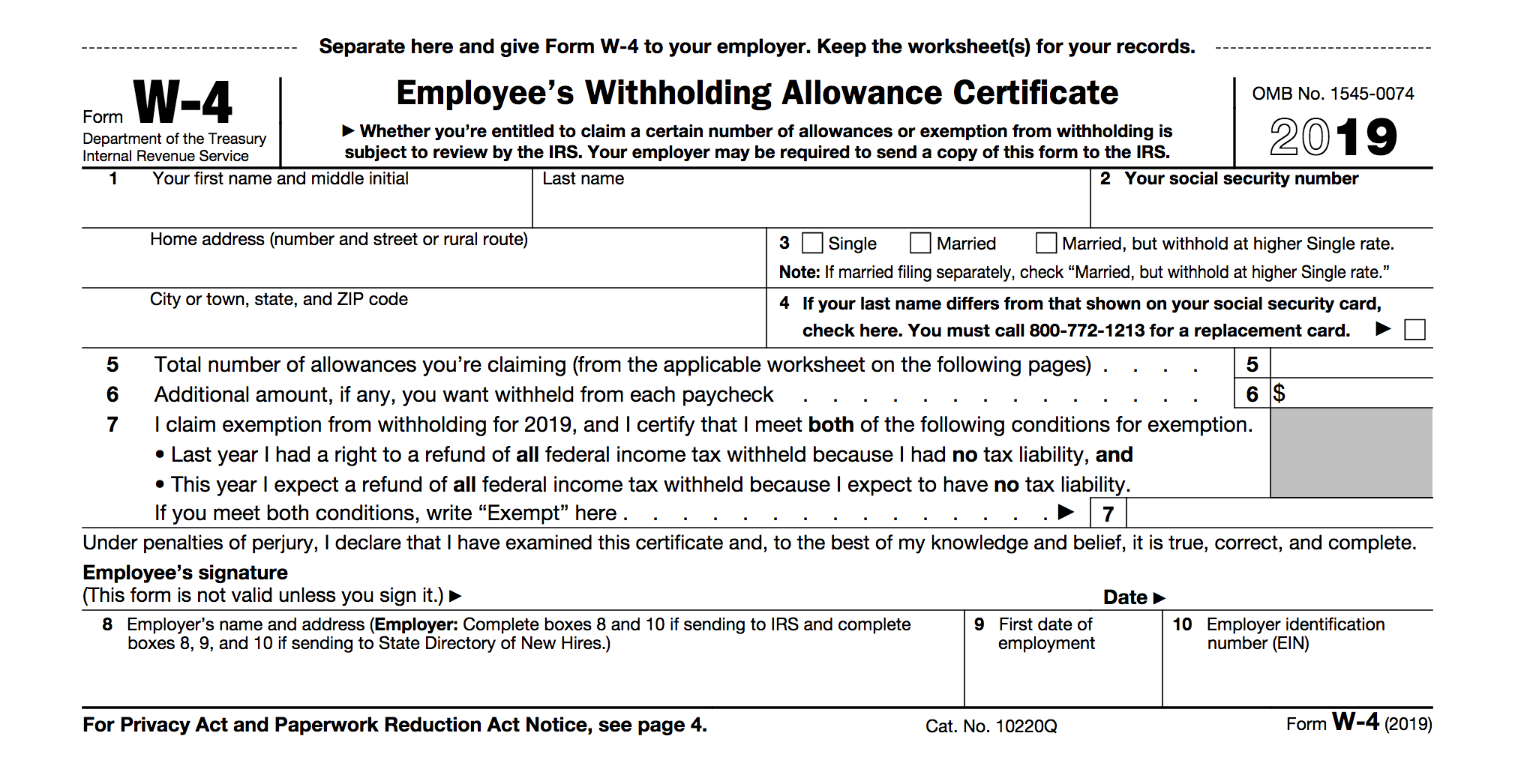

W4 Allowance Worksheet 2019

/w42018.cropped-5bfc2e8e46e0fb00265c78e6.jpg)

For the latest information about any future developments related to form w 4 such as legislation.

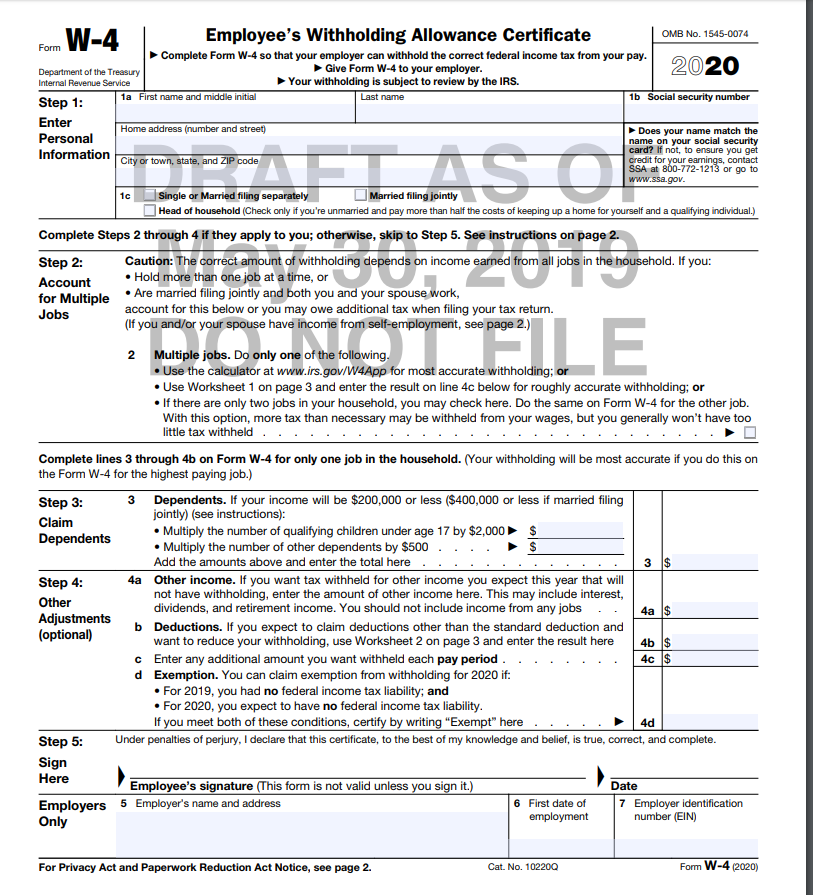

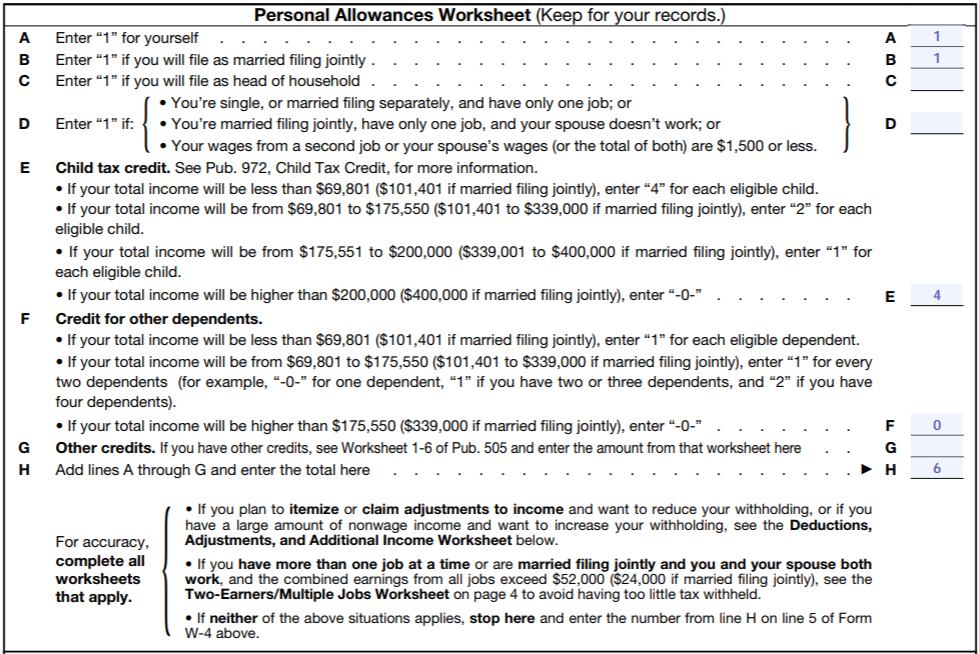

W4 allowance worksheet 2019. The 2020 w4 form consists of 4 pages and you can download a 2020 w 4 form printable pdf copy here. If you are not exempt from withholding youll have three worksheets to fill in addition to the main w 4 form. Complete step 2 if you or your spouse are age 65 or older or legally blind or you wrote an amount on line 4 of the deductions worksheet for federal form w 4. Allowances you may enter on your form il w 4.

You should consider completing a new form w 4 when your personal or financial situation changes. If you choose the option in step 2b on form w 4 complete this worksheet which calculates the total extra tax for all jobs on only one form w 4. To understand how allowances worked it helps to first understand the concept of tax withholding. Form w 4 2019 future developments.

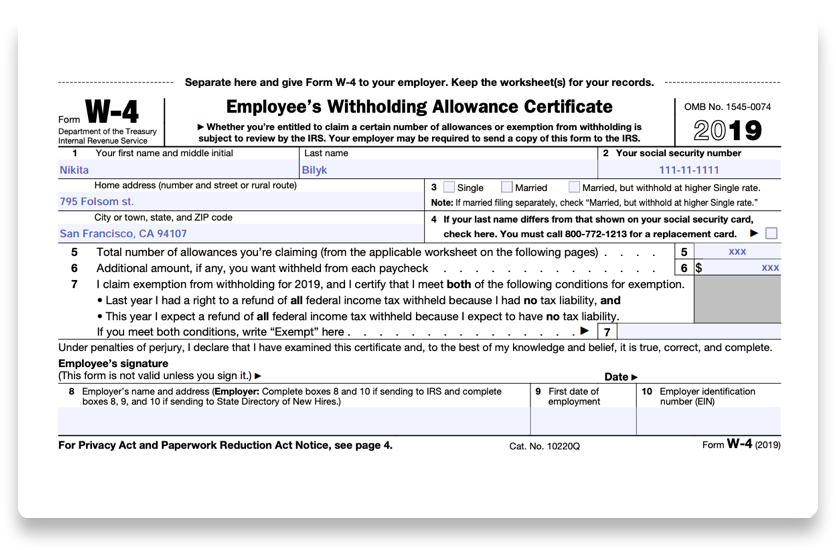

So if you claim more allowances less money is taken out of your paycheck for taxes. Irs 2019 form w 4 represents major changes to payroll. Use the information on the back to. Here is more information about the w 4 worksheet including how to fill out the w 4 allowance worksheet line by line.

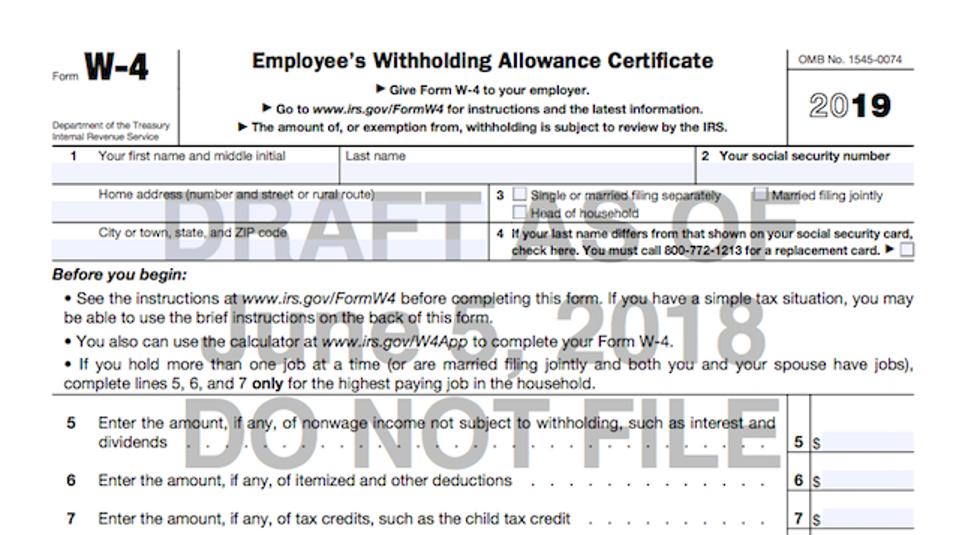

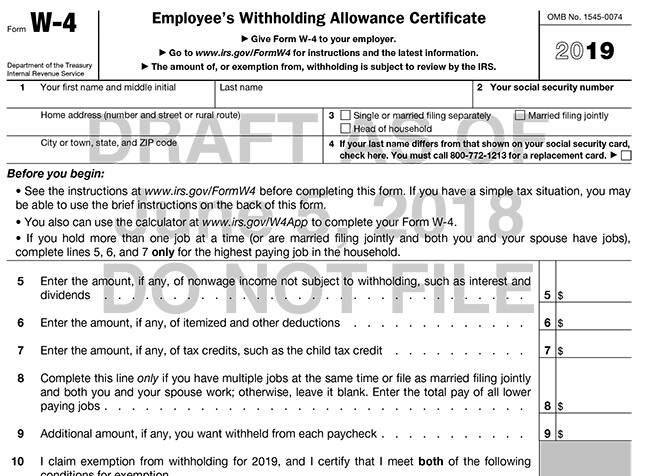

On june 6 2018 the internal revenue service irs released a draft form w 4 employees withholding allowance certicate for 2019several changes are fundamental in nature potentially requiring significant reprogramming of payroll systems. Complete this worksheet on page 3 first to determine the number of withholding allowances to claim. You may also claim exemption from withholdings if your income in 2018 was 1000 or less. You can calculate your number by filling out the personal allowances worksheet on page 3 of the w 4.

Page 2 includes instructions see below. Page 3 comprises the multiple jobs worksheet and deductions worksheet. Whenever you get paid your employer removes or withholds a certain amount of money from your paycheck. Sign the form and give it to your employer.

What you should know about tax withholding. A withholding allowance reduces the amount of income tax withheld from your paycheck. The 2019 w 4 worksheet line by line. This is the only page that must be returned to your employer.

Page 1 consists of the actual form itself. Efo00307 12 11 2019 page 1 of 2 form id w 4 employees withholding allowance certificate complete form id w 4 so your employer can withhold the correct amount of state income tax from your paycheck. So how do i figure out the right number of allowances.

/w42018.cropped-5bfc2e8e46e0fb00265c78e6.jpg)

:max_bytes(150000):strip_icc()/how-to-fill-out-form-w-4-3193169-final-5b64a71d46e0fb0050775430.png)