Debt Repayment Template

The creditor agrees to accept from the debtor payment amount of written settlement dollar amount dollars numerical dollar amount as full repayment of the debt outstanding to the creditor at the date hereof subject to the terms and conditions of this agreement.

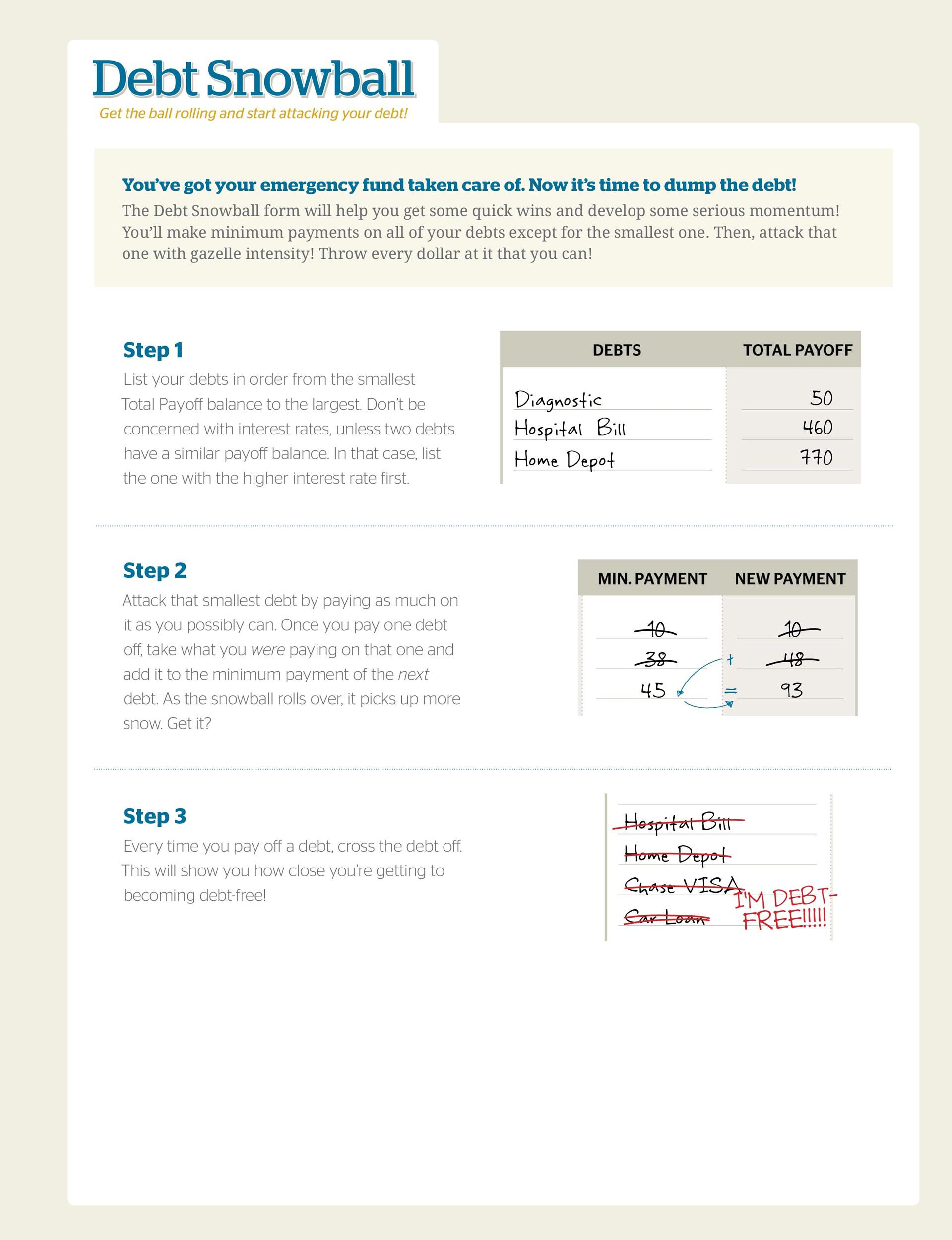

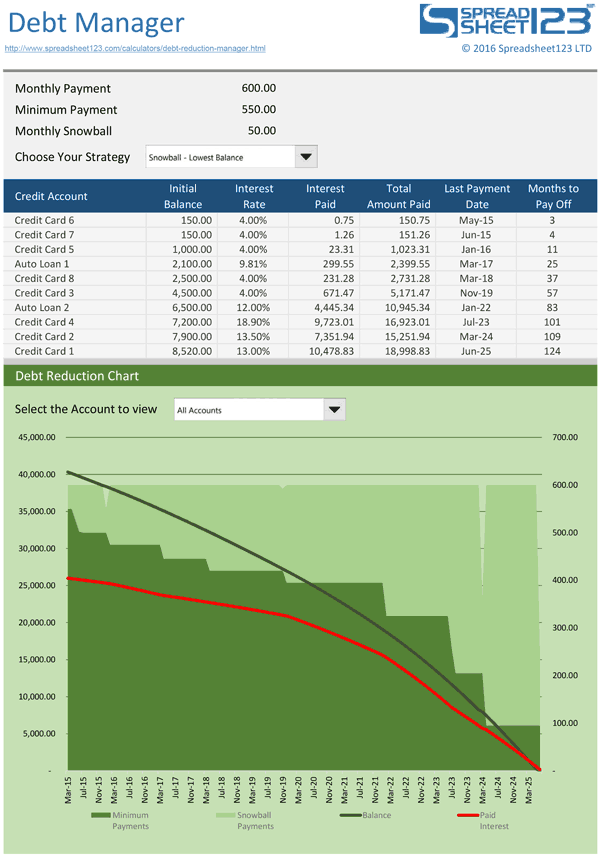

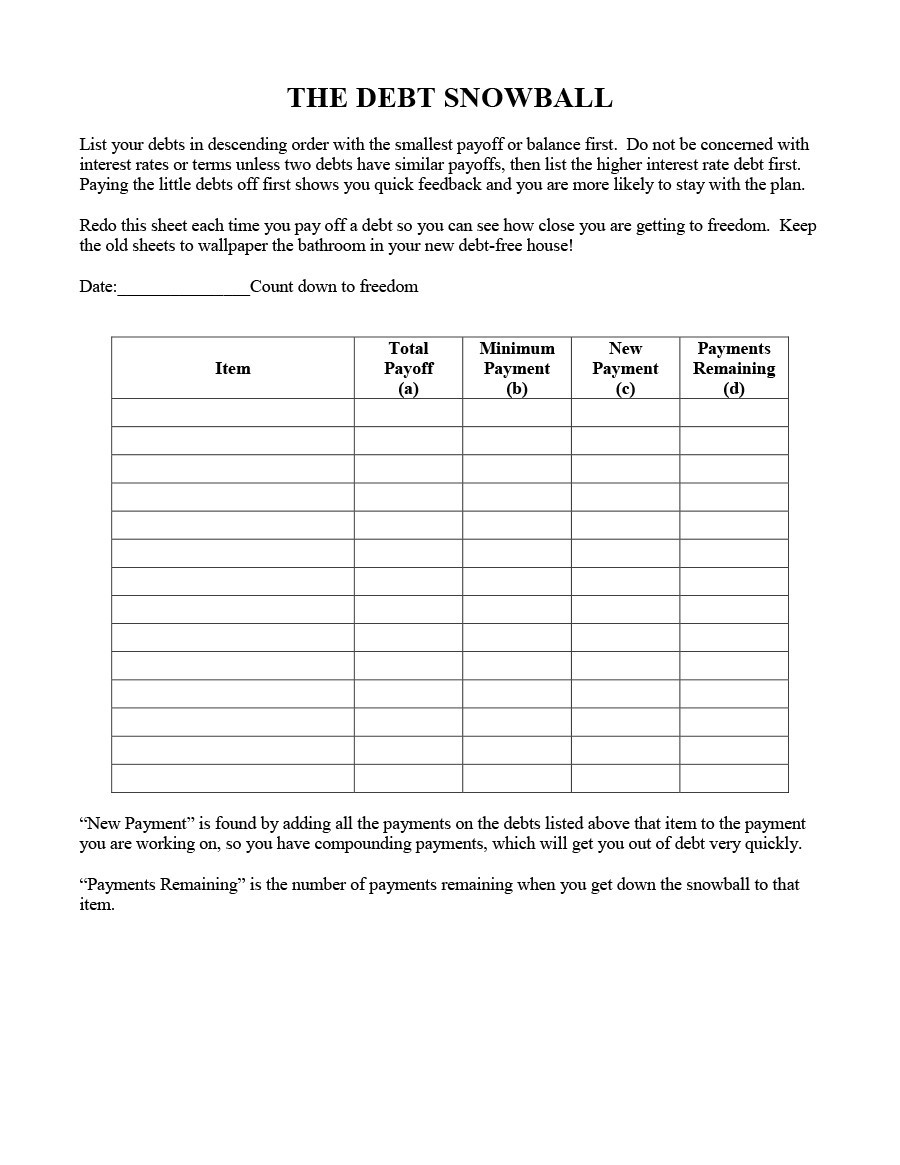

Debt repayment template. It uses the debt roll up approach also known as the debt snowball to create a payment schedule that shows how you can most effectively pay off your debts. Sample repayment agreement form. These themes offer exceptional examples of ways to structure such a letter as well as include example content to act as an overview to format. When composing a formal or business letter presentation design and format is essential making a great impression.

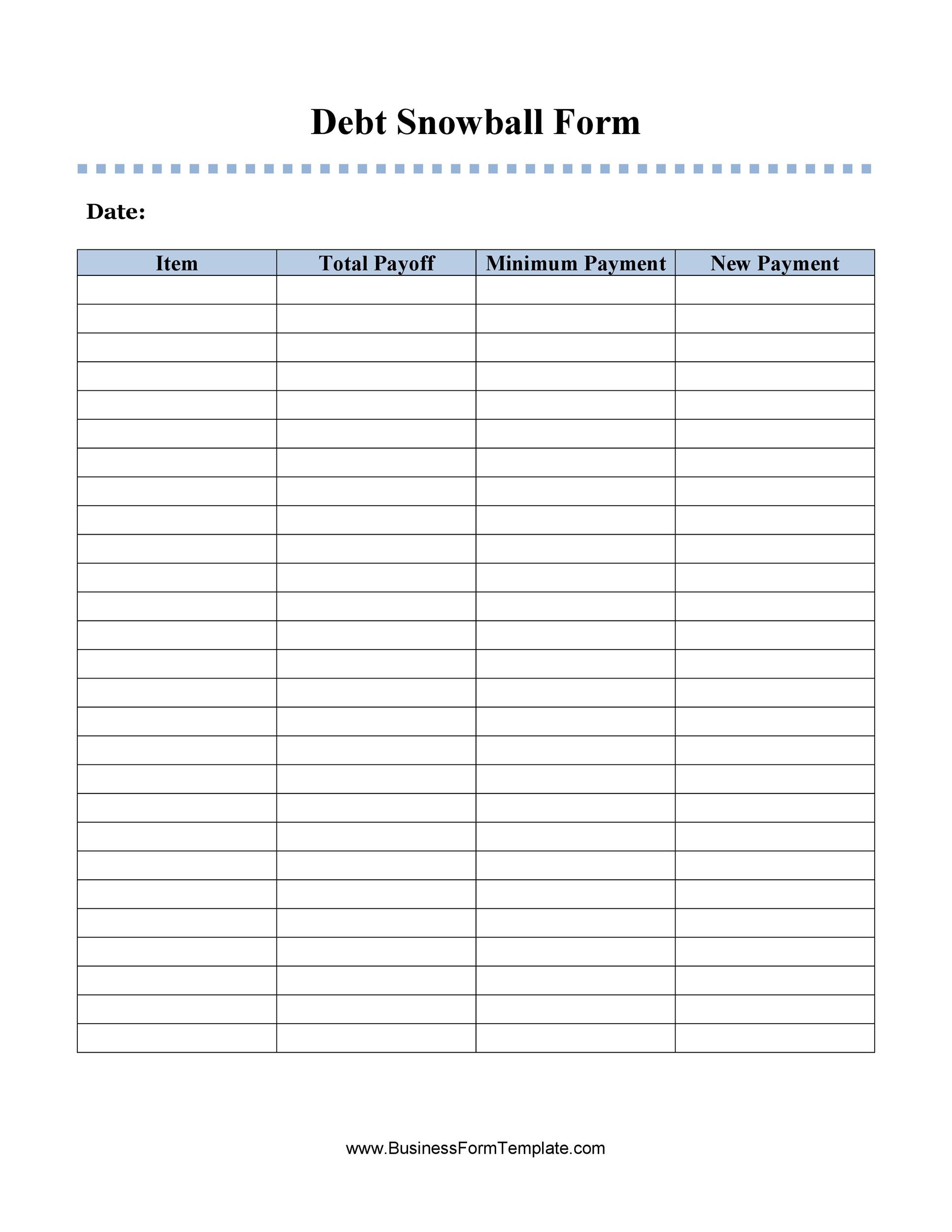

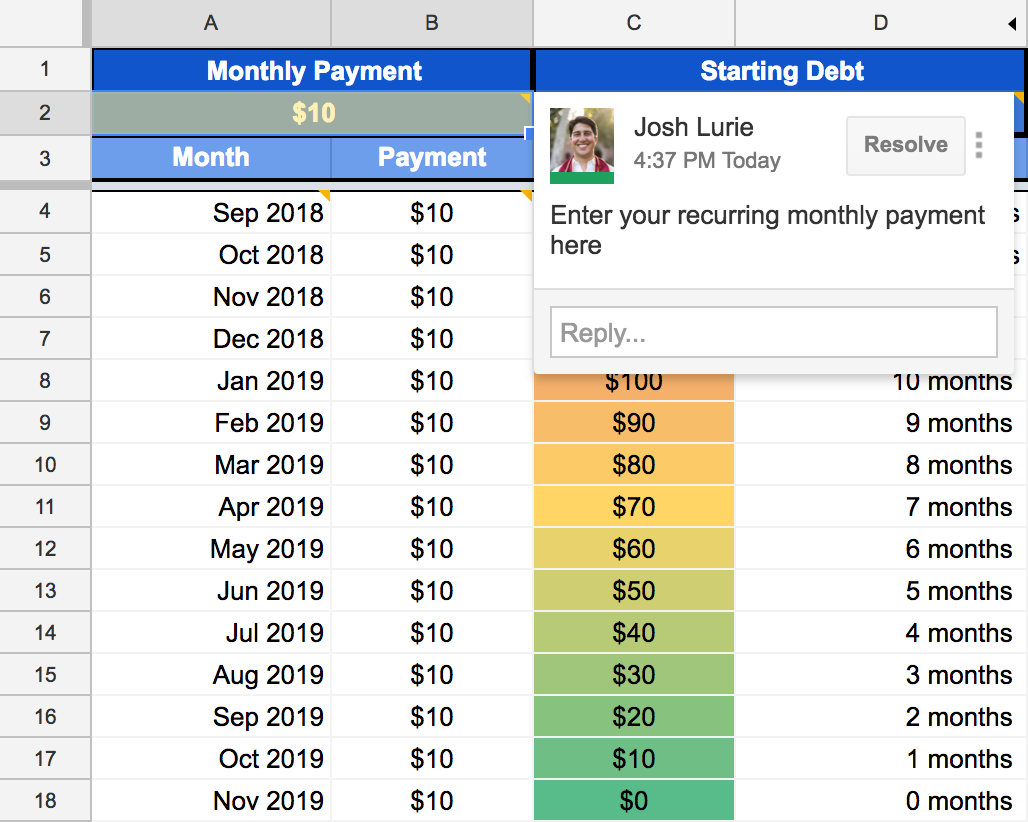

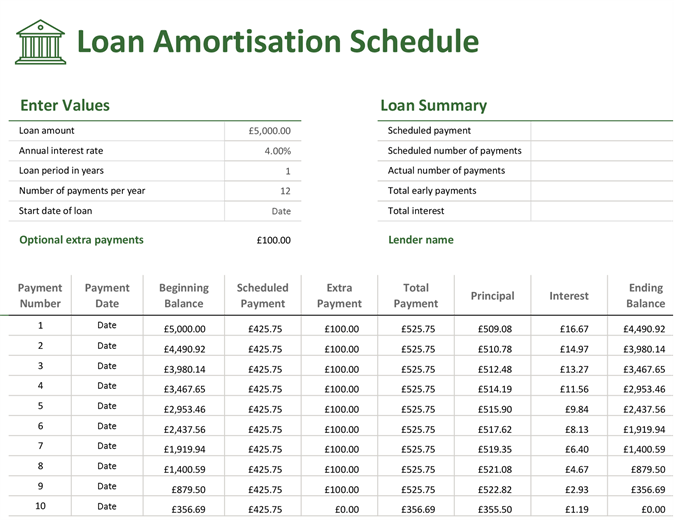

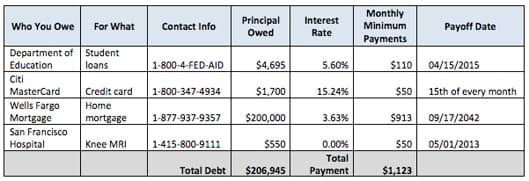

Debt repayment agreement template debt payment plan agreement template debt repayment agreement form york university debt repayment agreement template a resume is a document often used to apply for tasks which includes explanations of your respective own education practical knowledge abilities and accomplishments. Make the payments agreed upon as soon as you can and in full. Fill in the sections on the right with your debts to populate the fields on the left. You can use the paymentschedule tab to figure out exactly what those amounts should be.

You can use the letter templates to tell your non priority creditors about your situation and to ask them to accept your repayment plan. Templates are pre formatted spreadsheets with formulas that have been entered and all you need to do is download the template and open it. These debts include credit cards and other unsecured loans. The debtor agrees and acknowledges that it is indebted to the creditor in the full amount of the debt.

Just plug in a few numbers and the spreadsheet does the math for you. Advertisement learn how you can save 100s or even 1000s of dollars. You can use the sample repayment agreement form below if you received a letter from a creditor demanding payment or simply to renegotiate your debt and obtain lower revised terms that you can manage. Whatever you fill in as your debts should be the opening balance of your debts on the left.

Having an effective repayment plan will help you track all of your debts. The debt repayment schedule in this case my two debts is on the left and the details about your debts go on the right. Sample letters to creditors. If more you are looking for an impressive planner then we offer you our best planner templates which include our debt repayment planner template.

If youve got debts you can use our sample letter generator to write to your creditors. Automate both your minimum payments and the extra payment youre making towards whichever debt youre prioritizing first. Assortment of repayment agreement letter template that will completely match your demands. This way you can easily track down its progress and be able to pay them before their due date.