Tax Prep Certification

Be sure to register as a tax preparer prior to filing any tax returns in the current calendar year to avoid penalties.

Tax prep certification. This does not cost you anything and can be done online in just a few minutes. Upon completion of this course you will be able to complete basic individual ny state and federal forms. An important difference in the types of practitioners is representation. Once you register online you can print your certificate of registration which includes your new york tax preparer registration identification number nytprin.

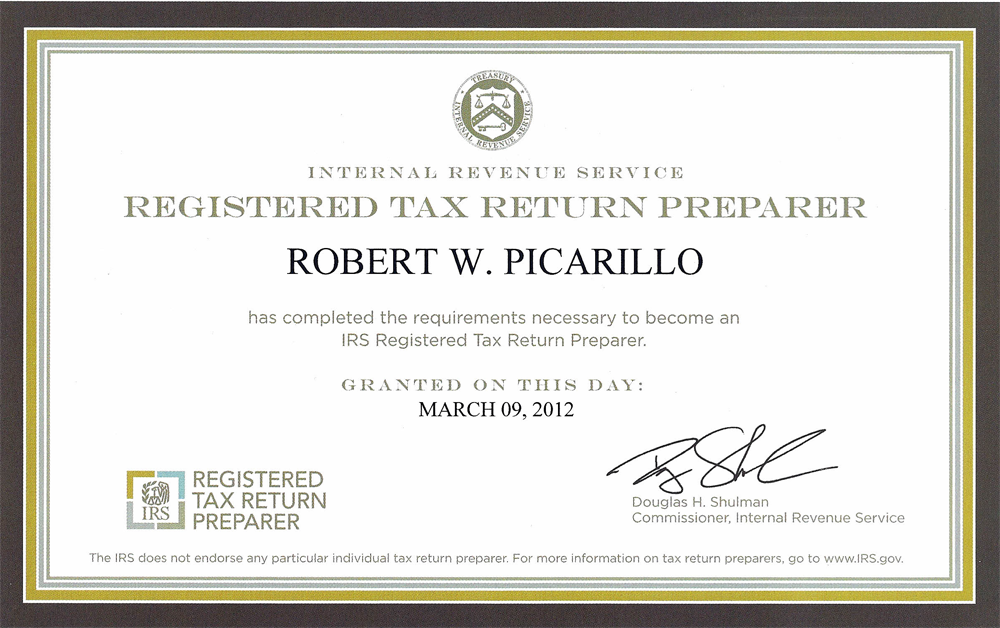

However this program is no longer enforced due to a february 2014 decision by the us. About the comprehensive tax course. The irs had a program providing registered tax return preparer certification to certain preparers. This program is designed for students new to tax preparation.

How to complete your requirements youll need to complete your free online continuing education courses using the states online statewide learning management system slms. California edition is ctec approved. In fact at hr block we offer a program called the income tax course a hands on program that teaches people of every walk of life the ropes of accounting and tax preparation. To determine if you are required to register pay the registration fee.

Plus the basics of schedule cself employed tax returns. Court of appeals for the district of columbia circuit court finding that the irs has insufficient statutory support for the irs regulation of federal tax return preparers. To become a certified tax preparer the second step is to apply for your preparer tax identification number ptin with the irs. If youre a tax preparer well notify you through your individual online services account when they become available.

There are no education requirements for obtaining a preparer tax identification number from the irs. The first step is to complete a tax preparation course. Continue reading below for more information on how to apply for a ptin with the irs. The irs course for tax preparers tax return preparer certification does not count toward your required new york state hours of coursework.

4 modules 4 chapters each 45 hours of ce no prerequisites required. However to obtain several of the tax preparation certifications you do need at least a high school diploma. In this beginner tax preparer course you will learn to prepare tax returns and research tax issues for most form 1040 individual non business taxpayers. However tax professionals have differing levels of skills education and expertise.

Any tax professional with an irs preparer tax identification number ptin is authorized to prepare federal tax returns. Earn extra money by becoming a registered tax preparer or learn to prepare taxes for personal use.

.png)