Taxes Worksheet Pdf

0 8500 10 8501 34500 15 34501 83600 25 83601 174400 28 174401 379150 33 379151 35.

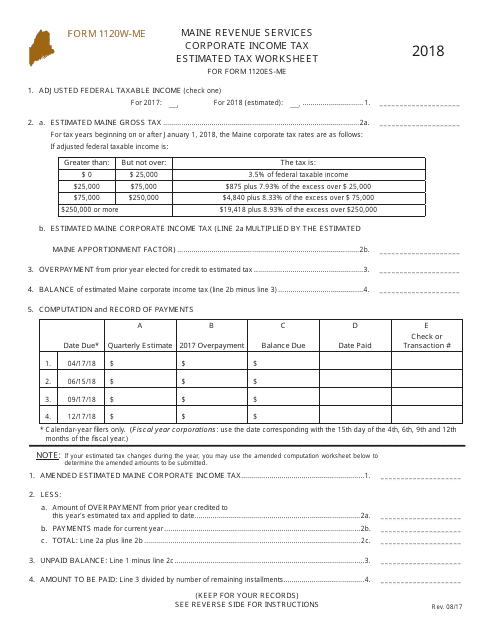

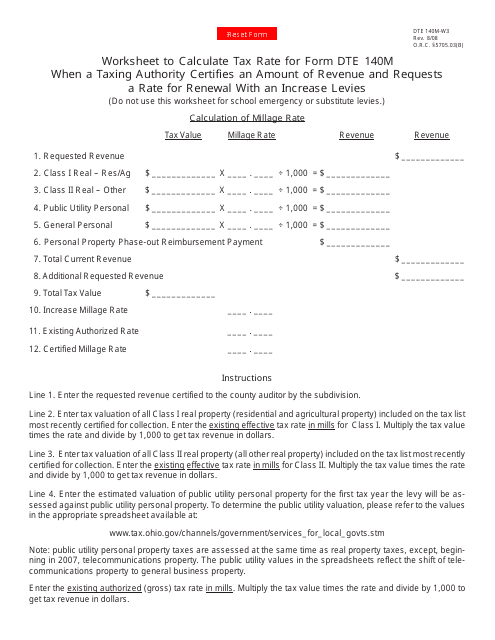

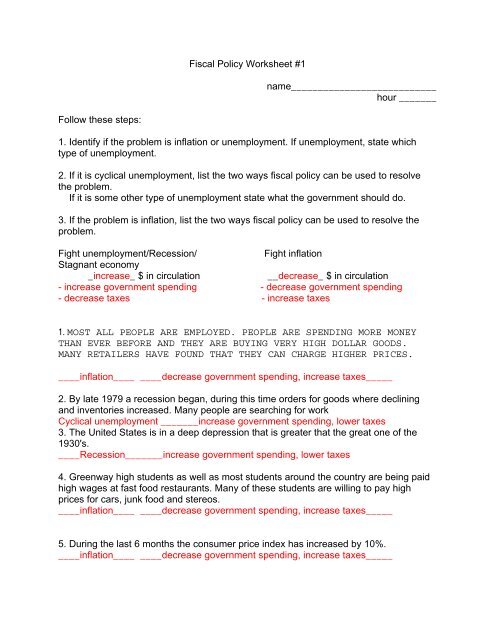

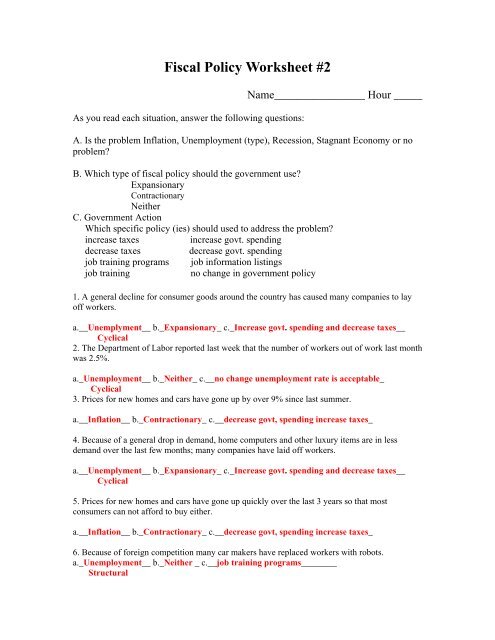

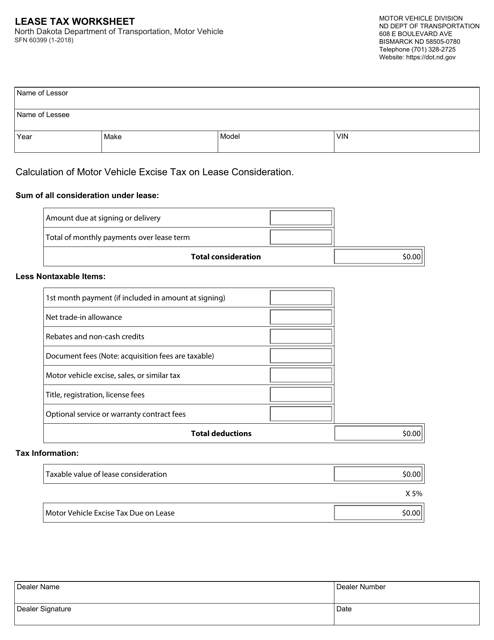

Taxes worksheet pdf. Exemption you will have no income tax withheld from your paycheck and may owe taxes and penalties when you file your 2020 tax return. Small business tax worksheet business name tax year or calendar year ended business address city state zip owners name owners taxpayer id. This form is used to track interest charges from one or more loan sources to different types of deductable and non deductable. If you or your spouse if filing jointly do not have an ssn or itin issued on or before the due date of your 2018 return including ex tensions you cant claim certain tax benefits on your original or amended 2018 return.

To claim exemption from withholding certify that you meet both of the conditions above by writing exempt on form w 4 in the space below step 4c. Who pays and how much. For 2019 the maximum adoption credit or exclusion for employer provided adoption benefits has increased to 14080. Then complete steps 1a 1b and 5.

Inside the vault income taxes. For 2019 the maximum amount of earned income wages and net earnings from self employment subject to the social security tax is 132900. There are over 300 ways to save taxes and are presented to you free of charge. Nursing care for a healthy baby.

Number owners address city state zip type of business employer id. We have created over 25 worksheets forms and checklists to serve as guidance to possible deductions. Adoption credit or exclusion. A look at individual federal income tax lesson plan key words and concepts ability to pay concept of tax fairness that states that people with different amount of income or wealth should pay tax at different rates.

If you were age 65 or older but not entitled to social security benefits you can deduct premi ums you voluntarily paid for medicare a coverage. The purpose of these forms and worksheets is so you can be as prepared as possible so the tax preparation process is quick and painless as possible. Due date of return. The medicare tax on your wages and tips or the medicare tax paid as part of the self employment tax or household employment taxes.

Taxpayer identification number require ments. Number accounting method date business started cash accrual other. Have any deductions to claim such as student loan inteest r deduction self employment tax or educator expenses. Taxed at marginal rate of.