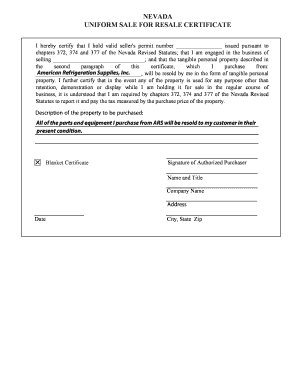

Nevada Resale Certificate

Even online based businesses shipping products to nevada residents must collect sales tax.

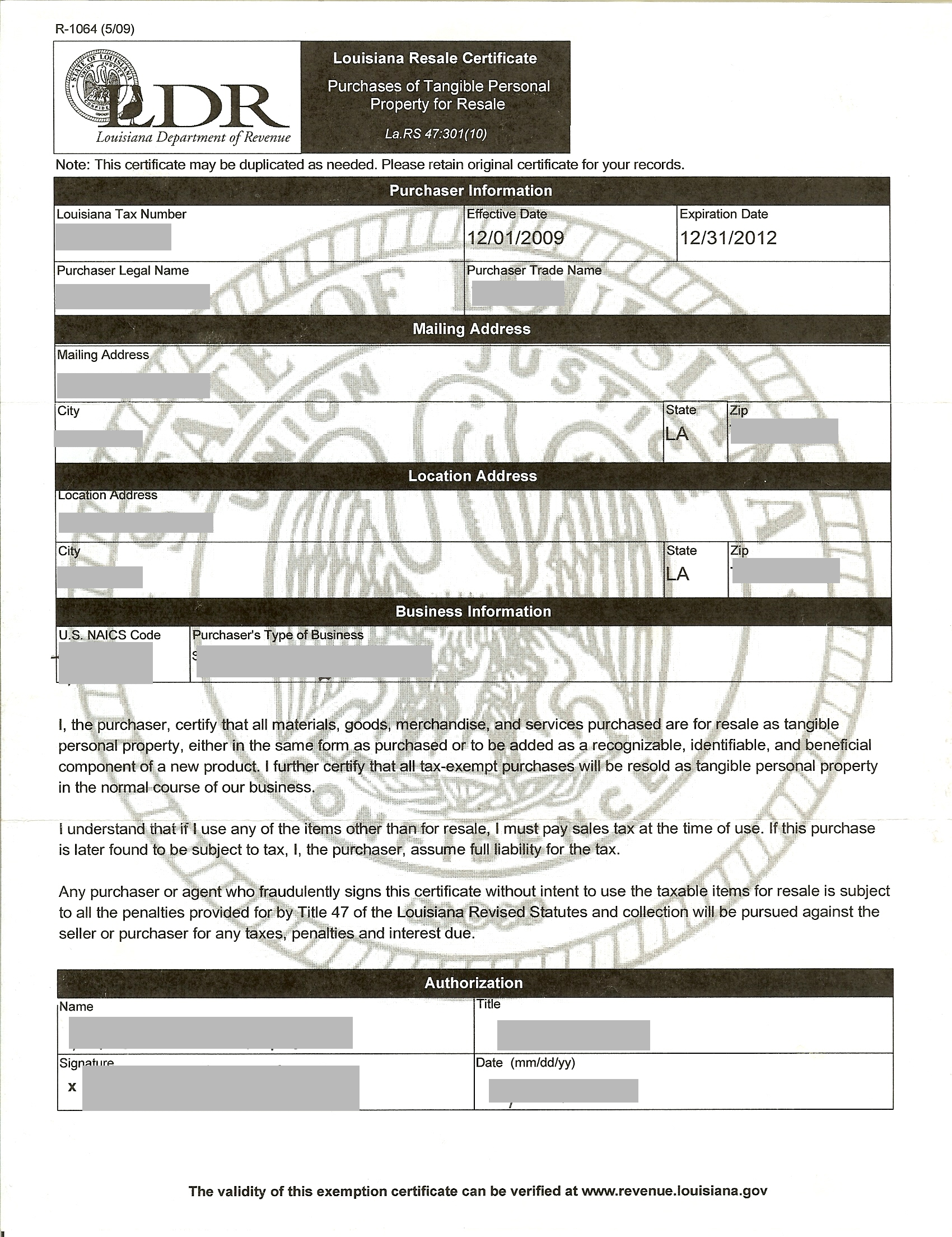

Nevada resale certificate. This certificate is used to collect sales tax from your clients and to avoid paying sales tax to your supplier. If audited the nevada department of taxation requires the seller to have a correctly filled out nevada resale certificate. A nevada state resale certificate can be used to purchase items at wholesale costs and will allow you to resell those items. The supplemental application is used by the department.

Nevada resale certificate fillable form. This page explains how to make tax free purchases in nevada and lists two nevada sales tax exemption forms available for download. Always keep in mind that you should only use your resale certificate to buy items you intend to resale. Most businesses operating in or selling in the state of nevada are required to purchase a resale certificate annually.

This download comes with instructions. Also known as. The universal application is used by the state and several counties. Both the nevada business registration and the supplemental application must be completed to issue your sales taxuse tax permit.

How to fill out the nevada resale certificate. Nevada sales tax resale certificate number. If you buy products to resale in the state of nevada you can avoid paying sales tax on your purchase by using a nevada resale certificate.