Filing Receipt For Llc

You will receive it whether you file by mail or online.

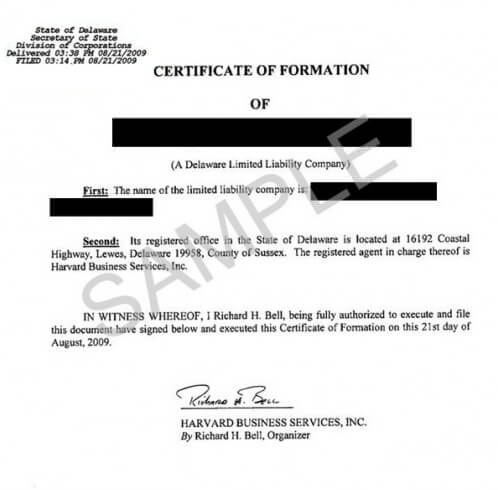

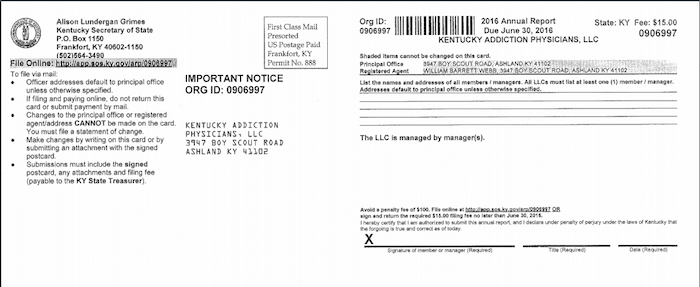

Filing receipt for llc. Filing must be received by 700pm est or edt. A receipt for filing taxes is another example that is relevant for both individuals and businesses. The department of state will issue an official filing receipt to the filer of the articles of. A filing receipt for llc is a receipt that confirms that you have submitted an application for the formation of a limited liability company llc.

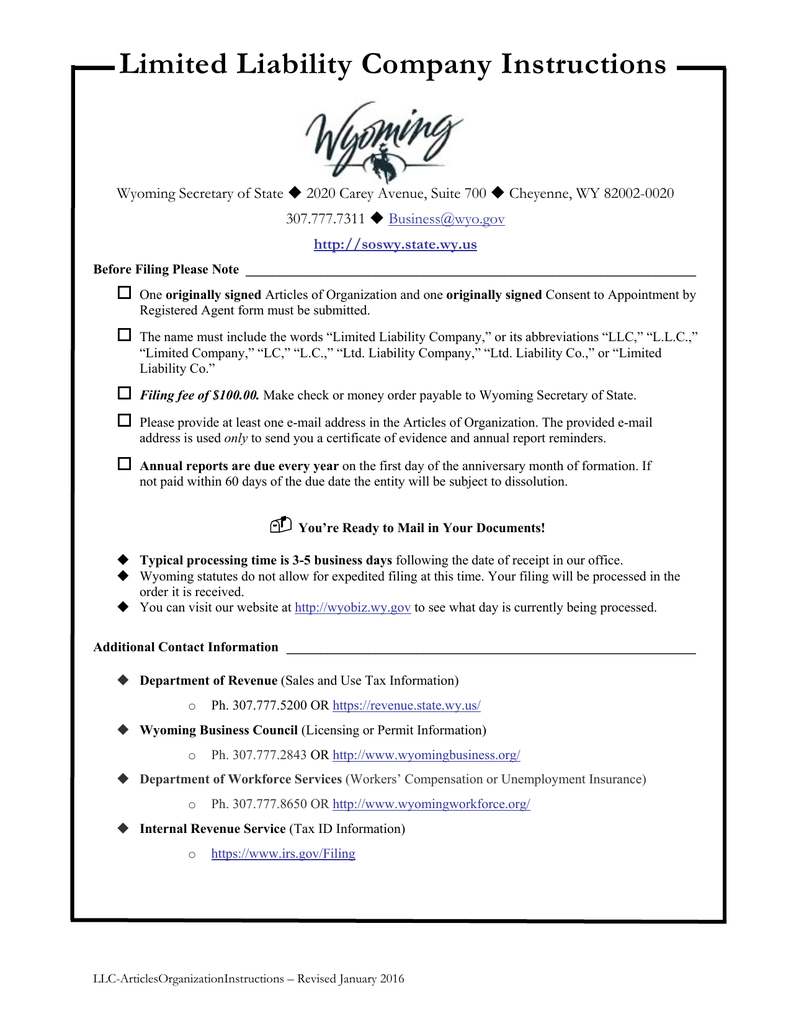

You will be forwarded to the new york state department of states online filing system. Forming a limited liability company in new york state. Missing a tax deadline often entails significant sanctions and penalties. Filing will be completed the next business day of receipt excluding weekend and holidays.

Same day service 20000 filing must be received by 200pm est or edt. The fee to file a request for extension of reservation of name is 20. Next day service 10000 filing must be received by 700pm est or edt. New york recognizes many business forms including the limited liability company llc corporation limited partnership sole proprietorship general partnership and other less familiar forms.

Filing receipt from new york dept. Also in the filing receipt the registered agent section is empty. The acceptable methods of payment are credit card mastercard visa american express. Llc a new york limited liability company filed articles of organization pursuant to the limited liability law on 01162020 and that the limited liability company is existing so far as shown by the records of the department is everything right.

Please note that immediately upon filing you will receive an email filing acknowledgement with your filing receipt attached in pdf format. Completed with 2 hours of receipt. This receipt is issued by the state agency that handles llc filings which is usually the secretary of state.