Free Credit Dispute Letter Template

It is important to dispute inaccurate information.

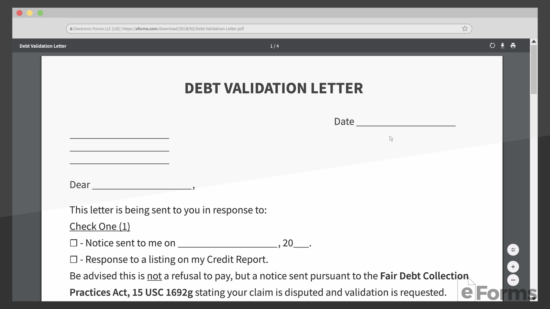

Free credit dispute letter template. Basic credit dispute letter this letter is a shorter version of the original credit dispute letter that shows you how to list multiple disputed items. How to write a dispute letter. By sending letters to credit reporting agencies you force lenders to prove that you owe them money and that they are justified in adding the negative item on your credit report. Sample dispute letter video what is a credit report dispute letter.

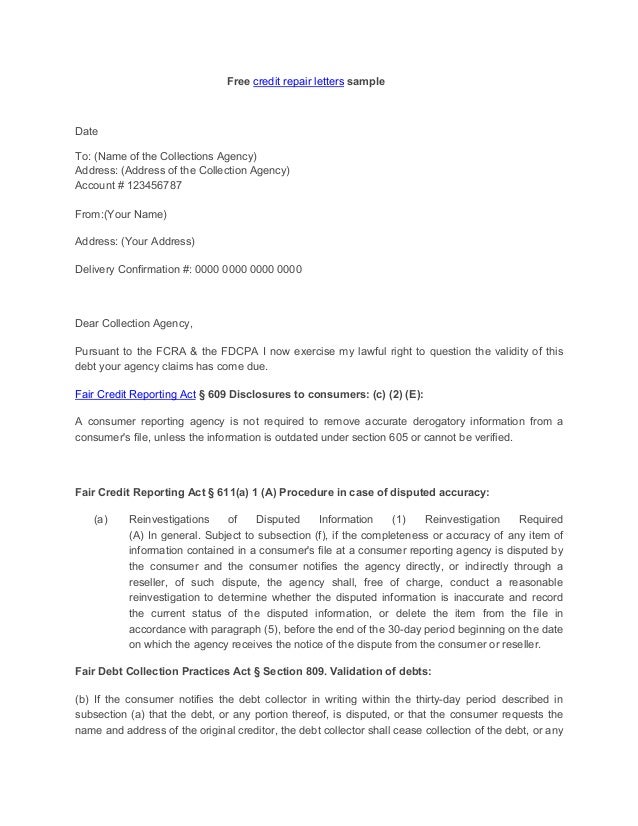

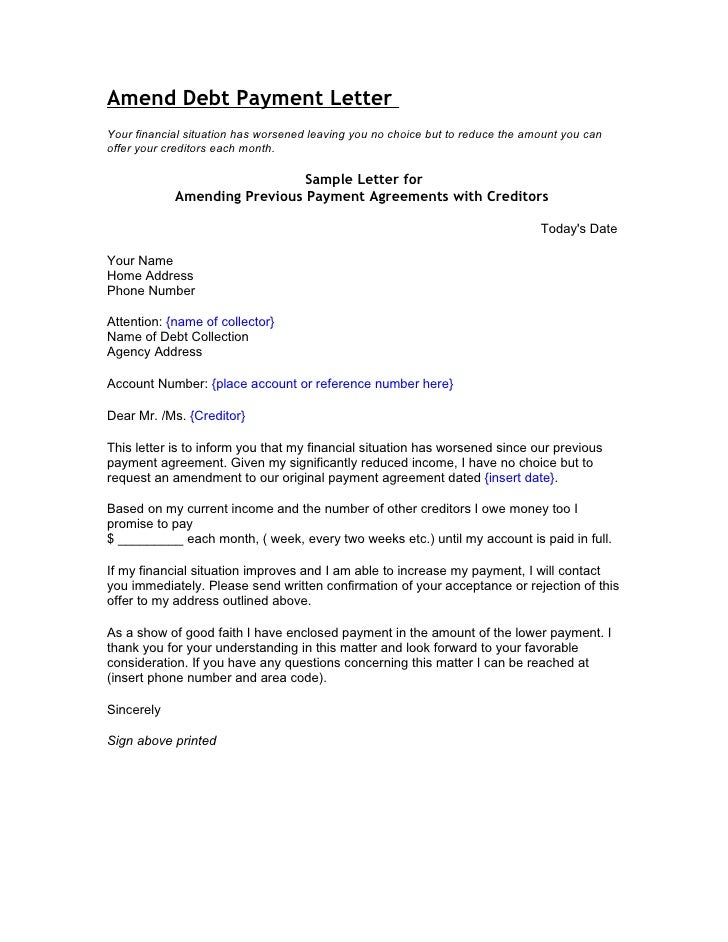

We believe that everyone should have free access to information regarding their credit. The 609 letter is similar to a debt verification letter you would send to a third party collector when trying to validate the legitimacy of a balance due which is your right under the fair debt collection practices actthe 609 letter however is based on section 609 of the fair credit reporting act fcra a federal law that regulates the credit reporting agencies. It can be used for an equifax experian or transunion dispute. The letters listed above are wonderful resources that you can use to help repair your credit.

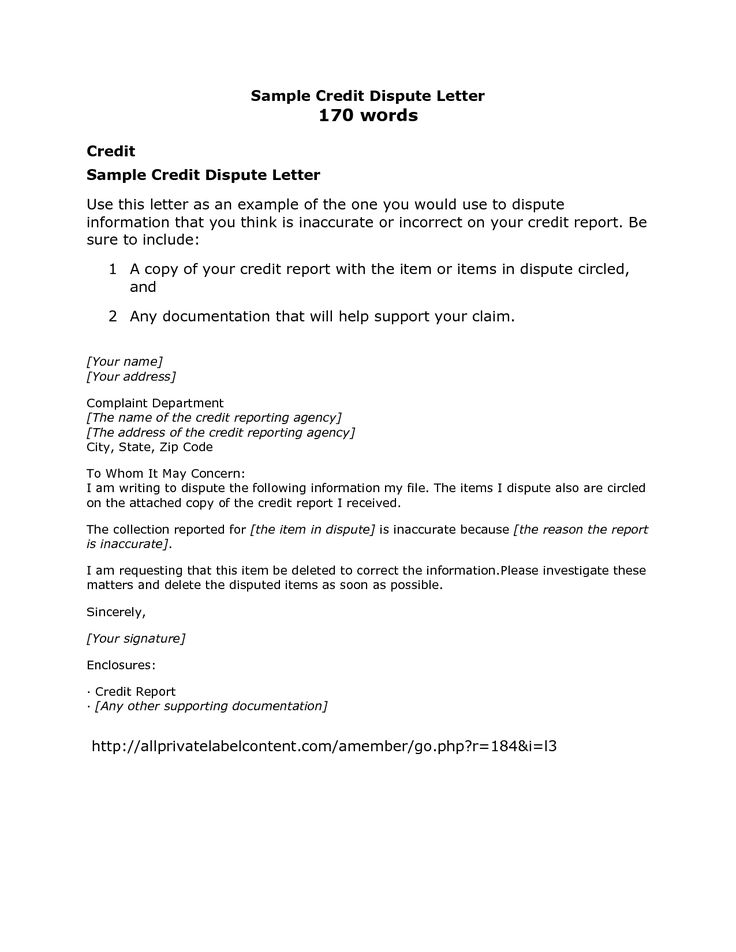

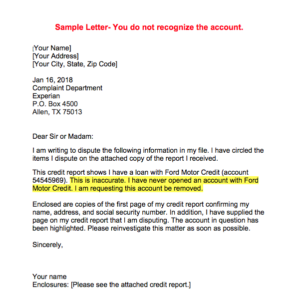

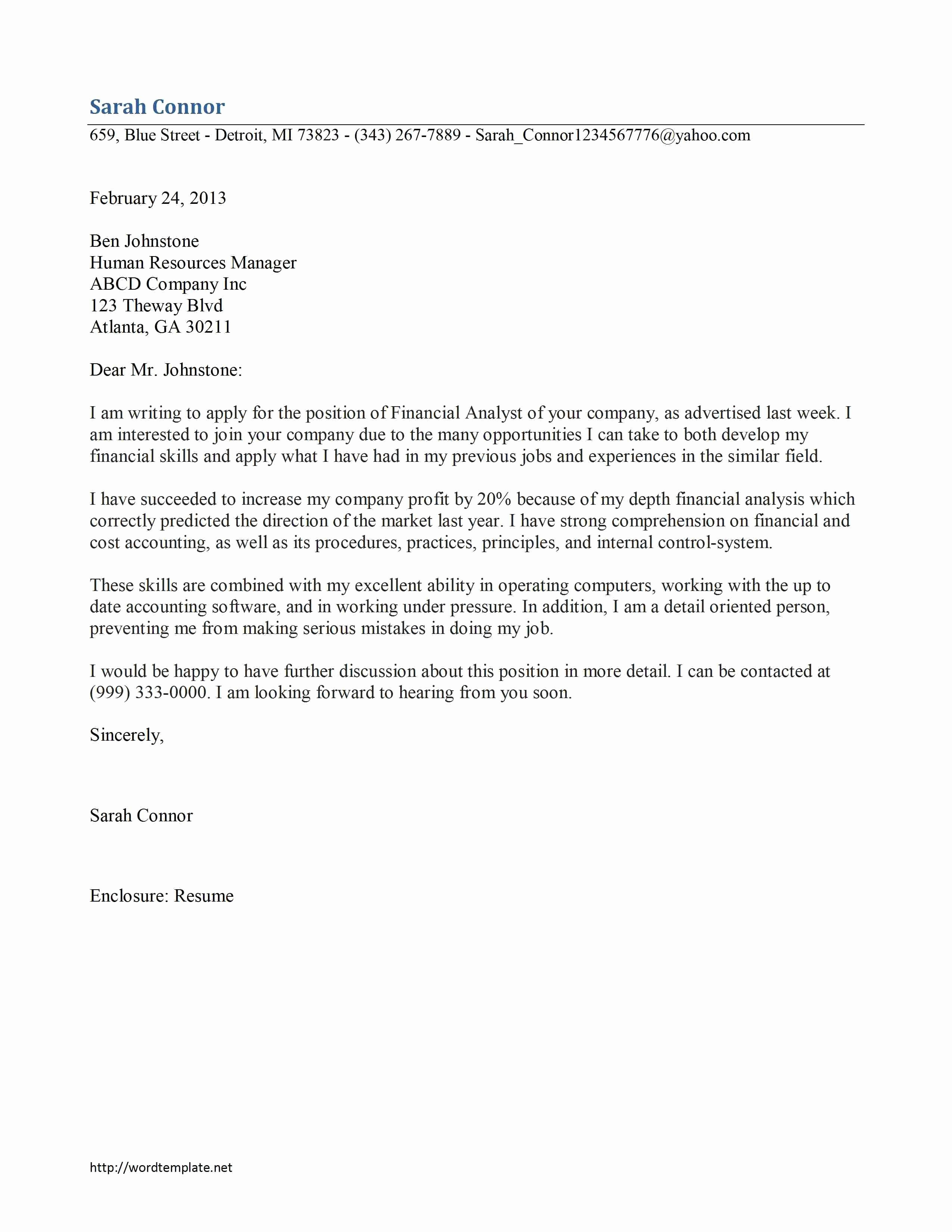

Its intended to give you an idea of what a credit report dispute letter should look like and what it should contain. Please remember that its just an example. Your letter should clearly identify each item in your report you dispute state the facts and explain why you dispute the information and request that it be removed or corrected. We do not charge for any of the information we provide on this website including any of our credit dispute letter templates.

Credit report dispute letter use this credit dispute letter to send to all three credit reporting agencies when disputing inaccurate incorrect or incomplete information found on your credit reports. Do you suspect an organization is reporting something incorrectly to one or more credit bureausyou can send them a credit dispute letter. Credit dispute letter template. Sample letter credit report dispute this guide provides information and tools you can use if you believe that your credit report contains information that is inaccurate or incomplete and you would like to submit a dispute of that information to the credit reporting company.

Below is a sample dispute letter disputing a credit card account. Dispute an item on a credit report. Disputing a credit report is a protected and free right under the consumer credit protection act that requires credit bureaus to investigate if a collection or debt is valid. That will require them to investigate and resolve your claim within 30 days.

The free printable general business letter is a letter template that can be used for sending a formal letter for credit freeze letter template if you feel that your credit information has been compromised you may need to request a credit freeze using the.