Printable 4868 Tax Form

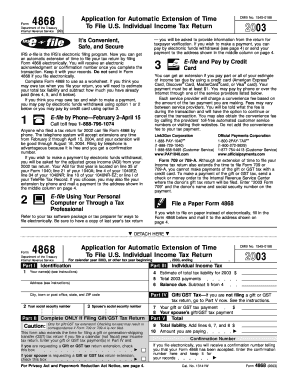

Enter your total tax liability on line 4 of form 4868 and 3.

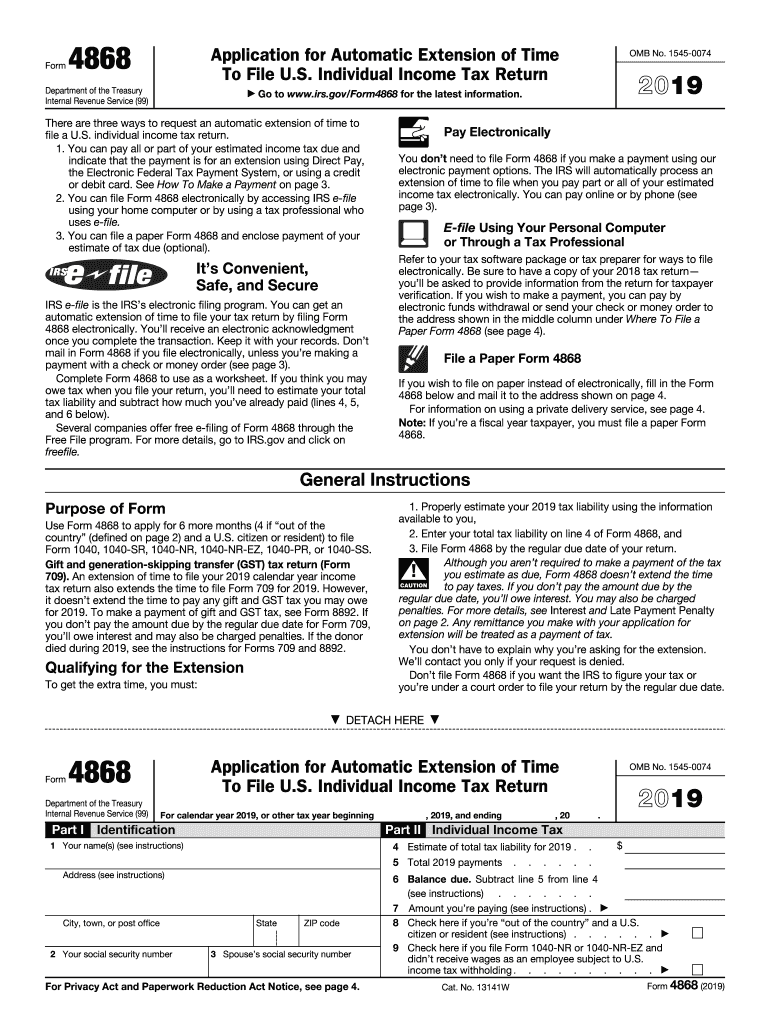

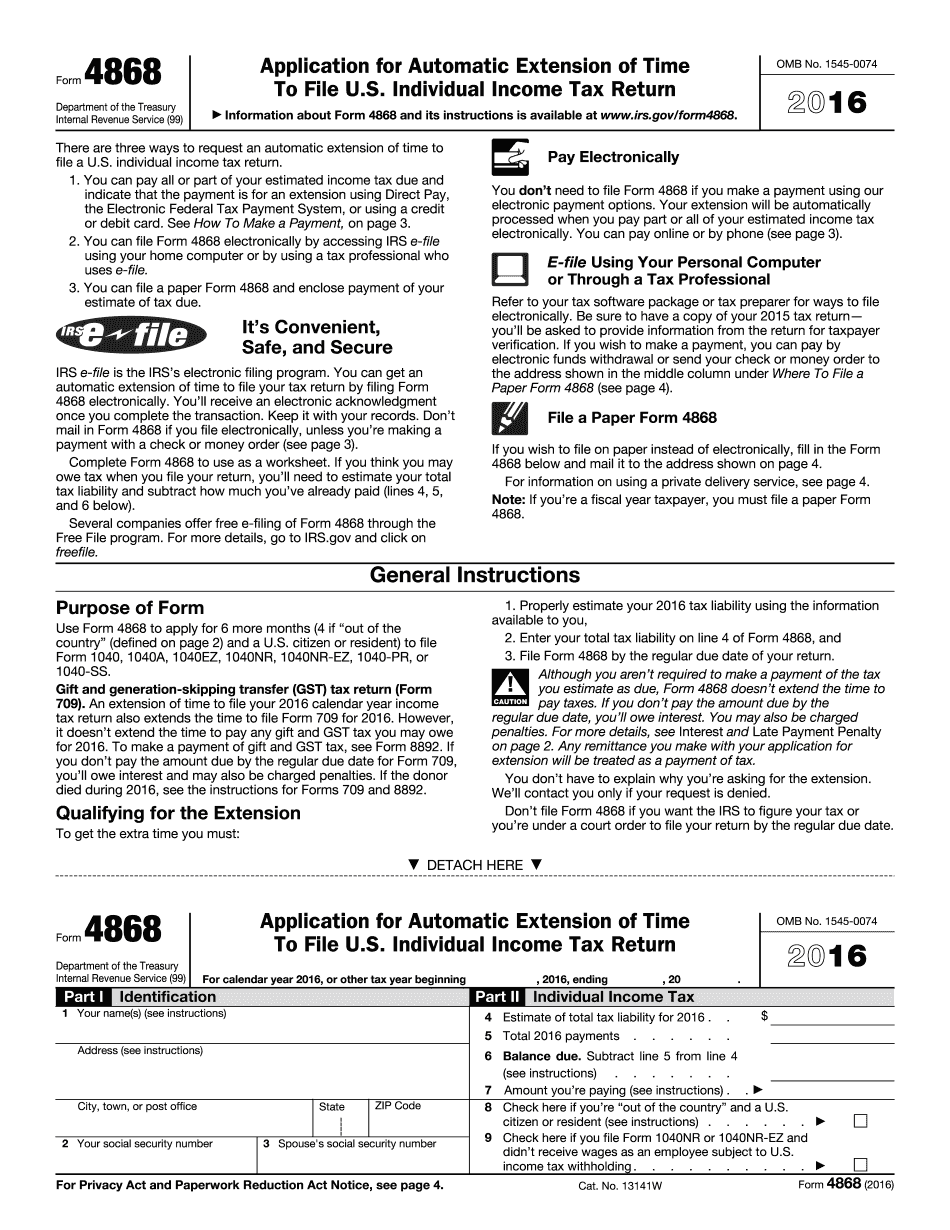

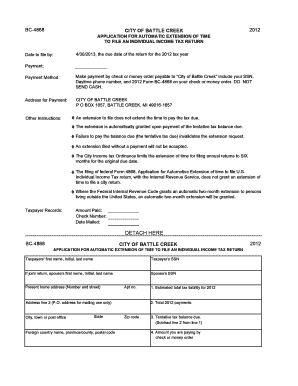

Printable 4868 tax form. Page one and two of the 2019 4868 form which includes both the payment instructions and mailing address. This document will be available soon. If you dont pay the amount due by the regular due date youll owe interest. If you dont pay the amount due by the regular due date youll owe interest.

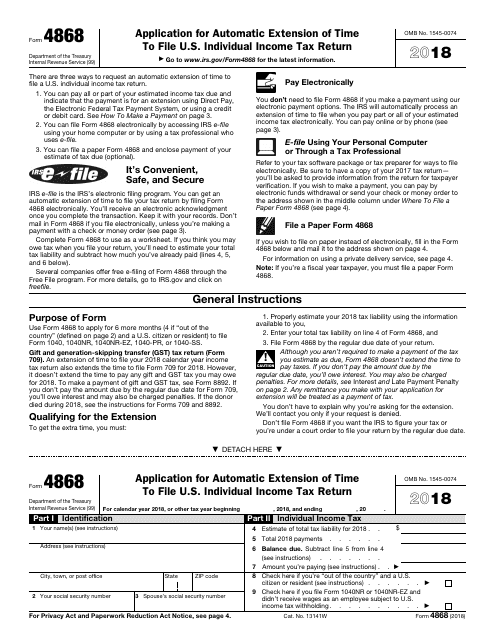

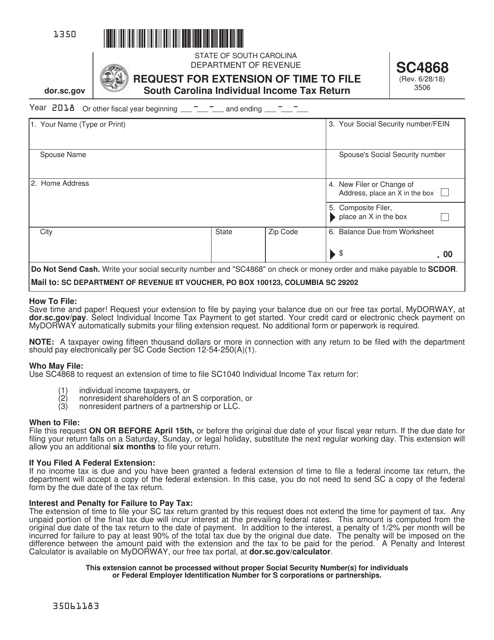

File form 4868 by the regular due date of your return. Citizen or resident files this form to request an automatic extension of time to file a us. Employers quarterly federal tax return. This form is for income earned in tax year 2018 with tax returns due in april 2019.

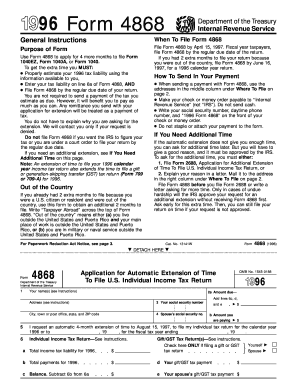

Although you arent required to make a payment of the tax you estimate as due form 4868 doesnt extend the time to pay taxes. Enter your total tax liability on line 4 of form 4868 and. 3 old irs 1040 tax forms instructions. Printable irs tax forms can be downloaded using the links found below and used for tax filing purposes.

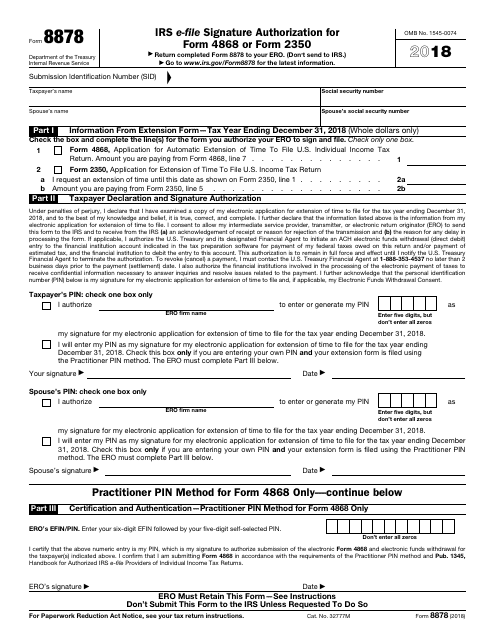

For filing by april 17 2018. Get all the benefits from online pdf samples you can easily fill print or download. Employers who withhold income taxes social security tax or medicare tax from employees paychecks or who must pay the employers portion of social security or medicare tax. Form 941 pdf related.

File form 4868 by the regular due date of your return. We will update this page with a new version of the form for 2020 as soon as it is made available by the federal government. Individual income tax return. Form 4868 is used by individuals to apply for six 6 more months to file form 1040 1040nr or 1040nr ez.

Printable tax form instructions payment voucher application for automatic extension of time to file. Although you arent required to make a payment of the tax you estimate as due form 4868 doesnt extend the time to pay taxes. However theres a better way to get your tax forms. Instructions for form 941 pdf.

A taxpayer can file this form to request an automatic 6 month extension of time to file a us. Enter your total tax liability on line 4 of form 4868 and 3. File form 4868 by the regular due date of your return. Qualifying for the extension to get the extra time you must.

Individual income tax return. Use irs form 4868 to make an application for automatic time extension to file your income tax return. Properly estimate your 2018 tax liability using the information available to you 2. Printable irs form 4868 income tax extension tax year 2017 for filing in 2018 tax season printable 2107 irs form 4868.

We last updated federal form 4868 in december 2018 from the federal internal revenue service.