Broward County Business Tax Receipt Application

Each owner must have a personal net worth that does not exceed 75000000 excluding the value of the primary residence and interest in the business for which certification is sought.

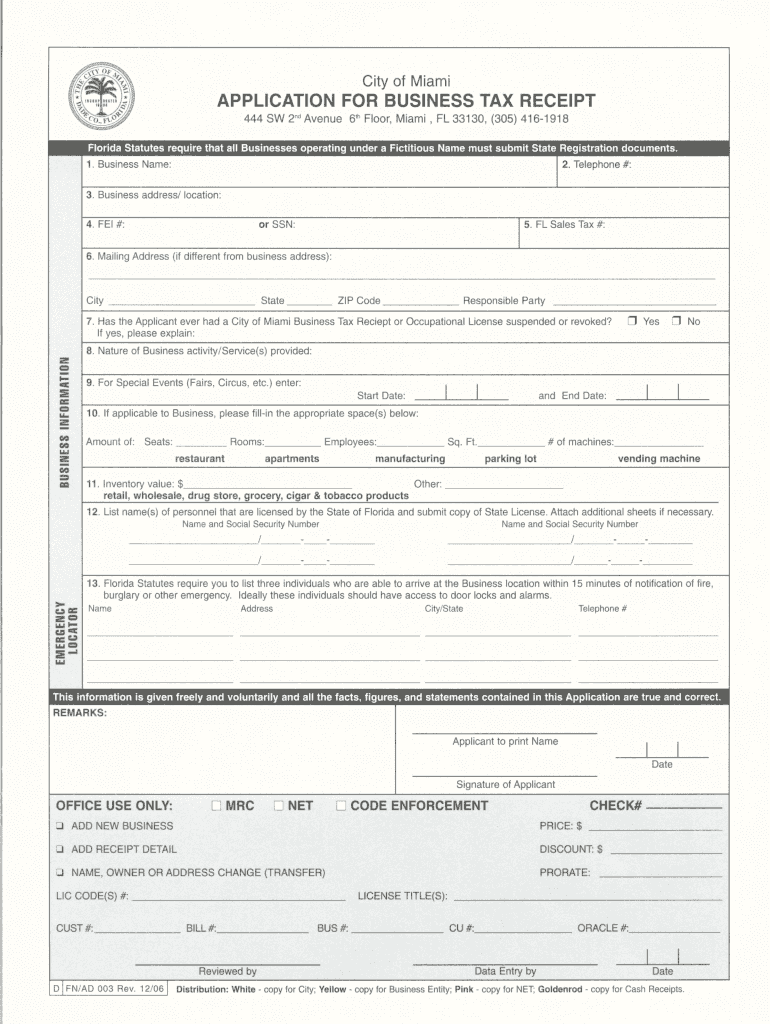

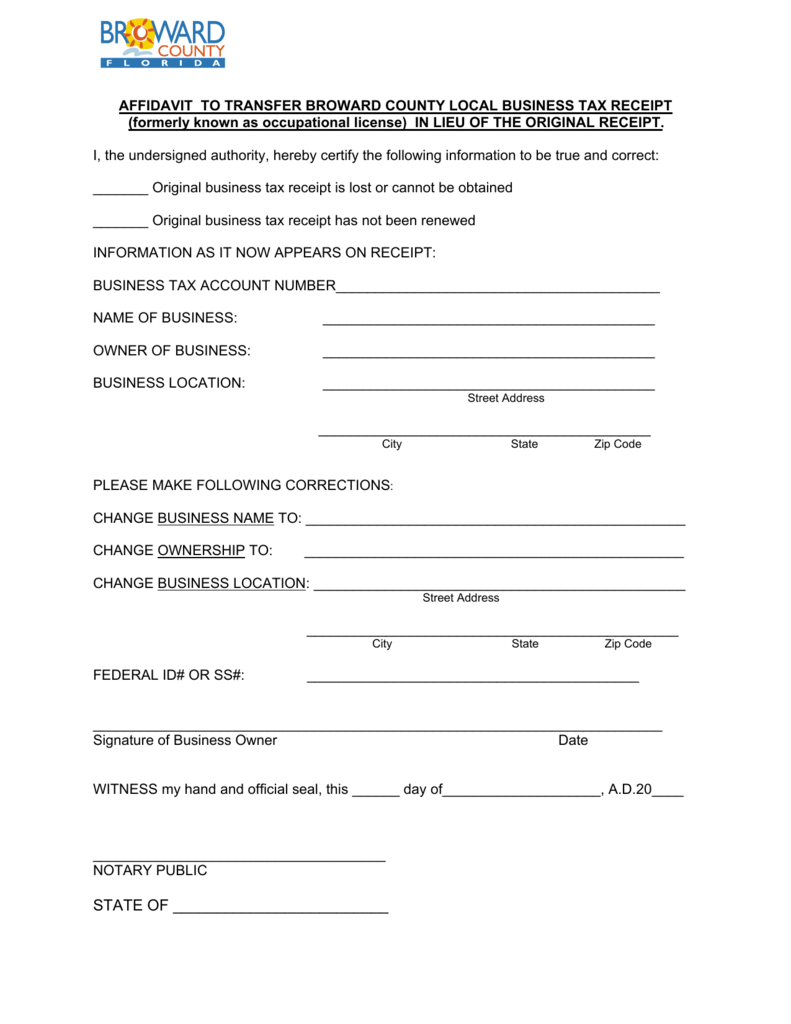

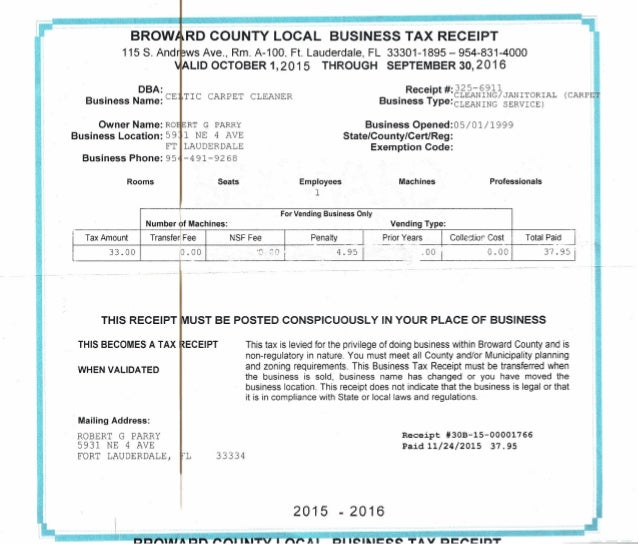

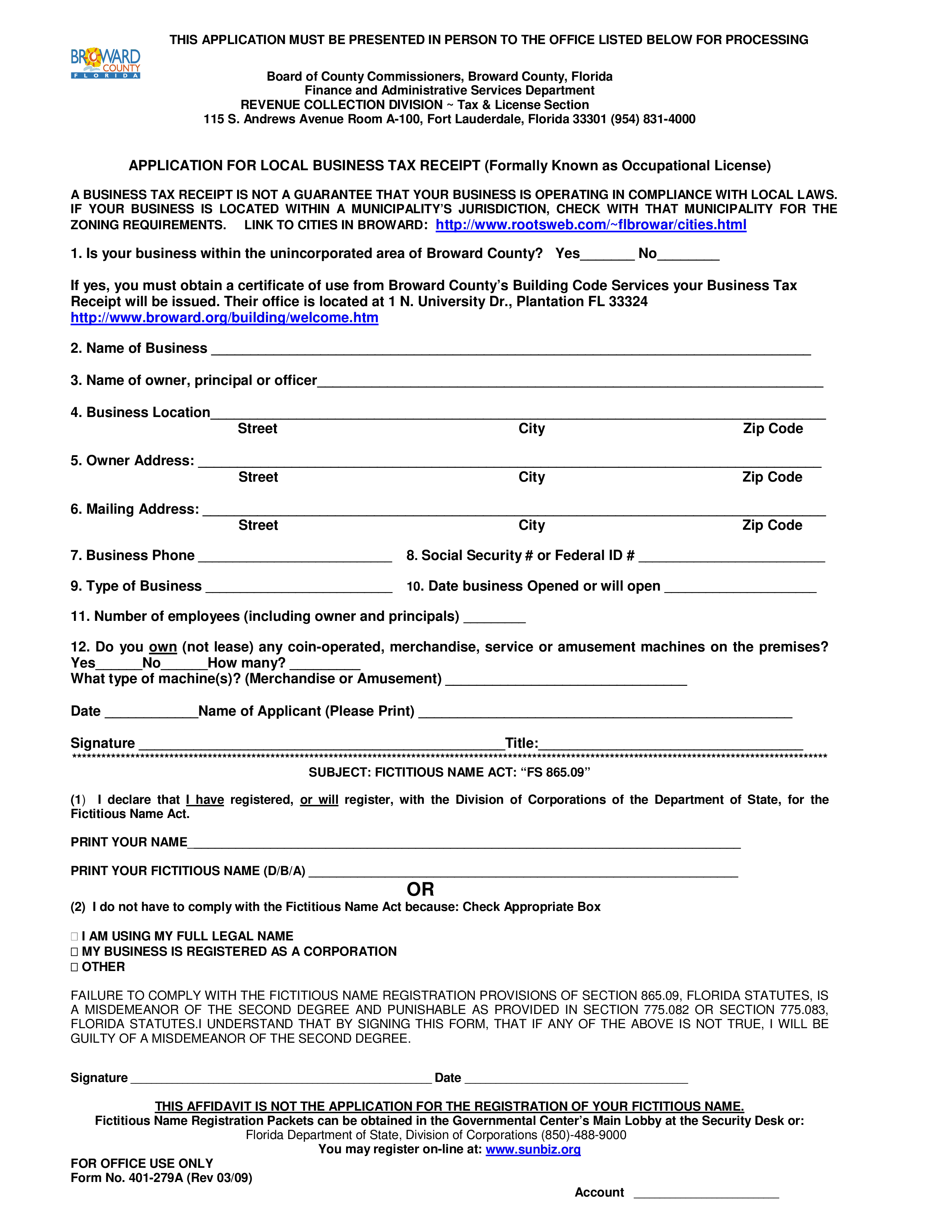

Broward county business tax receipt application. Andrews avenue room a 100 fort lauderdale florida 33301 954 831 4000 fax 954 357 5479. Per machine 1 66 225 ea. Application for business tax. Tax license section.

7 or more 15000. Has an office located in broward county meaning that it has a current broward county business tax receipt a physical business address not a post office box located within the geographical limits of broward county in an area zoned for the conduct of such business and. No special license required. This application must be presented in person to the office listed below for processing board of county commissioners broward county florida finance and administrative services department revenue collection division tax license section 115 s.

You can file an application for a new business tax receipt andor change address information on an existing business tax receipt. For more information and assistance please call 954 831 4000. The firm must meet several criteria. Per machine 1 16 900 ea.

Per machine 1 6 2250 ea. Andrews avenue room a 100 fort lauderdale florida 33301 954 831 4000 application for local business. Applicant resides in broward county florida the permanent address of applicant is. 67 or more 15000 includes soap bleach etc 38.

Local business tax receipt application form pdf 135 kb broward county fictitious name form pdf 223 kb list of local business tax receipt categories pdf 72 kb local business tax receipt exemption application form pdf 149 kb property taxes. No special license required. 2019 property tax bill brochure pdf 211 kb 2019 taxing authorities phone list pdf 57 kb frequently asked questions about your tax bill pdf 256 kb.