Printable W 9 Form Irs

The form is needed by the entities to prepare their 1099 misc form.

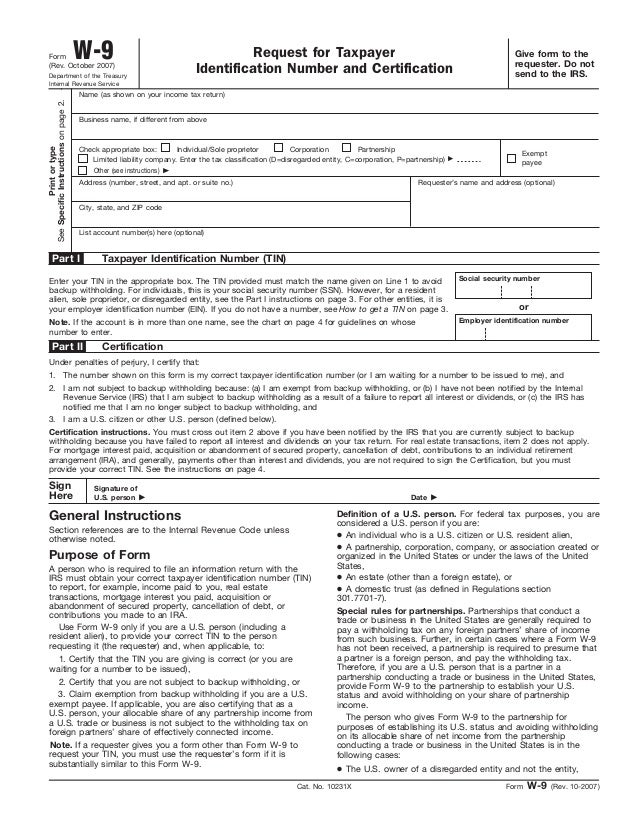

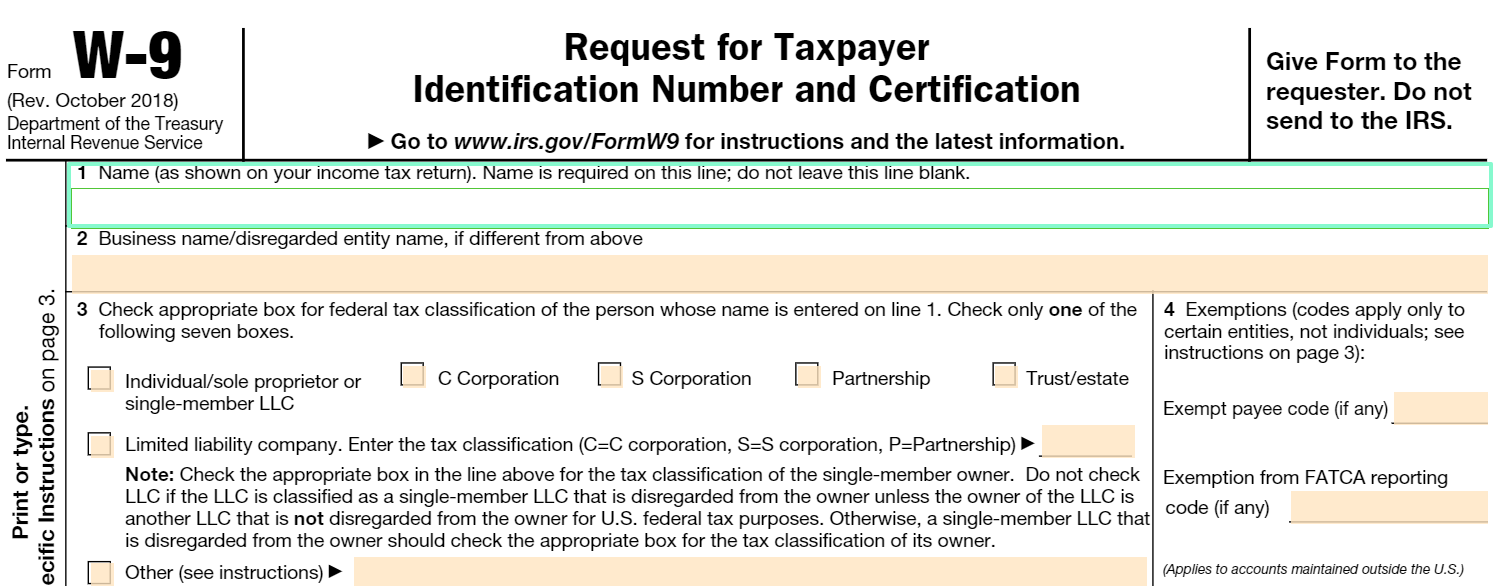

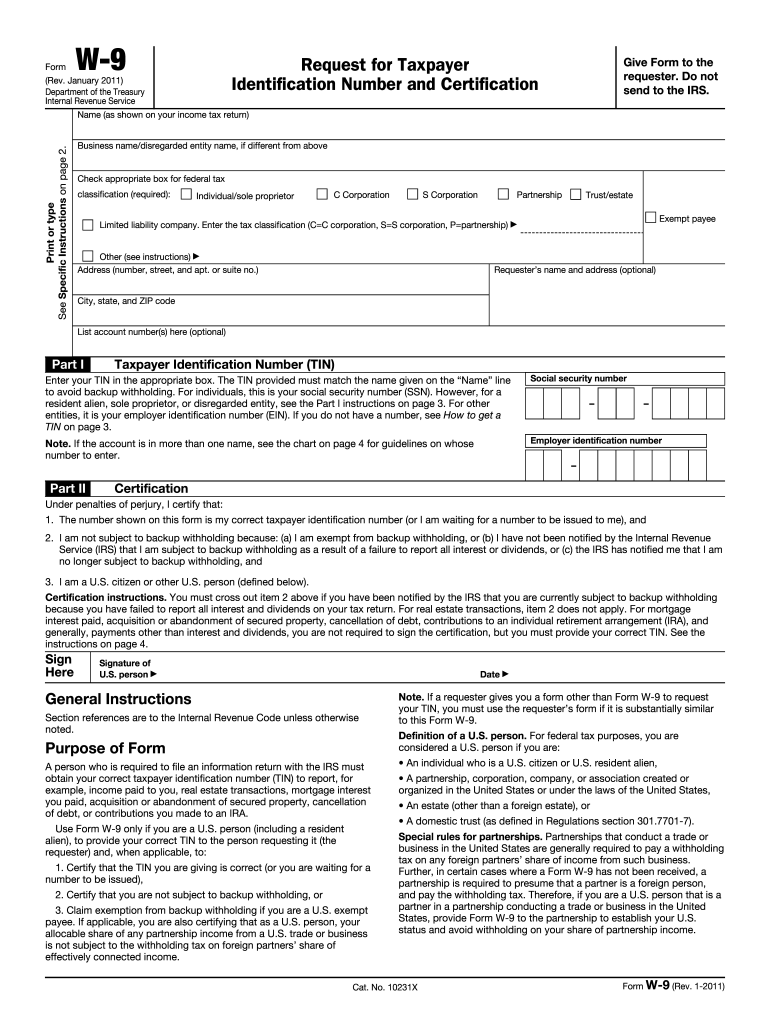

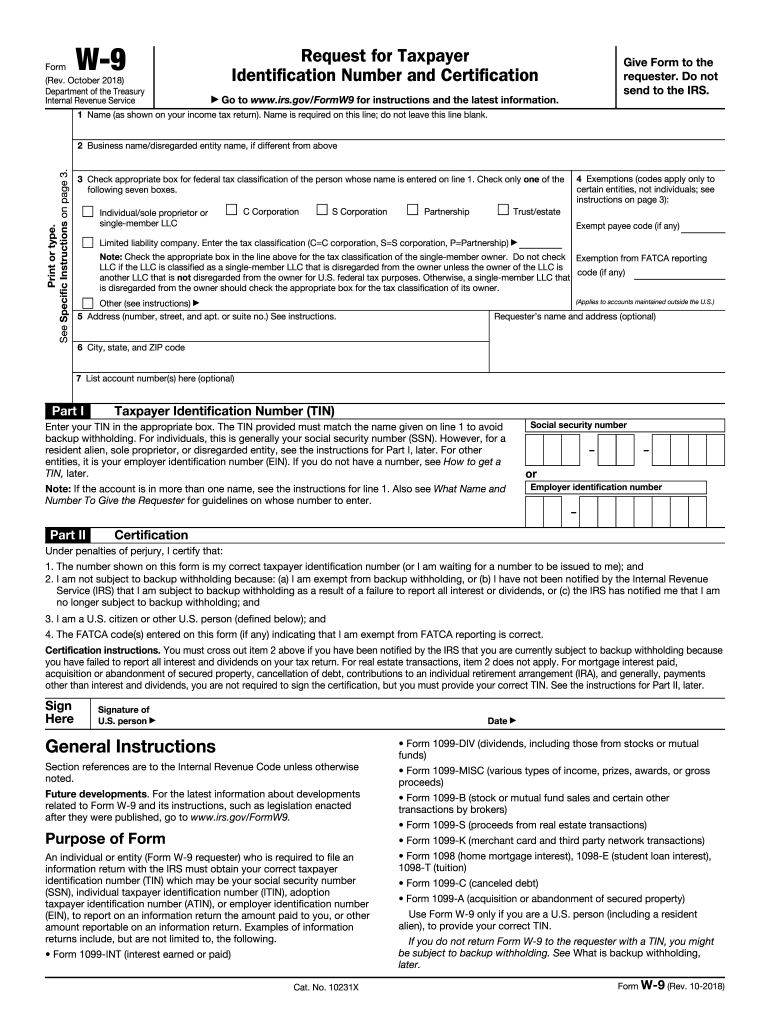

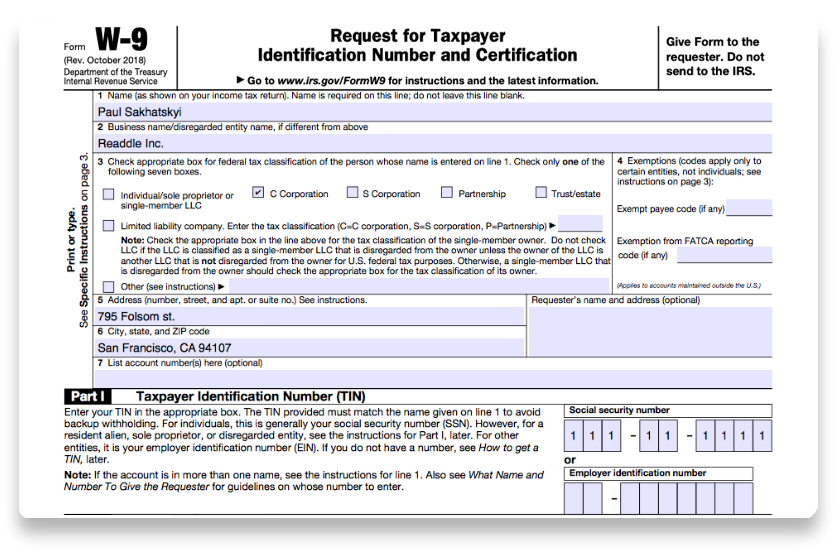

Printable w 9 form irs. Do not send to the irs. Form w 2ccorrected wage and tax statement. It is worth roughly twenty eight percentage on all payments given to you and depends on some conditions. Business namedisregarded entity name if different from above.

Instructions for the requestor of form w 9 request for taxpayer identification number and certification 1018 10292018 form w 9 sp solicitud y certificacion del numero de identificacion del contribuyente. Use form w 9 to provide your correct taxpayer identification number tin to the person who is required to file an information return with the irs to report for example. Form w 8 imy may serve to establish foreign status for purposes of sections 1441 1442 and 1446. Form w 3 transmittal of wage and tax statements.

Information about form w 8 imy certificate of foreign intermediary foreign flow through entity or certain us. Form ss 8 determination of worker status. Form w 2 wage and tax statement. It is an annual wage report form so it must be prepared and submitted to the irs.

October 12 2019 the irs form w 9 is a commonly used form that informs and verifies the taxpayer identification number of the contractors and freelancers. Give form to the requester. Print or type see specific instructions on page 2. Name as shown on your income tax return.

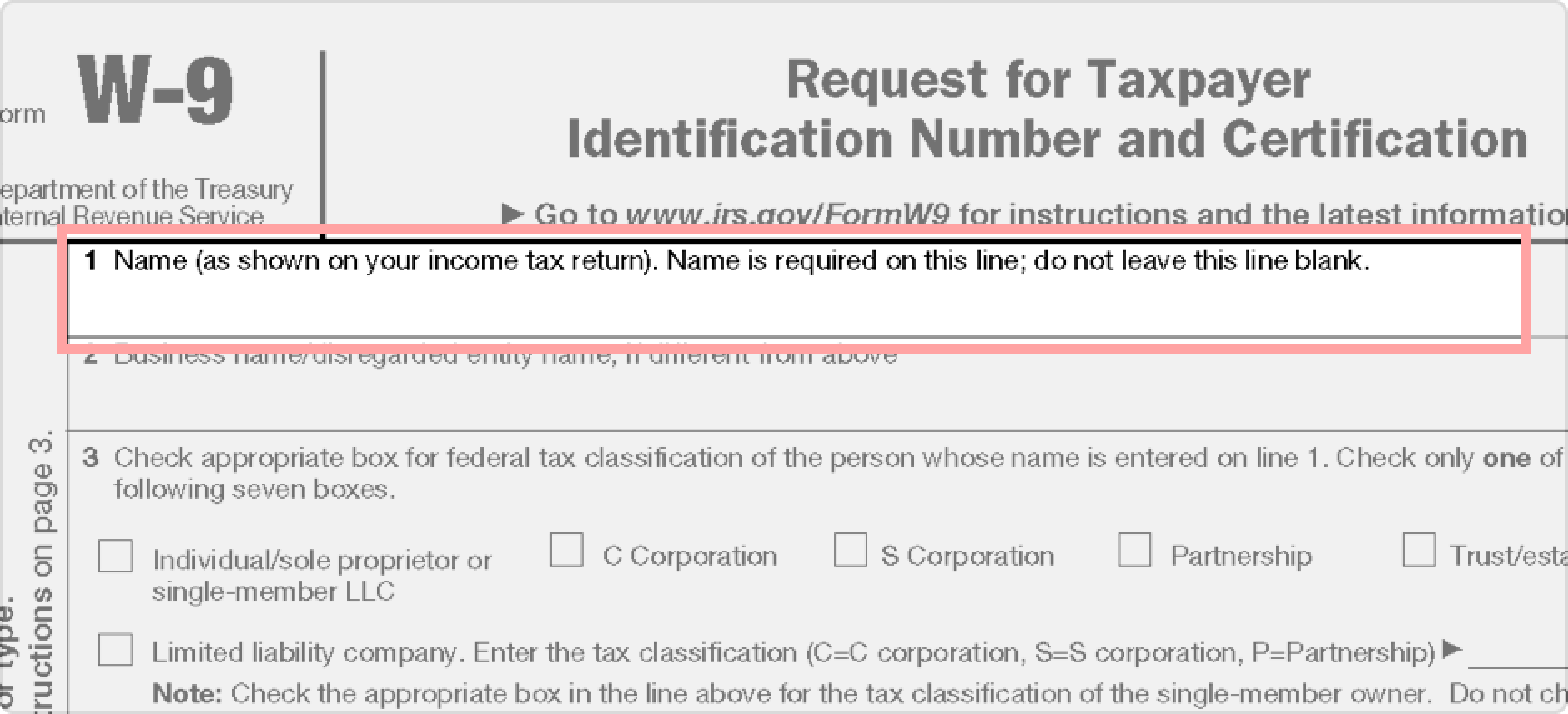

Do not leave this line blank. January 2011 department of the treasury internal revenue service request for taxpayer identification number and certification give form to the requester. Income paid to you. Request for taxpayer identification number and certification 1018 10242018 inst w 9.

Instructions are included with the form unless otherwise noted. Get ready for the 2018 tax season. Name is required on this line. Branches for united states tax withholding and reporting including recent updates related forms and instructions on how to file.

W 9 forms to print also include a section where you need to state whether you are subject to backup withholding or not. Name as shown on your income tax return business namedisregarded entity name if different from above.

/w-9-form-4f788e54c74c4242a4e88dc1183361f5.jpg)