Section 125 Plan Template

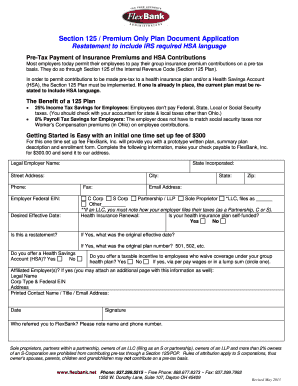

A premium only plan contains limited language of the section 125 plan that only allows for eligible benefit premiums and hsa health savings account contributions to be withdrawn from payroll on a pre tax basis.

Section 125 plan template. It is the intent that this plan shall qualify as a section 125 plan of irc as amended from time to time. Because of differences in facts circumstances and the laws of the various states interested parties should consult their own attorneys. The premium only plan is the building block of the section 125 plan. Frequently asked questions what is the difference between a full blown section 125 plan and a section 125 premium only plan.

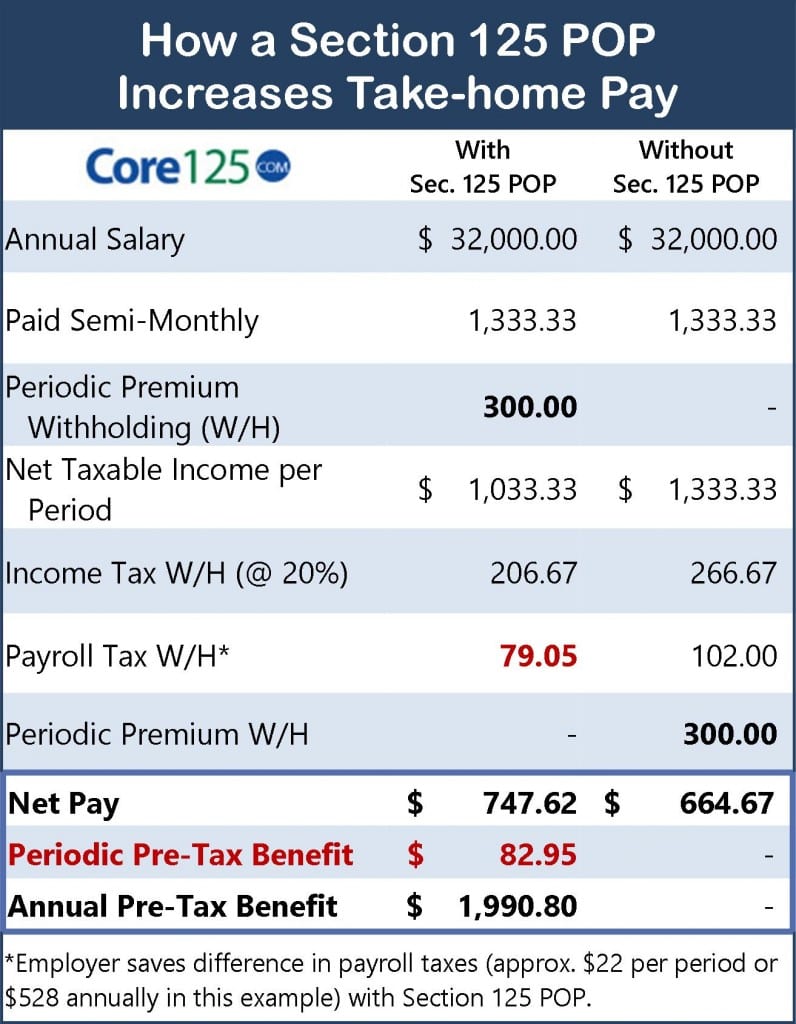

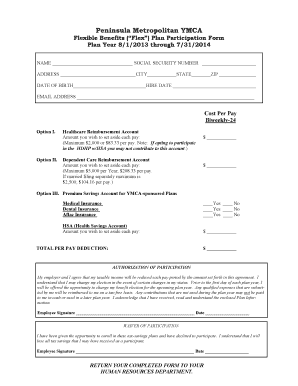

This document is intended as a. Although most cafeteria plan documents include hipaa special enrollment rights under code section 9801f many plans likely do not allow for a 60 day election period. 220 plan means the premium only section 125 plan with opt out as set forth herein. Under a section 125 program you may choose to pay for qualified benefit premiums before any taxes are deducted from employee paychecks.

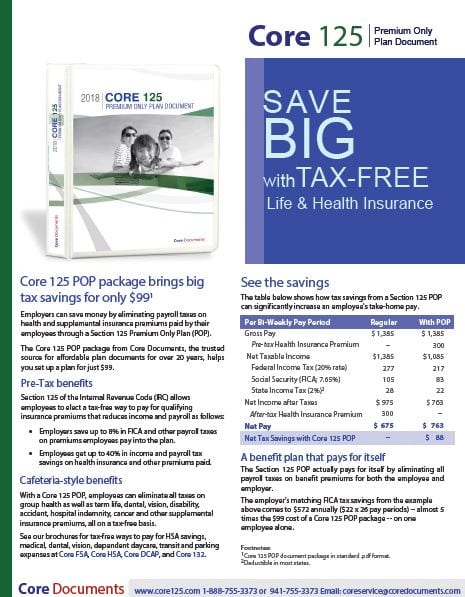

That the plan is a simple cafeteria plan as defined in code section 125j compensation shall mean section 414s compensation defined below. Premium only plan effective april 1 2014. A section 125 cafeteria plan lets a business owner offer affordable employee benefits while giving themselves a payroll tax break. Plan year or to the extent applicable the period of coverage is any other shorter period as may result from a permitted or required change to a participants benefit option elections made during a plan year.

Dependent care assistance account means the account established with respect to the participants election to have dependent care expenses reimbursed by the plan pursuant to section 403. As is the case with our sample cafeteria plan documents since past special enrollment rights had only a 30 day timeframe. When you search online for section 125 plan documents chances are good your search results will include web sites offering cheap or even free self serve plan document templates. Section 125 is officially an irs pretax vehicle nicknamed cafeteria plan because employees can choose pretax benefits like medical or dental insurance or opt to receive the equivalent amount on their paycheck paying taxes on it.

The plan is intended to qualify as a cafeteria plan under section 125 of the code so that optional. The purpose of the plan is to allow employees the opportunity to elect to pay the portion of medical insurance premium costs for which they are responsible either on a pre salary reduction basis or through a post tax salary deduction. The section 125 program is a tremendous opportunity for you to enhance your benefits package. After all the whole point of setting up a section 125 plan is to save money by eliminating income tax on insurance premiums.