Mortgage Pre Qualification Letter Template

How pre approval differs from pre qualification there has been some confusion among those looking to buy a home and qualify for a mortgage loan regarding the difference between a mortgage pre approval vs.

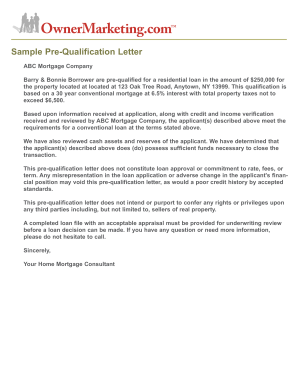

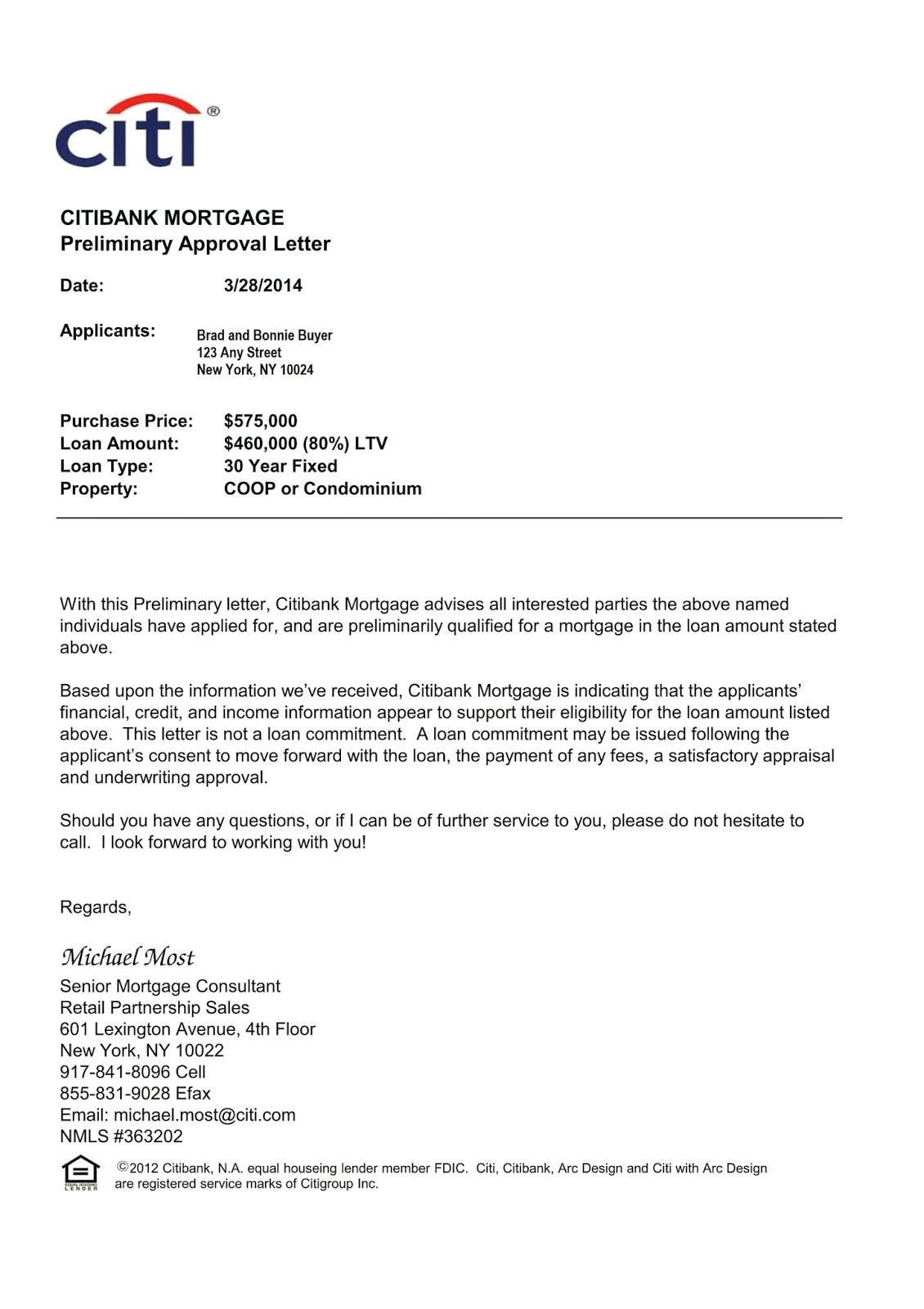

Mortgage pre qualification letter template. When creating an official or organisation letter presentation style and also style is essential making an excellent impression. This is because pre qualification letters typically expire after 60 or 90 days. Every pre qualification letter includes dates. While there are some legal distinctions in practice both terms refer to a letter from a lender that says the lender is generally willing to lend to you up to a certain amount and based on certain assumptions.

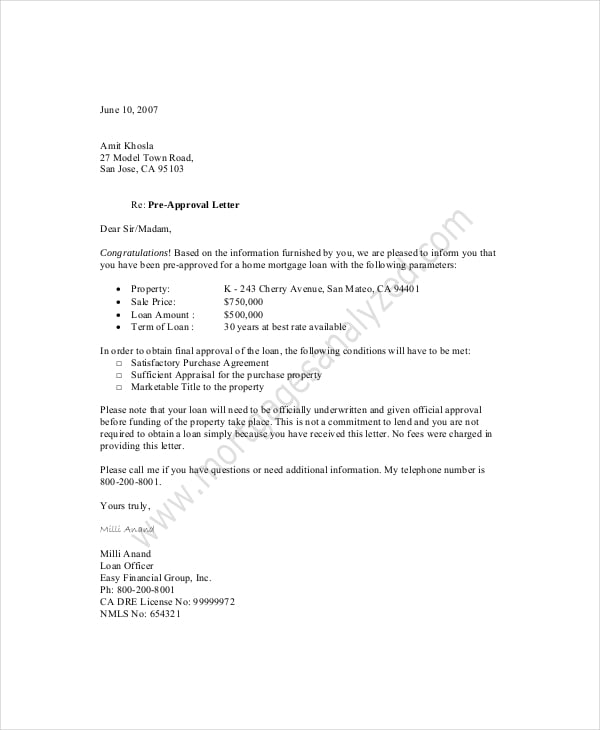

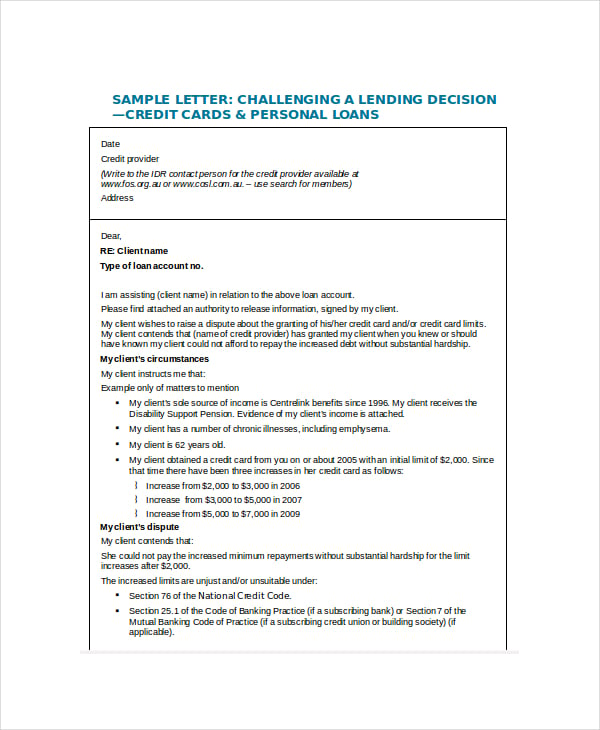

When writing an official or company letter presentation design as well as format is key making a good first impression. To get a preapproval letter you need documents verifying your income employment assets and debts. A mortgage preapproval tells sellers you can back up your offer. A completed loan file with an acceptable appraisal must be provided for underwriting review before a loan decision can be made.

Mortgage pre qualification letter template it is recommended for financing major one off expenses including home renovations or repairs medical bills repayment of credit card debt or funding college tuition. Lenders typically check your credit before issuing a preapproval letter and the letter may have an expiration date on it typically 30 to 60 days. Theres not a lot of difference between a prequalification letter and a preapproval letter. Collection of mortgage pre qualification letter template that will completely match your needs.

Assortment of mortgage pre qualification letter template that will flawlessly match your demands. Pre qualified offers are. Mortgage pre approvals are a more substantive. Issue and expiration dates.

Indeed they sound pretty similar so hearing these terms before or during the hectic time while considering buying a can only add to the confusion for novice. For example real estate agents will most likely ask you to get a pre approval letter before working with you. Many sellers will not consider bids from buyers whove only taken the pre qualification step. Decide when to get a preapproval letter.

As such pre qualifications dont carry much weight. The letter will likely include a contingency that says the loan is subject to an acceptable home appraisal. Sincerely your home mortgage consultant sample pre qualification letter.

:max_bytes(150000):strip_icc()/PreQualification.folger-5c19152c46e0fb0001719e6b.jpg)