Free Printable 1099 Misc Form 2019

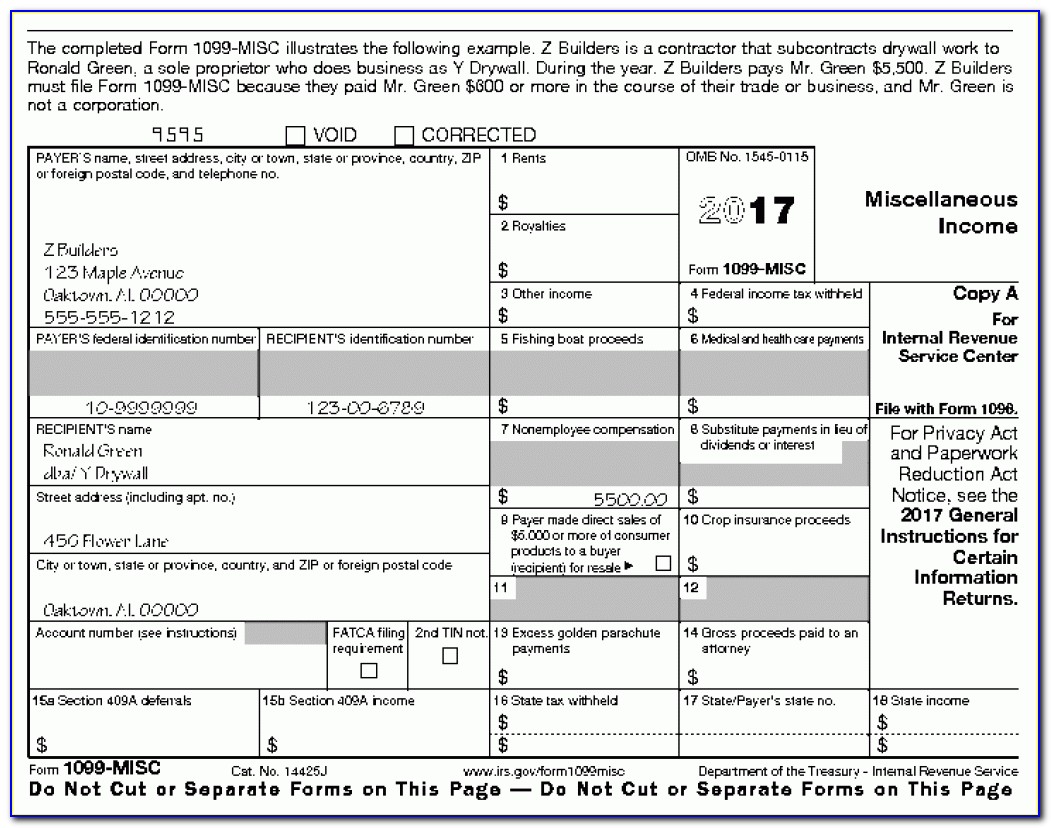

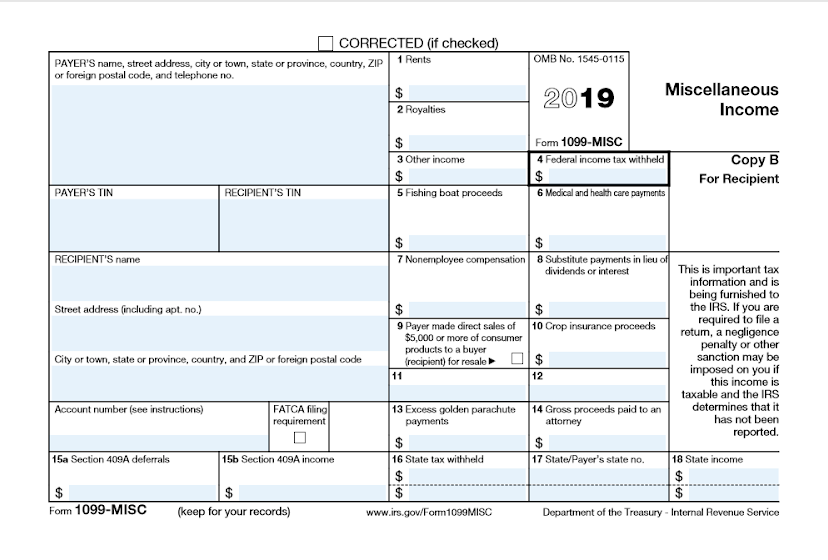

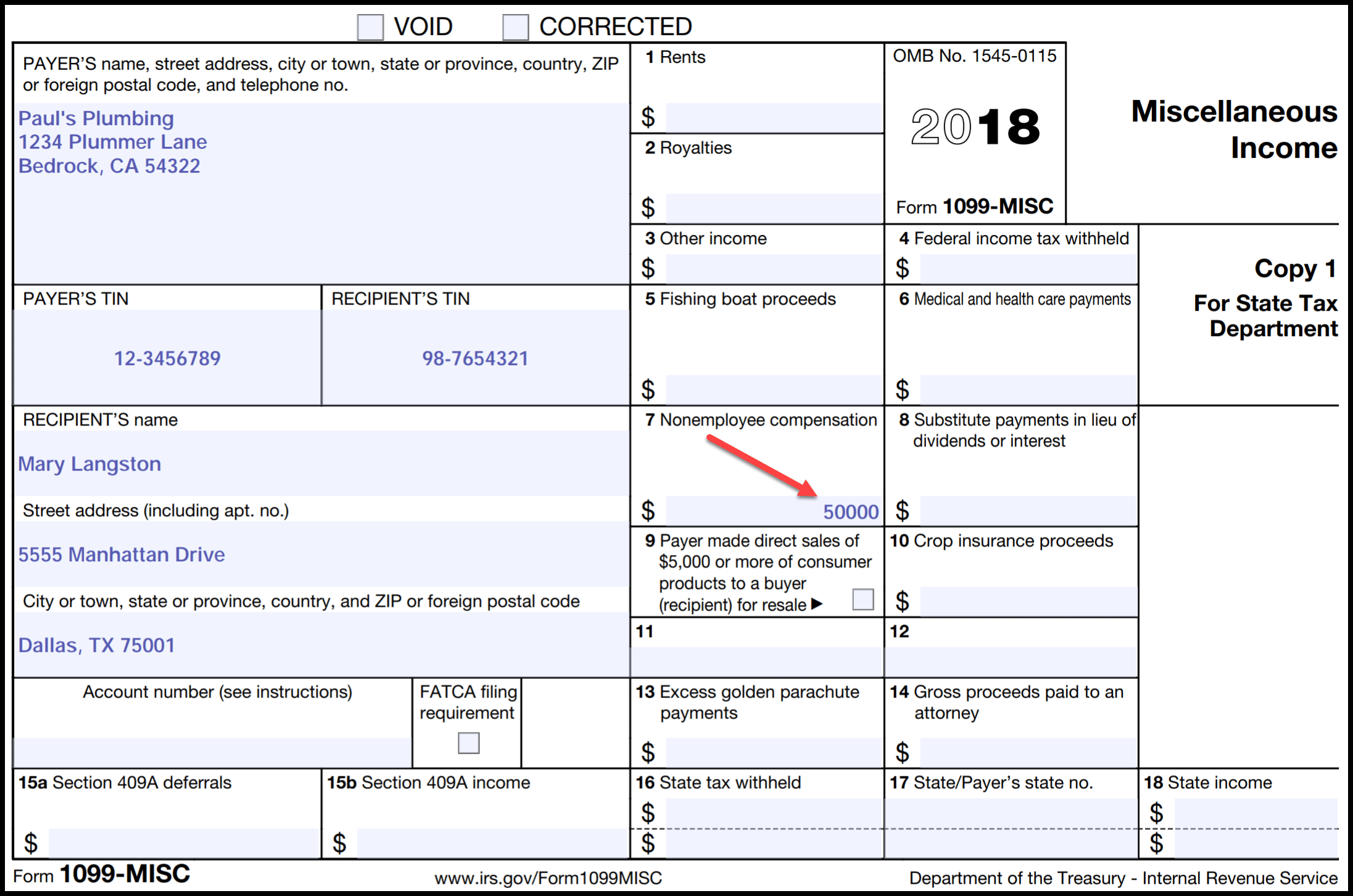

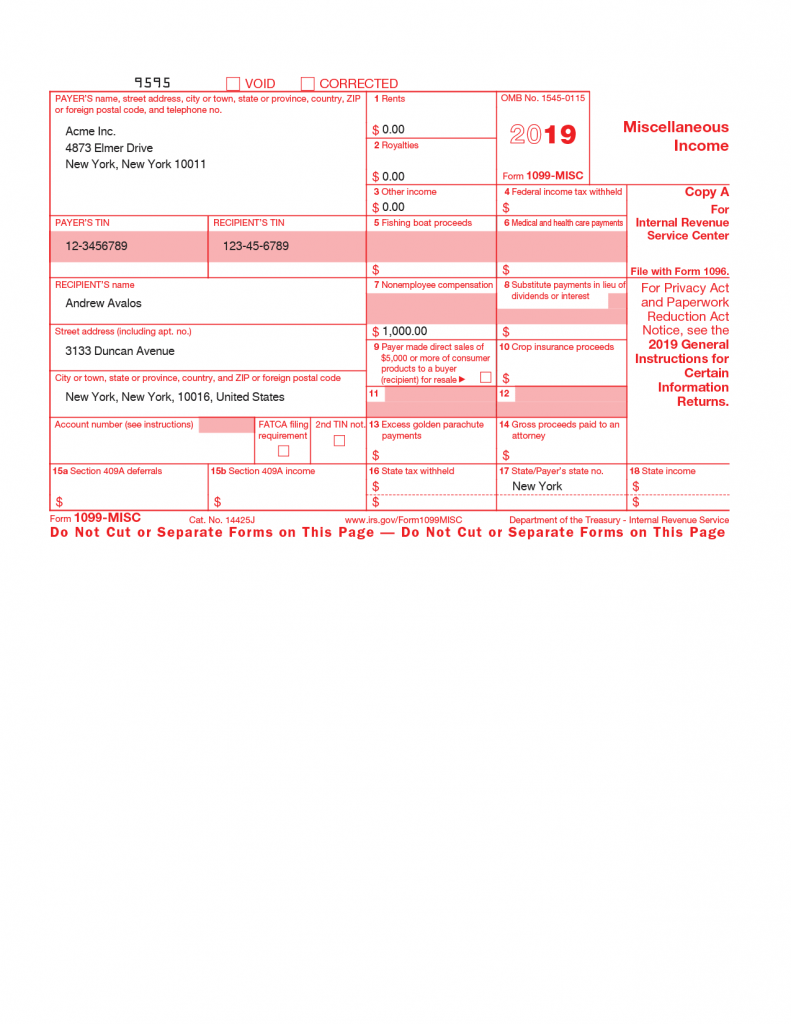

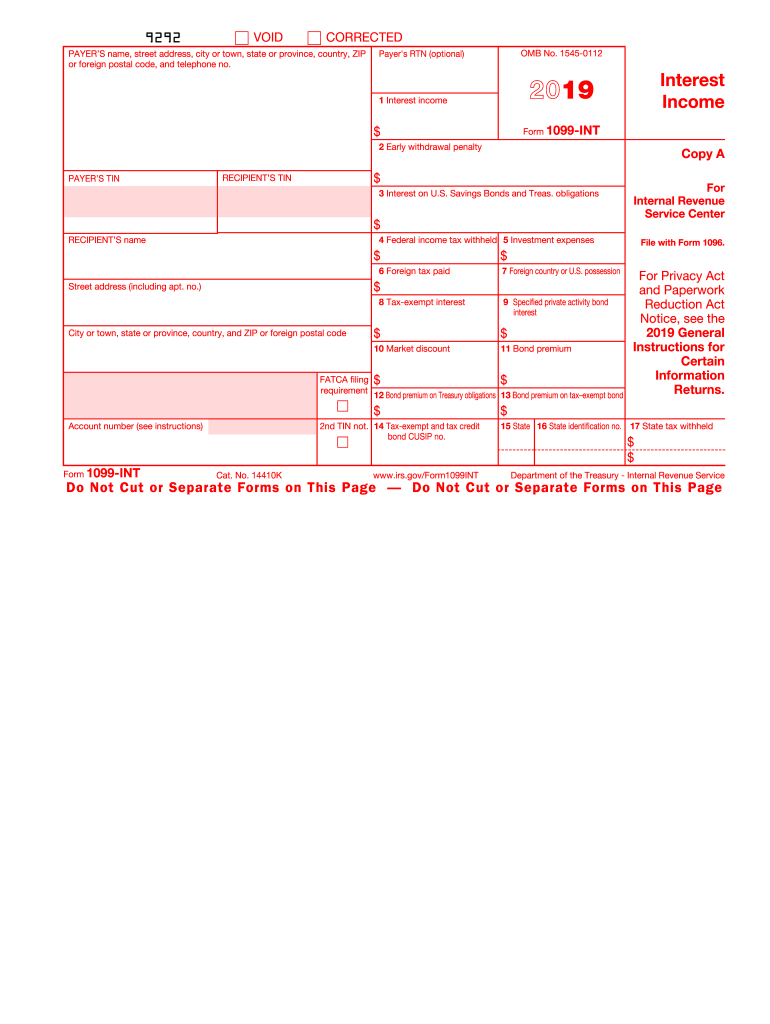

Once youve received your copy of the form youll want to familiarize yourself with the various boxes that must be completed.

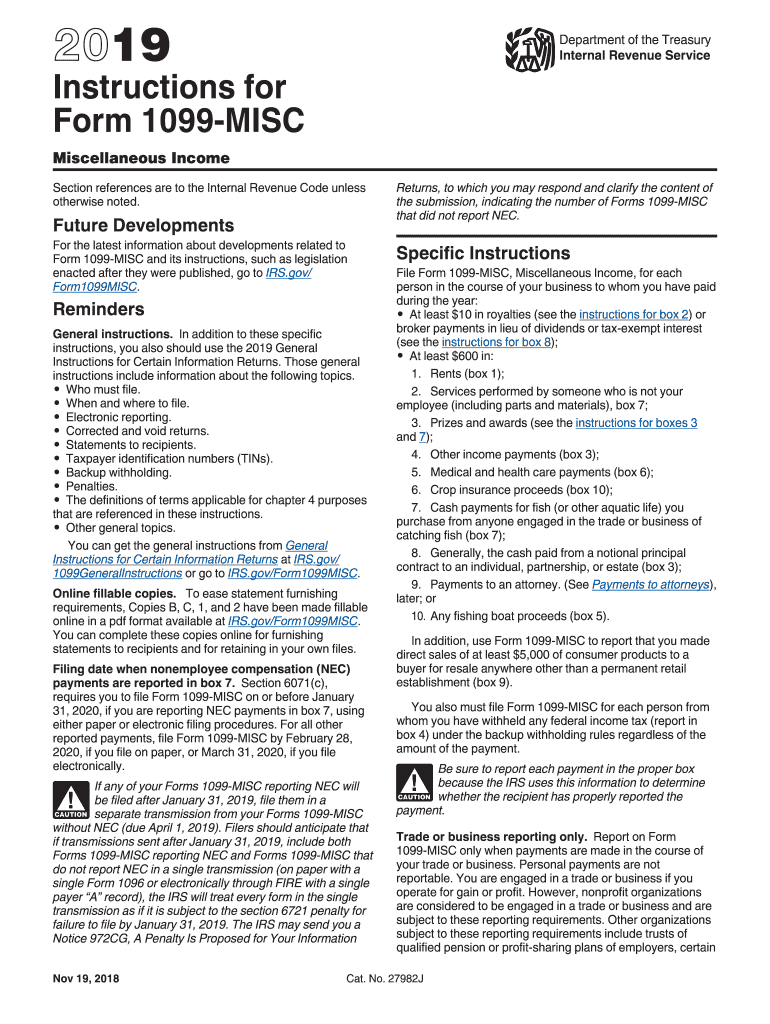

Free printable 1099 misc form 2019. You may also have a filing requirement. In common words a 1099 form reports all income earnings dividends payments and other personal income. Choose the fillable and printable pdf template. And you will be charged a penalty of 100 per form if you file form 1099 misc after 30 days of the due date.

1099 information return is provided by payers to individuals like independent contract workers to report payments made during the total year. If your net products on schedule c form 1040 or 1040 sr. What is 1099 form. You will be charged a penalty of 50 per form if you file form 1099 misc within 30 days of the due date.

Those who need to send out a 1099 misc can acquire a free fillable form by navigating the website of the irs which is located at wwwirsgov. Create complete and share securely. Free printable 1099 misc form 2019 online. Instantly send or print your documents.

The irs form 1099 misc due date is january 31 2020 if you are reporting nonemployee compensation nec payments in box 7 whether the filing is done on paper or electronically. Amounts shown may be subject to self employment se tax. 1099 misc form is used to report various types of miscellaneous income. The most popular type is a 1099 misc form.

See the instructions for form 8938. Form 1099 misc call the information reporting customer service site toll free at 866 455 7438 or 304 263 8700 not toll free. Reported payments file form 1099 misc by february 28 2020 if you file on paper or march 31 2020 if you file electronically. Payer is reporting on this form 1099 to satisfy its chapter 4 account reporting requirement.

If any of your forms 1099 misc reporting nec will be filed after january 31 2019 file them in a separate transmission from your forms 1099 misc without nec due april 1 2019. For all other reported payments form 1099 misc must be filed by february 28 2020 if filed on paper or by march 31 2020 if filed electronically. Persons with a hearing or speech disability with access to ttytdd equipment can call 304 579 4827 not toll free. Printable versions for 1099 form for the 2019 year in pdf doc jpg and other popular file formats.