Illinois Promissory Note Template

Illinois compiled statutes table of contents.

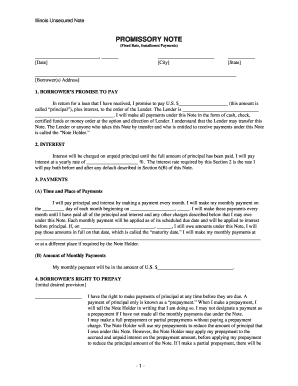

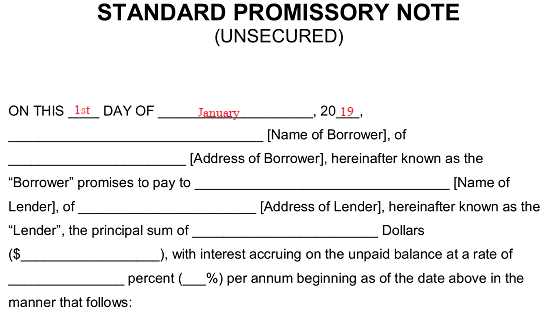

Illinois promissory note template. For rent payment a promissory note can be given by the landlord or the tenant. Provides illinois promissory note forms for all your promissory note needs including installment notes demand notes notes with or without interest secured notes notes for personal loans business loans etc. You can search our library of over 700000 free legal documents to find the legal form that is right for your legal needs. Download this illinois promissory note form.

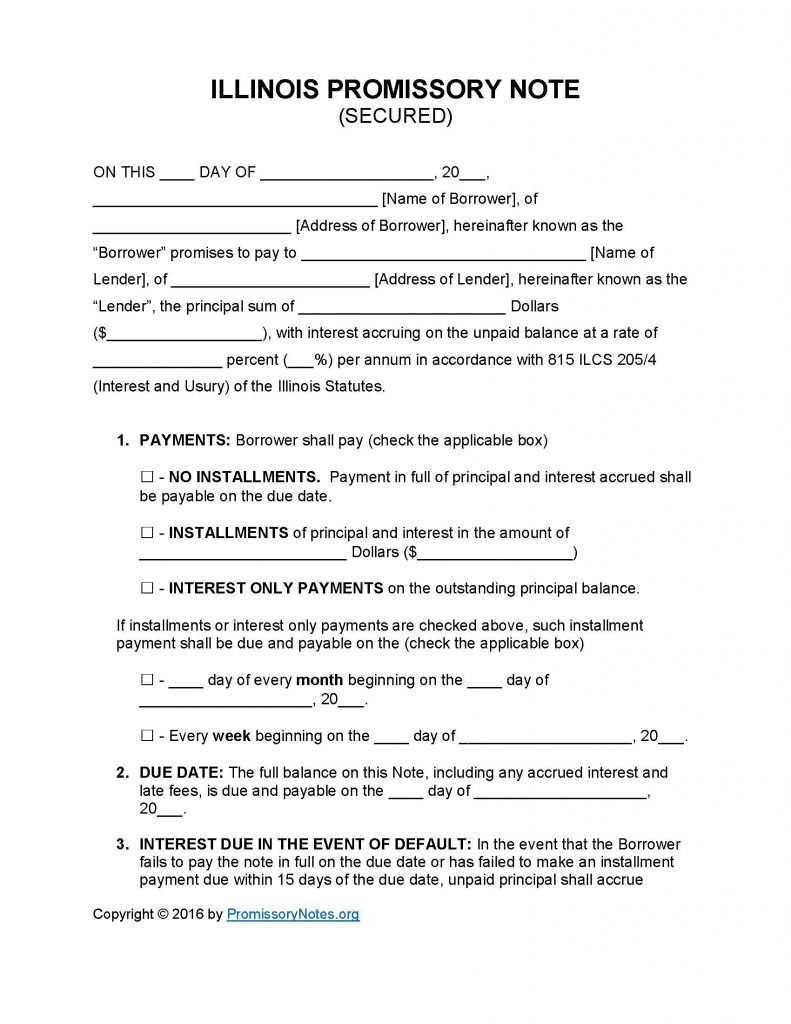

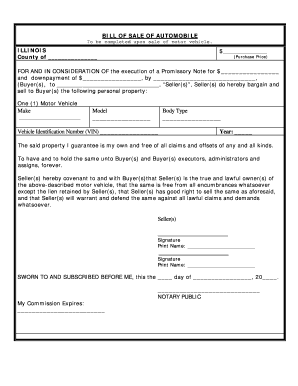

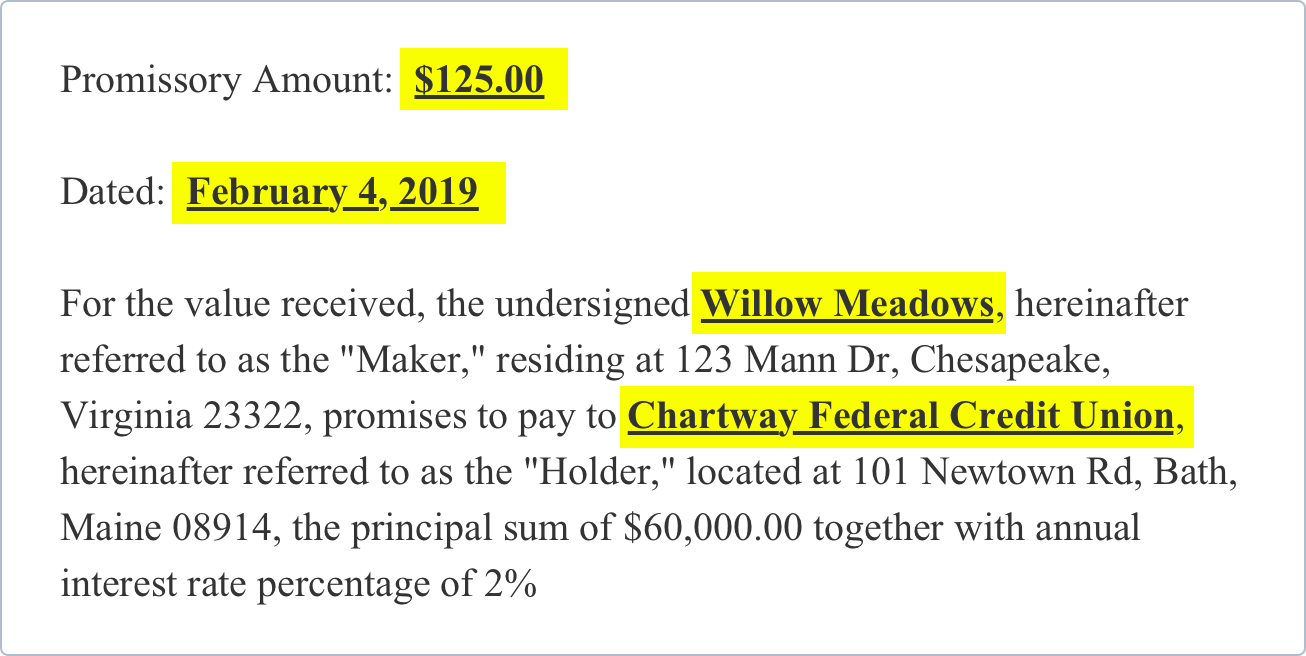

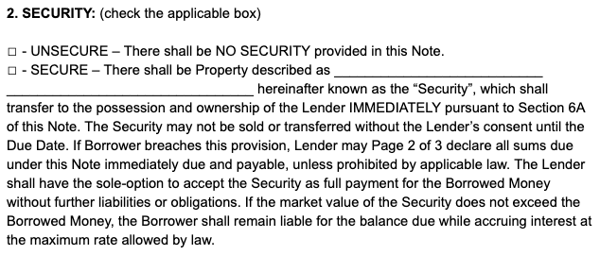

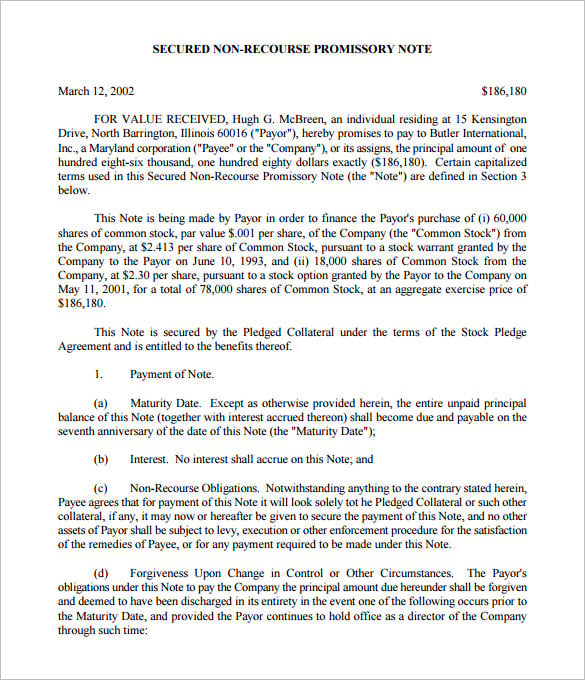

Secured promissory notes are backed by the borrowers pledged assets. The templates are. The most common form of a secured promissory note is a car loan or a mortgage. The parties include the lender the borrower and sometimes a co signer.

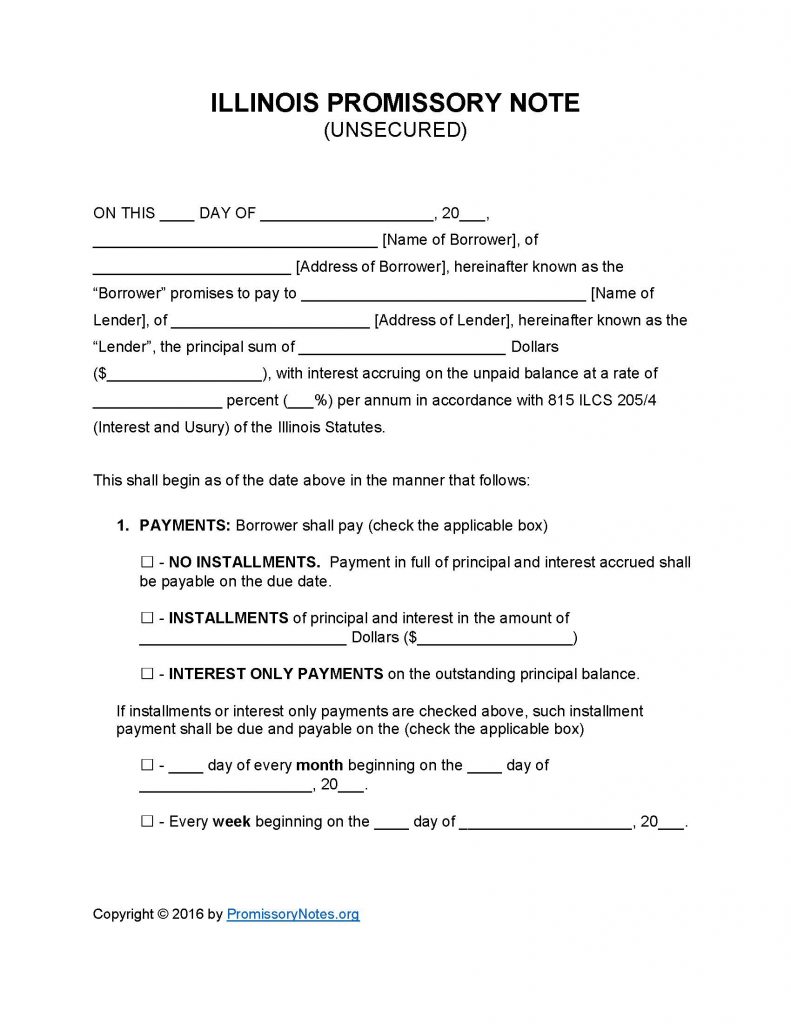

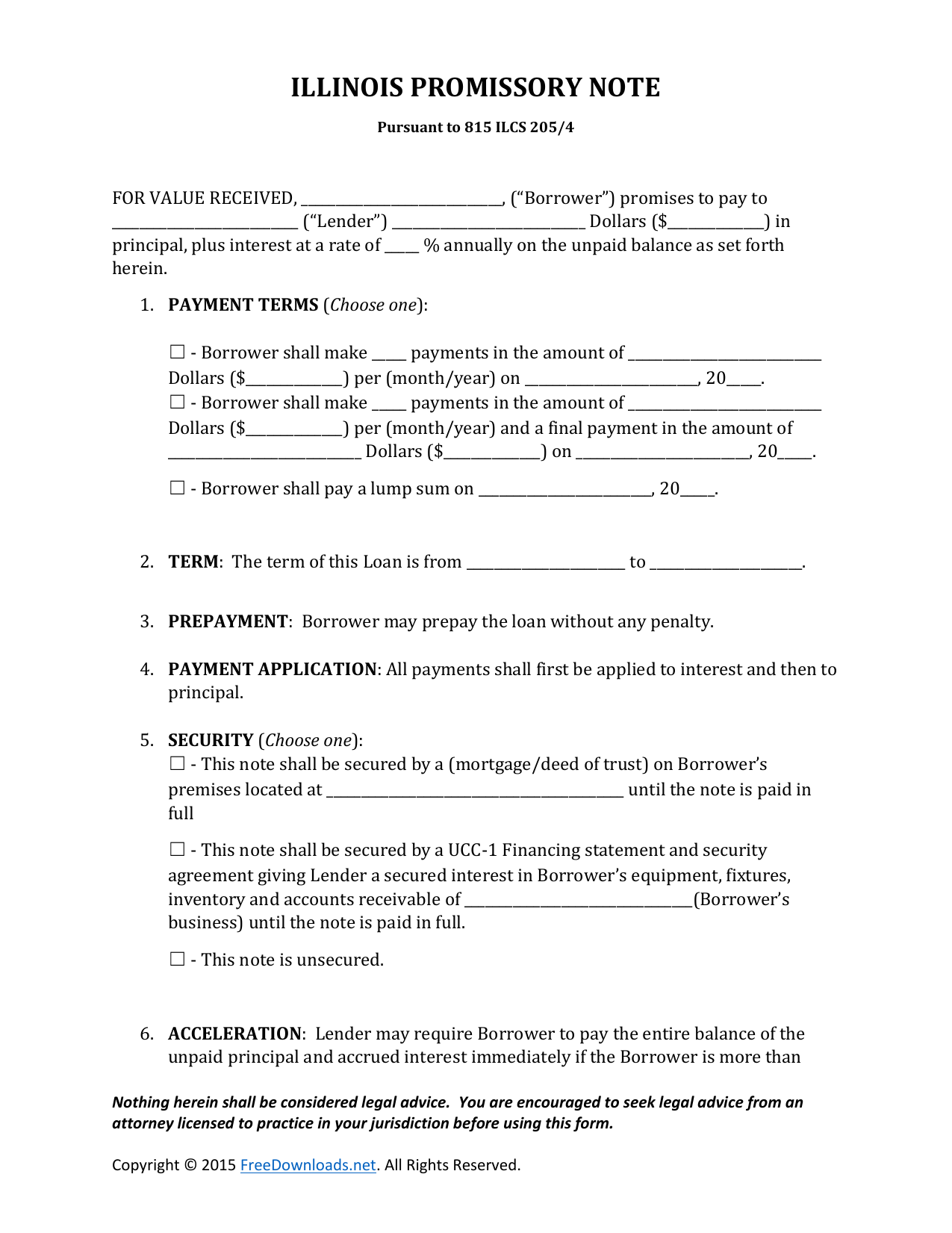

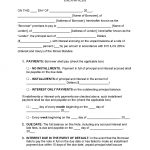

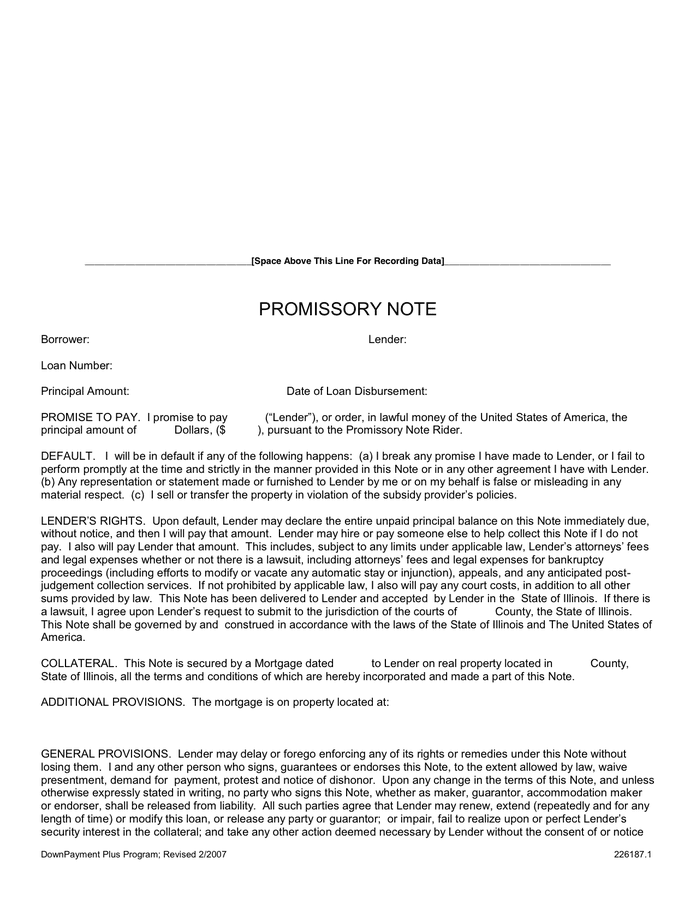

The guide below is intended to provide. If a borrower defaults on a secured promissory note the lender can take possession of the collateral. The illinois secured promissory note binds two parties to a contract requiring a borrower of a monetary balance to reimburse a lender the loaned amount of money plus interest over timeareas of the document that will need to be agreed upon consist of payment types interest rates items to be used as security and many other areas. The illinois promissory note templates are designed to be used as a starting point when drafting a secured or unsecured promissory note.

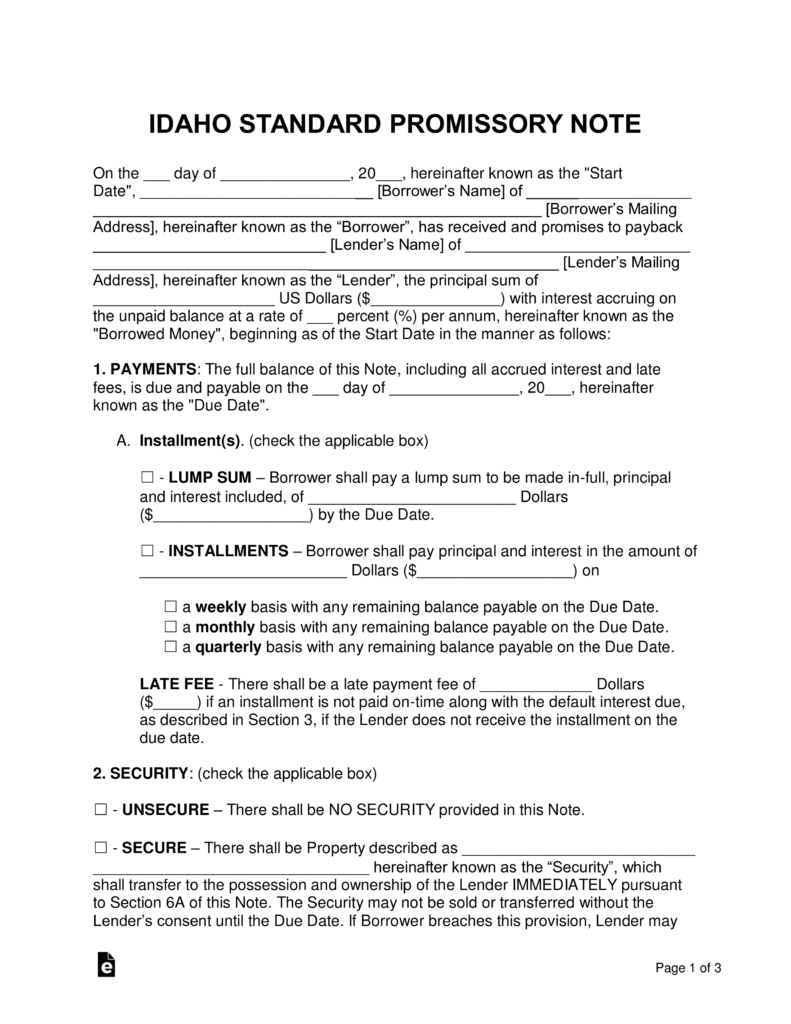

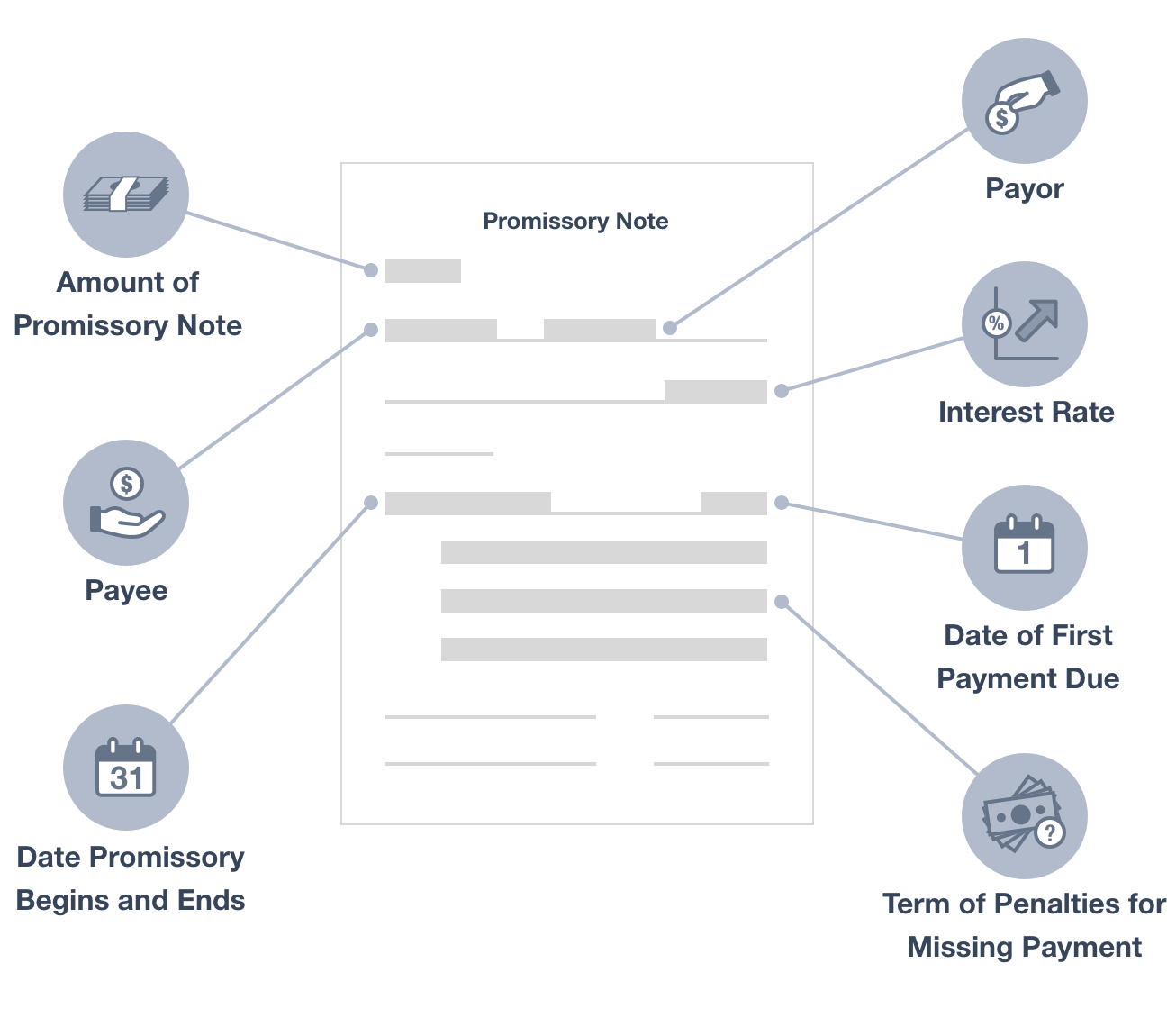

The parties may also detemine whether the monies lent pursuant to this note will be secured by collateral or will be unsecured. This form can be used to document the lending of monies from one illinois resident to another. The agreement helps ensure the deal is legal and both parties are clear on the terms and conditions of the deal. A promissory note pn is also called a payment agreement and it sets out the terms and conditions of payment for any debt.

Find free promissory notes legal forms designed for use in illinois. If the borrower defaults on the loan and fails to cure the default the lender may legally take possession of the pledged collateral. The illinois secured promissory note template is available for download in ms word or pdf format. The difference between a secured and unsecured note is that unsecured notes do not have assets pledged by the borrower as collateral.

The promissory note may be secured or unsecured. Failure to put it in writing can be costly. The parties to this note may specify for how long the monies will be lent and how the monies will be repaid. 815 ilcs 1053 from ch.

In the case of rent payments a pn may be used when the rent has not been paid for some time. All promissory notes bonds due bills and other instruments in writing made or to be made by any person body politic or corporate whereby such person promises or agrees to pay any sum of money or articles of personal property or any sum of money in personal property or acknowledges any sum of.