Save Receipts For Taxes App

/GettyImages-520230184-588b80333df78caebc447449.jpg)

Here are the seven best tax apps for freelancers and small business owners to keep taxes organized on the go.

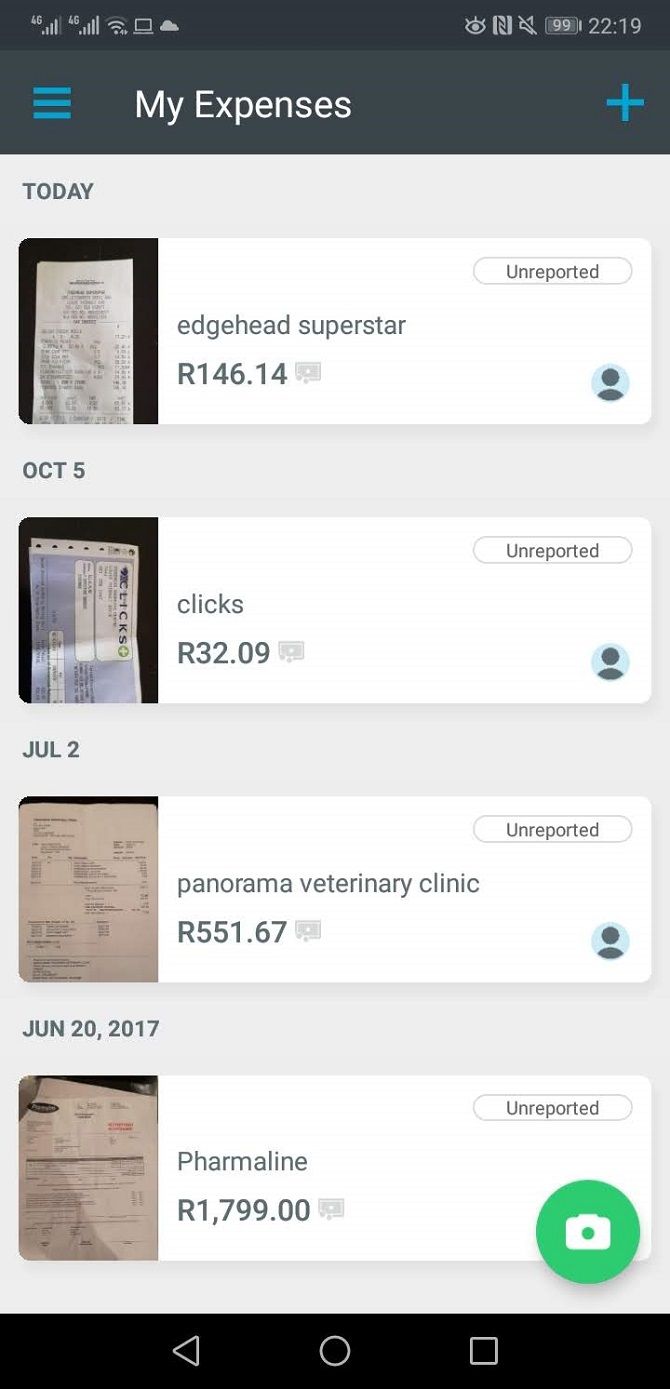

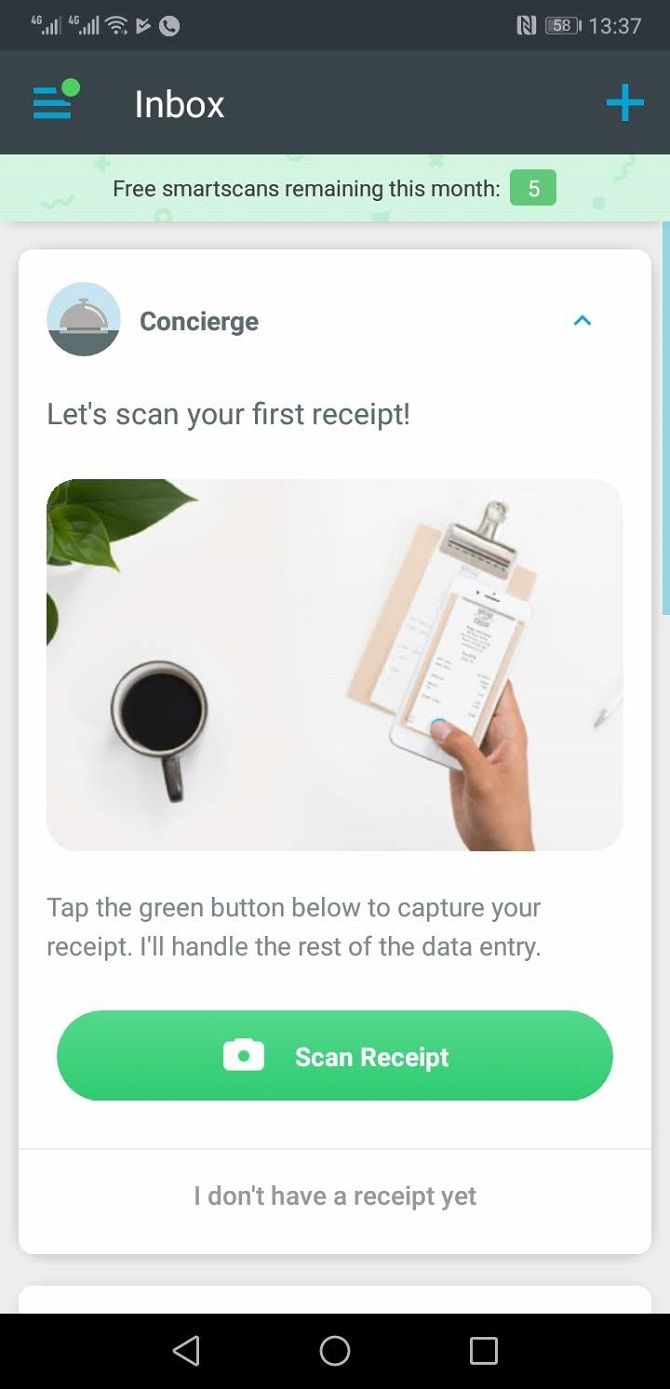

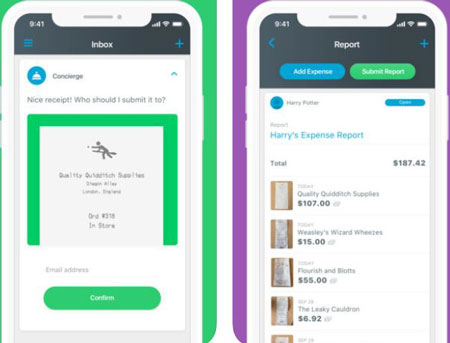

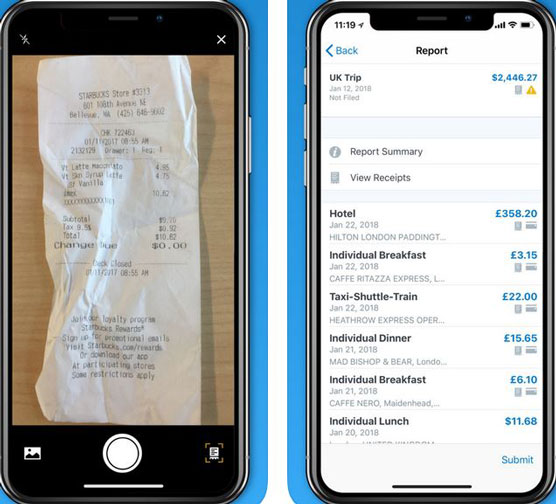

Save receipts for taxes app. If you decide to use abukai as your expense reporting app an individual plan will run you 120 per year with business solutions plans ranging in cost from 200 per year and up. The 10 best tax apps for freelancers by danielle. Best app for receipts after trying a multitude of apps and software to keep and organize my work and personal receipts i stopped looking when i found shoeboxed. The app then reads the receipt and.

The abukai expenses app is a free download which includes three free expense report submissions with up to 10 receipts per report. You can keep track of your income expenses and receipts year round to make the most dreaded time of year a little less painful. If youre looking to lower your taxable income and increase your potential for a tax refund a great place to start may be by looking at the purchases you already make and the. He adds that receipts can be lost and notepads forgotten but apps make it easy to instantly record data and keep it.

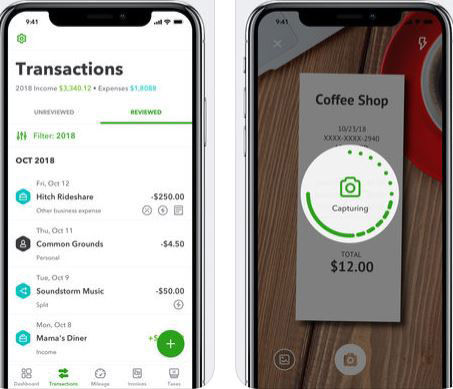

So basically all of the things you might otherwise keep in a shoebox under your bed. If you opt for the standard deduction retention of your receipts is not important for tax purposes. Expenses for tax prep. Receipts by wave is a great receipt tracking app for small business owners and freelancers who need to keep up with receipts invoices and bills.

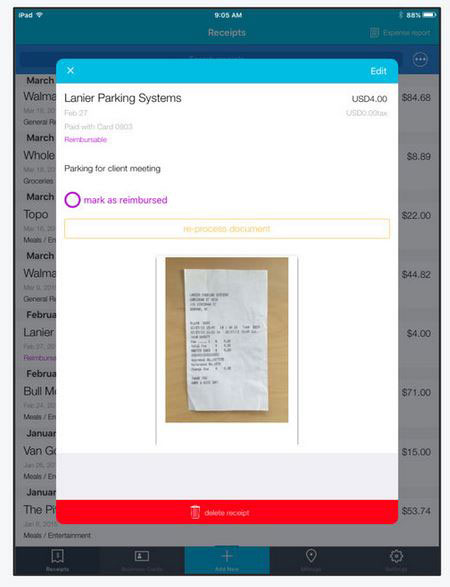

Knowing which receipts to save and which to toss will help you maximize your tax refund while minimizing the amount of paperwork you have to save for tax time each year. You can also input cash expenses manually or take a photo of the receipt. Hr block tax preparation app. The app does require you to also use waves free accounting software which provides additional functionality for expense tracking and report creation.

Take a photo of your receipt or use snail mail to send in receipts using prepaid envelopes provided by shoeboxed. For the 2019 tax year the standard deduction is 12200 for single taxpayers and 24400 for those who are married and filing jointly. 10 apps to use now to make taxes easier next year. Plus you can scan business cards.

To taxes mealsentertainment subscriptions etc.