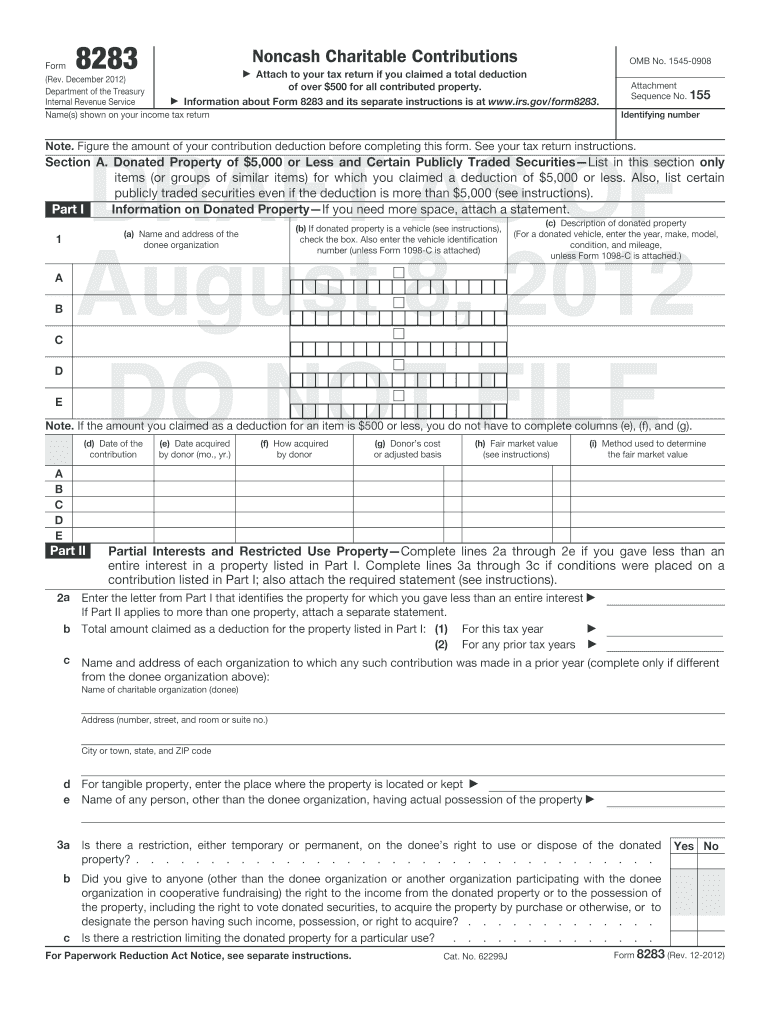

Irs Form 8283 Printable

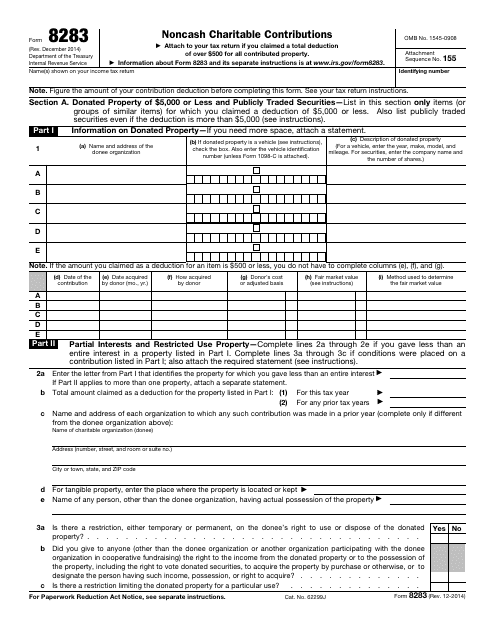

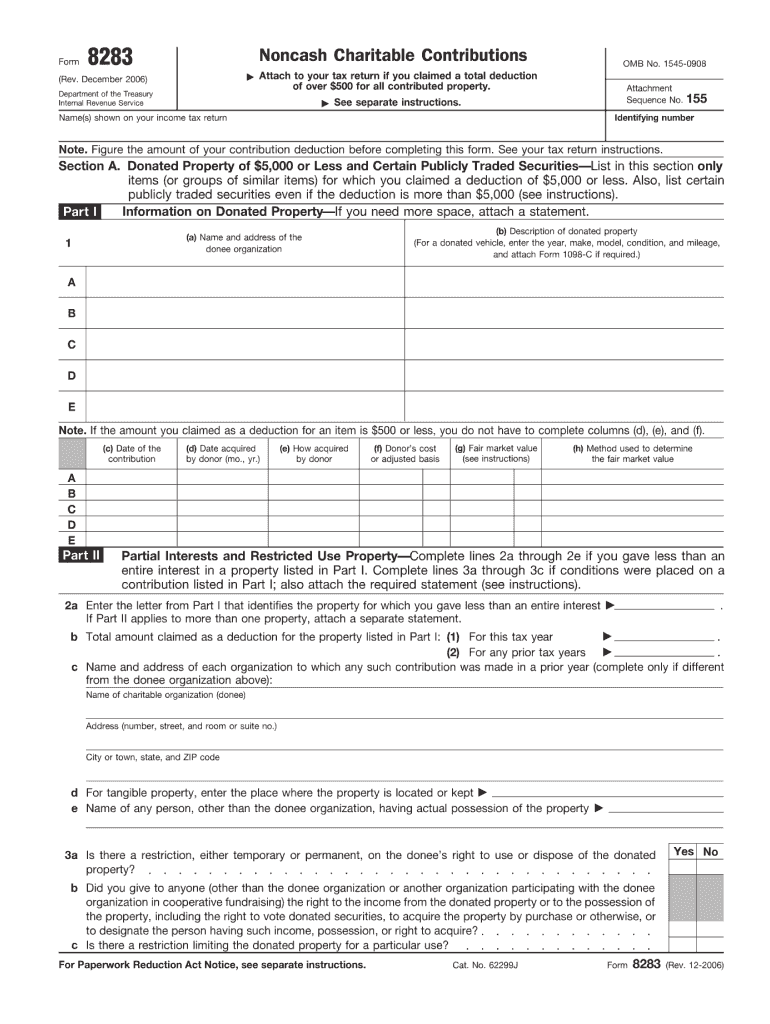

Noncash charitable contributions 1119 12042019 inst 8283.

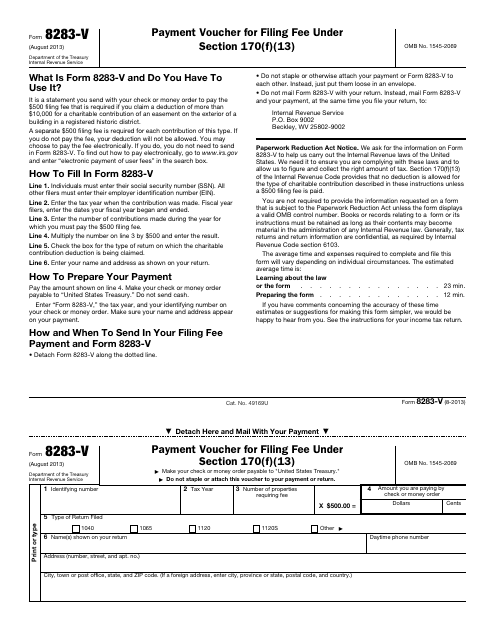

Irs form 8283 printable. Information about form 8283 noncash charitable contributions including recent updates related forms and instructions on how to file. Noncash charitable contributions attach one or more forms 8283 to your tax return if you claimed a total deduction. Use your computer or mobile to download and send them instantly. Instructions for form 8283 noncash charitable contributions 1119 12042019 form 8283 v.

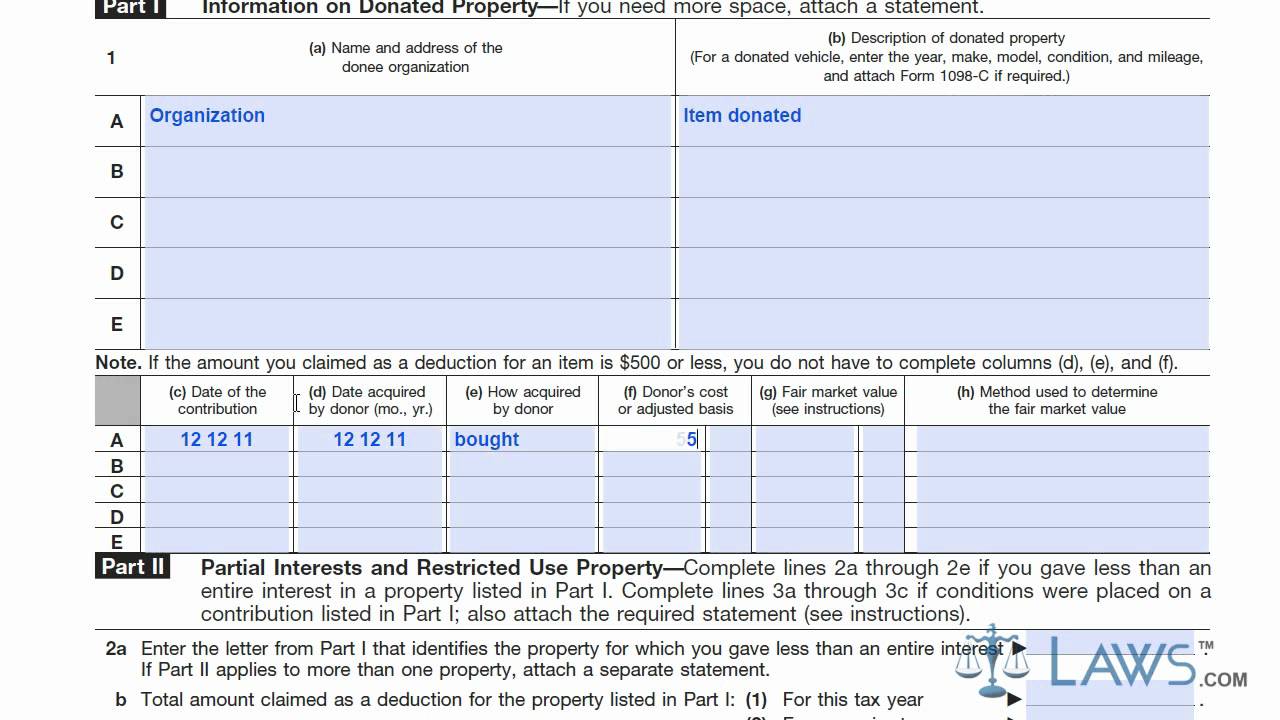

Form 8283 is used to claim a deduction for a charitable contribution of property or similar items of property the claimed value of which exceeds 500. November 2019 department of the treasury internal revenue service. Noncash charitable contributions form 8283 rev. File form 8283 with your tax return for the year you contribute the property and first claim a deduction.

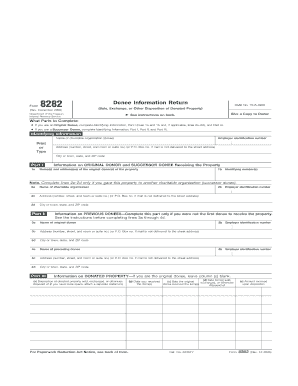

Which sections to complete form 8283 has two sections. If you must file form 8283 you must complete either section a or section b depending on the type of property donated and the amount claimed as a deduction. December 2014 8283 noncash charitable contributions form attach to your tax return if you claimed a total deduction rev. Payment voucher for filing fee under section 170f13 0813 10282013.

December 2014 of over 500 for all contributed property.