Obtaining Cpa Certification

Both have strict requirements to sit of the exam and both have extremely difficult exams.

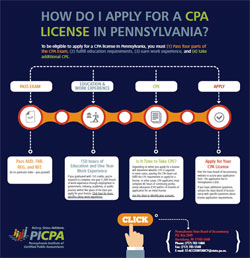

Obtaining cpa certification. Completed the educational requirement for florida cpa licensure. Any applicant who has never been licensed as a cpa in another us. There is a lot of speculation about which accounting certification is the most difficult. Now youre ready to apply for your florida state cpa license.

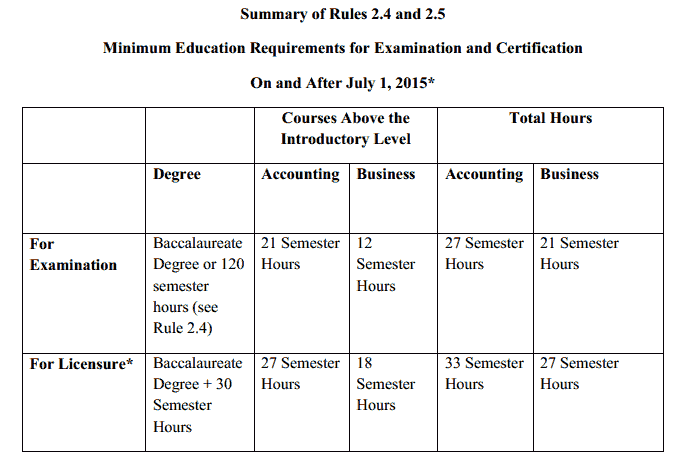

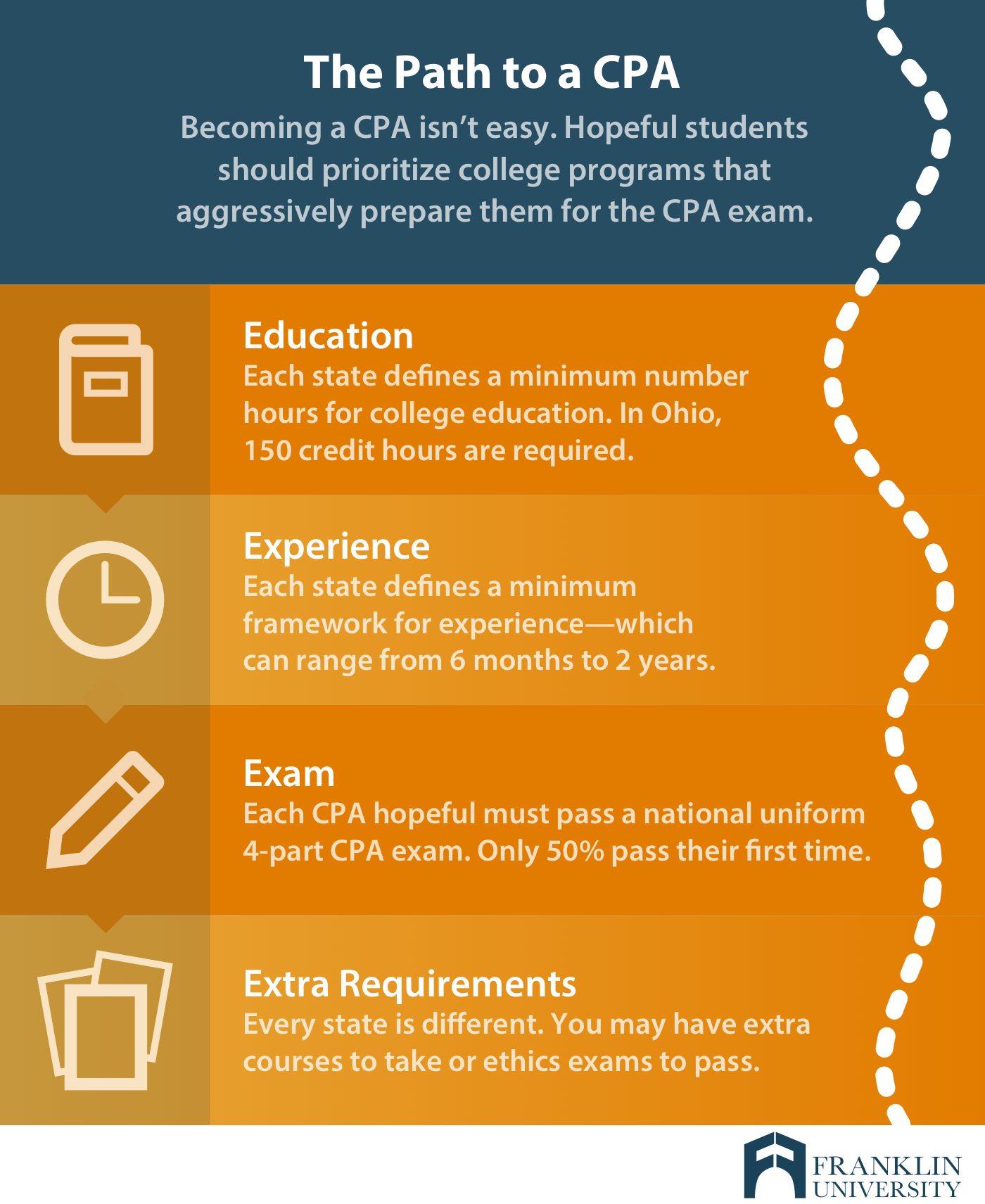

The information below is meant to serve as an easy reference guide for some of the commonly asked questions regarding becoming a cpa in new york state. To obtain the required body of knowledge and to develop the skills and abilities needed to be successful cpas students should complete 150 semester hours of education. Determine where you plan to take the exam and complete the requirements for that state. In addition to the regular cpe requirements all cpa certificate holders in texas must complete a 4 hour ethics course every two years.

How to get licensed. Who should apply for an initial license. I think it is tied between the cpa and cfa. Request information from new york colleges and universities offering programs in accounting.

Which accounting certification is the hardest to obtain. Earning a cpa license demonstrates a commitment to the profession and often highlights potential candidates for leadership and management positions. You have worked hard studied and earned a texas cpa license. It is not meant to replace the guidelines set forth by the new york state education department and is not the final authority in answering questions about the cpa licensure process.

The state of new york requires 150 semester hours as well as 1 year of work experience in order to obtain your cpa license. Obtain your florida cpa license. Checklist confirm that youve satisfied all education exam and experience requirements for licensure as a cpa in florida. The new york state board of regents in conjunction with the new york state board of public accountancy requires that cpa candidates hold a bachelors degree or higher from a program that meets the 150 semester hour requirement.

State or by a foreign licensing jurisdiction that has a mutual recognition agreement with mra with the national association of state board for accountancy nasba. Conquering the cpa exam and obtaining the cpa license allows individuals to stand out to potential employers who are often impressed with accountants who earn this highly coveted title. Now that youre a cpa in texas. However you may sit for the cpa exam upon completion of your bachelors degree and 120 semester hours.

.png?width=600&name=Visual_1%20(1).png)