Understanding Taxes Worksheet Answers

In addition you can download a powerpoint presentation that introduces each theme in the whys of taxes.

Understanding taxes worksheet answers. 2provide an example or explanation with each answer. The united stated internal revenue service at wwwirsgov directions use the links provided for each tax form to answer the corresponding questions in 50 to 150 word responses. Learn vocabulary terms and more with flashcards games and other study tools. Husband is a factory worker.

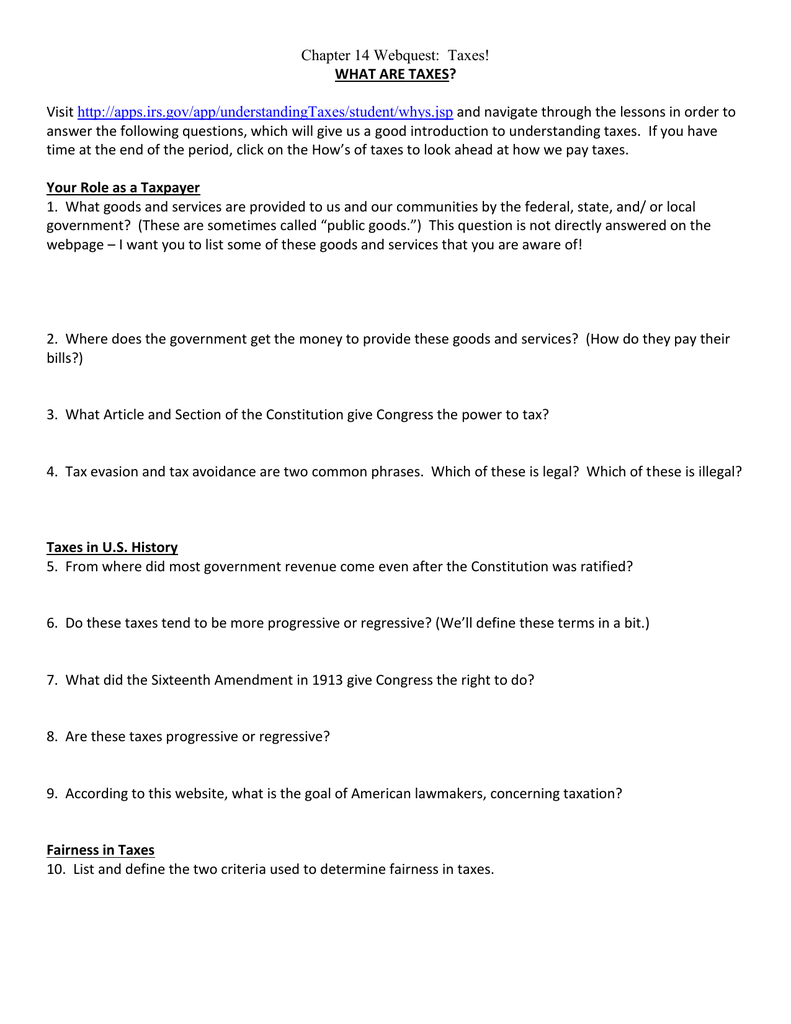

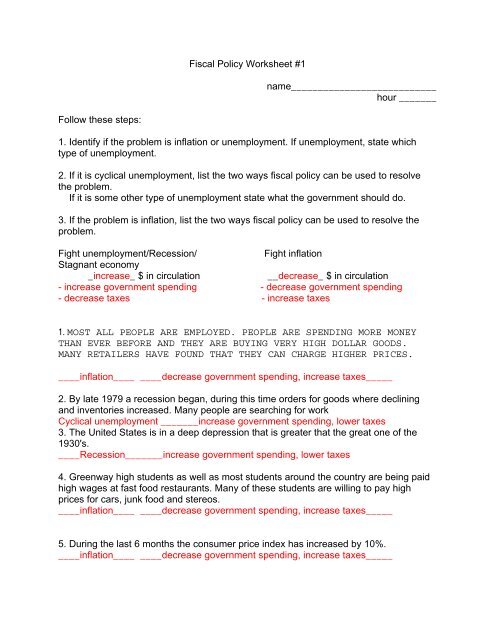

How taxes affect us. The hows of taxes includes 14 self paced modules offering a step by step approach to tax preparation. The united stated internal revenue service at wwwirsgov directions use the links provided for each tax form to answer the corresponding questions in 50 to 150 word responses. Understanding taxes 1 worksheet solutions activity 1 a tale of two families millers carpenters personal husband and wife both retired teachers young couple 3 children.

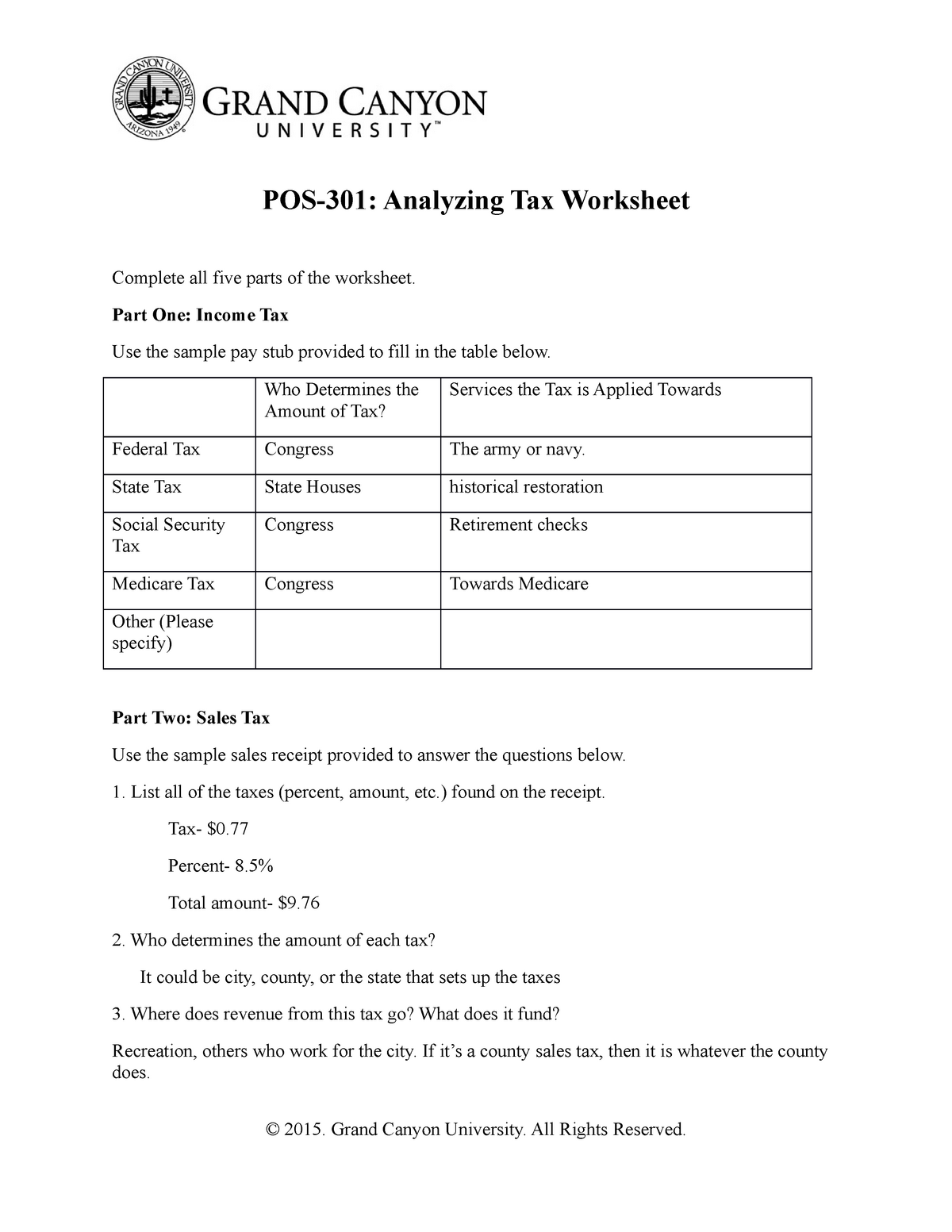

202 the basics of taxes. Many of the materials that are part of the understanding taxes program can be downloaded as adobe acrobat pdfs. More specifically according to article 1 section viii of the constitution congress has the power to levy taxes. Understanding taxes worksheet resources.

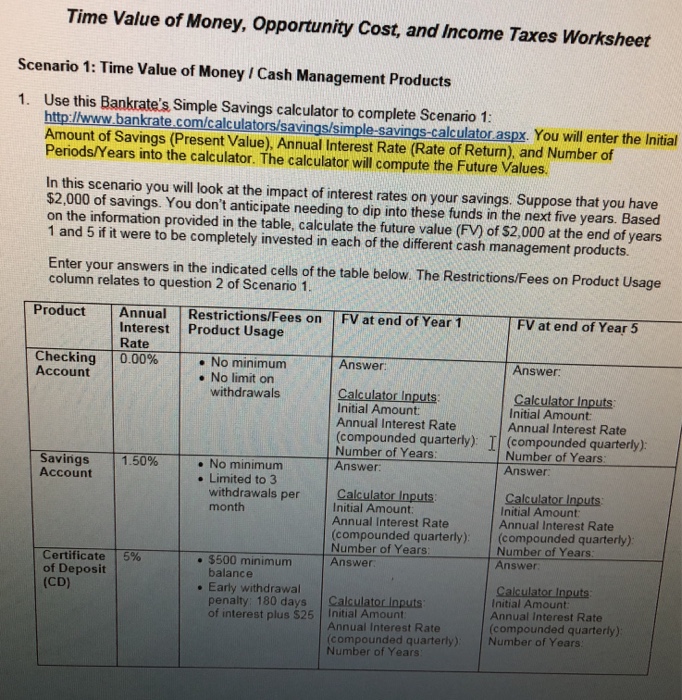

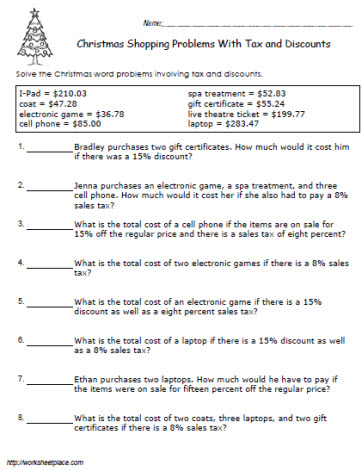

The hows of taxes includes 14 self paced modules offering a step by step approach to tax preparation. Wife has evening paper route home own home rent home income 40000 25000 income tax 2000 1250 gas tax 100 350. 1determine whether each statement is true t or false f. Understanding why and how taxes and other items are deducted from a workers paycheck is an important step toward gaining financial knowledge.

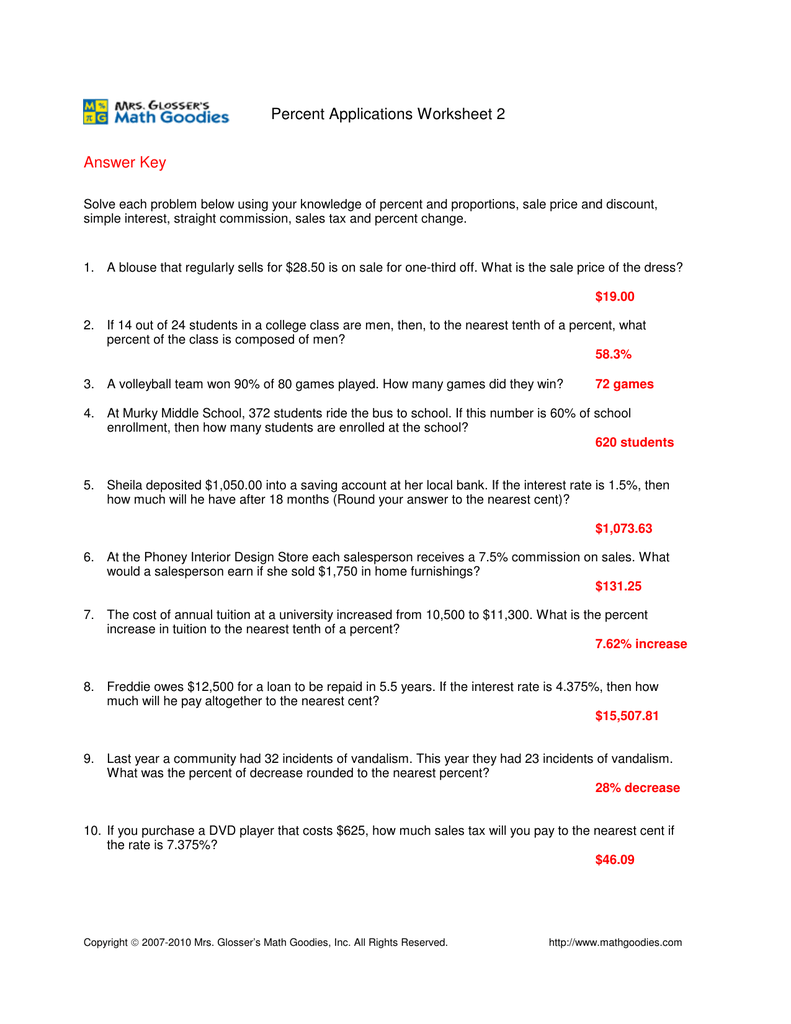

3if youre not sure you can research the answers on the following webpages. Worksheet solutions comparing regressive progressive and proportional taxes theme 3. University of phoenix material understanding taxes worksheet resources. For example you can download teacher lesson plans factinfo sheets worksheets and assessments.

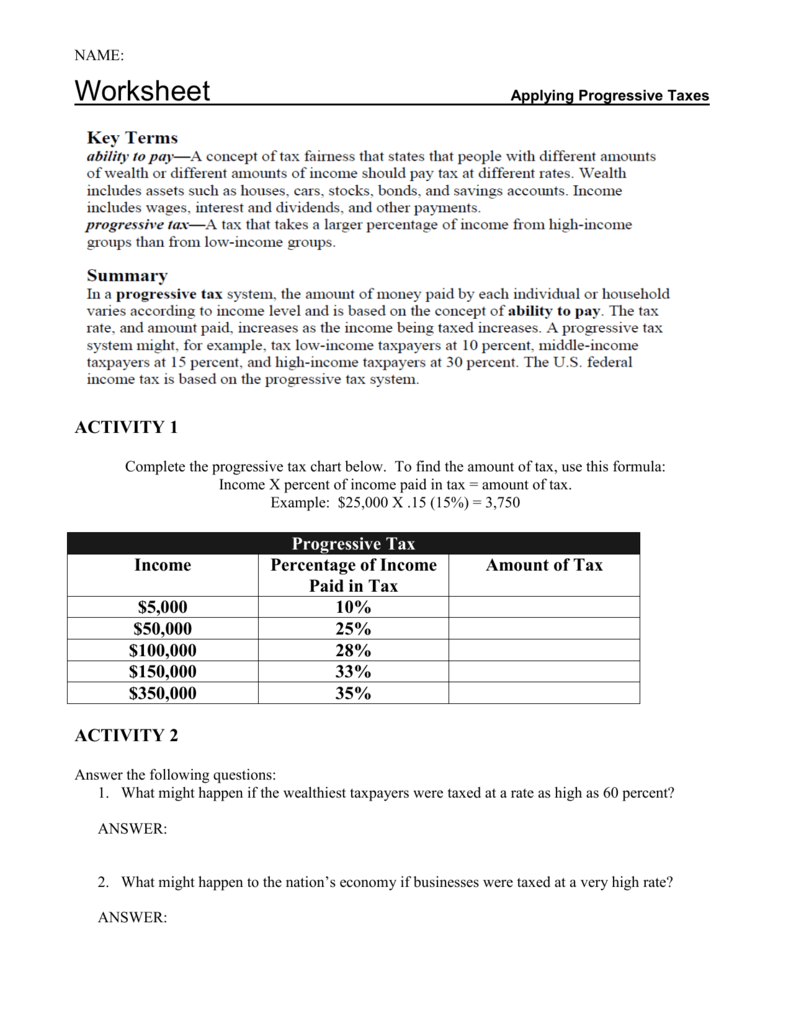

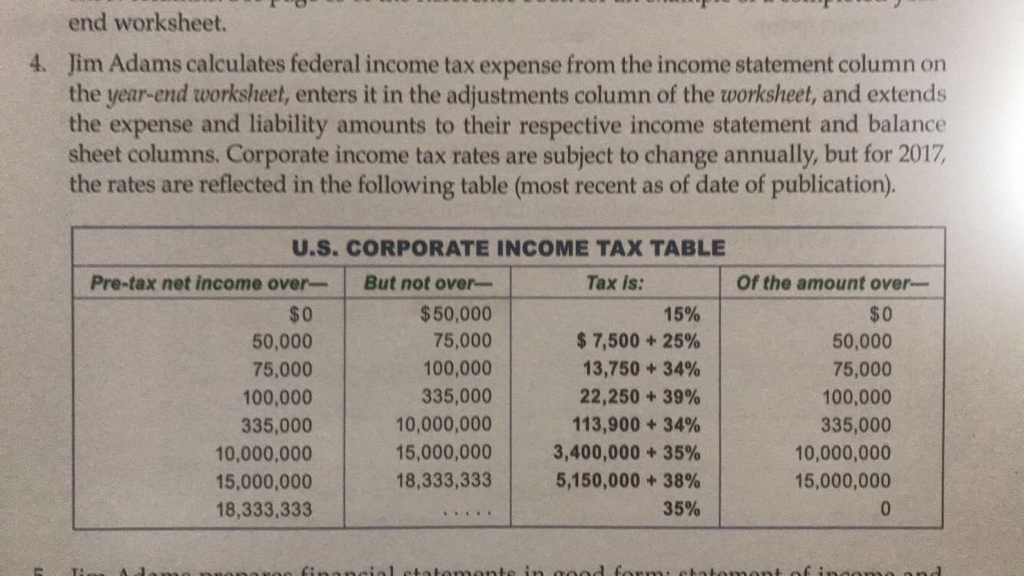

Understanding taxes can take the mystery out of taxes. Fairness in taxes lesson 5. Income tax who determines the amount of tax. Key terms progressive taxa tax that takes a larger percentage of income from high income groups than from low income groups.

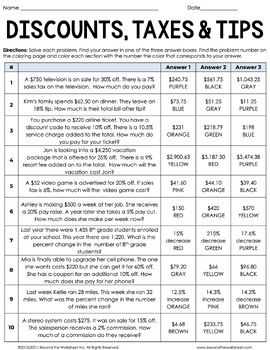

Taxes shift resources from private individuals and businesses to the government in order to pay for public goods and services regulate the economy and redistribute income. The federal tax is used to pay for different federal programs.