Shareholder Basis Worksheet Template Excel

When a shareholder contributes money to the company the basis goes up.

Shareholder basis worksheet template excel. Shareholders stock basis at beginning of year 1 2. This worksheet assumes loans from the shareholder are combined and not evidenced by separate written instruments. S corporation shareholders are required to compute both stock and debt basis. Results ultratax cs generates schedule e page 2 figure 11.

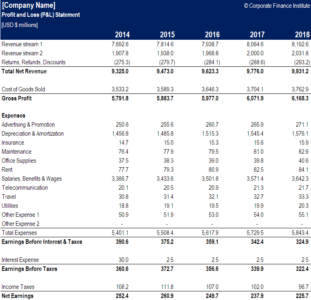

When there is a payment of an expense the basis goes down. When a shareholder withdraws money the basis goes down. The amount that the propertys owner has invested into the property is considered the basis. After you complete the calculations for each income level create a cluster column chart at the bottom of each worksheet to show how each component of the total federal tax liability would change increase or decrease if jayne converts her sole proprietorship to an s corporation.

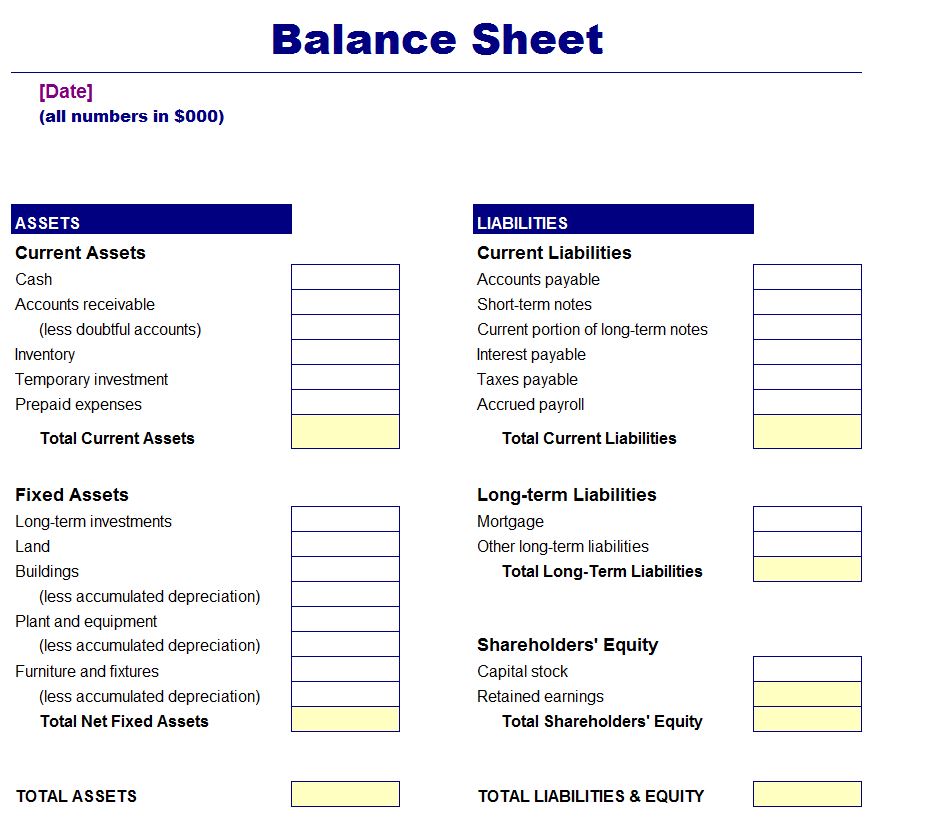

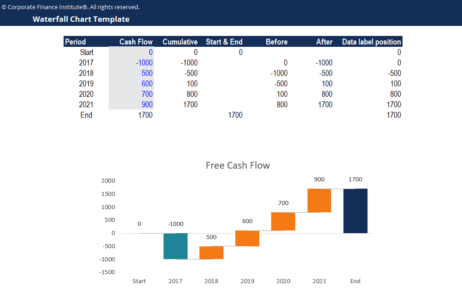

Shareholders who have ownership in an s corporation must make a point to have a general understanding of basis. Shareholders debt basis at beginning of year 2 adjustments to shareholders basis 3. Unlike a c corporation each year a shareholders stock andor debt basis of an s corporation increases or decreases based upon the s corporations operations. By using this spreadsheet you will not only be able to see the values associated with each of these assumptions but it will also provide the associated percentages as well as a graphical representation of each.

When there is a deposit of income the basis goes up for all shareholders based upon percentage of ownership. You do need to prepare a worksheet like the one linked above for each prior year of your ownership in order to get to your current basis. Stock basis is also adjusted when shareholders buy sell or transfer shares. See open account debt page 19 11 thetaxbook deluxe editionsmall business edition.

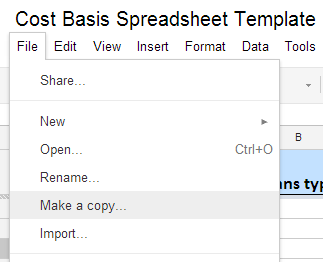

Shareholder basis worksheet field must be marked to produce the shareholders basis worksheet. Click the k1 8 tab. Without this share basis analysis template these 3 simple calculations would have to be run each time you tweaked one of the inputs. You do need to prepare a worksheet like the one linked above for each prior year of your ownership in order to get to your current basis.

There are separate worksheets for stock and debt basis. This basis fluctuates with changes in the company. Each income assumption has its own worksheet in the excel template. I hope this helps for computing your basis in the s corporation.

Each block of stock is accounted for separately. Shareholders basis worksheet page 1 figure. Shareholder basis worksheet excel the initial stock basis is the amount of equity capital supplied by the shareholder. An s corp basis worksheet is used to compute a shareholders basis in an s corporation.