Michigan Exemption Certificate

All claims are subject to audit.

Michigan exemption certificate. You must file a revised form within 10 days if your exem ptions decrease or your residency status changes from nonresident to resident. Also known as. The property owner should complete the form and return it to the contractor who will submit this form to the supplier along with michigans sales and use tax certificate of exemption form 3372 at the time of purchase. For resale at retail in section 3 basis for exemption claim.

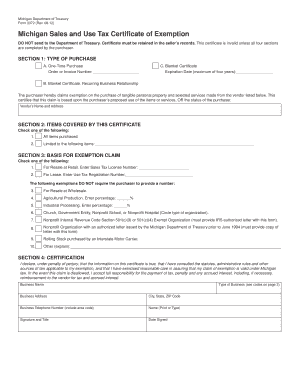

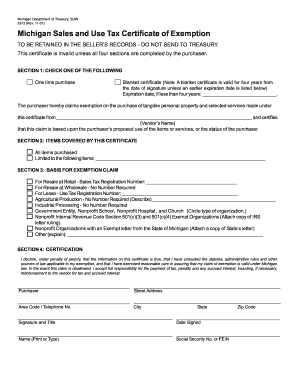

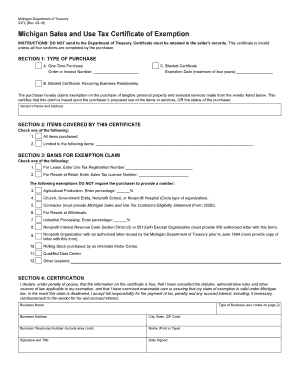

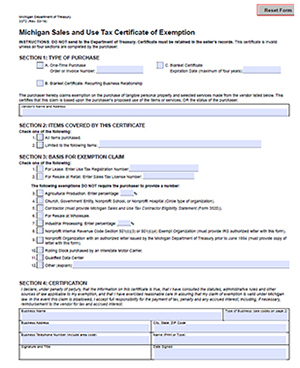

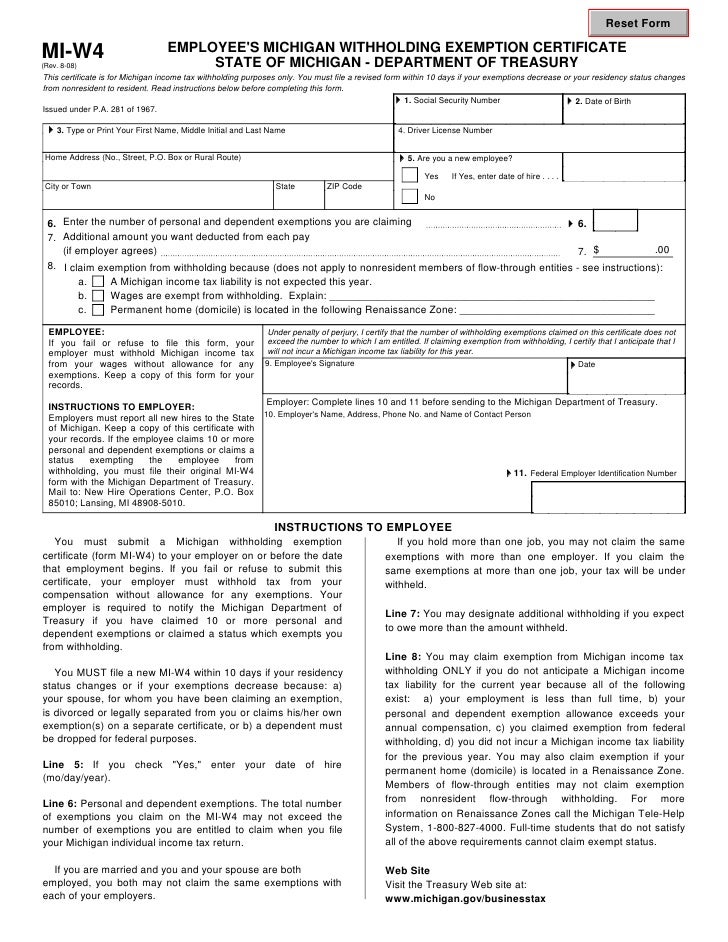

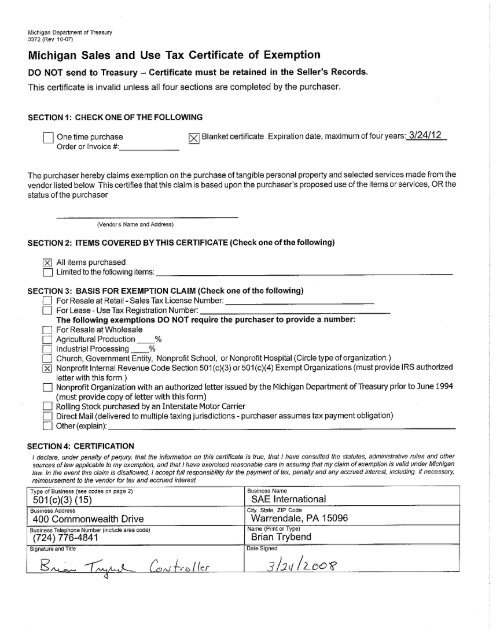

11 09 michigan sales and use tax certificate of exemption do not send to the department of treasury. For this purpose michigan provides michigan sales and use tax certificate of exemption form 3372 for resellers who wish to buy items tax free at retail. An industrial facilities exemption ife certificate entitles the facility to exemption from ad valorem real andor personal property taxes for a term of 1 12 years as determined by the local unit of government. 11 19 this certificate is for michigan income tax withholding purposes onl y.

Employees michigan withholding exemption certificate state of michigan department of treasury mi w4 rev. 3372 michigan sales and use tax certificate of exemption reset form michigan department of treasury form 3372 rev. Certain real property qualify for exemption based on facts within the control of the property owner. Retailers who wish to buy items tax free for resale in the state of michigan must present a michigan resale certificate to the seller when making the purchase.

Their sales tax license number must be included in the blank provided on the exemption claim. Even online based businesses shipping products to michigan residents must collect sales tax. Most businesses operating in or selling in the state of michigan are required to purchase a resale certificate annually. The michigan sales and use tax exemption certificate can be used to purchase any of the tax exempt items in michigan.

It is the purchasers responsibility to ensure the eligibility of the exemption being claimed. Retailers retailers purchasing for resale should provide a signed exemption certificate by completing form 3372 michigan sales and use tax certificate of exemption and check box 1. Michigan tax exemption michigan resale certificate michigan sale and use tax michigan wholesale certificate etc. Form 3372 michigan sales and use tax certificate of exemption is used to claim exemption from michigan sales and use tax.

The michigan department of treasury does not issue tax exempt numbers. Michigan is uncommon in having only one tax exemption certificate. Instructions for completing michigan sales and use tax certificate of exemption form 3372 purchasers may use this form to claim exemption from michigan sales and use tax on qualified transactions. The buyer must present.

To apply the certificate the buyer must first present the seller with their written certificate which legally documents the exemption.