Risk Analytics Certification

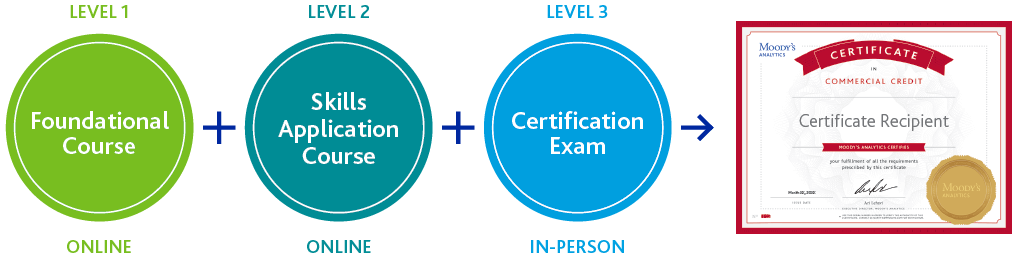

Moodys analytics helps professionals develop world class skills through industry leading online courses and expert instruction.

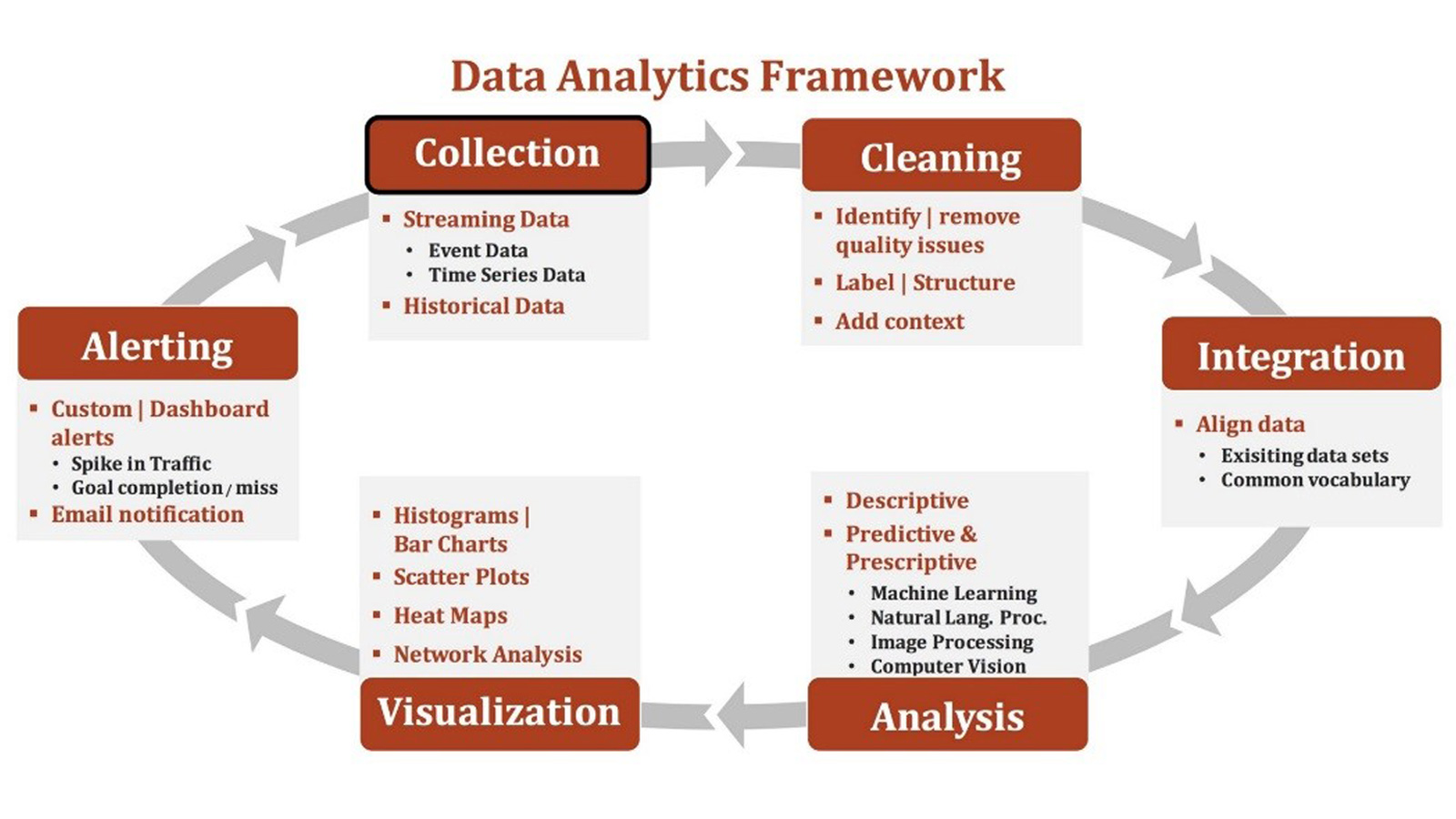

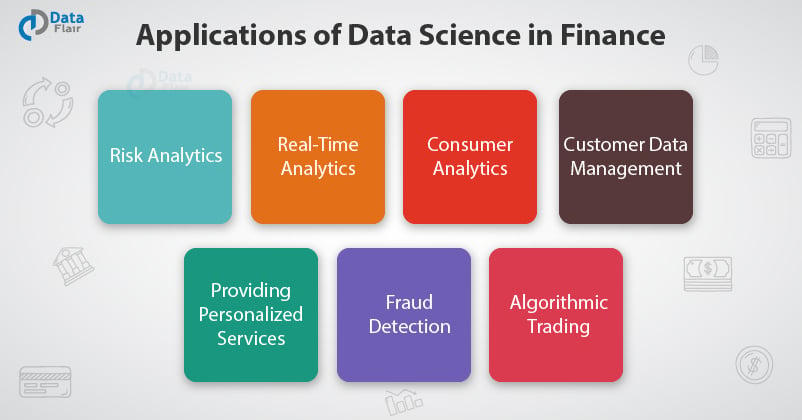

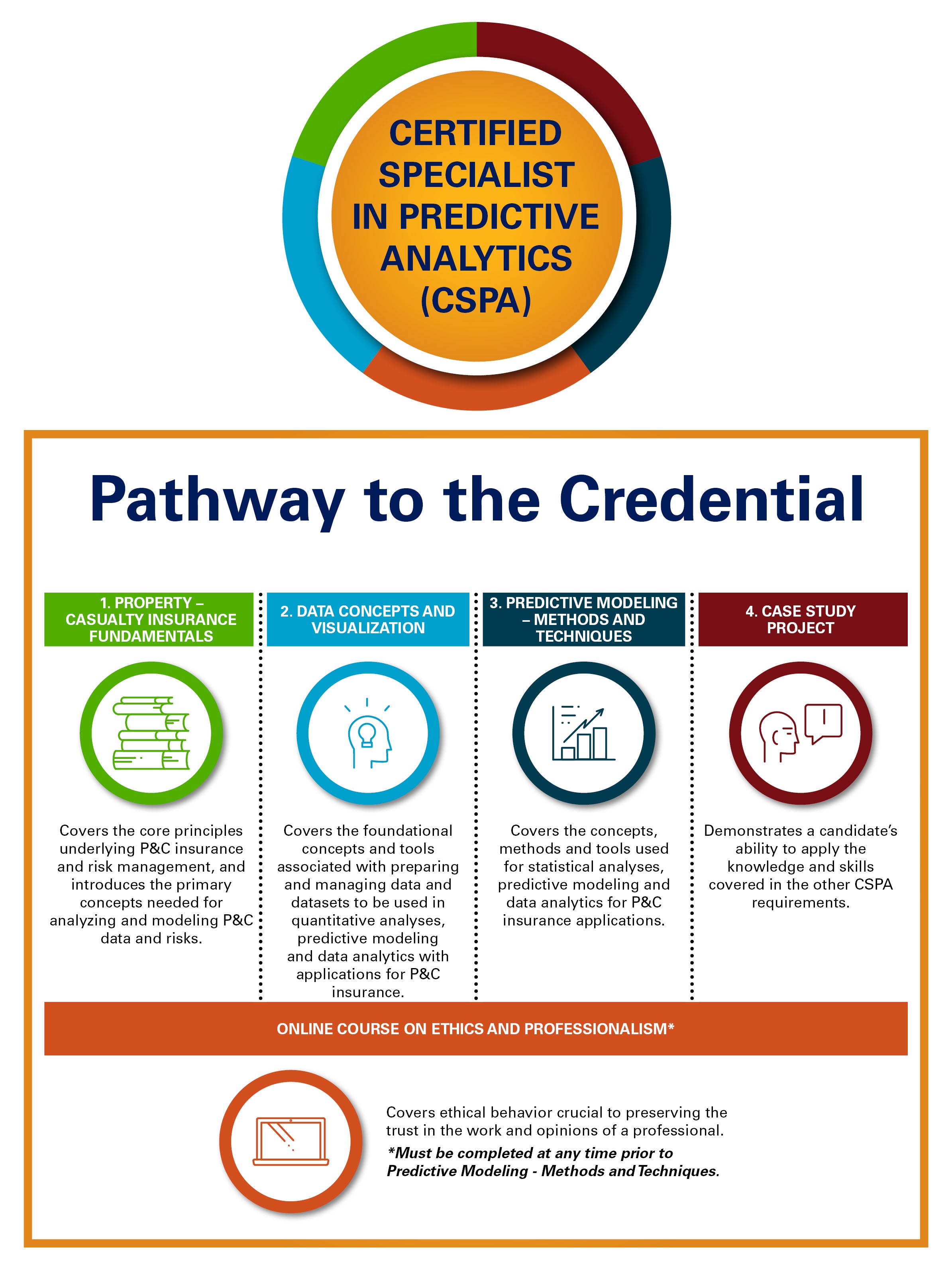

Risk analytics certification. Certificate in quantitative risk management risk reporting organisational resilience choosing and using key risk indicators. Dexlab analytics offers online classes on market risk management analytics modeling using sas in gurgaon and delhi by focusing on economic capital model enterprise risk liquidity risk and predictive modeling. Understanding credit risk analytics. Develop a practical knowledge of effective risk analysis and mapping tools quantitative qualitative as well as the analytical ability to turn data into information to support for effective strategic and operational decision making.

Competence in risk management is vital to protecting your institution and achieving regulatory compliance. The risk management certification highlights your ability to assess project risks mitigate threats and capitalize on opportunities. Taking risks is part of conducting business. But that doesnt mean that the risks your organization takes cant be forecasted and assessed before decisions are made.

2 certified risk manager crm the national alliance for insurance education and research grants the crm status to qualified individuals. An individual with crm certification is equipped to handle risks and exposures. Asqs risk management training courses will help you do just that. Theres no way around it.

For all enquiries please contact the training team on. Effective risk registers and assessment optimising risk workshops root cause analysis advanced problem solving 2 day course action monitoring and review. Gain credibility and demonstrate your dedication professional competency career focus and leadership with a certification. Moodys analytics sets the worldwide standard for financial services education.

The risk is mainly for the lender and it can include complete or partial loss of principal loss of interest and disruption of cash flow. Mitigate risk in advance of injuries and catastrophic events by mastering hazard identification risk analysis and risk evaluation processes. In simple terms credit risk refers to the potential for loss due to failure of a borrower to make a payment when it is due.