Filing Receipt For Business

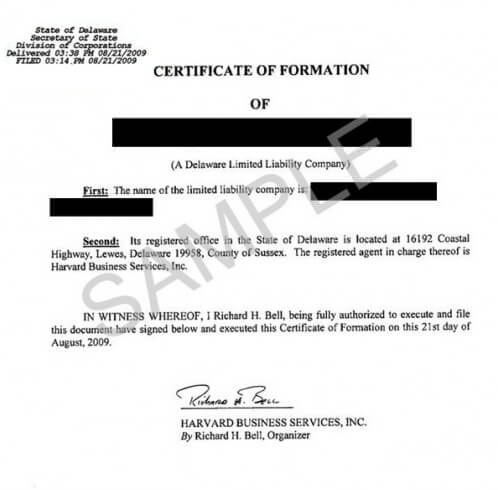

Certificates of good standing.

Filing receipt for business. When you have a plan in place to organize all those papers you can clear out quite a. Filing receipt from new york dept. Tax id ein filings. Nys online corporation llc filings.

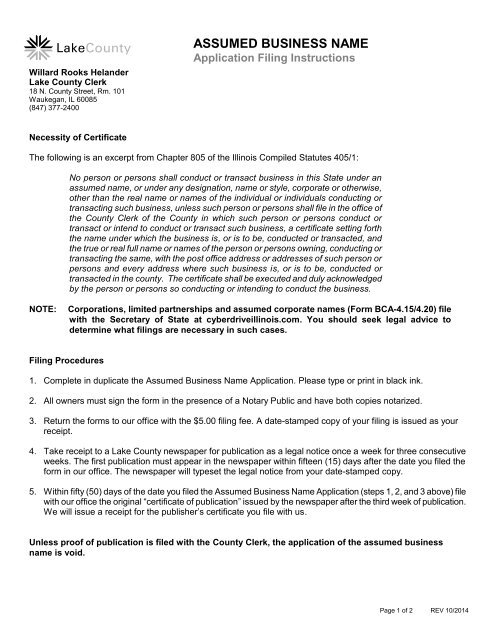

Oldest type of business entity. Naming your folders is the first step to organising this part of your business. Of course discovering a disorganized mass of receipts can create a mess of trouble. Notifies you upon receipt of documents learn.

A filing receipt establishes when the item was registered so a dispute or infringement issue can be settled if there is a competing claim. You may have a folder called invoices receipts 2017. As a business owner receipts copies of invoices bills and other paperwork can pile up quickly making our desks cluttered and offices messy. You may choose any recordkeeping system suited to your business that clearly shows your income and expenses.

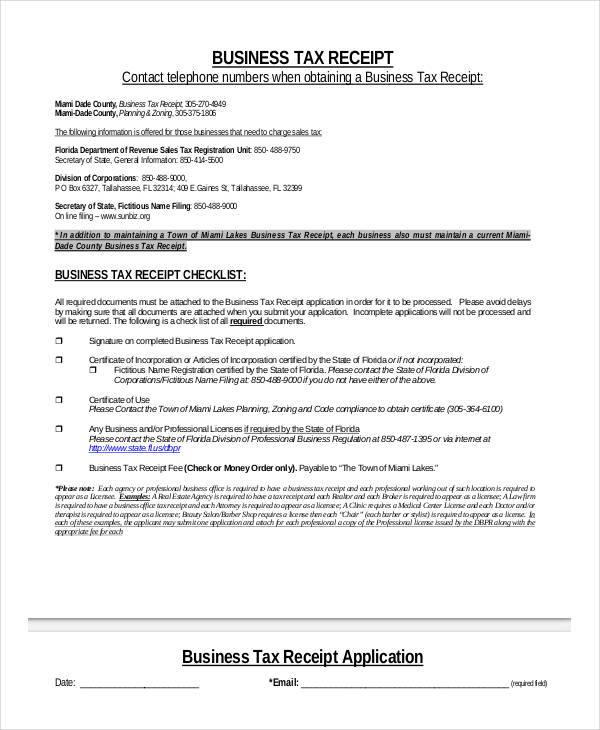

The business you are in affects the type of records you need to keep for federal tax purposes. If you set a strong foundation from the start and adopt strong organization habits youll find that keeping your receipts organized is a breeze. A receipt for filing taxes is another example that is relevant for both individuals and businesses. The form for filing may be drafted by the filer by following the requirements of section 1309 ac of the business corporation law.

Your recordkeeping system should include a summary of your business transactions. The certificate must be enclosed in a white cover sheet that sets forth the title of the document and the name and address of the individual to whom the receipt for the filing should be mailed. In conclusion the key to organizing receipts for your small business is to make sure theres an easily manageable workflow for the software tools youre using or your filing cabinet. Within this a set of dividers with 1 12 april to march or a to z filing the invoices and receipts within the correct index.

When first starting a business you might want to keep receipts gathered to deduct business expenses on your income tax and morea better system is required for when its time to do bookkeeping rather than stuffing all of your business receipts into a desk drawer. A business will have different types of tax to take care of the main ones being payroll tax sales tax and income tax.