Sale Of Partnership Interest Worksheet

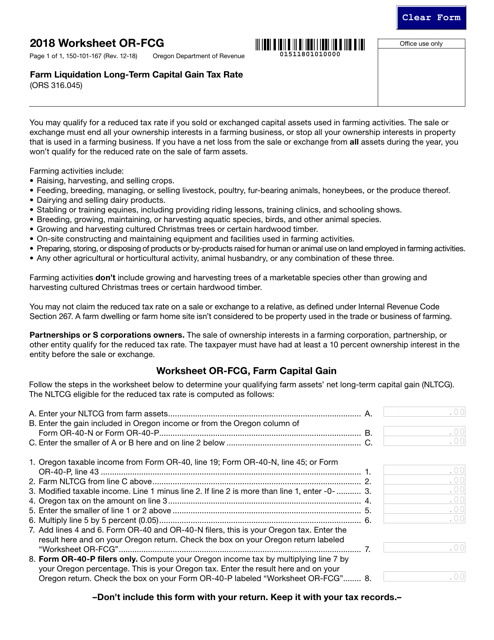

The sale of a partnership interest is treated as the sale of a single capital asset.

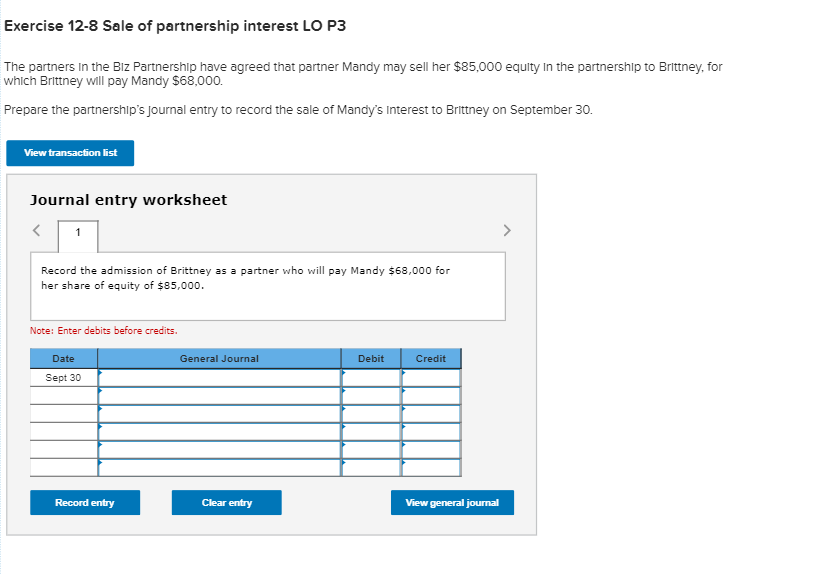

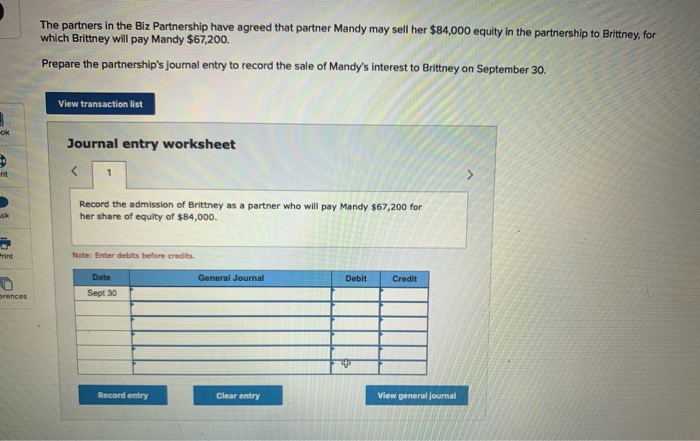

Sale of partnership interest worksheet. Sale of a partnership interests in general the partnership provisions in subchapter k of the code adopt an entity approach in dealing with the tax consequences of a transfer of a partnership interest. 751 1 a3 also requires a disclosure statement to be included with the partnerships and with each partners tax return in the year of sale. A purchaser of a partnership interest which may include the partnership itself may have to withhold tax on the amount realized by a foreign partner on the sale for that partnership interest if the partnership is engaged in a trade or business in the united states. Withholding on foreign partners sale of a partnership interest.

A partner who sells a partnership interest at a gain may be able to report the sale on the installment method. The seller realizes ordinary income for your share of the hot assets. The part of any gain or loss from unrealized receivables or inventory items will be treated as ordinary income. The preparer of the llc return should provide some direction in determining your share of the hot assets.

When completing the form 1065 us return of partnership income each partner is required to be given a schedule k 1 form 1065. However the partnership isnt responsible for keeping the information needed to figure the basis of the taxpayers partnership interest. Thus it is primarily considered to be a separate. However section 751 provides an important exception.

In general a sale of a partnership interest is considered a capital asset. Instructions for form 1065 us return of partnership income. 1 adjusted basis from prior year do not enter less than zero. From the schedule k 1 partnership 2014 form 1065 additional information worksheet in the turbotax program instructions on reporting disposition of partnership interest.

If this is a full or partial disposition of a publicly traded partnership ptp or master limited partnership mlp that was reported to you on a form 1099 b enter a sales. Toos for tax pros e oo partners adjusted basis worksheet outside basis tax year end name of partner. The transferred interest is treated like corporate stock. Sales of mlp interest sales of mlp and ptp units are reported on form 1099 b reported as the disposition of a traded security however due to the nature of mlps some component of the sale proceeds is treated as ordinary income for tax purposes mlpptp k 1s include a sales worksheet which generally break out the portion of the proceeds.

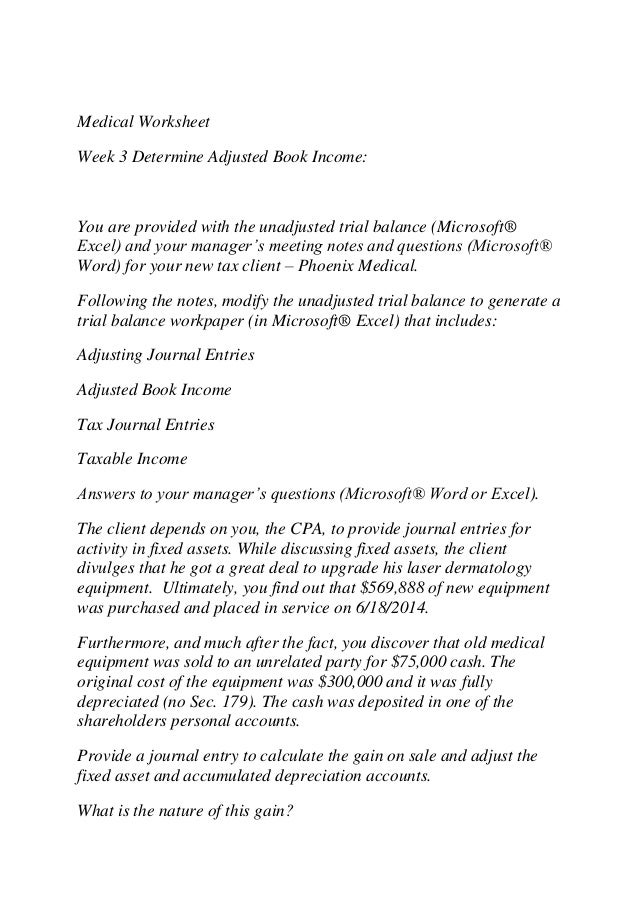

Computing tax obligations when a partner liquidates his partnership interest can be simple or extremely complex.