How To Keep Track Of Receipts For Small Business

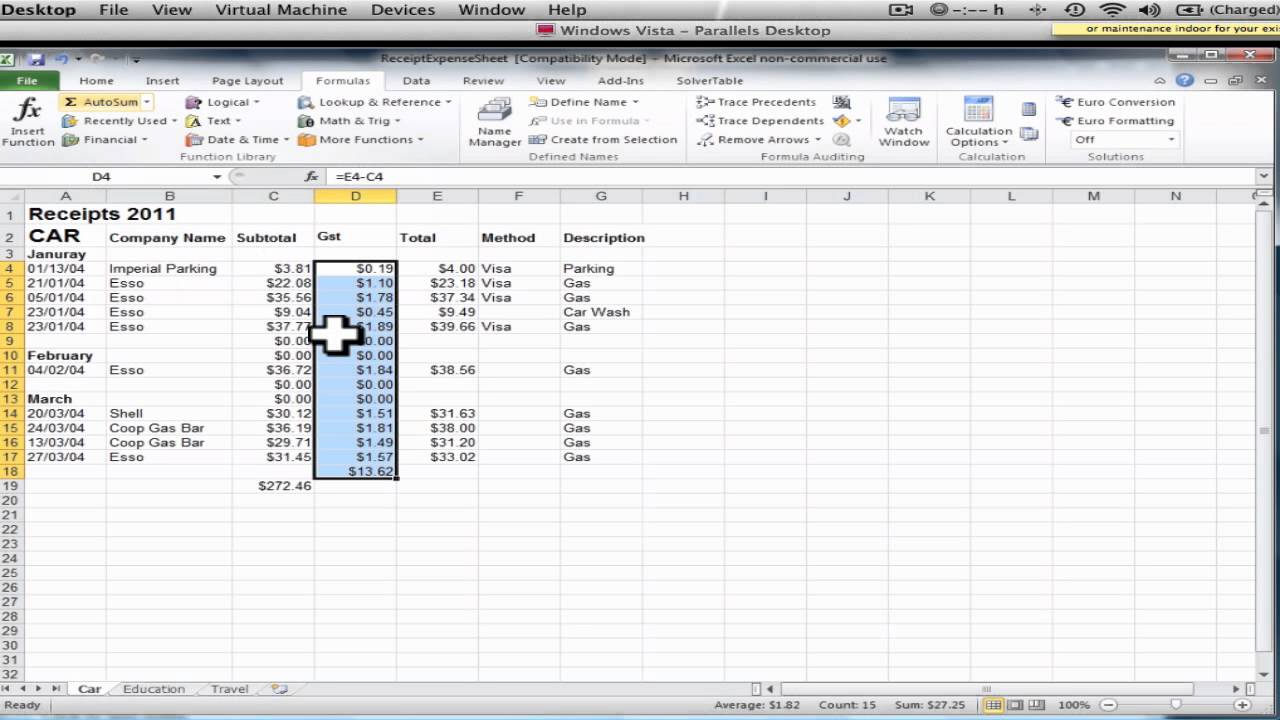

For instance organize them by year and type of income or expense.

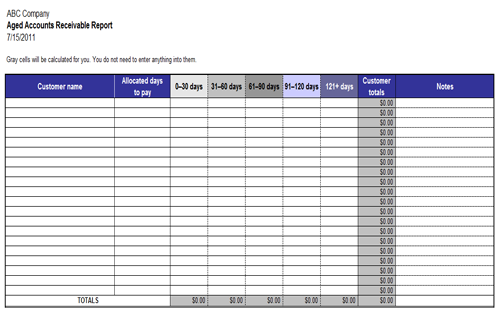

How to keep track of receipts for small business. The irs isnt just going to take your word for it though. Cash is hard to track easy to spend and nearly impossible to reconcile with receipts. By keeping track of business expenses you can take the largest tax deduction youre entitled to. You may tweak your system in small ways over time by trying a new app or management system for more convenience but using the same overall method of keeping the receipts capturing the info and categorizing them each year will keep your information consistent reliable and easily accessible to you.

Its all about routine. It keeps you organized keeps you on budget and can be a big money saver when you file deductions at tax time. Right from the beginning you should establish a system for organizing receipts and other important records. Its a crucial step that allows you to monitor the growth of your business build financial statements keep track of deductible expenses prepare tax returns and support what you report on your tax return.

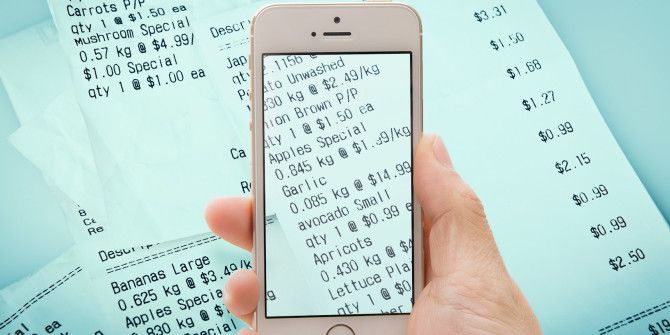

The irs is not a big fan of estimating your expenses. If it was an online receipt create a folder for it or put in folder named business expenses. If you are going to claim a deduction youre going to need. The key to successfully and consistently organizing your receipts is to lay a strong foundation from the start.

Keeping track of receipts for your small business is very important. The more deductions you can take the lower your taxable income will be which means youll have more money in your pocket. Documents for gross receipts include the following. You should keep them in an orderly fashion and in a safe place.

You should keep supporting documents that show the amounts and sources of your gross receipts. Simply stating that you spent 200 on dinner for a new client isnt adequate enough. The date of the transaction. The following are some of the types of records you should keep.

Gross receipts are the income you receive from your business. Print it out as soon as possible and file in the appropriate place. Particularly you want to follow an approach. See seven business management tips for keeping track of business receipts.

You need to have the names of the attendees and their job titles as well as the date of the event and the restaurant. Keep on track of these processes and youll be in a much better position to scale your business.