Ira Certificate Account

An important distinction to make between a certificate of deposit cd.

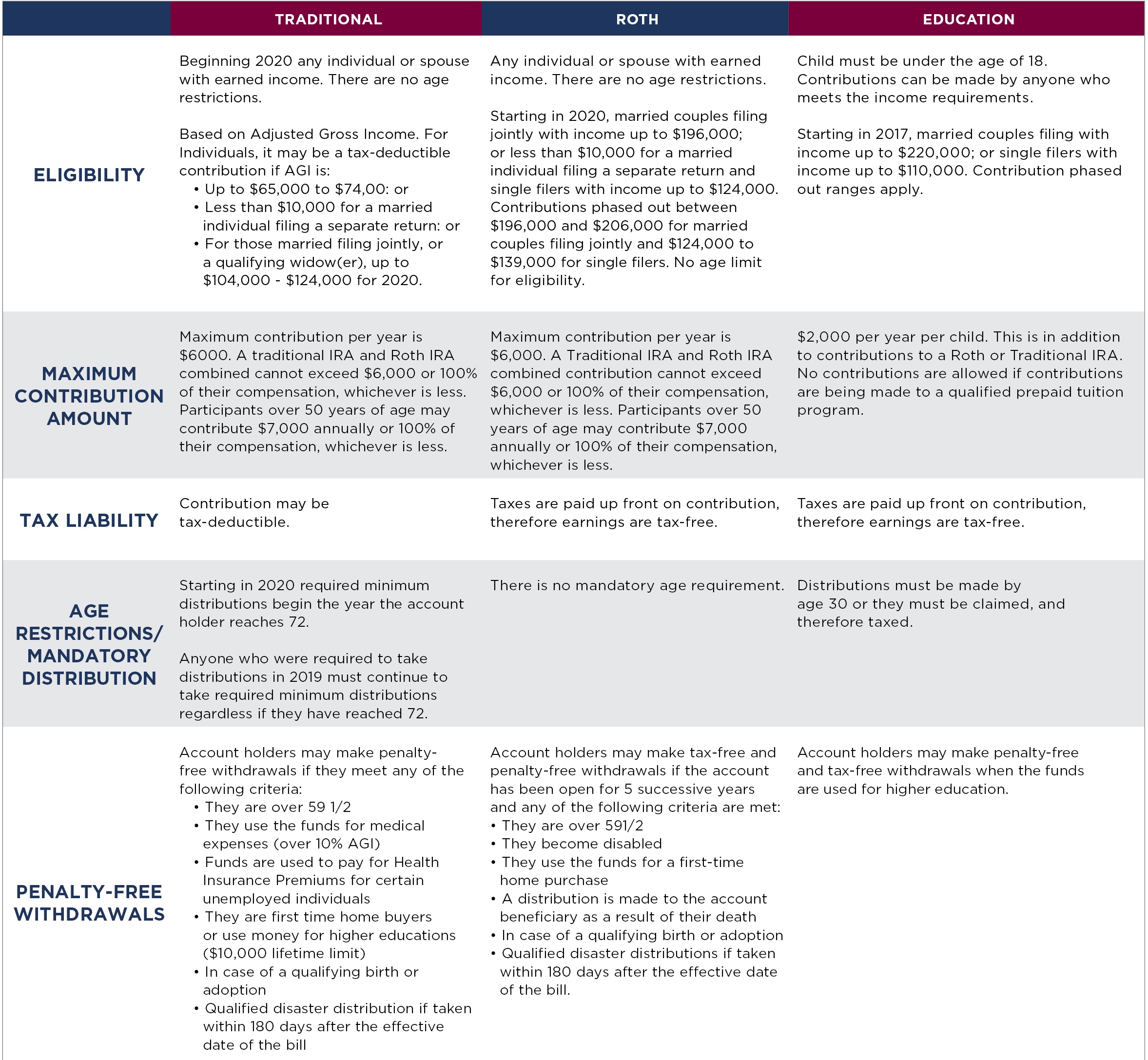

Ira certificate account. An ira share account is a credit union retirement account that operates similarly to an ira retirement savings account in a bank. If youre investing your ira contributions in a certificate of deposit you might want to take a step back. As a result an ira share certificate is the credit union equivalent to a bank ira certificate of deposit. An individual retirement account ira can be considered an individual savings and investment account that has tax benefits.

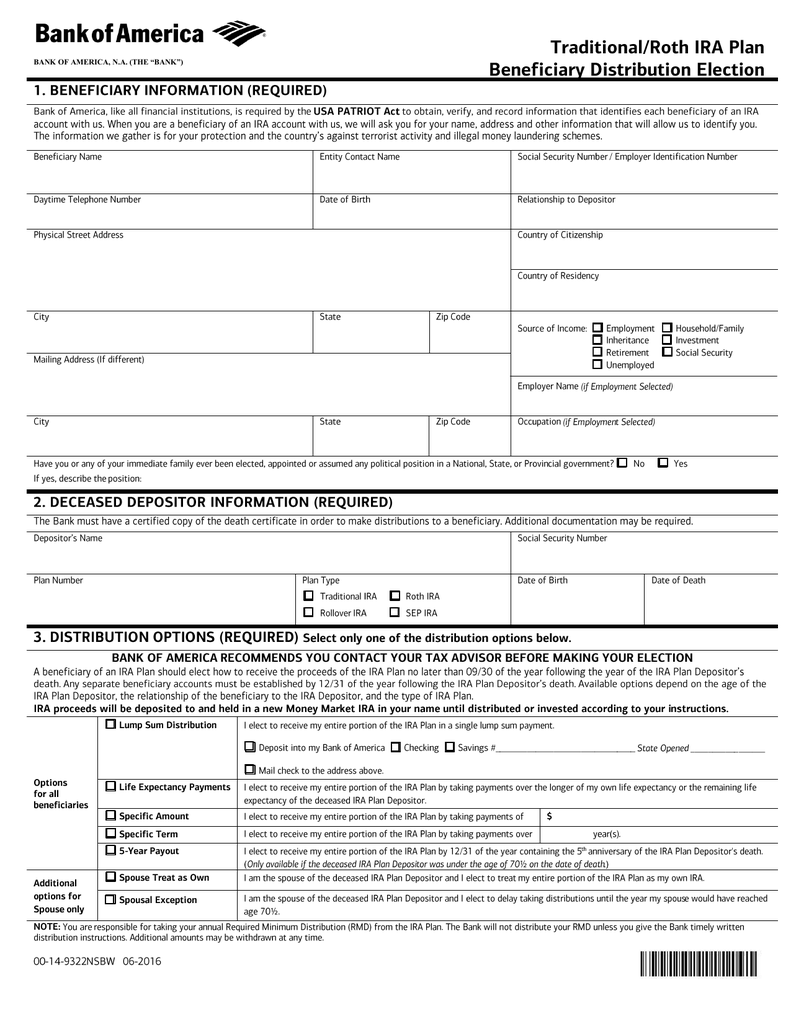

Iras were authorized by the us. To take a qualified distribution and avoid any tax liabilities you must wait until after the five taxable year period beginning with the taxable year in which you first contributed to a roth ira. Before opening such an account you should make sure you understand the interest rate deposit term length and any penalties for early withdrawal. Certificate rates are for a limited time only.

Ira share certificates vs. Individual retirement accounts and certificates are a great place for funds that you likely wont need for a period of time. Rates could change after account opening. If youre nearing retirement and want an ira with a higher dividend rate consider america firsts ira certificate accounts.

With an ira certificate account you get. Open an ira certificate account today. Congress as part of the 1974 employee retirement income security act to provide taxpayers who were not covered by a qualified retirement plan with a means. Rates could change after account opening.

To understand what that means lets look at the two types of bank accounts that an ira cd combines. Investing ira funds in cds is a good choice for. Most earn a higher rate than a savings account and provide you with peace of mind knowing that the rate you open the account with is what you will receive until the account matures. An ira cd is simply an ira where all the money is invested in certificates of deposit cds.

Early withdrawal penalties will apply and may reduce earnings. An ira certificate of deposit works similarly to any other cd except that it is within an ira. An individual retirement account ira is a special type of account that has specific tax benefits. An ira and a cd.