Credit Union Certificate Of Deposit Rates

Members 1st fcu is committed to providing a website that is accessible to the widest possible audience in accordance with ada standards and guidelines.

Credit union certificate of deposit rates. There is a substantial penalty for early withdrawals on certificates. Call the member contact center at 800 451 4292 visit any credit union one branch or use online banking. Thereafter esl may call the certificate one time every six months. Department of treasury site under the daily treasury yield curve rate drop down option.

The 1 month treasury bill rate can be found from the us. If the preceding friday monday or tuesday are an observed holiday the rates will be updated the following wednesday. All rates subject to change without notice. A penalty may apply for early withdrawal.

Insured up to 250000 by national credit union association. With a variety of rates terms well help you find one thats right for you. Apy is accurate as of the last dividend declaration date. If esl does not call the certificate the original apy remains fixed for every six month period until the term ends.

Texas bay credit union is excited to offer the new payroll growth certificate of deposit. Available as individual retirement accounts iras specials occasionally excluded dividends earned can be added to your certificate or transferred to another tcu deposit account to supplement your income. In online banking click on open an account and choose certificate of deposit from the drop down menu. We use the daily balance method to calculate the dividend on your account.

As in the case of all credit union accounts the amount on deposit is fully insured up to the legal limitations. Technically a cd is something you cant get at a credit union. A summit certificate like a banks certificate of deposit cd is a great way to invest your money. Credit unions issue share certificates instead which are insured by the national credit union administration instead of the fdic.

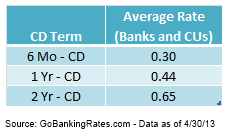

Minimum deposit options based on term. This new cd is designed to help you start earning more faster by starting with a lower deposit. Interest is compounded and paid monthly. A certificate is a very safe investment.

We do business in accordance with the federal fair housing law and equal credit opportunity act. Almost all banks offer certificates but with an alliant credit union certificate youll get a rate of return that is far above industry averages. If you dont have the initial 1000 deposit for a regular texas bay cd the payroll growth cd is a great way to get there. The first 250000 is insured by the national credit union share insurance fund ncusif.

:max_bytes(150000):strip_icc()/cd-basics-how-cds-work-315245-v4-5ba5068946e0fb002558ccde.png)