Nonprofit Tax Receipt Letter

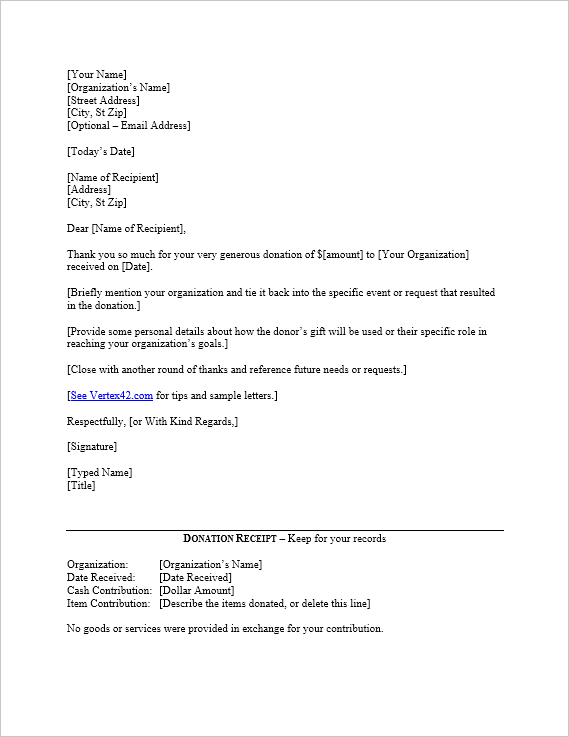

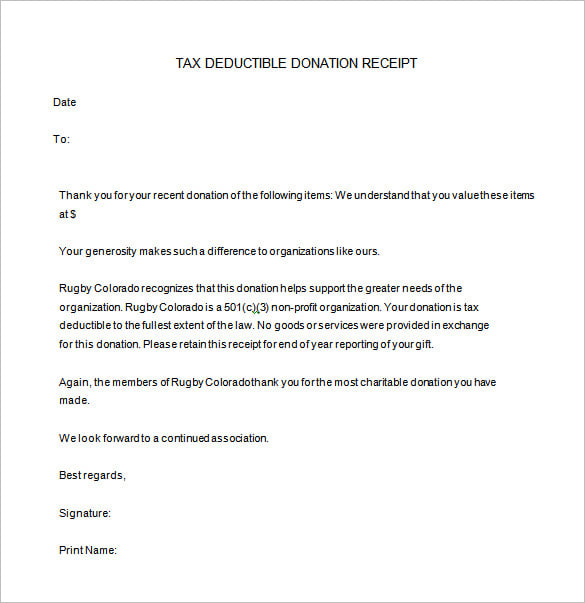

The irs requires public charities also known as 501c3 organizations to send a formal acknowledgment letter for any donation of more than 250.

Nonprofit tax receipt letter. Ok am responsible for tax receipt letters for a 501c3 i am volunteering trying to get it all straight 1cash donation include amount and whether any goods or services provided got it. Irs regulations place the responsibility on donors to make sure they have a written gift acknowledgment for any single contribution of 250 or more. Tax exempt nonprofits have certain requirements to follow including providing donors with a donation receipt often called an acknowledgment letter. A good faith estimate of the value of goods or services provided.

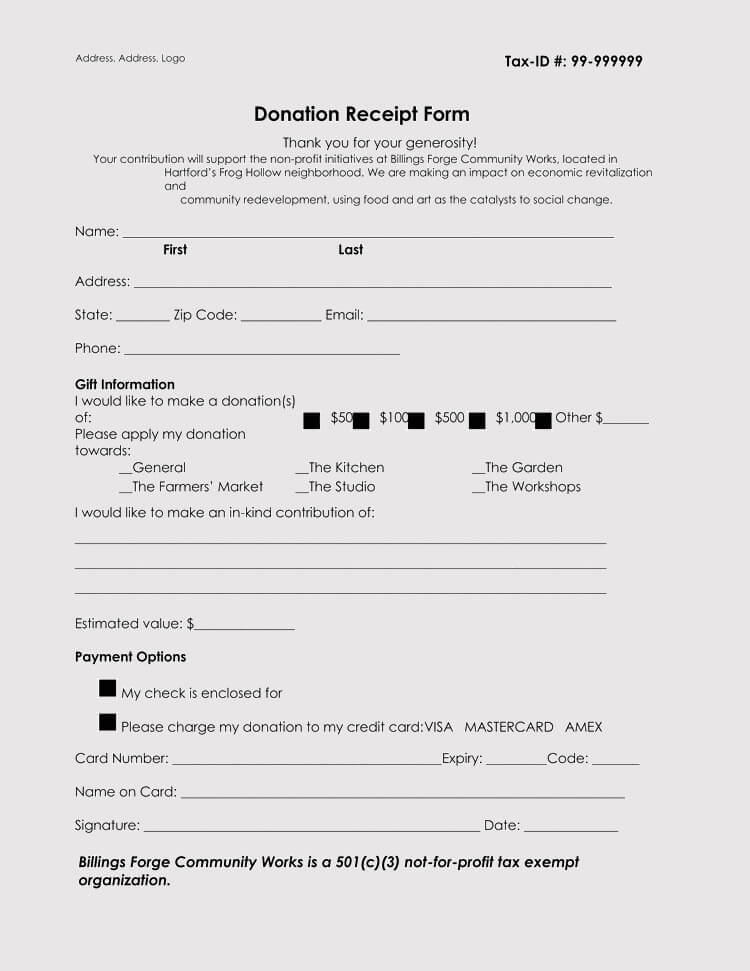

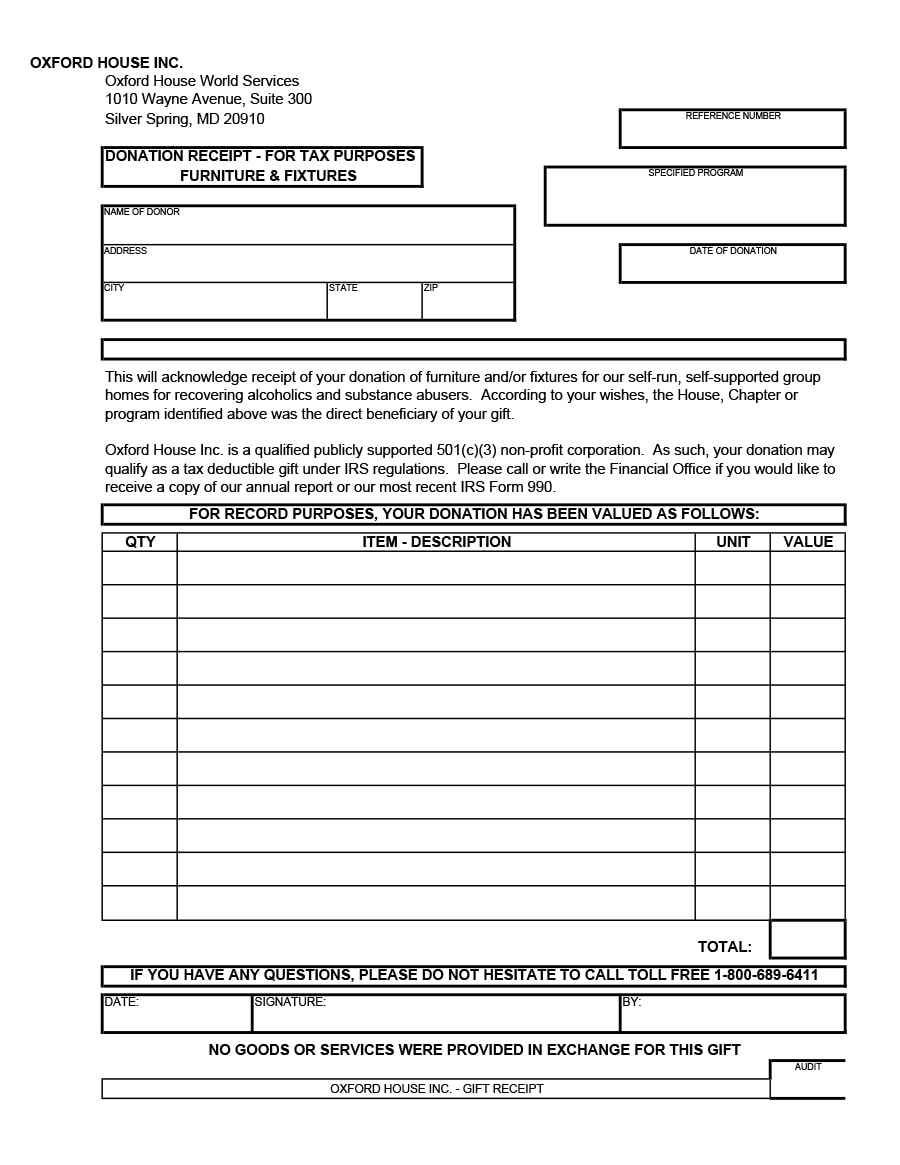

Amount of money donor contributed. Because charitable donations are tax deductible for the donor and reportable by the nonprofit organization a donation receipt must include specific information about the value of the donation and what the donor received in return. Its important to remember that without a written acknowledgment the donor cannot claim the tax deduction. As a result donors expect a nonprofit to provide a receipt for their contribution.

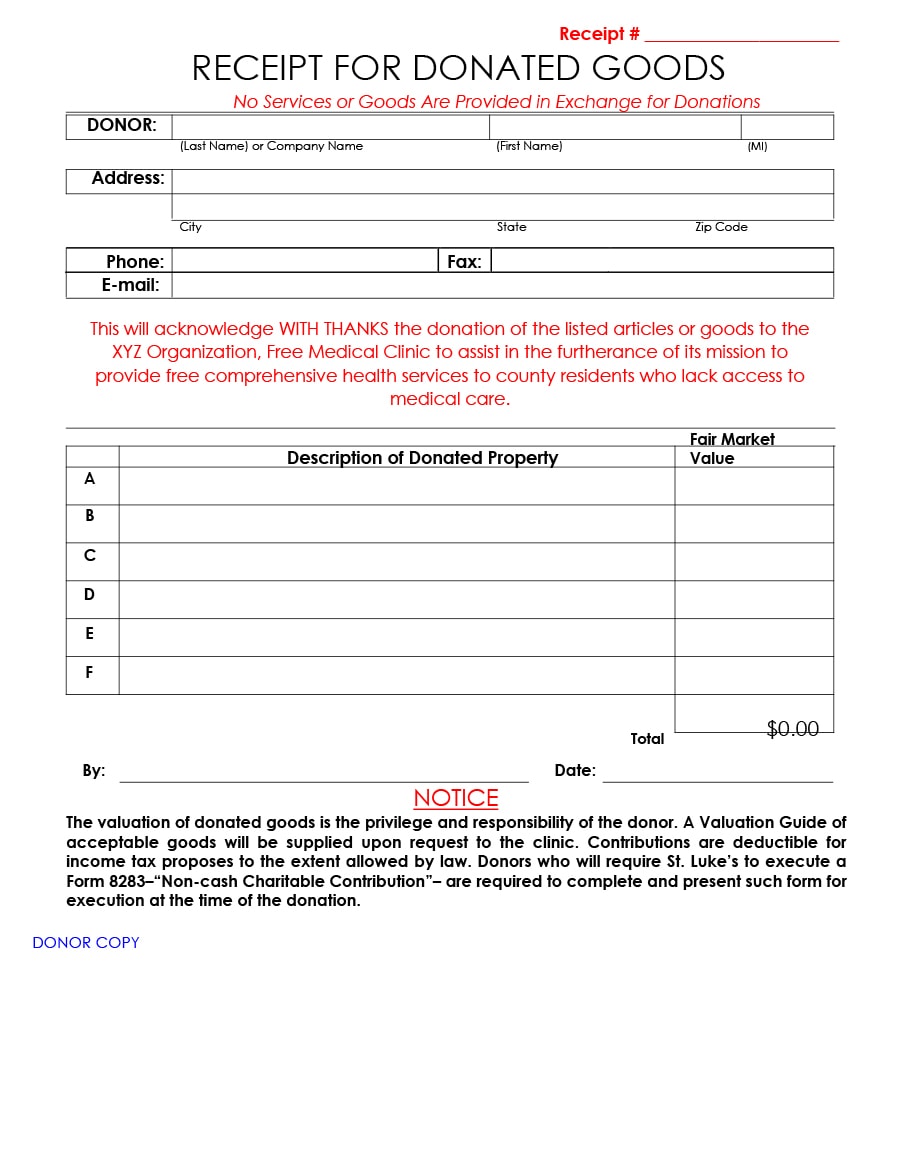

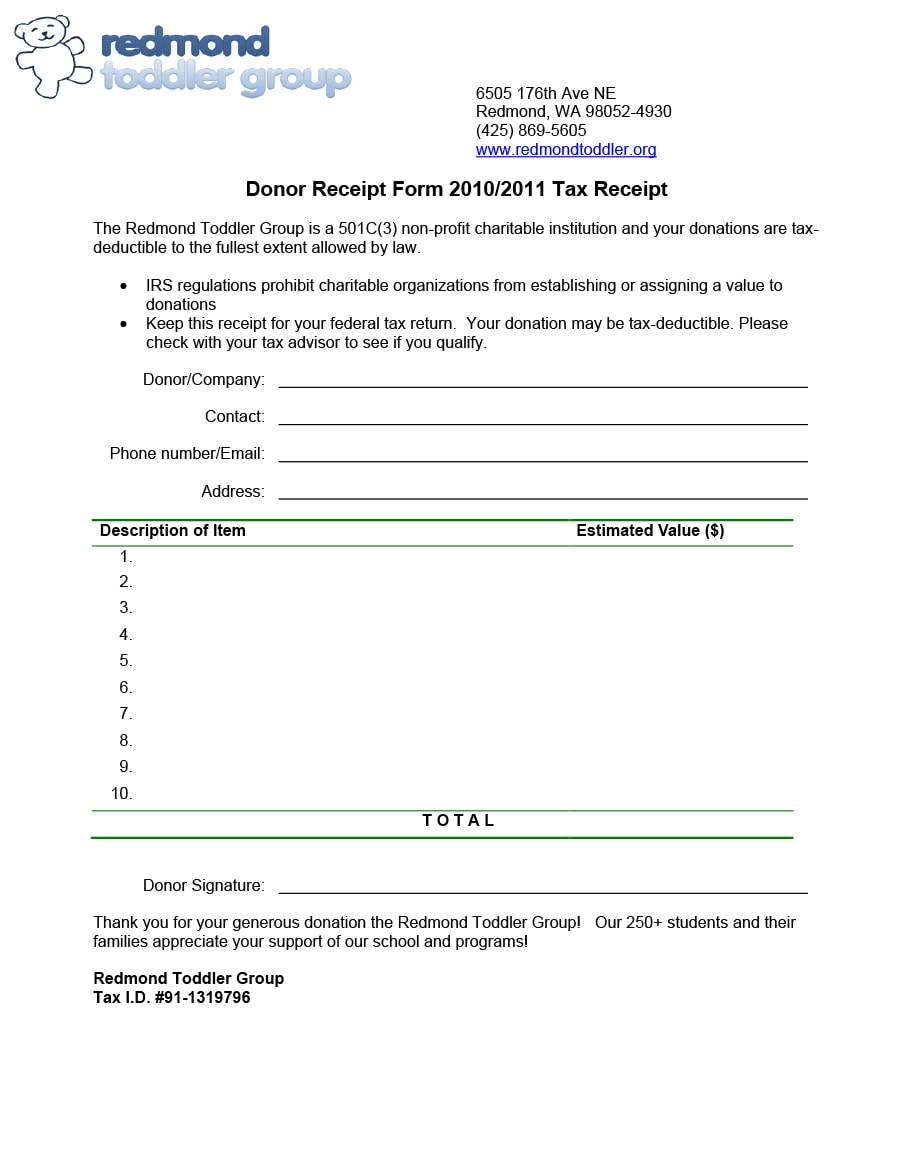

Best practices for creating a 501c3 tax compliant donation receipt. And statement that goods or services if any that the organization. The irs provides guidelines for what should be included on these receipts. A charitable organization is required to provide a written disclosure to a donor who receives goods or services in exchange for a single payment in excess of 75.

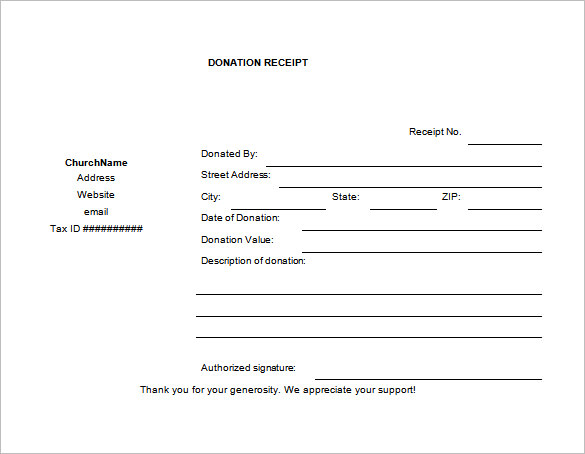

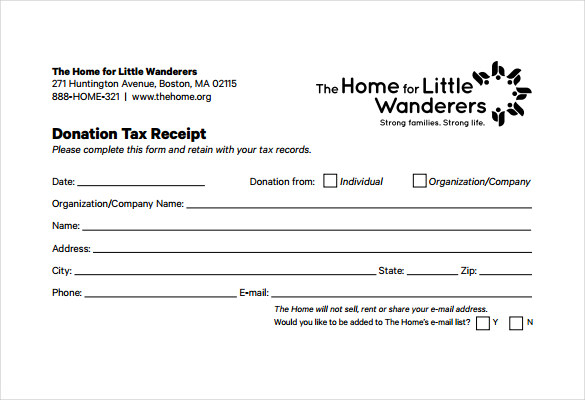

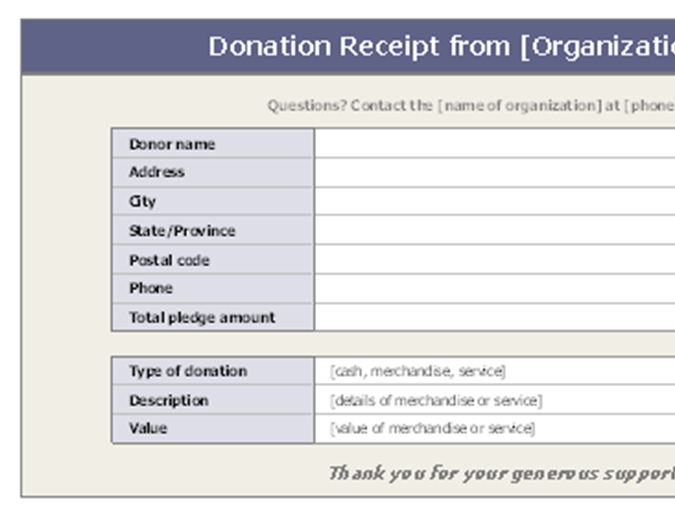

Include in your statement the following information. For the beneficiaries non profit organizations donation receipts serve as legal documents or legal requirements for non profit organizations. Insubstantial values need not be recorded. The receipt can be a letter a postcard an e mail message or a form created for the purpose.

Any donations worth 250 or more must be recognized with a receipt. Name of your organization. Donors giving more than 250 in a single contribution to a tax exempt nonprofit organization need a written acknowledgment from the organization to claim that deduction on their individual income tax return. The receipt can take a variety of written forms letters formal receipts postcard computer generated forms etc.

Statement that no goods or services were provided by the organization if that is the case. Description and good faith estimate of the value of goods or services if any that organization provided in return for the contribution.