Nc 1099 Form Printable

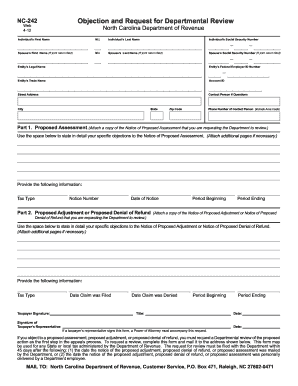

Received a notice notices are sent out when the department determines taxpayers owe taxes to the state that have not been paid for a number of reasons.

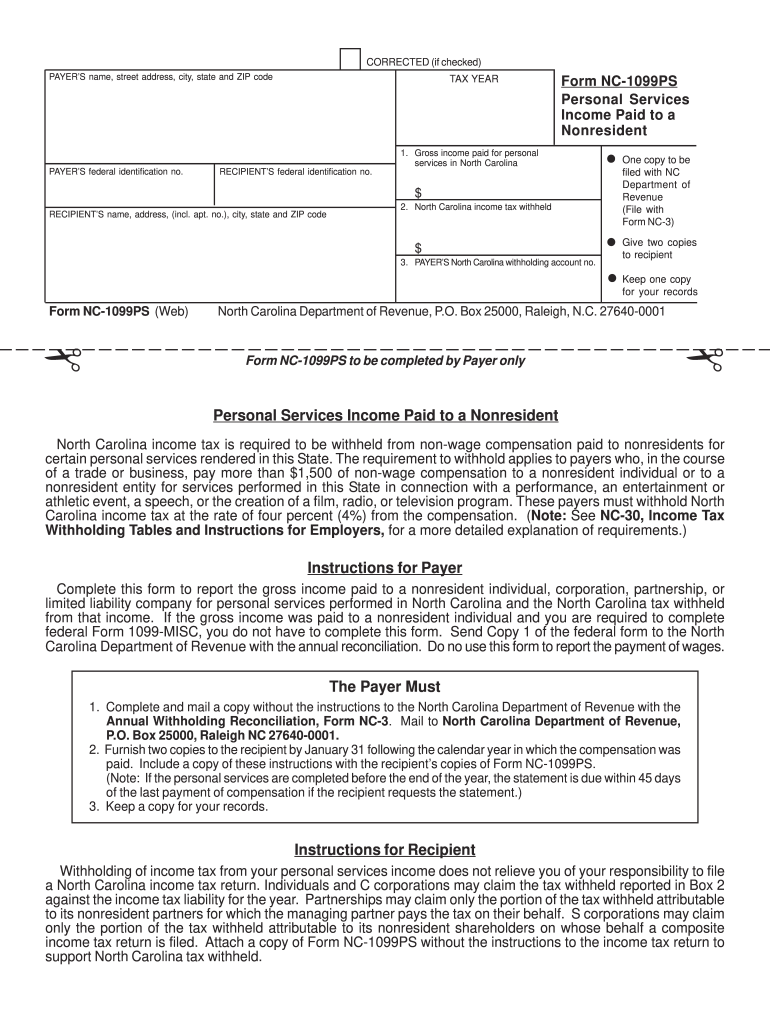

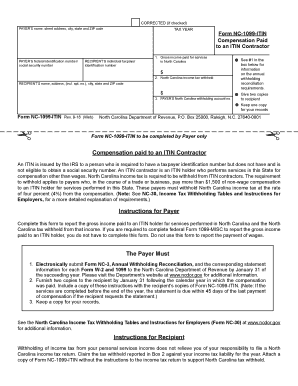

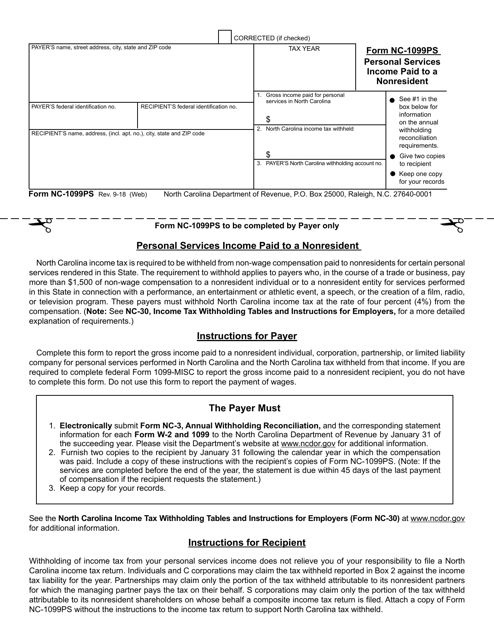

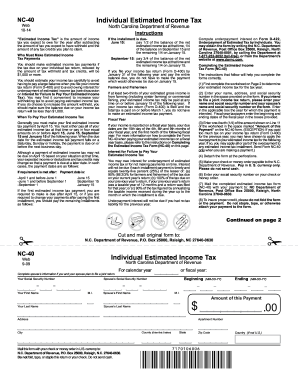

Nc 1099 form printable. Payers use form 1099 misc miscellaneous income to. If your net income from self employment is 400 or more you must file a return and. The files will be uploaded using the enc3 web application located on the ncdor website. You also may have a filing requirement.

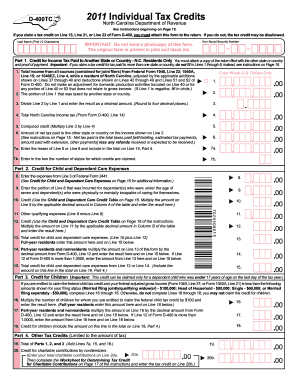

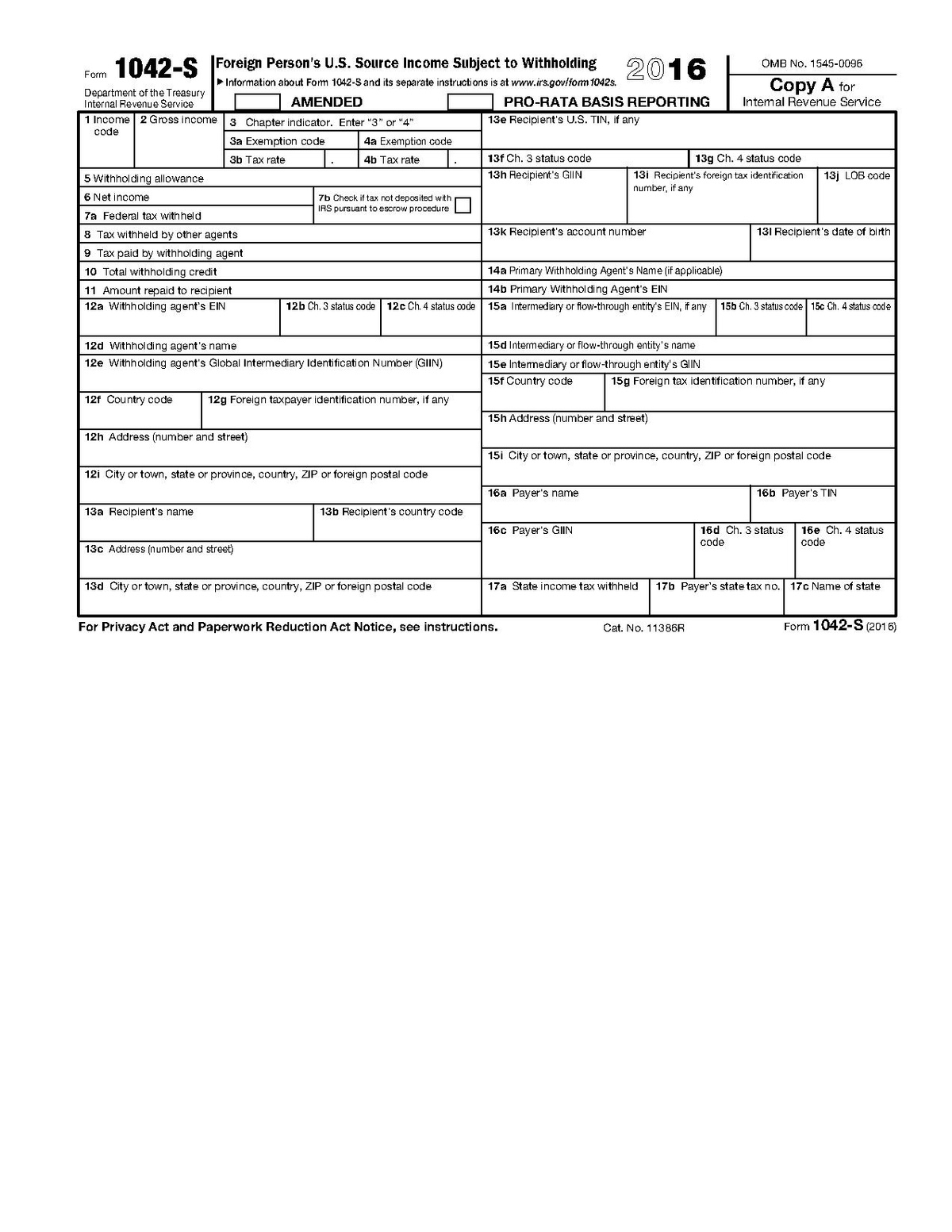

Form 1099 g should be used to calculate your federal adjusted gross income. North carolina taxpayers are choosing a faster more convenient way to file and pay using electronic services. See the instructions for form 8938. Form nc 3 and the required statements do not have to be filed simultaneously in one submission.

To download forms from this website go to nc individual income tax forms. You may also obtain forms from a service center or from our order forms page. Payer is reporting on this form 1099 to satisfy its chapter 4 account reporting requirement. To order forms call 1 877 252 3052.

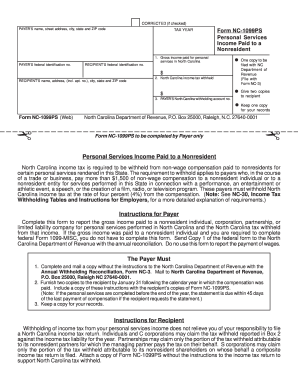

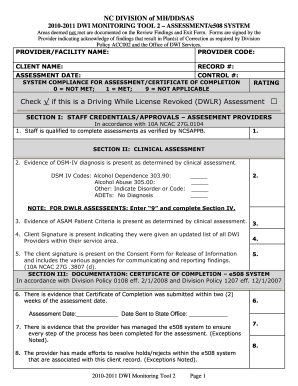

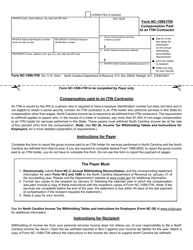

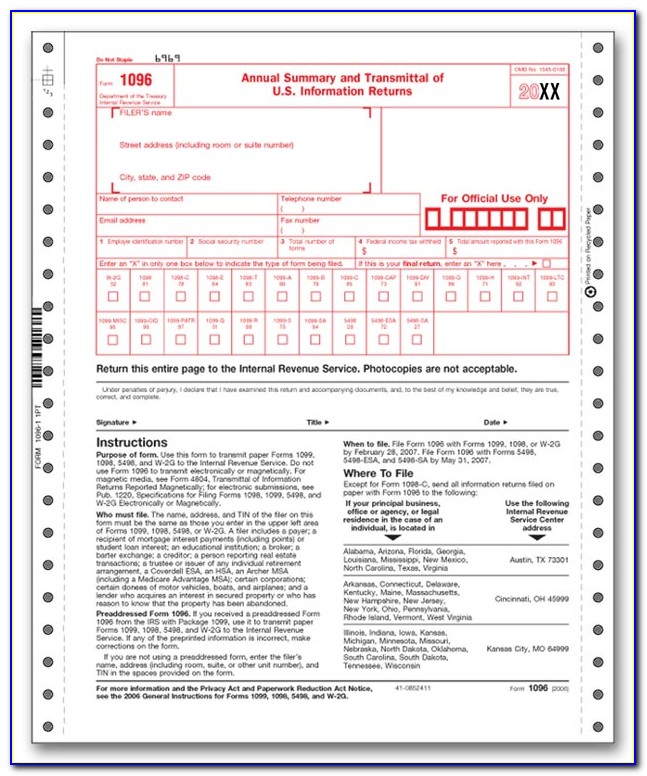

Touch tone callers may order forms 24 hours a day seven days a week. The uploaded files must meet these requirements for filing federal 1099 information as specified in internal revenue service publication 1220. File upload specifications for 1099 wage and tax statements. Form nc 1099 is a north carolina other form.

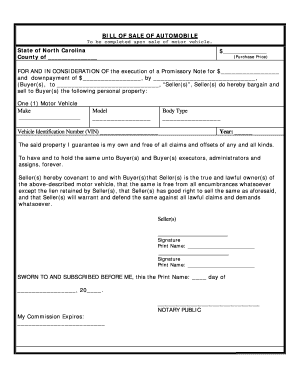

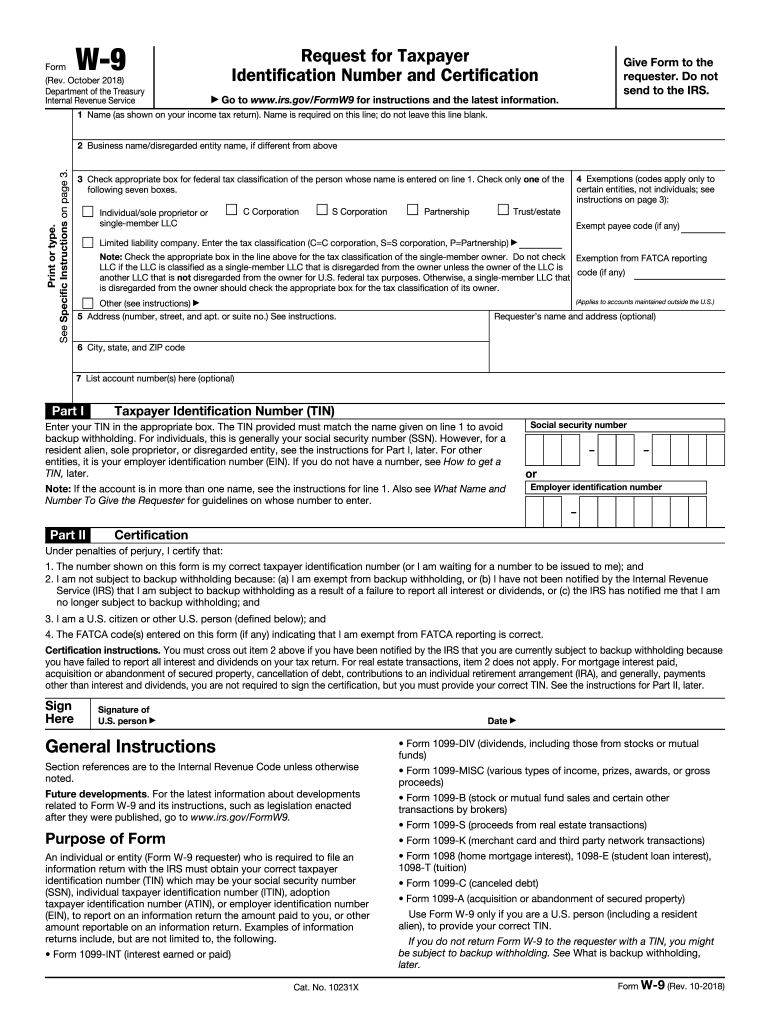

To view and print online copies sign into the des website. Form 1099 s proceeds from real estate transactions form 1099 k merchant card and third party network transactions form 1098 home mortgage interest 1098 e student loan interest 1098 t tuition form 1099 c canceled debt form 1099 a acquisition or abandonment of secured property use form w 9 only if you are a us. Amounts shown may be subject to self employment se tax. Report payments of 10 or more in gross royalties or 600 or more in rents or compensation.

If so you will receive a form 1099 g from the division of employment security. On the state return form d 400 the amount of state and local tax refunds reported on the federal return should be entered on the appropriate line of form d 400 schedule s line 7 for tax year 2018. If you are required to file form nc 3 you must electronically file form nc 3 and the required w 2 and 1099 statements via the enc3 and information reporting application on or before the due date of the return. More information about the 1099 g can be found here.

Report payments made in the course of a trade or business to a person whos not an employee or to an unincorporated business. Many states have separate versions of their tax returns for nonresidents or part year residents that is people who earn taxable income in that state live in a different state or who live in the state for only a portion of the year.