Printable W 9 Form For Employees

Citizenship and immigration services section 2.

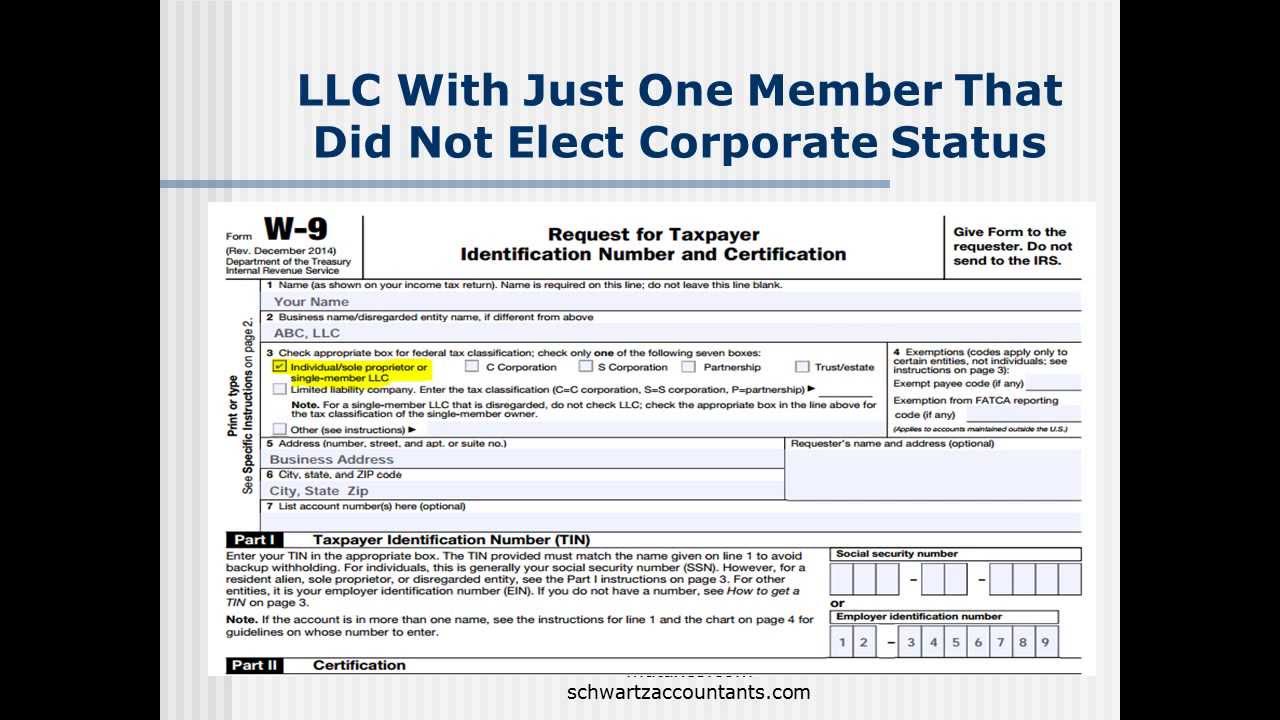

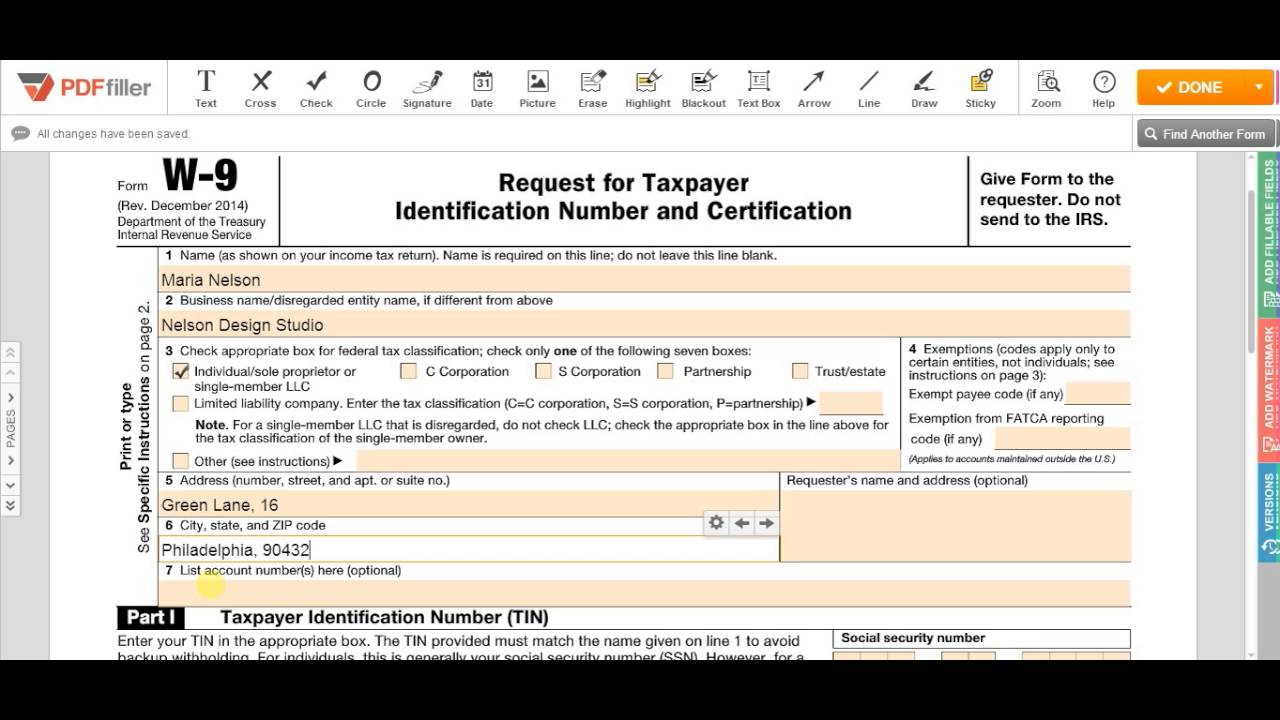

Printable w 9 form for employees. Form w 4 2020 employees withholding certificate department of the treasury internal revenue service complete form w 4 so that your employer can withhold the correct federal income tax from your pay. Owner of a disregarded entity and not the entity. Employer or authorized representative review and verification. Status and avoiding withholding on its allocable share of net income from the partnership conducting a trade or business in the united states is in the following cases.

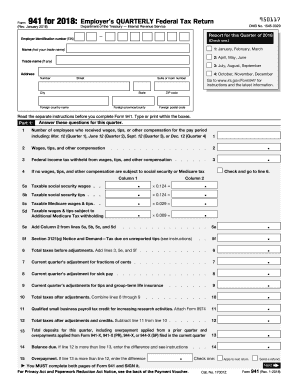

Form 940 schedule a. Instructions for the requestor of form w 9 request for taxpayer identification number and certification 1018 10292018 form w 9 sp solicitud y certificacion del numero de identificacion del contribuyente 1018 11072018 inst w 9 sp instrucciones para el solicitante del formulario w 9sp solicitud y certificacion del numero de. Form w 4p withholding certificate for pension or annuity payments. Form w 3c transmittal of corrected wage and tax statements.

Participating foreign financial institution to report all united states 515 withholding of tax on nonresident aliens and foreign entities. If employees claim exemption from income tax withholding they must give you a new form w 4 each year. Enter personal information a. Form w 4 employees withholding certificate.

1615 0047 expires 08312019 employment eligibility verification department of homeland security us. Nonresident alien who becomes a resident alien. This printable form helps getting information from a worker who can be hired for performance of some work or self employee the employer is planning to use to do some job. Instead use the appropriate form w 8 or form 8233 see pub.

If you are an employee you need to complete w 9 form. While most of other forms help to inform and pay taxes but printable w 9 form 2018 is little bit different. Form i 9 071717 n page 2 of 3 uscis form i 9 omb no. Form 940 schedule r allocation schedule for aggregate form 940 filers pdf form 941.

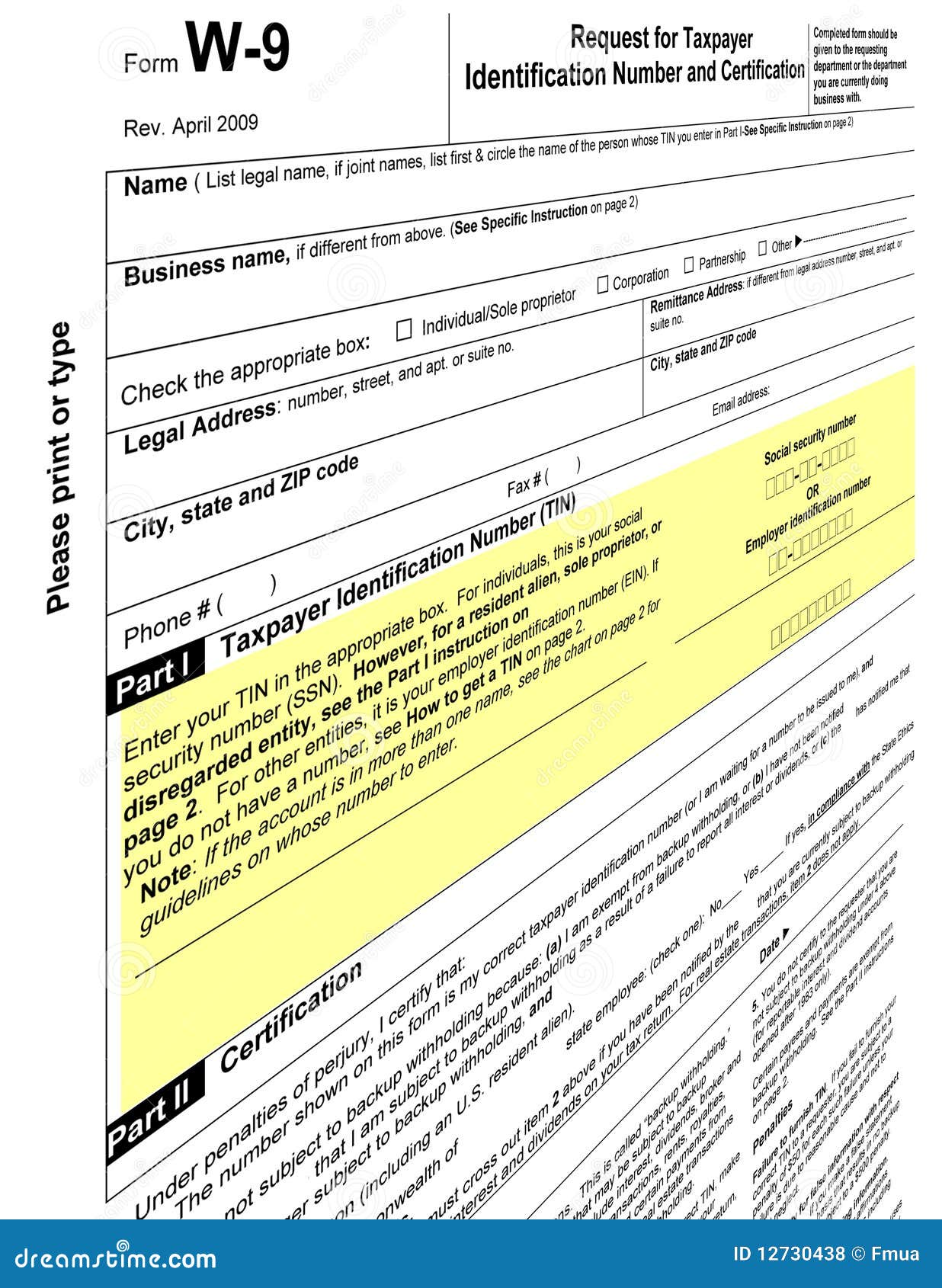

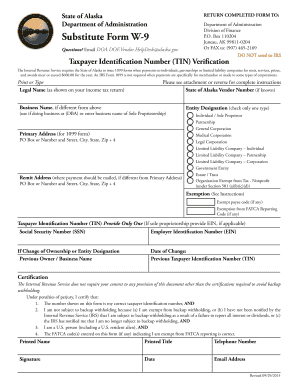

Form w 9 is used to provide a correct tin to payers or brokers required to file information returns with irs. This one is a tax blank from the us irs or irs. If an employee gives you a form w 4 that replaces an existing form w 4 begin withholding no later than the start of the first payroll period ending on or after the 30th day from the date you received the replacement form w 4. Form 940 employers annual federal unemployment tax return.

1 2011 page 2 the person who gives form w 9 to the partnership for purposes of establishing its us. Give form w 4 to your employer. Information about form w 9 request for taxpayer identification number tin and certification including recent updates related forms and instructions on how to file.

/documents-when-hiring-a-contract-worker-398608_final-c7b9e3e0f1704d388f723fe60239b079.png)

:max_bytes(150000):strip_icc()/filling-out-form-w9-3193471-v2-5b733961c9e77c00572ddf88.png)