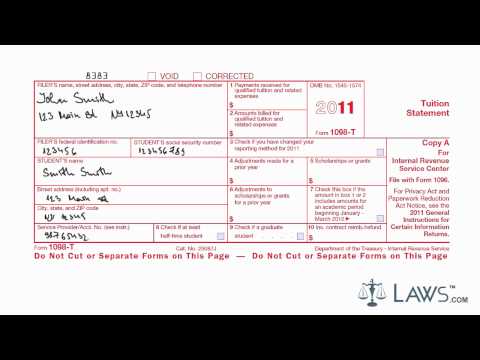

Printable 1080 Tax Form

2 new printable irs 1040 tax forms schedules instructions.

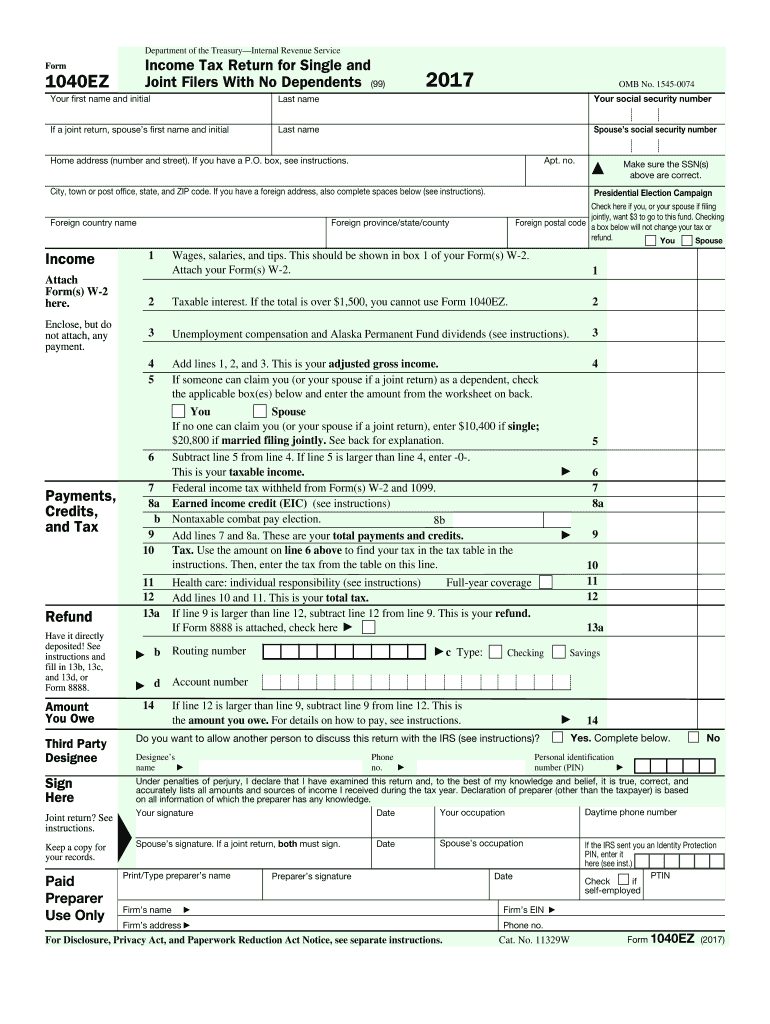

Printable 1080 tax form. Federal individual income tax return. Income tax return filed by certain citizens or residents of the united states. This form is for income earned in tax year 2018 with tax returns due in april 2019. Irs use onlydo not write or staple in this space.

The form 1040 tax table can be found inside the instructions booklet. It is the simplest form for individual federal income tax returns filed with the irs. We will update this page with a new version of the form for 2020 as soon as it is made available by the federal government. Annual income tax return filed by citizens or residents of the united states.

1 the best way to get your irs tax forms. Self employment tax return including the additional child tax credit for bona fide residents of puerto rico 2019 01072020 inst 1040 ss. Printable federal income tax form 1040 form 1040 is the us. Self employment tax return including the additional child tax credit for bona fide residents of puerto rico 2018.

Instructions for form 1040 ss us. Single married filing jointly. However theres a better way to get your tax forms. Printable 2018 federal tax forms 1040ez 1040a and 1040 are grouped below along with their most commonly filed supporting irs schedules worksheets 2018 tax tables and instructions for easy one page access.

Have other payments such as an amount paid with a request for an extension to file or excess social security tax withheld. These free pdf files are unaltered and are sourced directly from the publisher. They are due each year on april 15 of the year after the tax year in question. Check only one box.

For most tax payers your 2018 federal income tax forms must be postmarked by april 15 2019. We last updated federal form 1040 in december 2018 from the federal internal revenue service. Many people will only need to file form 1040 and no schedules. Form 1040 department of the treasuryinternal revenue service 99 us.

Form 1040 ez is a short version tax form for annual income tax returns filed by single filers with no dependents. Married filing separately mfs head of household hoh qualifying widower qw. Can claim any credit that you didnt claim on form 1040 or 1040 sr such as the foreign tax credit education credits general business credit. 3 old irs 1040 tax forms instructions.

Us individual income tax return. Printable irs tax forms can be downloaded using the links found below and used for tax filing purposes.

/Screenshot2018-12-0623.28.52-5c09f72d46e0fb000195b16b.png)

:max_bytes(150000):strip_icc()/Screenshot2018-12-0623.28.52-5c09f72d46e0fb000195b16b.png)