Illinois Resale Certificate

Resale exemption certificate document title.

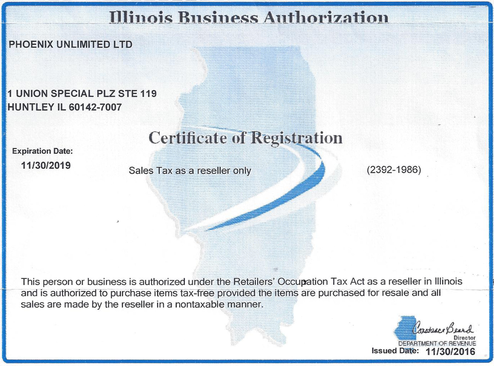

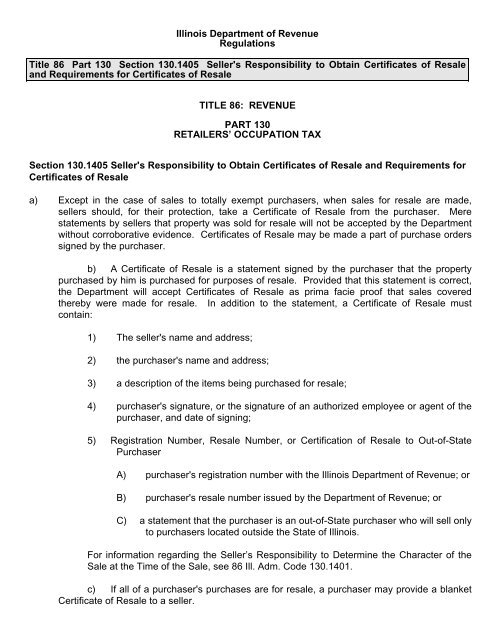

Illinois resale certificate. You can print a copy of your certificate of registration or license using mytax illinoisfrom your mytax account the certificate of registration or license is located under the correspondence tab then under view letters it will be labeled business authorization you can also contact our central registration division at 217 785 3707 or by email by using the questions comments or request. This system allows you to inquire whether a business is registered with the illinois department of revenue and how that business is registered with idor. Illinois department of revenue regulations title 86 part 130 section 1301405 sellers responsibility to obtain certificates of resale and requirements for certificates of resale. To document tax exempt purchases of such items retailers must keep in their books and records a certificate of resale.

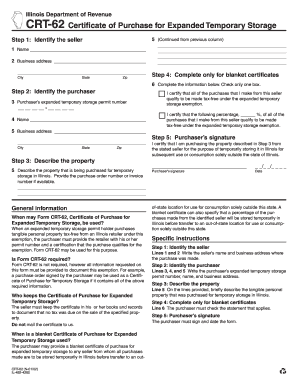

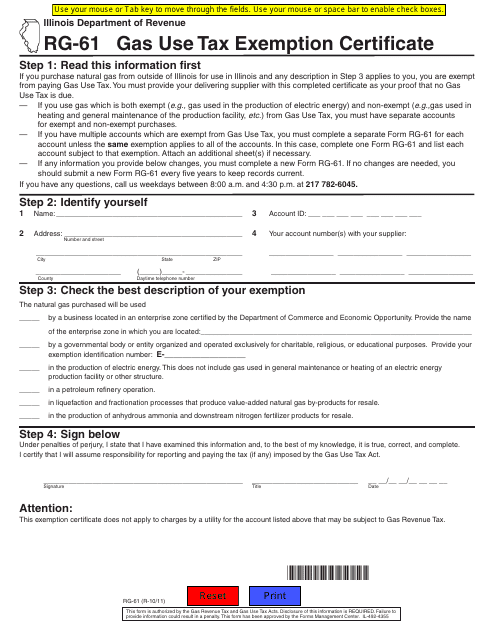

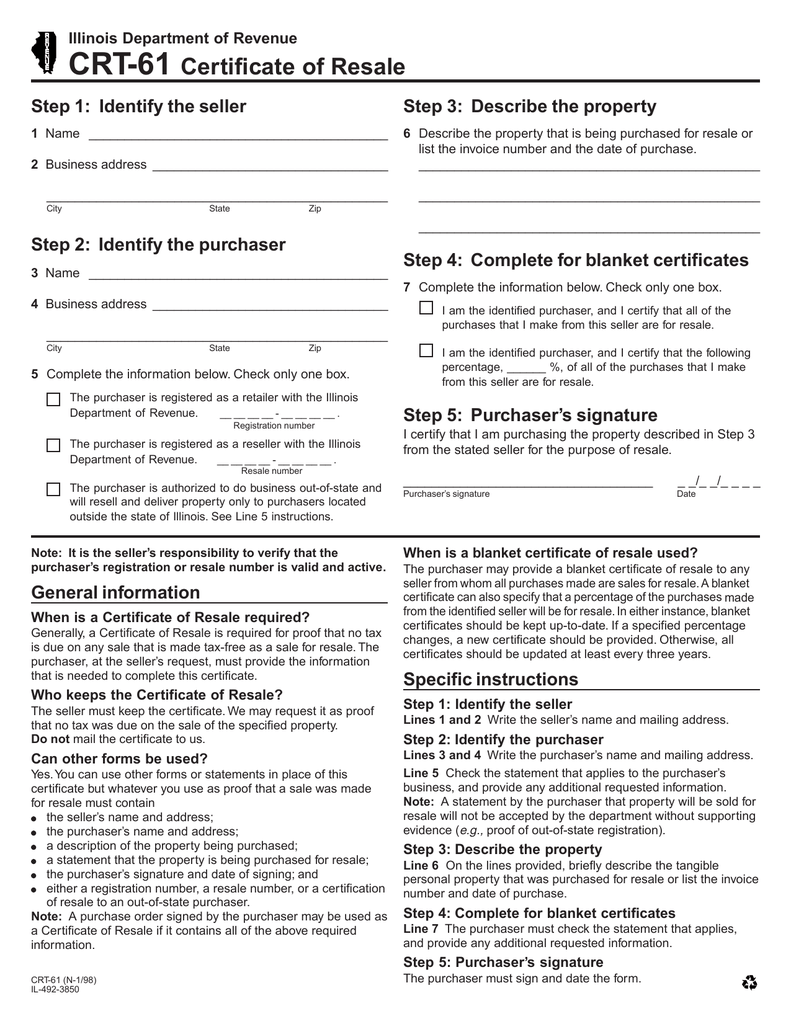

If you wish to use an illinois resale certificate. Filling out the crt 61 is pretty straightforward but is critical for the seller to gather all the information. Either an illinois account id number an illinois resale number or a certi cation of resale to an out of state purchaser. Without it correctly filled out the.

When does my certificate of registration expire. Lets say laura lives in illinois and want to go to your local big box store and source some items to resale on amazon fba. The primary responsibility of the department of revenue is to serve as the tax collection agency for state government and for local governments. Certificates of resale may be made a part of purchase orders signed by the purchaser.

Crt 61 r 1210 il 492 3850 when is a blanket certi cate of resale used. What is the difference between a certificate of registration resale certificate tax exempt number and license number. B a certificate of resale is a statement signed by the purchaser that the. A purchase order signed by the purchaser may be used as a certi cate of resale if it contains all of the above required information.

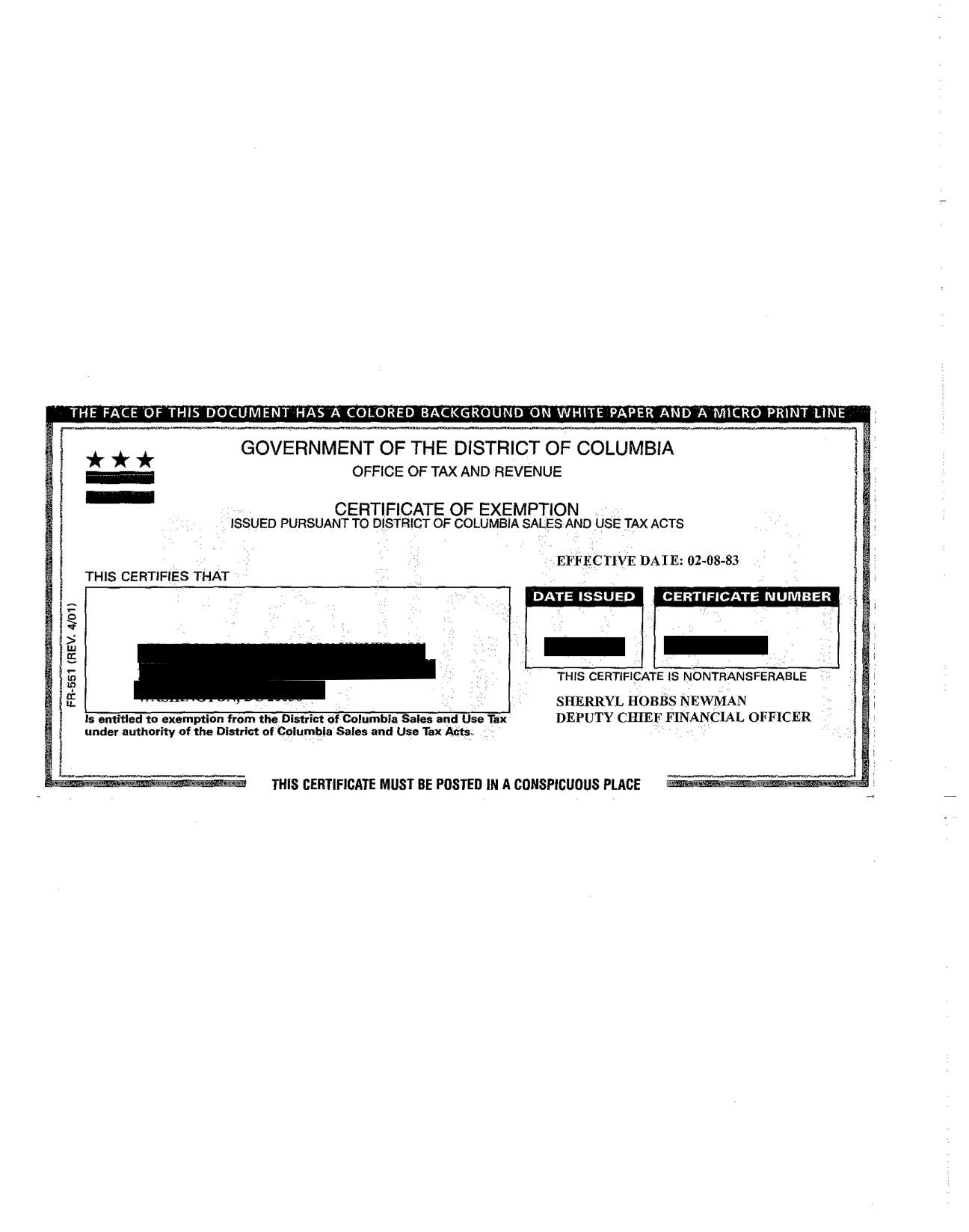

What does the certificate of registration look like. To do that shell need to bring along an illinois resale certificate and present it to the retailer. If audited the illinois department of revenue requires the seller to have a correctly filled out crt 61 certificate of resale. Describe the property 1 name 2 business address 6 describe the property that is being purchased for resale or list the invoice number and the date of purchase.

Illinois businesses may purchase items tax free to resell. Identify the seller step 3. How to fill out the illinois certificate of resale form crt 61. Sales tax is then collected and paid when the items are sold at retail.

Account id fein resale and license numbers can be verified on our website using our tax registration inquiry system.