectives upon completion of this course you should be able to. If no additional questions pertaining to both the income and the children should be asked.