Scan Receipts For Tax Purposes

The rule that supports scanned receipts is called revenue proclamation 97 22.

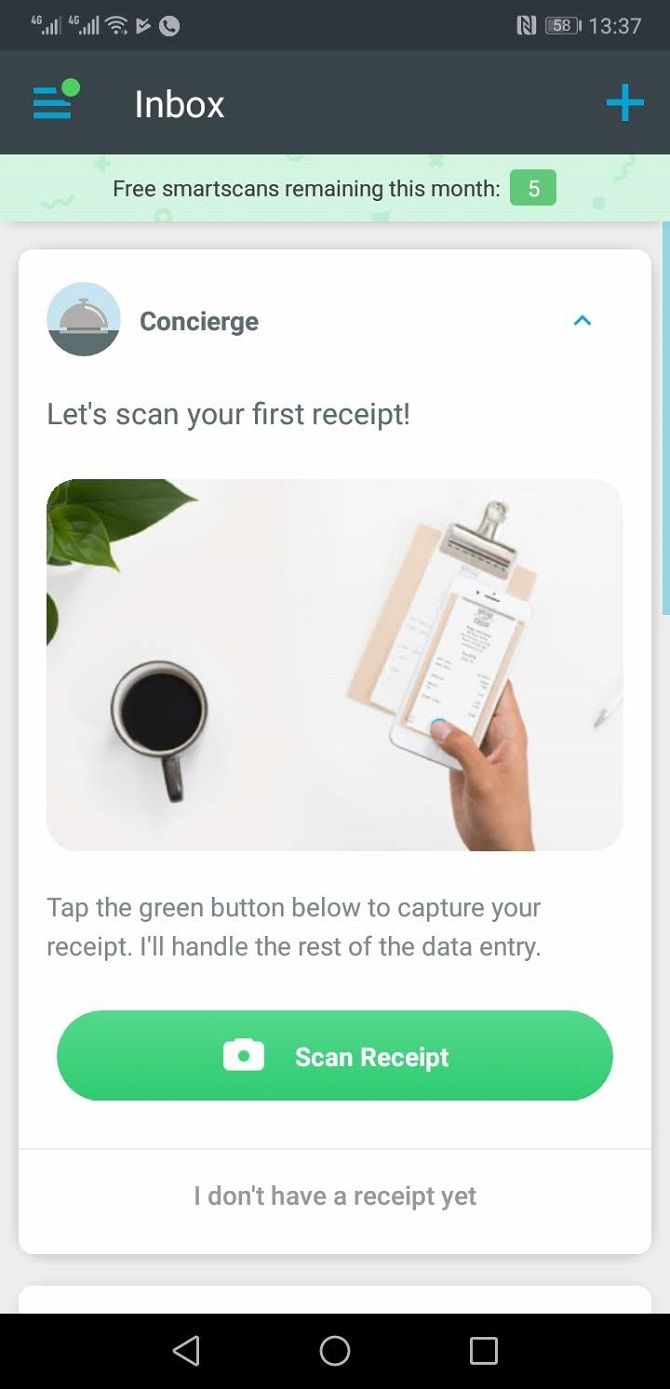

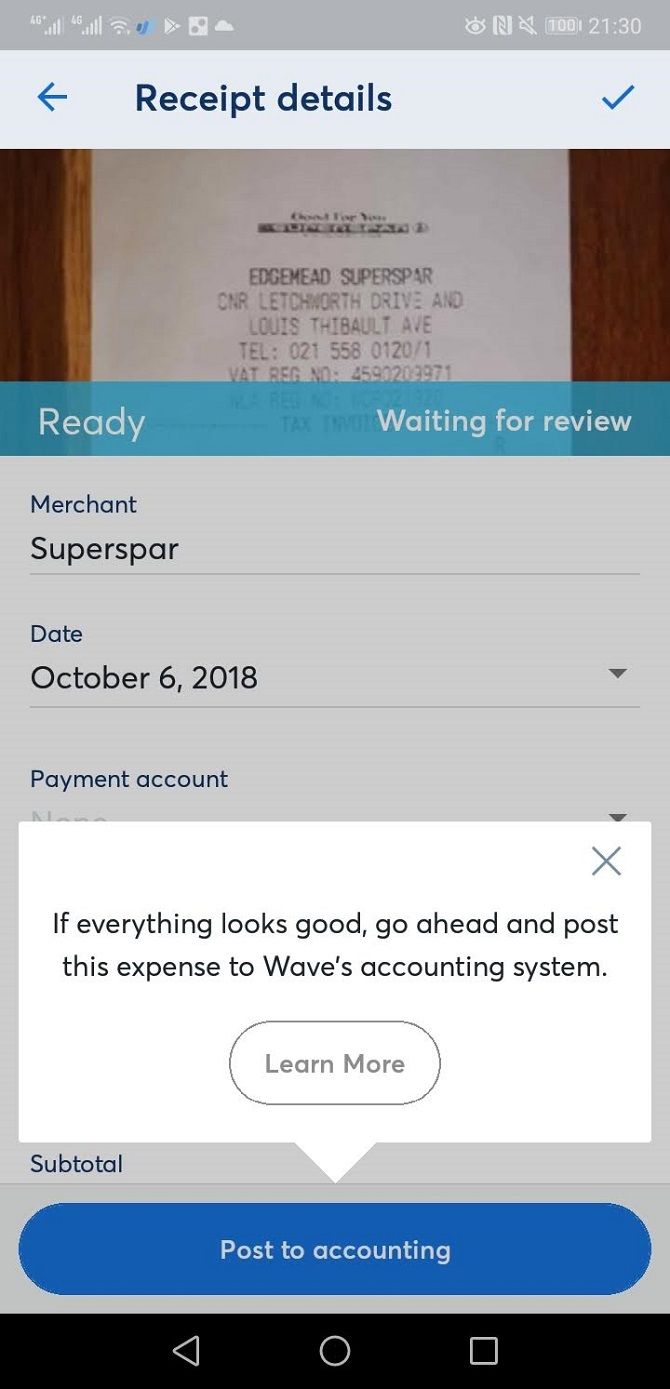

Scan receipts for tax purposes. Scanning software included with the scanner allows you to scan receipts to a variety of locationson your local device a shared folder email or a printer. A receipt scanner a mobile phone receipt organizer app or another receipt scanning service may be the answer not only to your clutter but to your expense accounting needs. For the 2019 tax year the standard deduction is 12200 for single taxpayers and 24400 for those who are married and filing jointly. Once youve scanned your receipts to your computer or folder youll have to organize your receipts manually or with separate receipt tracking software.

Tax system works largely on the honor system but the internal revenue service conducts audits of tax returns every year to keep people honest. If you have a cpa or accountant who prepares your taxes for you you can share your receipts through genius scan and toss that shoebox. The irs has always accepted physical receipts for audit and record keeping purposes. Whether you want to store receipts in the cloud use a mobile app or scan and store your receipts any one of these options will help you complete expense reports faster document tax deductible expenses keep insurance records or manage receipts for any reason.

Keeping receipts for your taxes is not only necessary to deducting the correct amount but also ensures your deduction holds up under examination. Most taxpayers dont realize it but the irs has actually accepted scanned receipts as far back as 1997. If you opt for the standard deduction retention of your receipts is not important for tax purposes. As of 1997 the irs accepts scanned and digital receipts as valid records for tax purposes.