Standard Deduction Worksheet For Dependents 2018

2018 standard deduction worksheet for dependents.

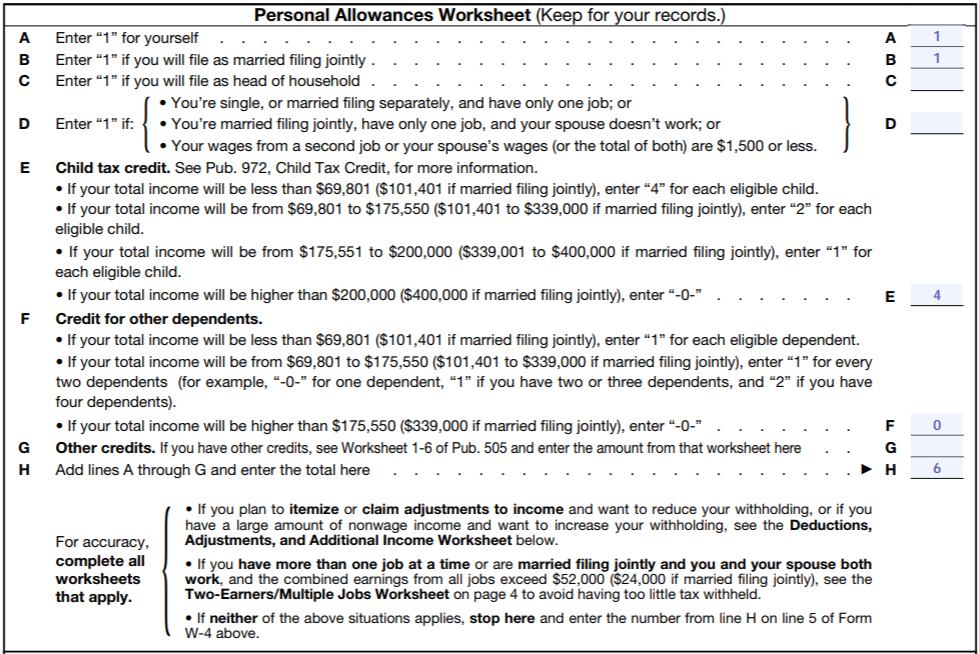

Standard deduction worksheet for dependents 2018. Fill online printable fillable blank 2018 form 1040 standard deduction worksheet for dependents form use fill to complete blank online irs pdf forms for free. If you were 65 or older andor blind check the correct number of boxes below. Once completed you can sign your fillable form or send for signing. Standard deduction worksheet for dependents form 1040 instructions html.

Individual income tax. The individuals earned income for the year plus 350 but not more than the regular standard deduction amount generally 12000. Taxpayer born before january 2 1954 taxpayer is blind spouse born before january 2 1954 spouse is blind. Standard deduction worksheet for dependents form 1040 instructions html.

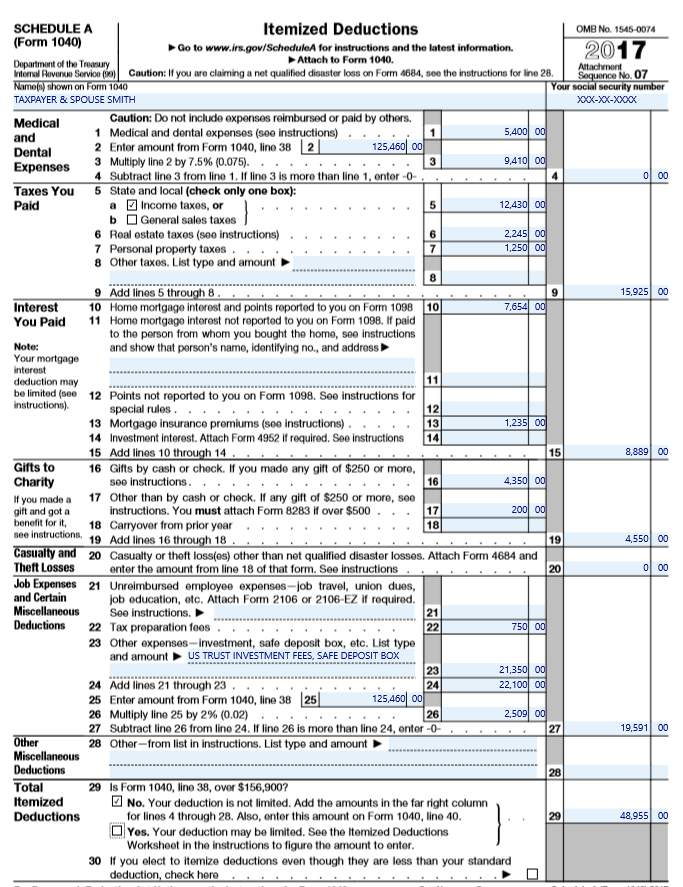

For 2018 you cant claim a personal exemption deduction for yourself your spouse or your dependents. The amount depends on your filing status. 2017 standard deduction worksheet for dependents. Standard deduction chart for people born before january 2 1955 or who are blind standard deduction continued standard deduction worksheet for dependents use this worksheet only if someone else can claim you or your spouse if filing jointly as a dependent.

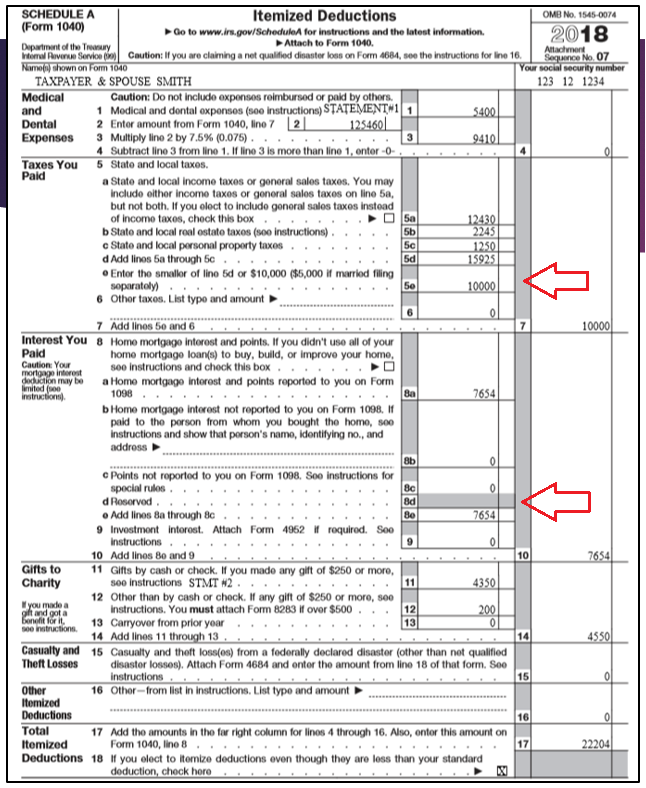

Standard deduction taxpayer claimed as dependent on another return if a taxpayer or taxpayers spouse is claimed as a dependent on someone elses return the standard deduction on the taxpayers return is generally reduced and calculated according to the worksheet on page 39 of the instructions for irs form 1040 us. Standard deduction worksheet for dependents form 1040 instructions page 35. Standard deduction worksheet for dependents use this worksheet only if someone else can claim you or your spouse if filing jointly as a dependent. 2018 standard deduction tables 2018 standard deduction tables if you are married filing a separate return and your spouse itemizes deductions or if you are a dual status alien you cant take the standard deduction even if you were born before january 2 1954 or are blind.

The standard deduction for an individual who can be claimed as a dependent on another persons tax return is generally limited to the greater of.