Printable W 7 Form

Fillable and editable templates can greatly save your time.

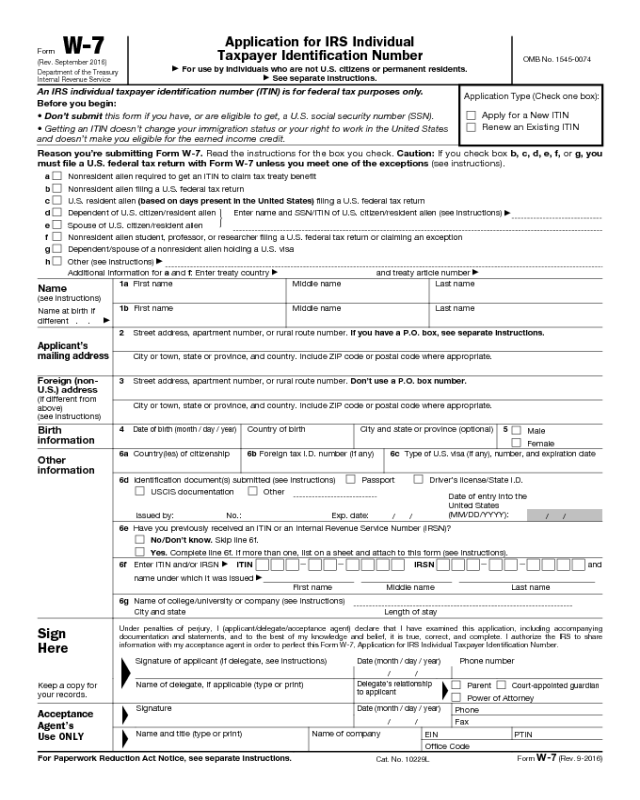

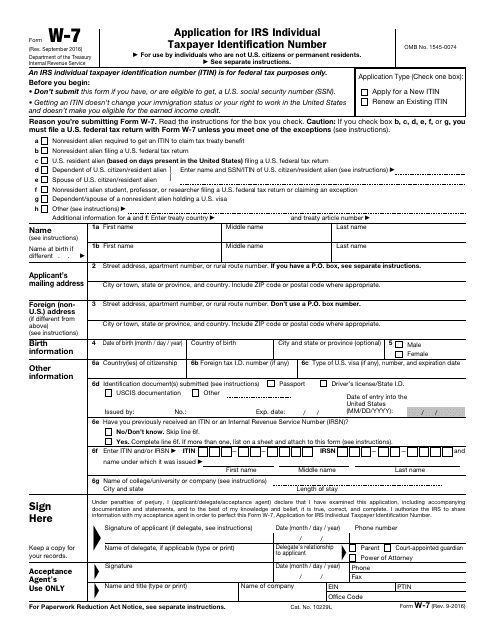

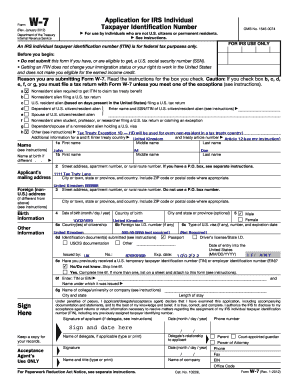

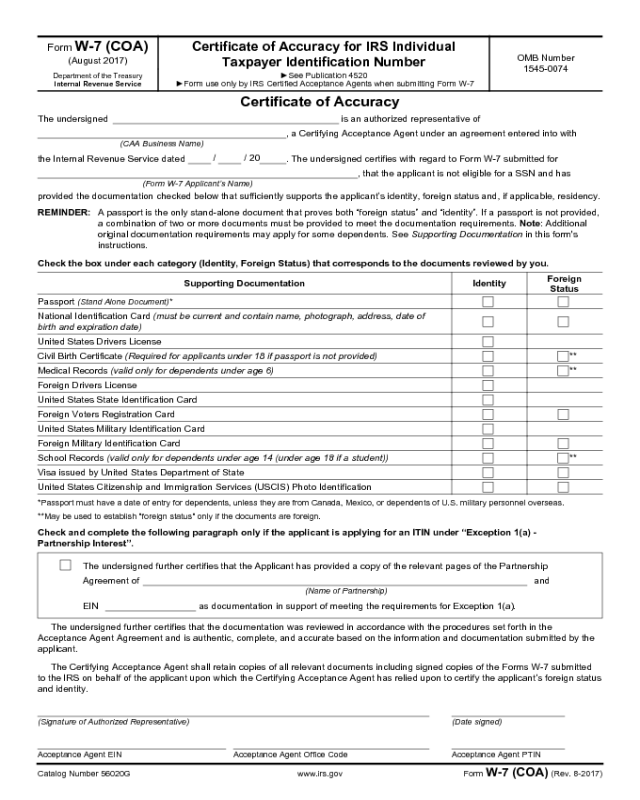

Printable w 7 form. Information about form w 7 application for irs individual taxpayer identification number including recent updates related forms and instructions on how to file. In order to apply for an itin form w 7 must be completed and attached to the tax return and mailed to the irs. Print save or send your document immediately. Printable irs tax forms can be downloaded using the links found below.

It may also be filed in person at any irs tax assistance center in the united states or through an authorized acceptance agent. No software is needed. The irs advises allowing 7 weeks for processing or 9 to 11 weeks if filing during tax season. Information about form w 9 request for taxpayer identification number tin and certification including recent updates related forms and instructions on how to file.

However theres a better way to get your tax forms. Just put your data into blank fields and put your signature. Form w 9 is used to provide a correct tin to payers or brokers required to file information returns with irs. Complete form w 7 only if the ssa notifies you that youre ineligible for an ssn.

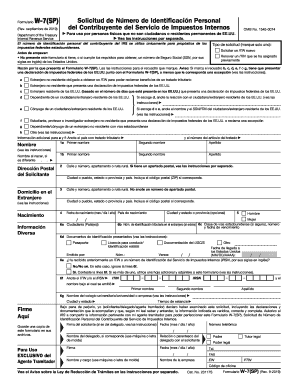

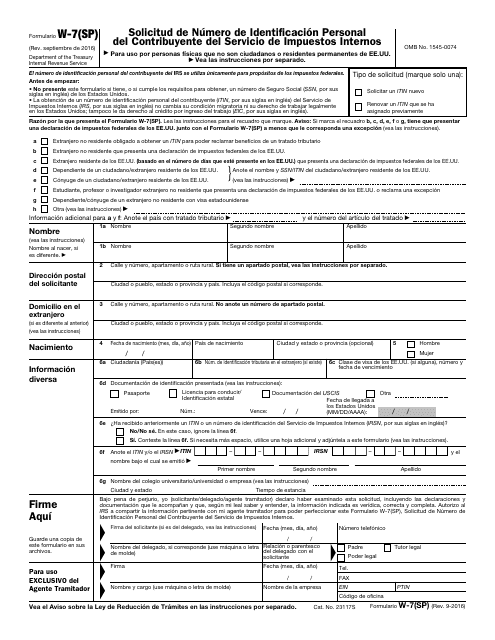

Mobile and tablet friendly services. Instructions for the requestor of form w 9 request for taxpayer identification number and certification 1018 10292018 form w 9 sp solicitud y certificacion del numero de identificacion del contribuyente. Create pdf irs form w 7 2019 online. Form w 7 is used to apply for an individual taxpayer identification number itin or to renew an existing itin.

Signature of applicant if delegate see instructions date month day year phone number name of delegate if applicable type or print delegates relationship to applicant parent. If the ssa determines that youre not eligible for an ssn you must get a letter of denial and attach it to your form w 7. Information with my acceptance agent in order to perfect this form w 7 application for irs individual taxpayer identification number. If you have an application for an ssn pending dont file form w 7.

However if you meet one of the exceptions complete and submit form w 7 as soon as possible after you determine you are covered by that exception. Complete and attach form w 7 when you file the tax return for which the itin is needed.