Free Printable 1099

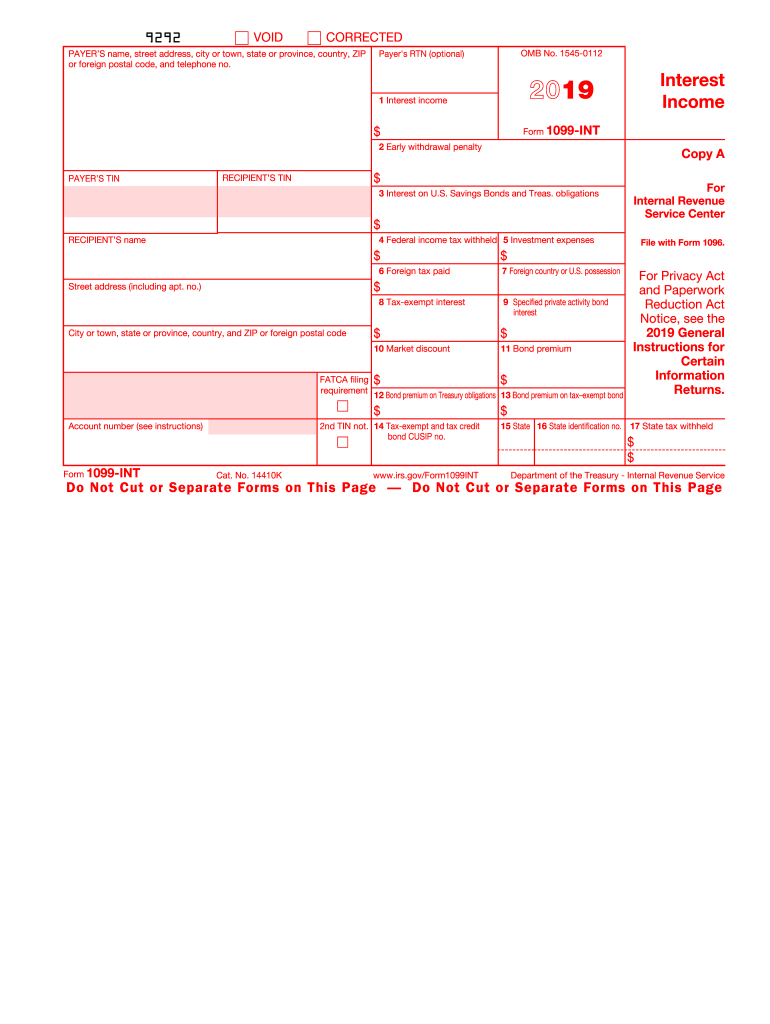

Print and file copy a downloaded from this website.

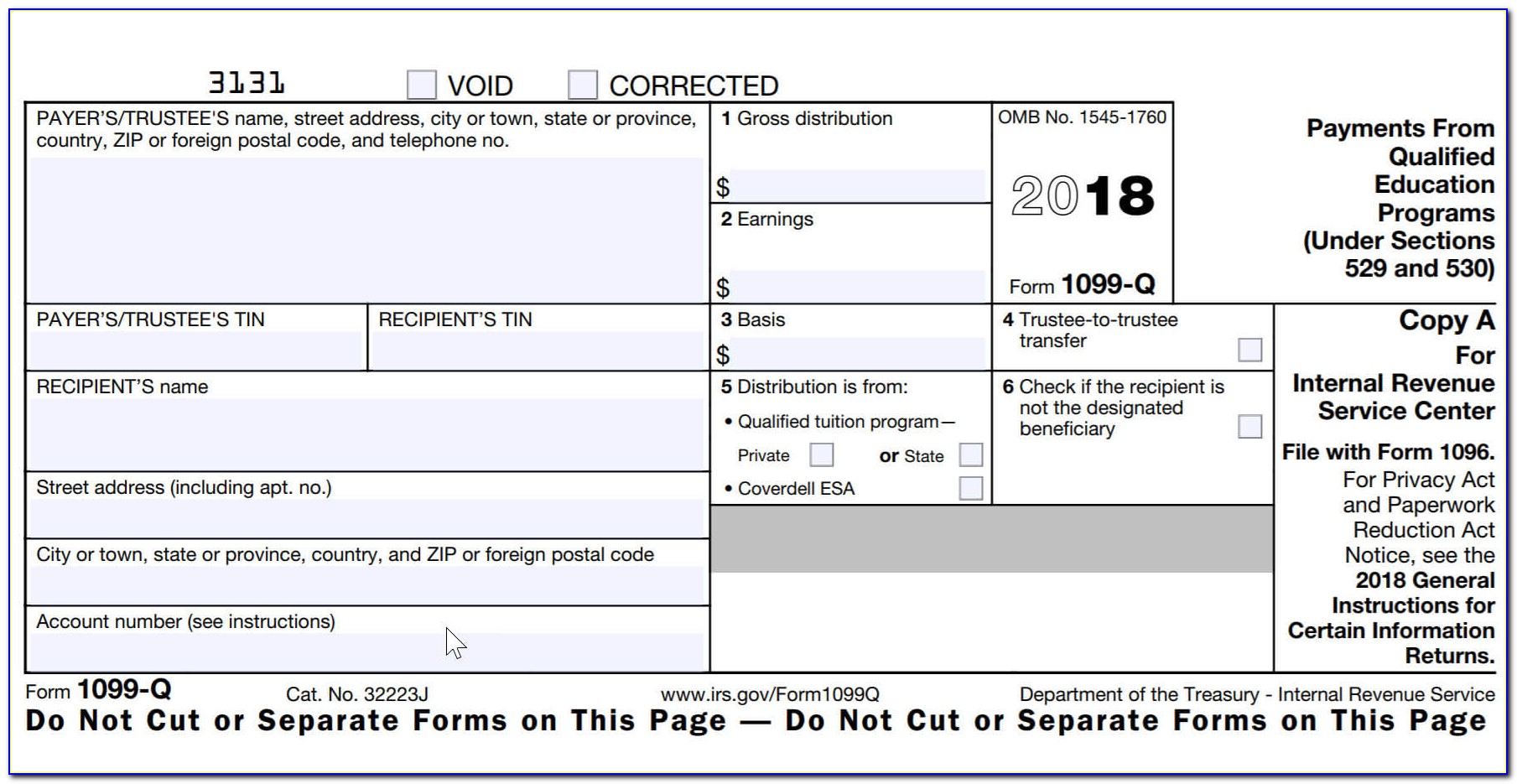

Free printable 1099. W2 and 1099 kit 52 everything you need to file your w2 and 1099 misc forms use to prepare w2s for up to 30 employees and prepare 1099 misc for up to 30 contractors vendors. Contract was transferred tax free to another trustee or. Online service compatible with any pc or mobile os. Fill download print forms instantly.

You also may have a filing requirement. Once youve received your copy of the form youll want to familiarize yourself with the various boxes that must be completed. In our download page users can find the 1099 tax form printable versions for free. Here you will find the fillable and editable blank in pdf.

See your tax return instructions for where to report. Report payments made in the course of a trade or business to a person whos not an employee. A penalty may be imposed for filing with the irs. Also it can be printed from the browser without saving the file to the device storage folder.

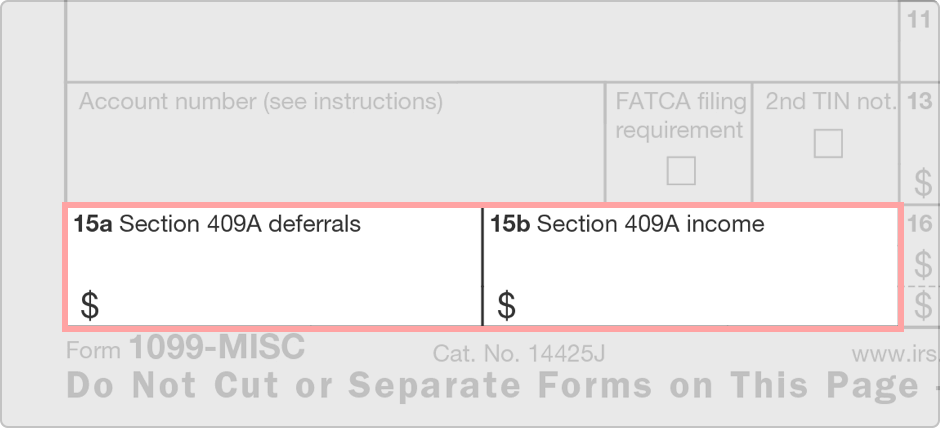

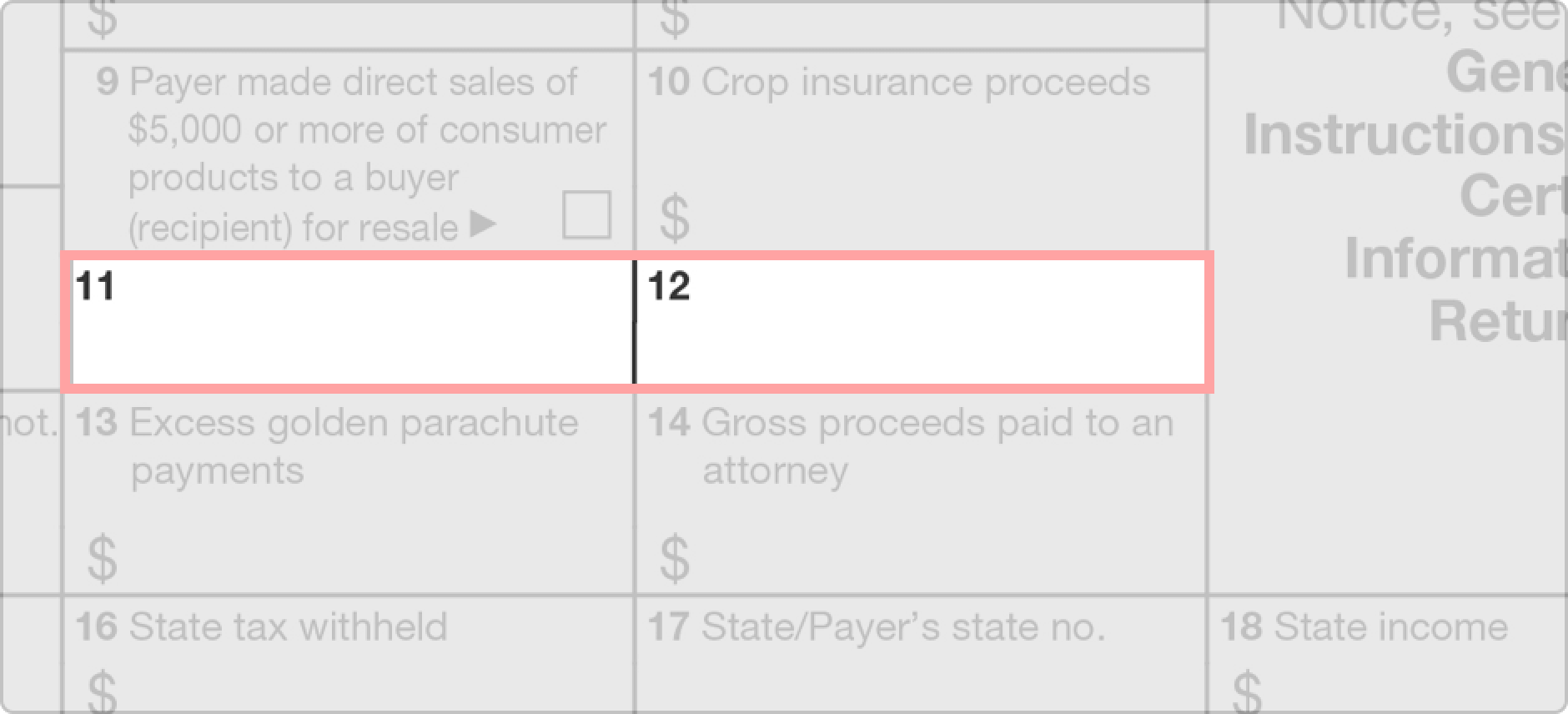

Shows your total compensation of excess golden parachute payments subject to a 20 excise tax. Create your 1099 misc form. Information about form 1099 misc miscellaneous income including recent updates related forms and instructions on how to file. Create free printable form 1099 misc online for 2019.

A penalty may be imposed for filing with the irs. Create your sample print save or send in a few clicks. Payers use form 1099 misc miscellaneous income to. Those who need to send out a 1099 misc can acquire a free fillable form by navigating the website of the irs which is located at wwwirsgov.

See the instructions for form 8938. Buy w2 kit w2 mate software details. Form 1099 misc is used to report rents royalties prizes and awards and other fixed determinable income. W2 mate will print 1099 misc copies b c 1 and 2 on blank paper with black ink.

Report payment information to the irs and the person or business that received the payment. Checked the payer is reporting on this form 1099 to satisfy its chapter 4 account reporting requirement. Form 1099 misc call the information reporting customer service site toll free at 866 455 7438 or 304 263 8700 not toll free. Make your tax filing easier e file returns to the irs at just 149 form.

Persons with a hearing or speech disability with access to ttytdd equipment can call 304 579 4827 not toll free. Looking for a printable form 1099 misc and independent contractors. Report payments of 10 or more in gross royalties or 600 or more in rents or for other specfied purposes. All 1099 irs form variations can be downloaded in pdf doc jpeg and other popular file formats.