Section 199a Calculation Template

Section 199a deductions pass thru tax breaks section 199a deduction also known as the qualified business income deduction qbid arises from the tax cuts jobs act of 2017.

Section 199a calculation template. See below for calculation details. This excel sheet is the introductory and input sheet. But we found a nifty and very easy to use calculator at the bradford tax institute of which we are members. The models permit the user to enter input variables and view how those variables affect the various components of the 199a deduction alongside the text of the statute.

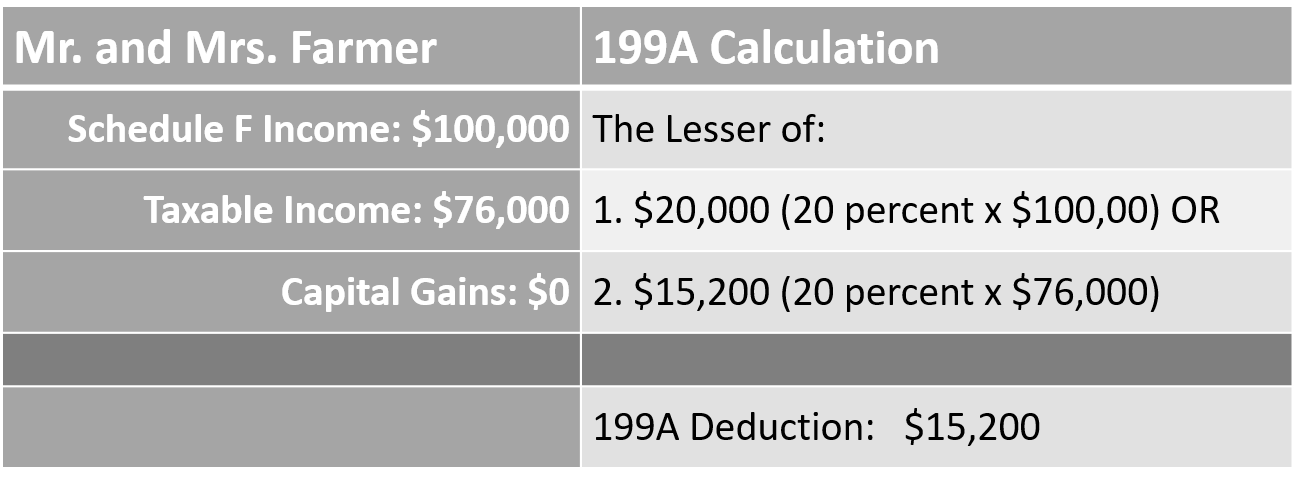

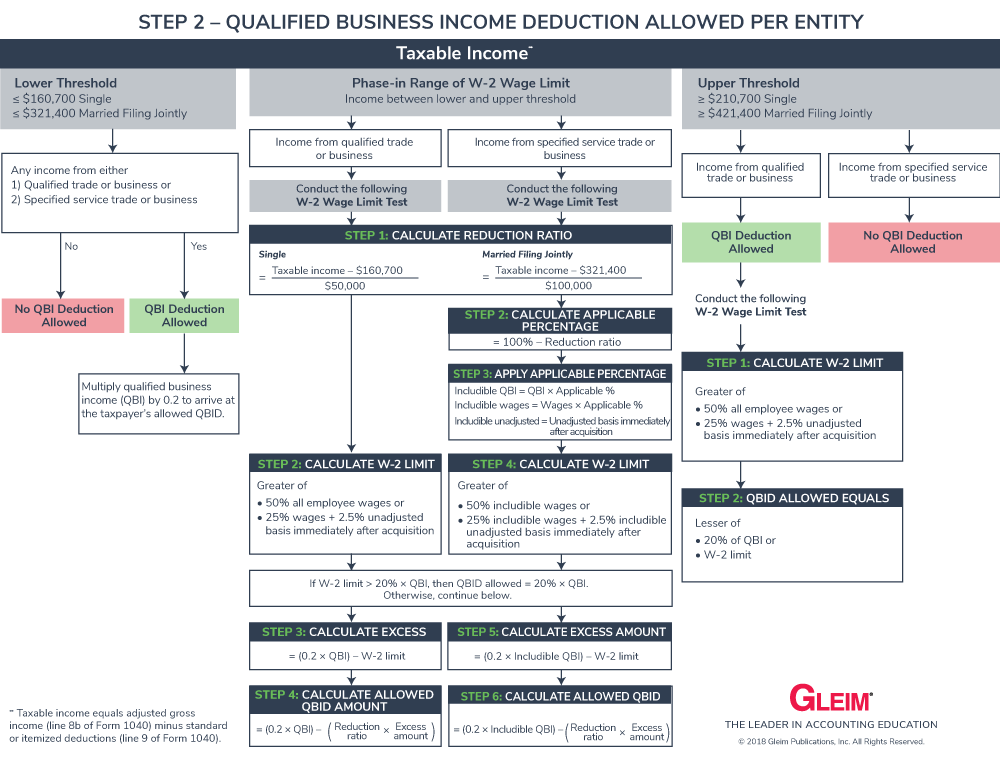

The mechanics of the calculations can be daunting. The section 199a deduction phase out calculations confuse lots of people. Should tie to the amount of taxable income that is reported on an individuals 1040. Fully functional excel model of section 199a as enacted by the tax cuts and jobs act of 2017.

This is a significant tax break for small business owners but there are rules and limits of course. Fully functional excel model of section 199a as enacted by the tax cuts and jobs act of 2017. Accordingly i want to give a high level overview of how the phase out math works including a quick review how the deduction works. As you know new tax code section 199a offers a 20 percent tax deduction on your qualified business incomeif you qualify for the deduction.

The models permit the user to enter input variables and view how those variables affect the various components of the 199a deduction alongside the text of the statute. A legend of terms and inputs is provided below along with some threshold questions and the necessary input cells. They even confuse smart accountants as several readers of my maximizing section 199a deductions monograph have told me. New online calculator launched for sec.

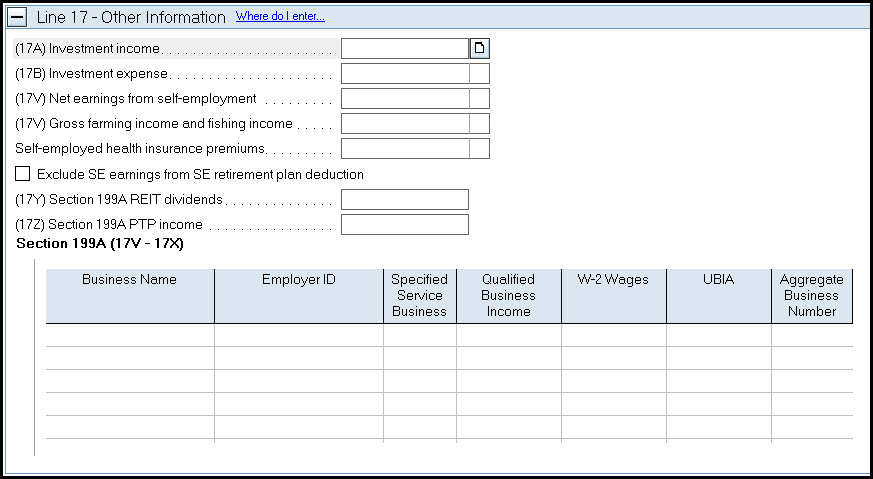

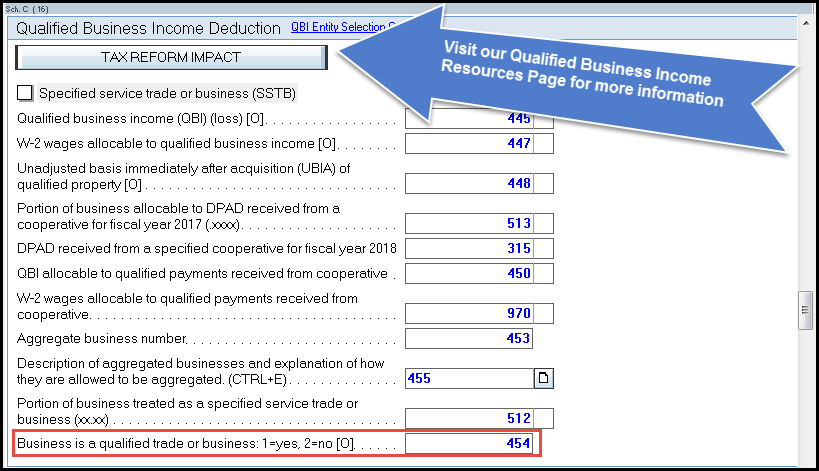

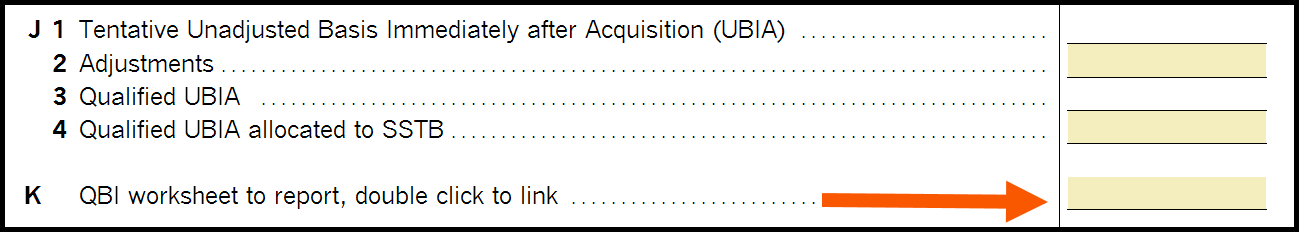

The calculator allows taxpayers to quickly and easily determine the 20 deduction on qualified business income of pass through entities. This amount is taxable income as indicated in section 199ae1. To use the calculator simply click here. For multiple rental business see how to handle multiple rental activities and the 199a deduction qualified property in business for definition of service business see irs section 199a final regs shed new light on service businesses yes results no your 199a deduction.

This version is the fully functional locked version.