Genworth Rental Income Calculation Worksheet

Lease agreement or fannie mae form 1025.

Genworth rental income calculation worksheet. Net rental losses are typically included with liabilities when calcu lating the debt ratio. Evaluate qualifying income using. For multi unit properties combine gross rent from all rental units. Use of the worksheets is optional tax return sch.

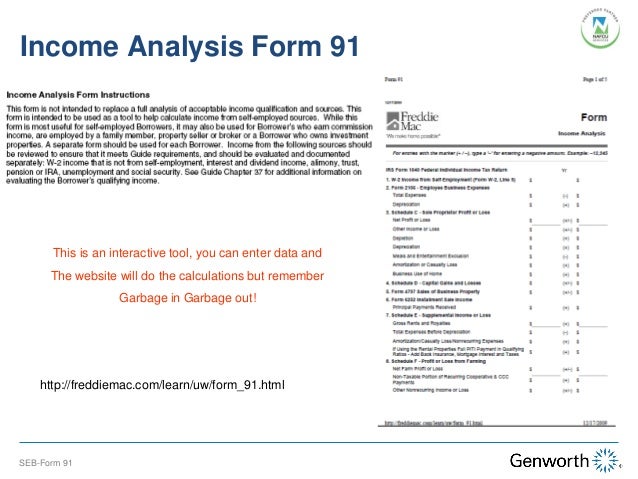

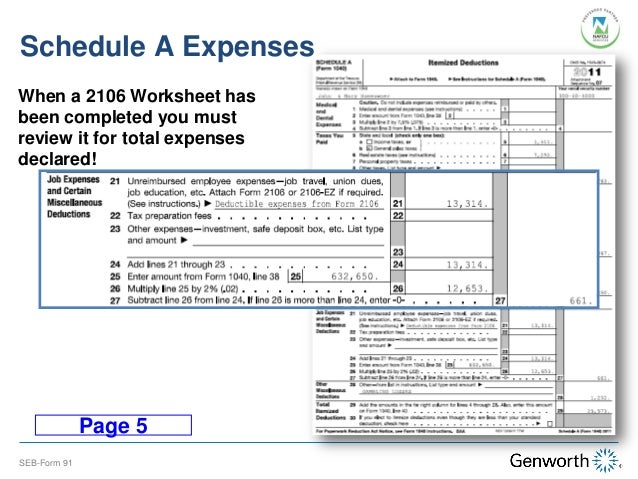

Total expenses line 20 c. Thats why weve developed several self employed borrower calculators to help you calculate and analyze their assets properly. Fannie mae publishes three rental worksheets which lenders may use to calculate rental income. B2 multiply x75 equals adjusted monthly rental income.

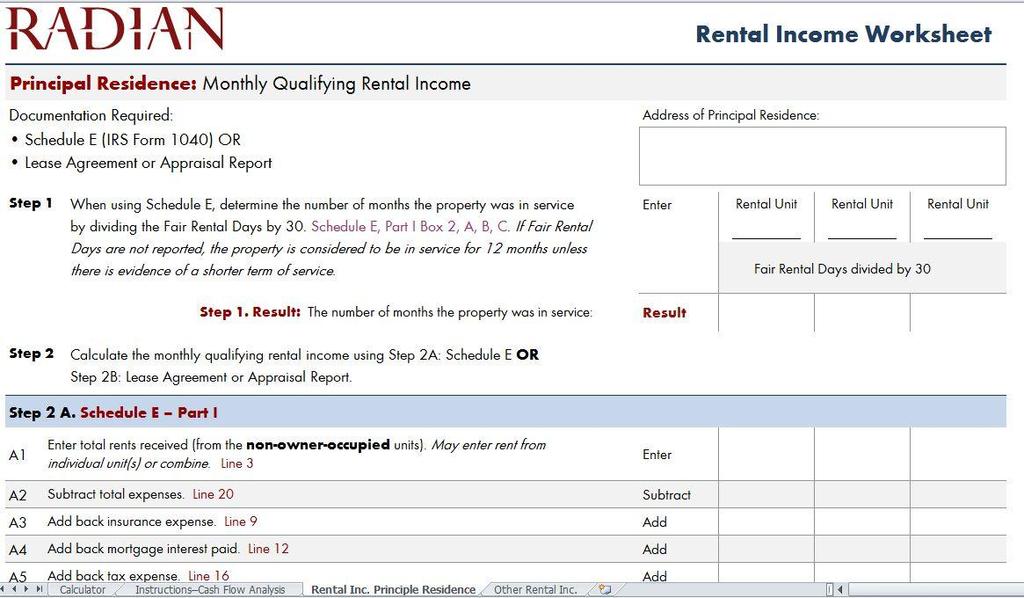

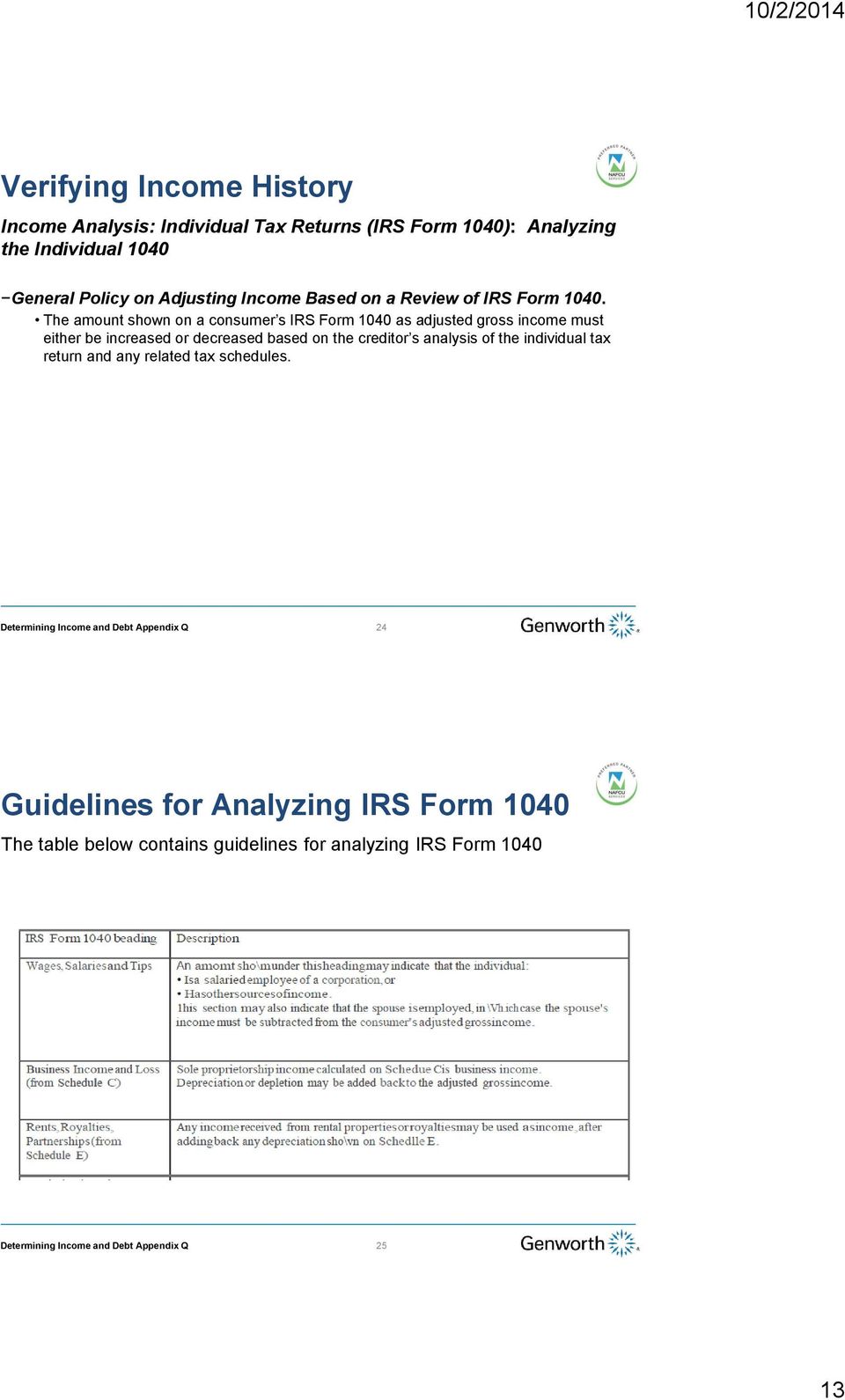

The course will help you understand general guidelines for calculating rental income including recent fannie maefreddie mac announcements and forms as well as how to use schedule e. Download worksheet pdf download calculator excel essent cash flow analysis sam method. Please use the following calculator and quick reference guide to assist in calculating rental income from irs form 1040 schedule e. Rental income calculation 2016 2015 notes.

Result step 2 b. Depletion line 18 subtotal schedule e 6 schedule f prot or loss from farming a. B1 enter the gross monthly rent from the lease agreement or market rent reported on form 1007 or form 1025. Rental property primary.

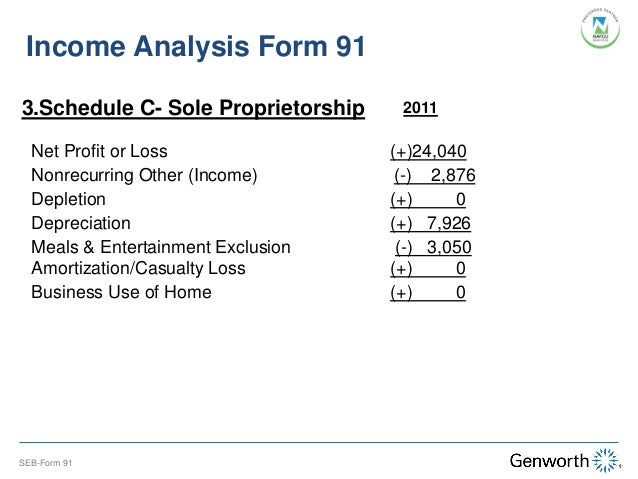

Determining a self employed borrowers income isnt always straightforward. Check applicable guidelines if not using 12 months. Royalties received line 4 b. Calculate the monthly qualifying income for a borrower who is a sole proprietor.

Use our pdf worksheets to total numbers by hand or let our excel calculators do the work for you. Monthly qualifying rental income. This method is used when the transaction is a purchase or the property was acquired subsequent to the most recent tax filing. Equals adjusted monthly rental income a10 existing pitia for non subject property.

B1 enter gross monthly rent from the lease agreement or market rent from form 1025 for the applicable rental unit. Monthly qualifying rental income or loss. Learn how to calculate rental income using personal tax returns as well as basic rental income qualifying guidelines. Please use the following calculator and quick reference guide to assist in calculating rental income from irs form 1040 schedule e.

It provides suggested guidance only and does not replace fannie mae or freddie mac instructions or applicable guidelines.