Free Anti Money Laundering Policy Template For Mortgage Brokers

Anti money laundering aml and suspicious activity reporting sar plans.

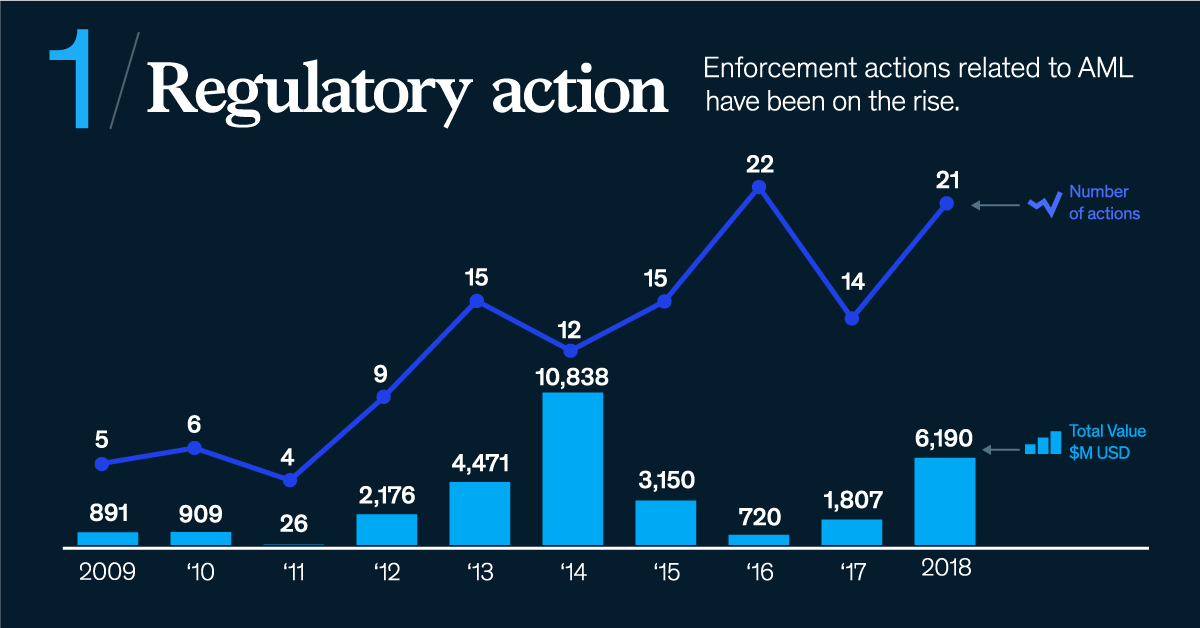

Free anti money laundering policy template for mortgage brokers. Private mortgage agreement form uk form resume anti money laundering pliance program template free best anti money laundering pliance program template anti money laundering debuts for nonbank mortgage panies pliance policies and procedures for mortgage lenders financial policy regulation department central bank of pliance audit checklist template templates resume best anti money laundering. Government agencies in detecting and preventing money laundering. This is the only section of bsa that must be implemented. With fincens determination that mortgage firms are money businesses we must now comply with the aml and sar rules.

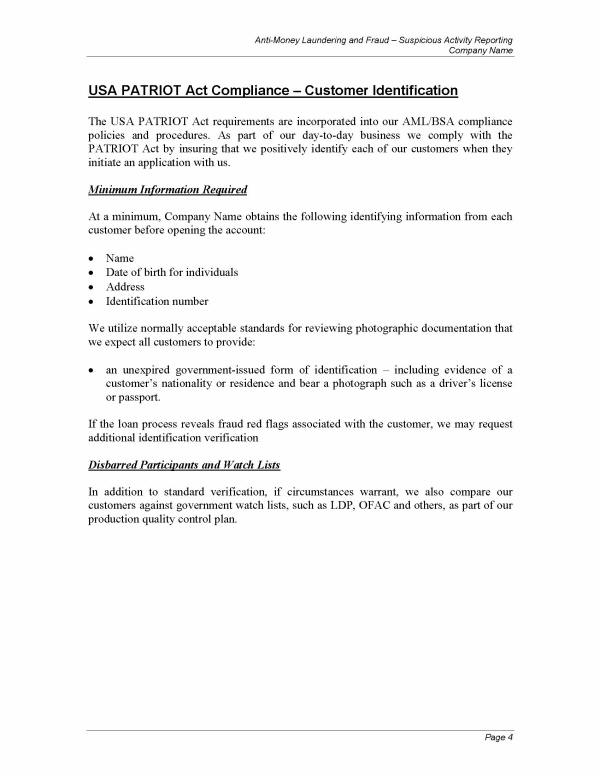

Yes as a mortgage broker you must have an anti money laundering program in place regardless of whether you are a company employing 100 loan originators or a one man shop the bank secrecy act of 1970 bsa or act requires financial institutions to assist us. Here is a free resource suspicious activity reporting for dummies. Onlineeds new inlineed aml compliance bundle provides you with a well written and customizable anti money laundering policy. Anti money laundering policy bank secrecy act with sar reporting matrix and step by step amlbsa compliance plan for brokers mortgage brokers are considered money service businesses by the financial crimes enforcement network fincen and must report incidences of suspicious activity.

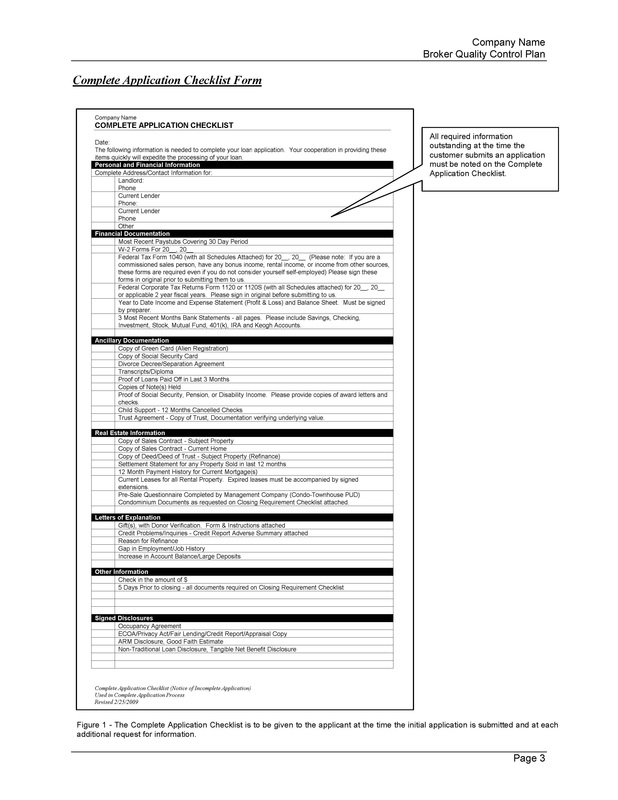

O establishing internal policies procedures and controls including a process for collecting. Policies procedures and internal controls developed and implemented by a loan or finance company under this section shall include provisions for complying with the applicable requirements of the united states code pertaining to integrating the companys employees agents and brokers into its anti money laundering program and obtaining all. The reports underscore the potential benefits of aml and sar regulations for a variety of businesses in the primary and secondary residential mortgage. Since 2006 fincen has issued numerous studies analyzing sars reporting suspected mortgage fraud and money laundering that involved both banks and residential mortgage lenders and originators.

Mortgage companies can develop their own training and compliance systems for aml bsa and sars but why not use ours. An aml program includes at a minimum. Anti money laundering policy with sar reporting matrix. Onlineed has developed a trouble free system that can help you comply with these new requirements.

The template provides text examples instructions relevant rules and websites and other resources that are useful for developing an aml plan for a small firm. The final rule requires residential mortgage loan originator rmlo companies to implement the anti money laundering aml and sar reporting section of bsa.

/arc-anglerfish-tgam-prod-tgam.s3.amazonaws.com/public/PJVEOU4TKNAGJJZMKJERHOD6ZE.jpg)