Printable Pa Tax Forms

These same forms can be printed as blank forms for hand written entries.

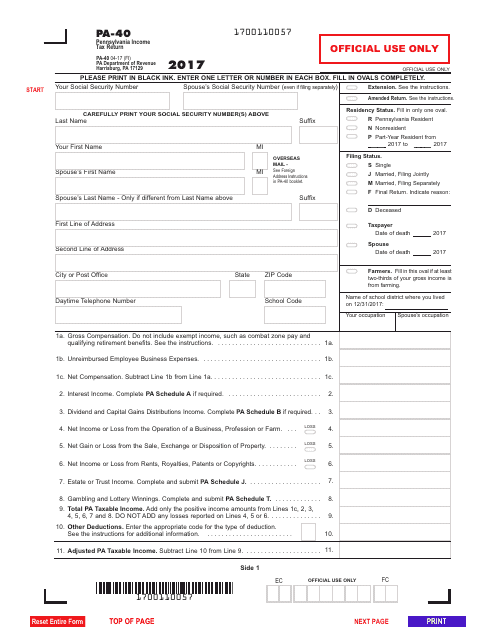

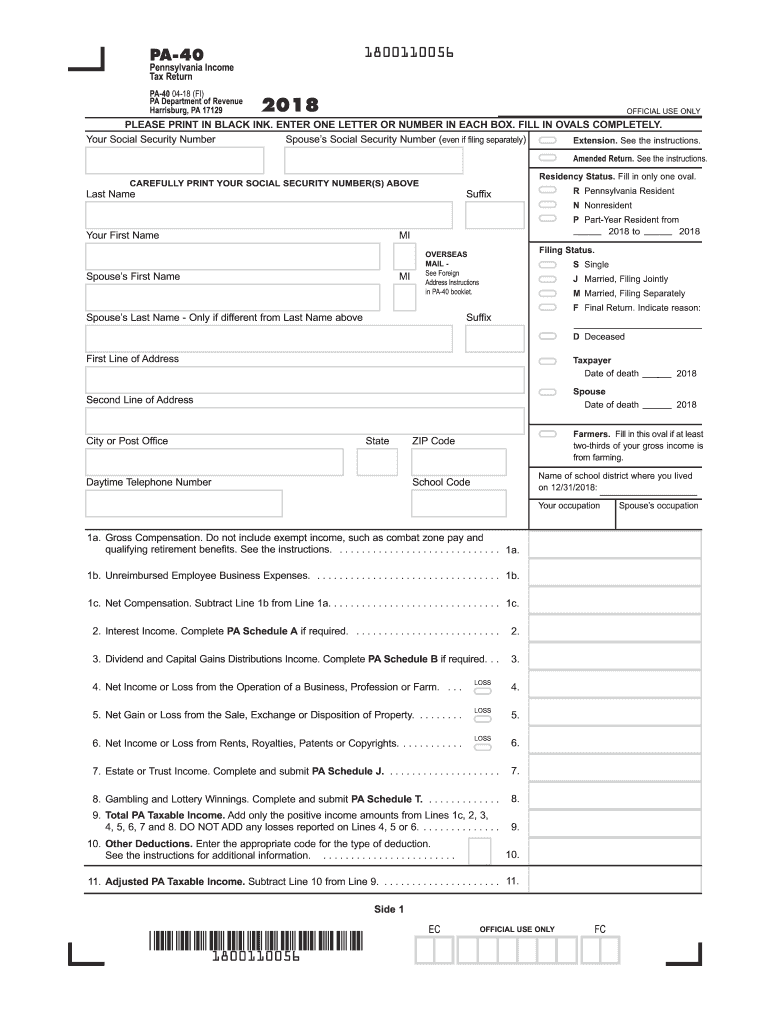

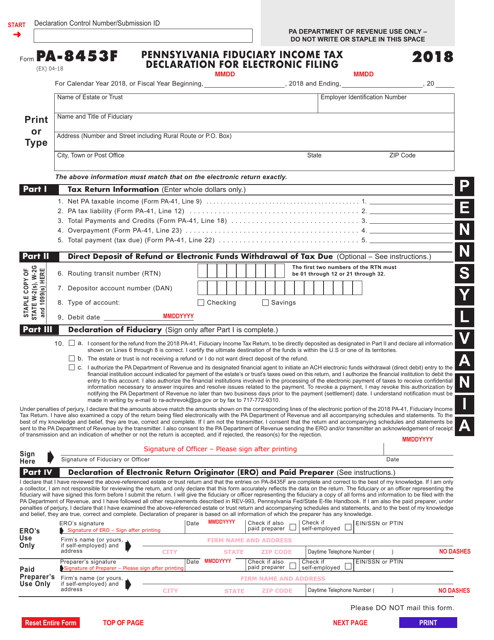

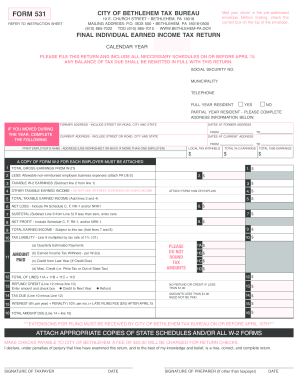

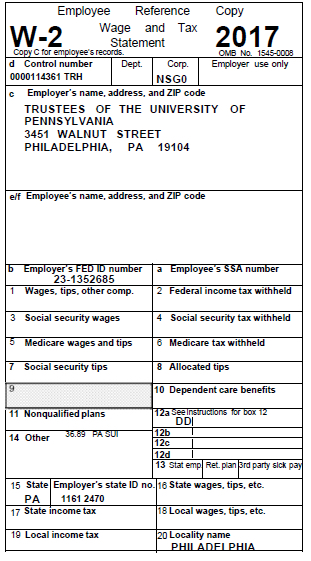

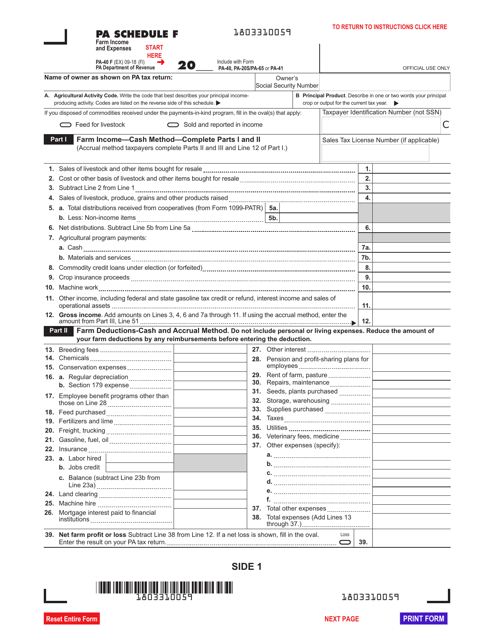

Printable pa tax forms. Pennsylvania has a state income tax of 307. Pa personal income tax guide. More about the pennsylvania form pa 40 tax return. 2019 personal income tax forms.

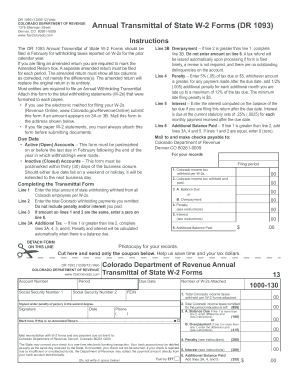

The words fillin will no longer appear at the end. E file is a free option to file your federal and state taxes simultaneously. Pennsylvania printable income tax forms 175 pdfs. The department will be able to process 2019 personal income tax estimated payments made in 2019 if taxpayers complete and mail a pa 40esr i declaration of estimated tax coupon to the department along with their check for the estimated tax amount.

Office of legislative affairs. The pa state tax rate is displayed on tax form pa 40 and also inside the pa 40 instructions booklet. Printable pennsylvania state tax forms for the current tax year will be based on income earned between january 1 2018 through december 31 2018. Padirectfile is a free and secure way to file your return directly with the pa department of revenue.

This form is for income earned in tax year 2018 with tax returns due in april 2019. The pennsylvania income tax rate for 2018 is a flat 307. The inheritance tax return was previously available as the rev 1500pdf and the rev 1500fillinpdf. This form is now combined and labeled as the rev 1500pdf.

We will update this page with a new version of the form for 2020 as soon as it is made available by the pennsylvania government. 2018 pennsylvania printable income tax forms 175 pdfs. Id theft victim assistance. If you are seeking tax forms for years older than those displayed please email your request to ra forms at pagov.

The updated form name will keep the print only format. Taxformfinder provides printable pdf copies of 175 current pennsylvania income tax forms. We last updated pennsylvania form pa 40 in january 2019 from the pennsylvania department of revenue. Pennsylvania has a flat state income tax of 307 which is administered by the pennsylvania department of revenue.

Taxpayers should write 2019 estimated tax payment and the last four digits of the primary taxpayers ssn.