Buy Receipts For Tax

To defend business usage said lee.

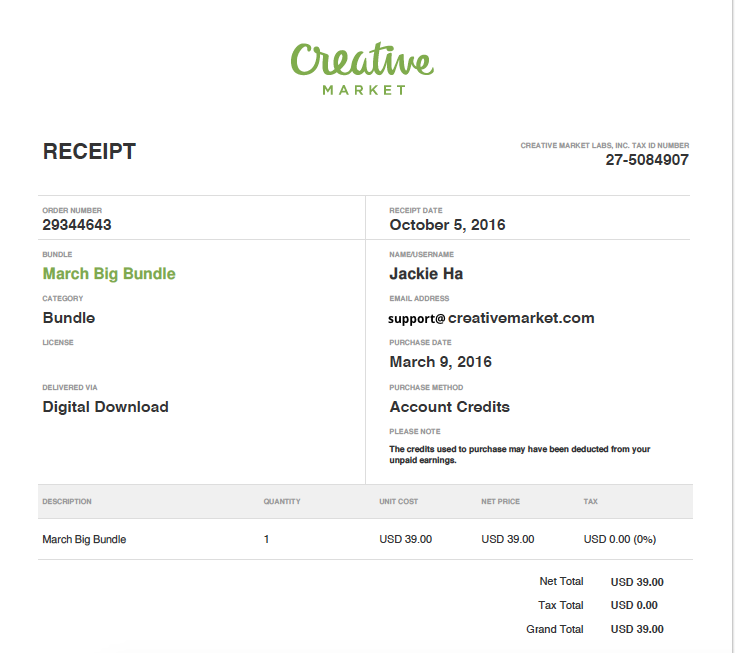

Buy receipts for tax. What can i deduct what receipts should i keep for my taxes. All is not lost even if you are missing some of these records at tax time. Forms 1099 misc purchases are the items you buy and resell to customers. The merchant the payment method total amount and the date of the purchase.

When preparing taxes you naturally want to take every allowable deduction. Cancelled check credit or debit card statements written records you create calendar notations and photographs. So be sure to keep the receipts business conference flyers etc. For example some of these deductions may be unreimbursed business expenses.

Credit card receipts and statements. If you opt for the standard deduction retention of your receipts is not important for tax purposes. Itemizing your deductions can help you reduce your annual tax bill. The app extracts the most important information from the receipt.

If you dont have receipts you can still claim expenses on your tax return without them. Careful recordkeeping not only enables you to track your. A microsoft receipt template is just the ticket. If you are a manufacturer or producer this includes the cost of all raw materials or parts purchased for manufacture into finished products.

Use excels classic blue sales receipt to provide detailed payment information to your customers. This sales receipt offers formatted fields for taxes discounts unit prices subtotals and more. That means that if the donor pays 75 and receives a calender or a dinner for example you must provide a receipt under law. What makes shoeboxed great for tax filing compared to the other receipt trackers is that you can indicate whether each expense is deductible.

You should keep supporting documents that show the amounts and sources of your gross receipts. For self employed individuals it is often helpful to save receipts from every purchase you make that is related to your business and to keep track of all of your utility bills rent and mortgage information for consideration at tax time. Give a receipt for a donation of 75 that buys goods or services. Must i have a receipt for all deductions.

Keep these expense receipts for taxes. Documents for gross receipts include the following. For the 2019 tax year the standard deduction is 12200 for single taxpayers and 24400 for those who are married and filing jointly. Deposit information cash and credit sales receipt books.

If you provide a good or service in return for a donation of 75 or more you are required to provide a receipt to the donor.