Md Resale Certificate

Frequently asked questions about the sales and use tax.

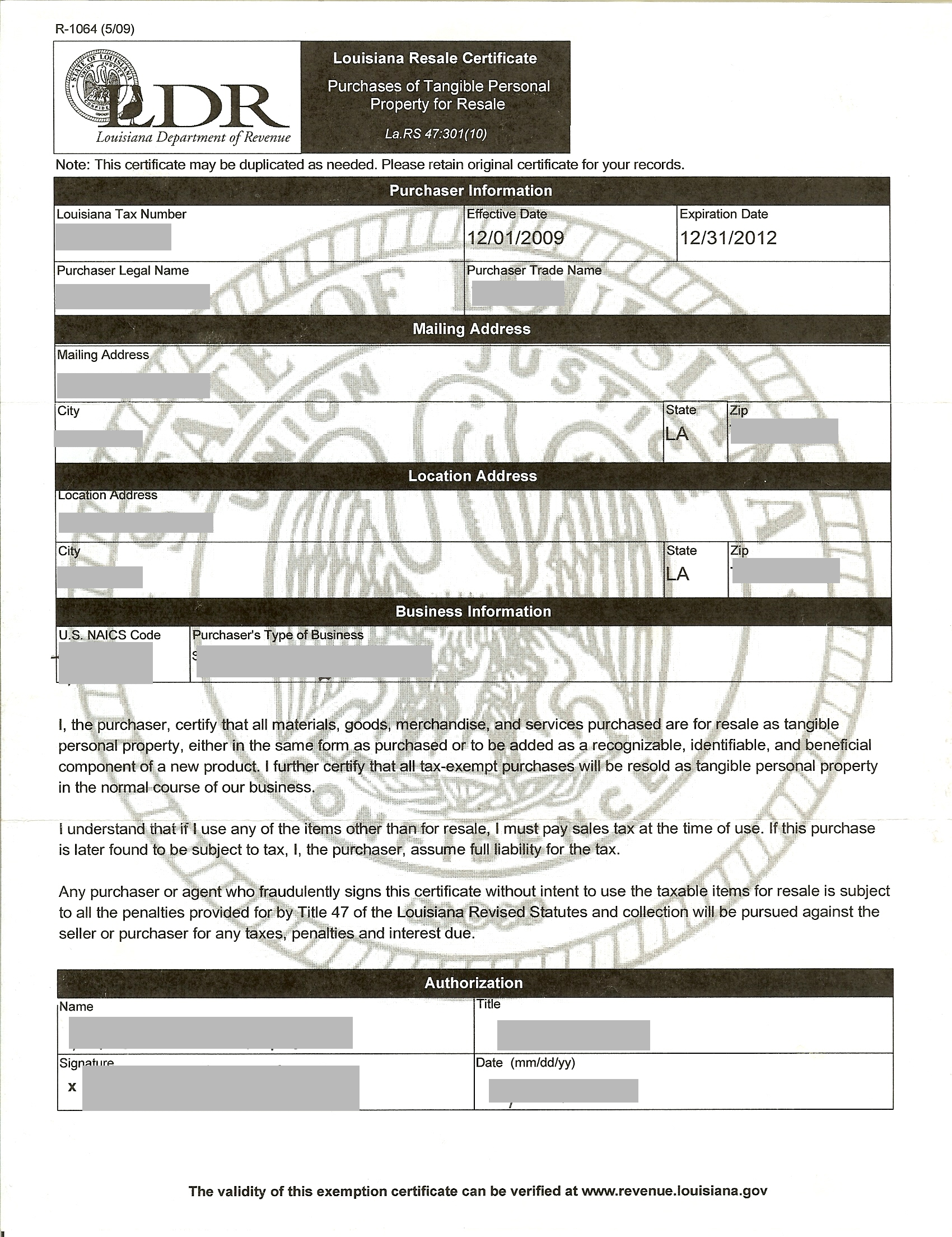

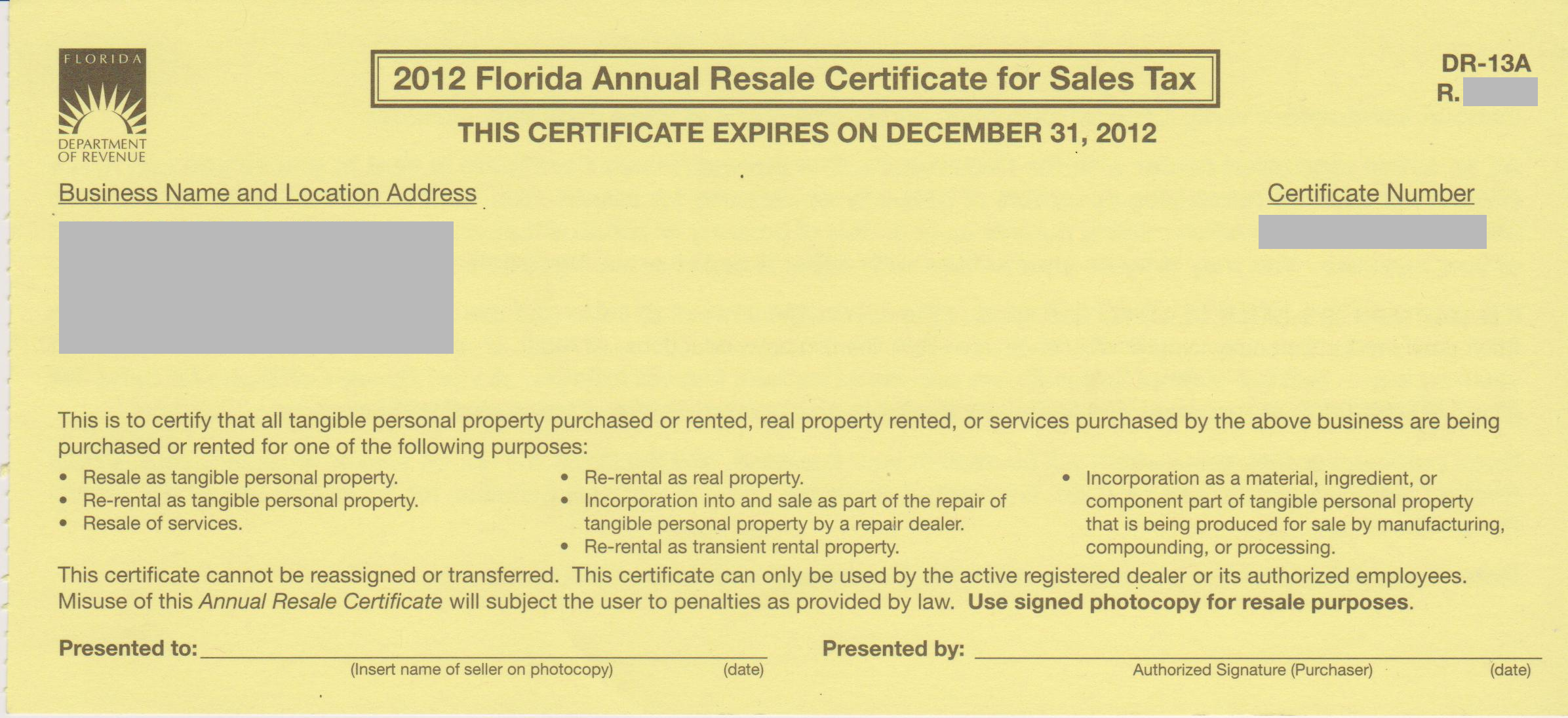

Md resale certificate. Individual tax filing season officially kicks off january 27 2020. In order to do so the retailer will need to provide a maryland resale certificate to their vendor. Most businesses operating in or selling in the state of maryland are required to purchase a resale certificate annually. A new certificate does not need to be made for each transaction.

A note on purchases under 200. Learn more about what a resale certificate is how to get one and more. Use the form below to verify that the customer possesses a valid tax exempt number or a valid maryland combined registration number and to print out a prepared resale certificate for your records if the purchase is being made for resale. This ia a resale certificate which is a special type of sales tax exemption certificate intended for use by businesses or individuals who are purchasing goods which will be resoldsince sales taxes are meant to be paid by the end consumer of the goods resellers and dealers are allowed to purchase their inventory of goods for resale tax free.

When a business purchases inventory to resell they can do so without paying sales tax. Its use is limited to use as a resale certificate subject to conn. Maryland tax exemption maryland resale certificate maryland sale and use tax maryland wholesale certificate etc. A resale certificate is a statement you produce and give to your supplier stating that the merchandise you are purchasing is going to be resold or will become a part of a product that will be resold.

This certificate is not valid as an exemption certificate. If you are presented with a resale certificate you may use our online services to verify its validity. Online verification of maryland tax account numbers. This is a reminder that state offices are closed monday january 20 2020 in observance of martin luther king jr.

Maryland does permit the use of a blanket resale certificate which means a single certificate on file with the vendor can be re used for all exempt purchases made from that vendor. Acceptance of uniform sales tax certificates in maryland. You should keep a resale certificate signed by the buyer and bearing the buyers maryland registration number on file to document the tax free sales of exempt materials. 12 how can i obtain a resale certificate.

Even online based businesses shipping products to maryland residents must collect sales tax. In maryland resale certificates may not be used to make tax free purchases for resale if the purchase is less than 200 and payment is by cash check or credit card unless the seller delivers the goods directly to the buyers retail place of business.